China’s chemical industry

Quest for sustainable growth provides ample opportunities for the chemical industry

In Move Toward Consumption-Led Economy, Specialty and High-End Chemical Segments Will Further Expand

A World Leader - The chemical industry in China is both a key driver and prime beneficiary of remarkable GDP growth. In the last decade, significant investments in capacity and technology have propelled China's chemical industry to the forefront of world producers. In 2010, Chinese chemical output exceeded American output for the first time.

Moving to Modest Growth Rates

Between 2007 and 2012, revenues for China's chemical industry grew at a compound annual growth rate (CAGR) of 21% to reach $1.2 trillion in 2012. In comparison, over the same period, the Japanese and Indian markets grew at a pace of 4% CAGR to $230.2 billion and 13.8% CAGR to $100 billion respectively.

Despite a changing policy environment and slowing economic growth in China, the long-term growth prospects for the chemical industry remain high and are expected to reach a volume of $1.9 trillion in 2016 - at a CAGR of 13% from 2012 to 2016. This is a more modest growth rate as a more mature economy orients itself away from an investment-led model to a model that focuses on consumption and services.

Driving Growth with Chinese Urbanization

To improve the geographic spread of its industries, the Chinese government plans to develop its inland infrastructure. It has set an urbanization target level of 60% by 2020 with less developed internal provinces catching up with the more developed southern and eastern coastal provinces. According to China Development Research Foundation, by 2020 investment in infrastructure is expected to reach more than $3.6 trillion.

Steady urbanization, infrastructure investments and a large Chinese middle class with growing household income driving demand for consumer, auto, IT and electronic products will provide ample growth opportunities for the chemical industry.

Shifting to Higher Value Specialty Chemicals

The more China moves toward a consumption-led economy, the higher the demand for high-end sophisticated products and advanced materials will be, resulting in the growth of specialty and high-end chemical segments. The chemical sector in China is still a net import market. During 2012, the country imported almost 10% of its specialty chemicals and more than 50% of its electronic chemicals. To close the gap, China plans to increase its self-sufficiency in new chemical materials from 56% in 2009 to 76% in 2015.

By 2020, China aims for 15% of its gross domestic product to come from seven strategic industries (new-generation IT, energy saving and environment protection, new energy, biology, high-end equipment manufacturing, new materials, and hybrid and electric cars), the majority of which use products from the chemical industry. In response, industry managers are now focused on strengthening and developing electronic chemicals, fluoro coatings, food additives, eco-friendly adhesives, plastic additives and water-treatment chemicals.

Investing In R&D

Chinese companies spend 3% to 5% of their revenues on R&D, improving their ability to innovate and incorporate technological changes into their production processes. For example, in 2012, the Wanhua Chemical Group spent 4% of its revenues on R&D. It focused on revitalizing the national polyurethane industry through the acquisition of technology and developing intellectual property rights of MDI manufacturing technology. Another example is Rising Sun Holdings (Risun) Group, China's largest coal chemical product manufacturer. Risun established its strength in a new sector using advanced technology from Germany and other patented technology from international research institutes.

China's commitment to R&D has risen and is expected to increase by 11.6% in 2013, following an 11.3% increase in 2012. The country is investing in all aspects of R&D at record rates. It already has more scientists and engineers than the U.S. and its share of technical papers has steadily increased in the past 10 years. Much has been said about the modest quality of China's technology paper output, but in many areas, such as materials science, chemistry and engineering, China is now a global leader.

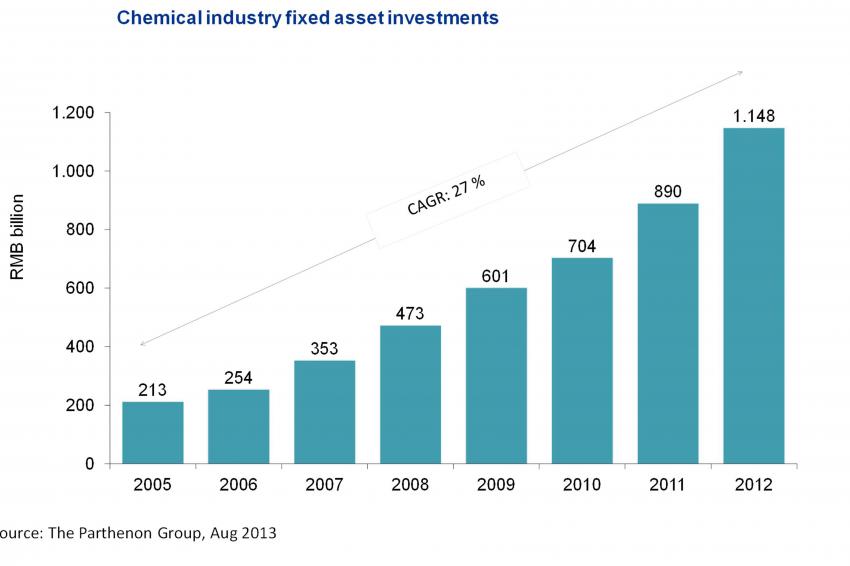

Investing In Fixed Assets

To capitalize on the growth prospects, Chinese as well as foreign chemical companies have made significant capital investments. Fixed asset investments in the first half of 2013 were up 20.1%, year on year.

Many multinational chemical companies operate and earn a significant portion of their revenue in China. Giants such as BASF, Dow, Evonik, LG Chem and Mitsui Chemicals have announced aggressive Chinese investment plans in both production and R&D. For instance, BASF plans to double sales in China to €12 billion by 2020 and will invest €10 billion in the Asia Pacific region, mainly in China, from 2013 to 2020. Evonik, a specialty chemicals company, plans to double revenues to €2 billion by 2015. From 2011 to 2015, Evonik will invest more than €350 million in specialty chemicals in China.

Examples of major chemical investments, sorted by capacity, are listed in the table.

Investing In Internationalization

To establish themselves as world-class chemical companies, domestic chemical companies also look to overseas investments. In a break from the past, natural resources now account for around 60% of overseas investments, compared with 75% in 2010. Although Asia remains the leading investment destination, acquisitions in Europe and North America have noticeably increased in the last few years. China started making a move toward Europe in 2007, and the trend of focusing on targeted downstream acquisitions will continue.

For example, in 2011, the Wanhua Industrial Group, a Chinese polyurethane raw materials producer, entered the European market and expanded downstream by acquiring for €1.26 billion a majority stake in BorsodChem, a Hungary-based chemical group involved in production and processing of plastic raw materials and isocyanate.

Zhejiang Longsheng Group (Lonsen) has a bold strategy of internationalization. In 2010, it acquired German-based DyStar. With this acquisition, Lonsen became the world's largest textile chemical producer, controlling more than 20% of the global market, and also contributed to improving Chinese chemical brands internationally. Lonsen benefited highly from DyStar's valuable patents, brands, network, sales channel and technology.

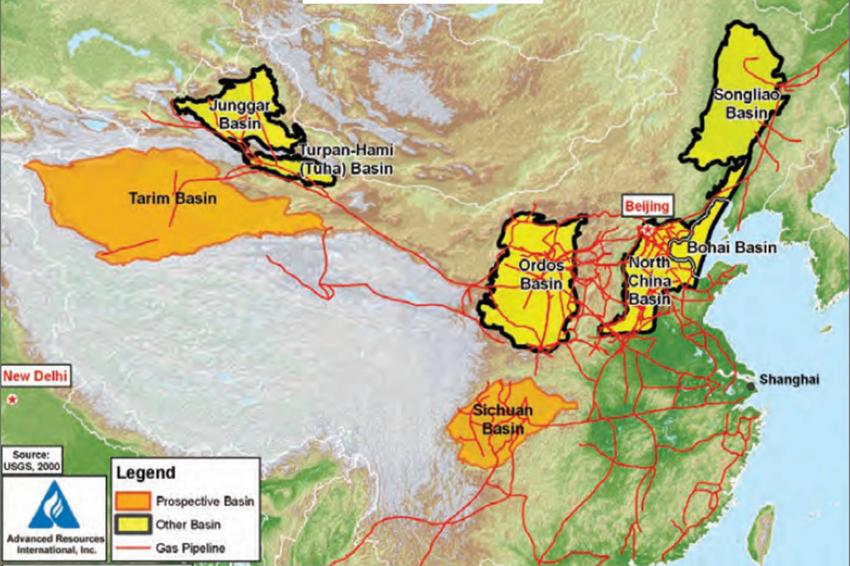

Securing Feedstock For Growth

China's technically recoverable reserves are estimated at 25 trillion cubic meters, 50% larger than those of the U.S.

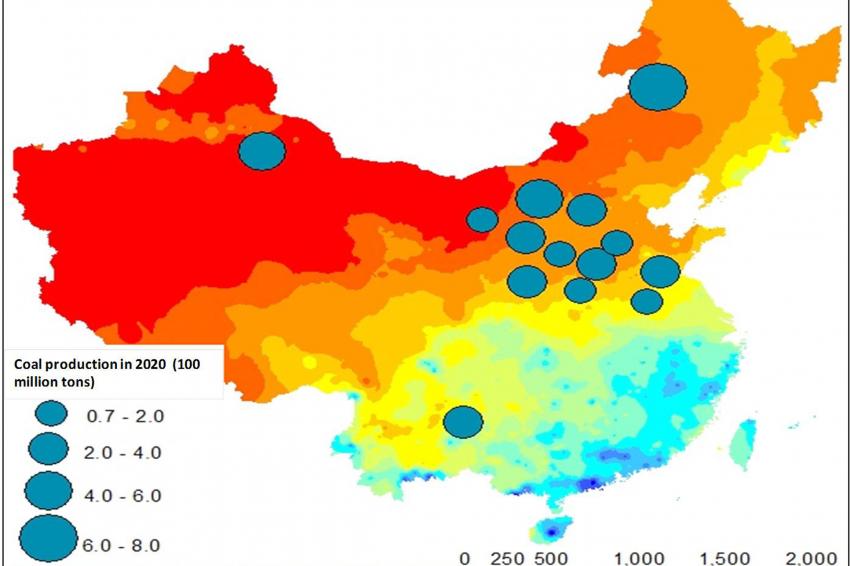

China has recently made significant investment in leveraging its large coal reserves (about 115 million tons) as a feedstock for the petrochemical industry. According to IHS Chemical, more than 120 coal-to-chemical projects have been announced in China. From 2013 to 2020, almost 20 million metric tons per year of coal-based olefins capacity will be online in China. The coal-to-chemicals development faces significant challenges such as remotely located reserves, fresh-water scarcity, financial constraints, and environmental concerns around excess waste and carbon emission.

Over the past few years, several foreign oil and gas companies, including Shell, Chevron, Hess and ExxonMobil, have partnered with China's state oil firms PetroChina and Sinopec Corp. to explore and eventually produce shale gas. China's goal to produce 6.5 billion cubic meters of natural gas from shale by 2015 is proving a challenge. High well costs and poor investment returns have held back digging. Reserves are located in difficult-to-access hilly terrain and are much deeper (4-6 kilometers, compared with 2-4 kilometers in the U.S.). Moreover, fracking technologies that proved successful in the U.S. require large amounts of fresh water, which is a constraint in China. Also, the ethane content from these reserves remains unknown, being a potential logistical and transportation challenge.

Balancing Growth with Environmental Protection

China has pledged to reduce carbon dioxide emissions by 40% to 45% per unit of GDP by 2020, compared with the levels in 2005, but it still relies heavily on energy-consuming, high-polluting industries for economic development and poverty relief. Pilot carbon-emissions trading schemes to curb greenhouse gas emissions with the help of a market mechanism are planned. The challenge for the government is to persuade heavy industries, including the chemical sector, to balance profit growth with environmental protection. Companies in the chemical, steel and cement sectors have expressed willingness to participate in carbon-emissions trading, but fundamental structural problems need to be resolved before the scheme can succeed.

Despite the challenges, continued urbanization, public and private investments as well as industrial restructuring ensure the chemical industry in China is well poised for sustainable growth.

Contact

KPMG AG Wirtschaftsprüfungsges.

Tersteegenstr. 19 -31

40474 Düsseldorf

Germany