Global M&A to Increase in 2014

New A.T. Kearney Survey Analyses Chemical Industry

Despite lingering uncertainty about Europe's recovery and global GDP growth, more than 50 % of executives surveyed at leading chemicals industry players and investment banks expect M&A activity to increase globally in 2014. The survey, conducted as part of A.T. Kearney's second annual "Chemicals Executive M&A Report" shows growth in chemicals M&A activity will be driven by the high liquidity of chemicals companies, resurgence of the U.S. chemicals industry because of low-cost feedstock, regional expansion plans of Asian companies pursuing growth through acquisitions in Western economies, and Western companies seeking access to developing markets. The report includes an analysis of global chemicals sector M&A deals in 2013 and a forward view of expected 2014 sector M&A activity.

"Consolidations are expected to account for the largest share of all transactions, due to the still highly fragmented Asian markets and to Western chemical companies focusing their M&A activities on strengthening their core businesses, " said Joachim von Hoyningen-Huene, A.T. Kearney partner and author of the study.

2013 M&A Analysis

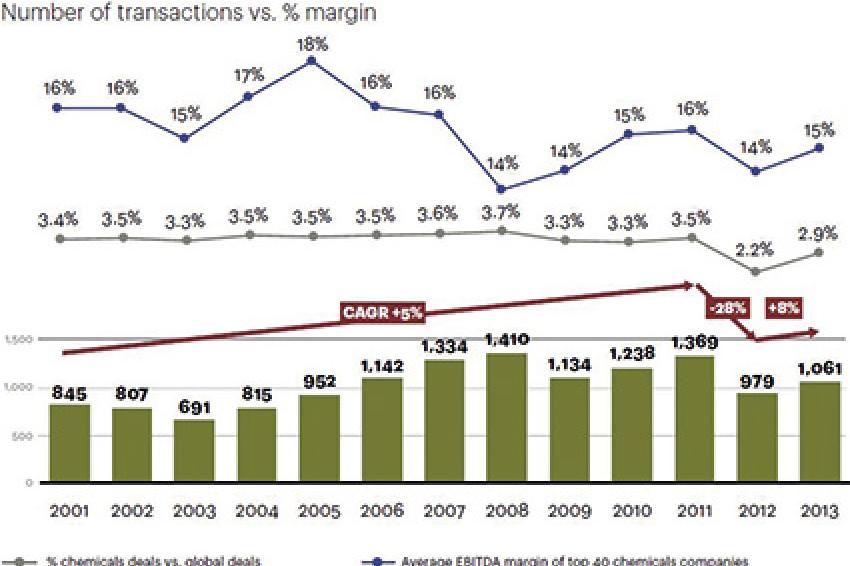

The analysis shows that 2013 M&A deal activity recovered slightly compared to low levels in 2012. Deal activity was driven by strategic investors' strong balance sheets, significant funds available to private equity, and the low cost of debt.

The value of deals in 2013 increased sharply by 47 %, mainly due to a rise in large transactions with private equity participation. Private equity company share of chemicals transactions stayed at almost 20 % from a volume standpoint, but value rose from 22 % to 32 % in 2013.

Companies in the specialties and fine chemicals sector are the most sought-after acquisition targets. Between 2001 and 2013 the share in deal volume remained relatively constant across all chemicals industry sectors. In terms of value, the share of specialty and fine chemicals deals rose by more than $7 billion since 2001, equaling a CAGR of almost 8 %.

Thomas Rings, A.T. Kearney partner and study author noted, "This trend reflects the increasing focus of Western and Asian companies on specialty chemicals. They are on the one hand attracted by higher margins and lower cyclicality and on the other want to create scale in the different specialty segments. Competition is rising for buying specialty chemicals assets, which translates into higher valuations."

Asian, specifically Chinese, acquirers are becoming more active, both in their domestic markets, driven by further consolidation of the chemicals industry, and outbound, seeking access to specialty chemicals know-how as well as increasing their global dominance in certain commodity chemicals by buying foreign targets at attractive valuations.

2014 M&A Outlook

The new survey results suggest that M&A activity in Asia, particularly in China, will increase as buyer interest in China remains high and the number of businesses available for acquisition has gone up. M&A activity is expected to also rise in North America, driven by the objective to gain access to low-cost feedstock and by portfolio realignments of large chemicals players that will bring sizable assets to the market. With regard to sectors, survey results indicate that deals will continue to focus on specialty and fine chemicals with higher deal levels than 2013. The M&A activities in petro and basic chemicals will remain stable with a slight upward trend.

For the full report visit A.T.Kearney!