Camelot’s Pharma Management Radar

Professionalizing the Virtual Pharmaceutical Supply Chain

Despite a positive estimation of the current business climate and an increasing number of products in the pipeline, the global pharmaceutical industry is looking for ways to improve its cost base. More and more often this includes outsourcing to contract manufacturing partners.

These activities are conducted primarily to reduce costs, as well as to leverage access to non-owned technologies - thereby avoiding investment in non-owned technologies. Typical VUCA challenges faced when outsourcing - i.e., challenges associated with volatility, uncertainty, complexity and ambiguity - are overruled by the cost maxim. At the same time, not all industry players follow the trend with an equal pace of professionalization - because of a number of risks and costs associated with outsourcing.

This is the picture that emerges from the fourth Camelot Management Consultants Pharma Management Radar survey, a biannual study based on surveys conducted with more than 100 industry executives that serve to provide an in-depth perspective on varying current management topics relevant to the pharmaceutical industry.

Between August and October 2014, the Pharma Management Radar panel members from globally active pharmaceutical companies based in 16 countries participated in an extensive online survey. Companies with a business model predominantly characterized by developing or commercializing innovative medicines ("Innovators") composed the majority of respondents; roughly one-fifth were participants from companies predominantly active in the generics segment ("Generics"). Survey participants represent almost two-thirds of the global Top 20 pharmaceutical companies. The focus topic of the fourth Pharma Management Radar is contract-manufacturing outsourcing (CMO).

The executives' view of the business climate for the pharmaceutical industry was relatively positive in the latest survey conducted in spring 2014. Though this aspect was not measured in the current Radar, the generally bullish mood is still reflected in the way the respondents describe their plans and expectations regarding product development and investments: As for the product pipeline, two-thirds of respondents expect the number of products to increase within the next five years, while less than a fifth describe the number of products as decreasing.

The executives' investment plans are rather consistent with these expectations. As far as new products - whether in the development or in the pre-launch/launch phase - are concerned, nearly all respondents show a very strong will to invest in additional capacities or to at least maintain the current manufacturing footprint. As long as products are mature and still protected by patents, the vast majority of respondents plan to preserve their current footprint.

However, a substantial number of respondents believe that outsourcing in this life-cycle stage will increase in the future, as processes mature and the freeing up of capacities allows for greater flexibility. The focus here is on maintaining high margin or critical products in-house, while seeking to outsource products with lower margins or low fluctuations in demand. After this phase, however, things change remarkably: More than half of the respondents plan to divest assets as soon as patents have expired.

Outsourcing Trend Continues to Gain Power

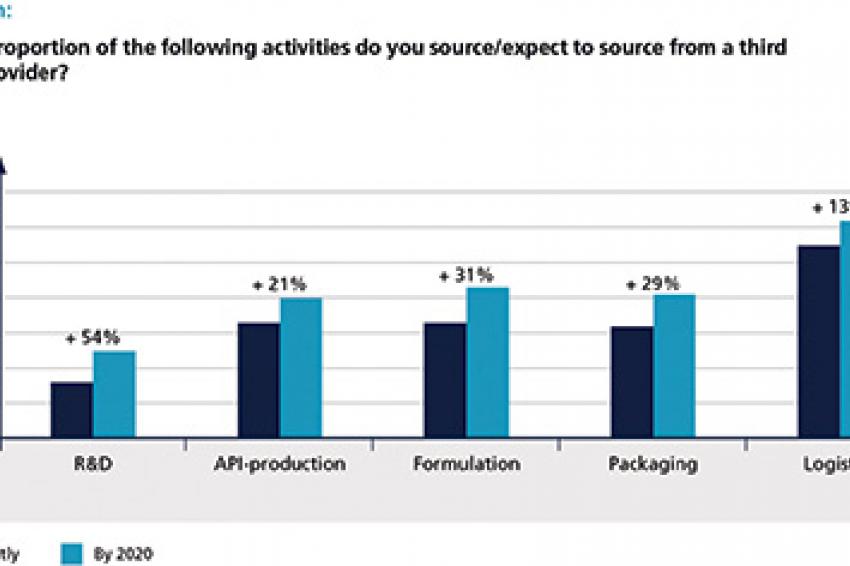

This is one of the typical situations when outsourcing becomes an option. Generally speaking, the external sourcing trend, which had already been observed in the last survey, continues to gain power. While all executives expect the rates of outsourced activities to be higher in 2020 than they are today, this trend is particularly strong for Innovators. Here, outsourcing will continue in all fields of activity - with logistics and formulation achieving the highest expected outsourcing rates in 2020. As far as Generics are concerned, the biggest outsourcing jump (from 11% in 2014 to 20% in 2020) is expected with regard to R&D, while no considerable changes are anticipated for active pharmaceutical ingredient (API) production and logistics.

The outsourcing trend not only applies to the companies' global business but also to their European activities: In five out of seven activity fields, executives expect the shares of European activities (R&D, API production, formulation, packaging, pricing, planning and marketing) sourced from contract manufacturing organizations (CMOs) to be notably higher in five years than they are now. Product pricing and marketing are the only exceptions to this rule of outsourcing growth. This might be seen as a correctional move to get back to normal after overestimating the benefit of outsourcing in some fields.

Speaking of geography, there seems to be a clear trend shifting outsourcing activities outside the "old established pharmaceutical world." In 2020, nearly 30% of respondents expect to source more than half of their company's sales volume from CMOs located outside of Europe. As far as European contract manufacturing outsourcing is concerned, the majority of respondents (57%) assume that they will buy-in around 26% to 50% of the respective company's sales volume.

It's All About Costs - Mostly

The main reason behind the outsourcing trend becomes very clear when listening to industry executives. Asked for the main drivers for considering external manufacturing, most of the respondents provide answers related to saving money - be it avoiding investments into new non-owned technologies (26%), general financial considerations (20%) or gaining efficiency by outsourcing standard technologies (17%).

Quite logically, this type of motivation also dominates when it comes to the actual make-or-buy decision: Overall costs and production technology are the criteria that count most, while only a minority of executives considers production flexibility the most important argument. Not surprisingly, costs are also the quality that the majority of executives look at when judging a CMO - closely followed by product supply reliability as well as high standards and systems to ensure quality.

When it comes to how and by whom outsourcing decisions are made, there are signs of an ongoing professionalization. More than 70% of respondents' companies have a formalized and standardized process for determining make-or-buy decisions. Not surprisingly, the rate is considerably higher among Innovators (79%), than among Generics (50%) who still have some backlog in this respect.

As not every company has a dedicated CMO department yet, the selection can often be described as a multifunctional, cross-departmental process. This applies to all elements of the RACI system, which rates a party's involvement according to whether it is responsible, accountable, consulted or informed: Both responsibility and accountability are spread over various departments including legal, procurement, strategic sourcing, manufacturing and quality control. A similar image emerges when it comes to managing relations to the chosen contract manufacturers. Regarding the grades of involvement, most executives name supply-chain management/logistics, quality control and procurement as the ones responsible for the operative management of CMOs.

Despite the general enthusiasm, not all types of products and production steps are equally suited for outsourcing. As far as product types are concerned, the survey's results may be summarized by a very simple formula: The more "solid" a product, the better its production can be outsourced. Oral solid dose as well as powders and granulates are relatively easy to produce - and thus rank highest in terms of outsourcing feasibility. Active substances such as biologicals and vaccines, on the other hand, require specific know-how - which is why more than 50% of respondents rate them low or very low on the outsourcing feasibility scale.

When distinguishing different phases of maturity, it seems quite logical that new products in development have a rather low outsourcing viability, while the shares of "very high" or "high" answers rise for products at launch or pre-launch - and reach the top in the phase after patent expiry. Nevertheless, neither new nor complicated products are excluded from outsourcing as a matter of principle. Several executives report on outsourcing activities for niche and state-of-the-art technologies as well. As far as the latter are concerned, formulation was named most often. One might assume that this mainly refers to more complicated substances such as liquids and injections, where some companies have to rely on the help of specialists from outside.

Just as outsourcing is not seen as the perfect choice for every product and phase, it is not considered beneficial for all areas. While outsourcing clearly decreases effort for production and logistics, many of the more administrative areas such as planning, legal or procurement, however, are facing an increase in effort. When asked for concrete cost benefits, the panel members name labor and fixed asset most often (more than 80%), whereas supplier management and procurement are subject to substantial cost increases because of outsourcing manufacturing.

Regarding the risks of outsourcing manufacturing, the answers differ according to the various production steps. For API production, executives consider increasing administration and coordination costs the highest risk, while for formulation they fear loss of control most. As far as packaging is concerned, increased lead/response times are most often suspected as a substantial hazard of outsourcing manufacturing. All in all, these risks as well as the costs associated with outsourcing indicate that outsourcing surely implicates growing complexity - which in the end is expected to be overcompensated by cost reductions in production and logistics.

Order a free copy of the survey here!

Register here for the participation in the next PMR survey!

Contact

Camelot Management Consultants AG

Theodor-Heuss-Anlage 12

68165 Mannheim

+49 621 86298 0

+49 621 86298 250