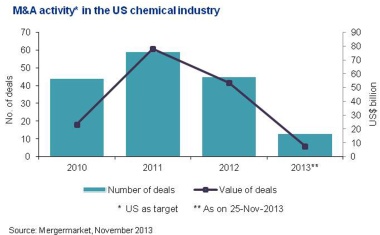

M&A in the Chemical Industry

Navigating Uncertainty While Unlocking Strategic Opportunities

Navigating Uncertainty While Unlocking Strategic Opportunities

Every year, the chemical industry sees hundreds of mergers and acquisitions (M&A). Traditional M&A drivers, such as consolidation and portfolio extension, are still important. But many transactions also show that the nature of M&A is evolving, as chemical companies look for ways to contend with ongoing volatility and move to a more sustainable future.

US private equity firms Blackstone and Carlyle may make a joint offer for the Novartis generics unit Sandoz, Bloomberg reports. With six other possible bidders seen as circling Basel-based Sandoz, the news agency’s sources said this sale could shape up to be one of the biggest-ever buyout deals, valued at around $25 billion.

Lanxess and private equity investor Advent International are reportedly discussing a transaction that could see the German company’s engineering plastics portfolios merge with the polymer-related activities being flogged off by DSM in the Netherlands. The resulting new entity would likely be controlled by Advent.