Repercussions of the US Shale Story

Shale changing the face of petroleum and petrochemical markets

The two words on everyone's lips in recent years in the energy industry have been "shale boom." This article will lay out JBC Energy's view of the future of the U.S. shale boom and its effect on the petrochemical industry.

Cheap and Abundant NGLs

The emergence of hydraulic fracturing in the early years of the 21st century changed the face of the U.S. energy industry. U.S. total liquids production began to increase rapidly from 2008, with crude and NGL production growing by 31% and 33% respectively in the period until 2012.

Although both crude and NGL (ethane, LPG and pentanes plus) output has expanded tremendously, the fact that producers strongly prefer drilling in "wet plays" - which contain a high proportion of NGLs - to maximize returns has led to a collapse in ethane and liquefied petroleum gas (LPG) prices. U.S. ethane prices are currently only a little more than 20% of crude prices, while LPG is around 70% (both on an energy content basis).

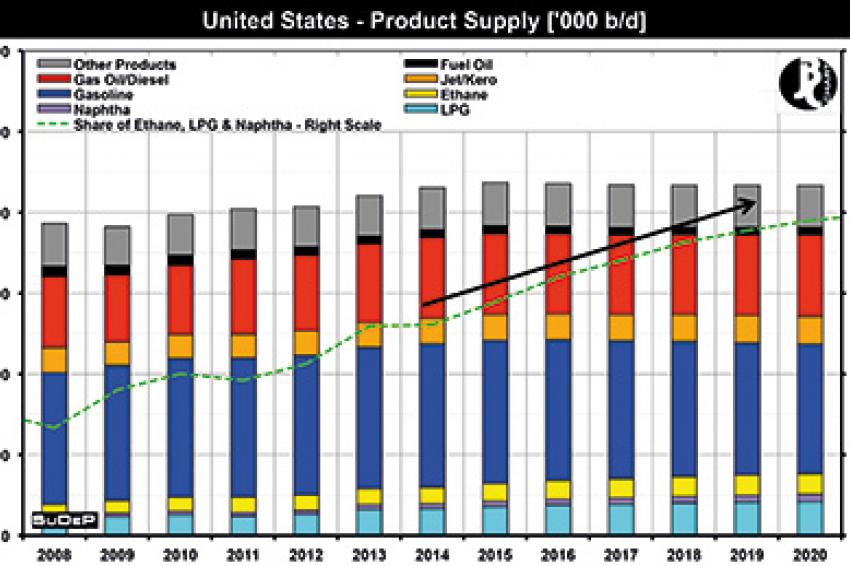

The shale boom has not only supported the energy and petrochemical sectors but has also reduced operating costs for steel producers and manufacturers. In terms of feedstock, the competitiveness of ethane and LPG has heavily affected the use of naphtha. According to the Alternative Motor Fuels Act (AMFA), the proportion of naphtha in the U.S. feedstock slate has declined from more than 25%-30% in 2007 to just more than 10% last year (see figure 1 for our assessment of the U.S. feedstock mix).

Now or Never

This deluge in NGL supplies and the cost advantage of running ethane- over naphtha-based crackers has resulted in a flurry of ethane cracker expansions and projects as well as several planned propane dehydrogenation (PDH) plants. The list of expansion and greenfield sites stretches to 20, while there are plans for five or more PDH facilities.

One thing is clear: Despite the expected growth in U.S. NGL output, the construction of all these plants would curtail the U.S. ethane and LPG surpluses and with that its current cost advantage. Therefore, we expect that this year and next will see the list whittled down. We expect that of the 10 million tons per year (tpy) of ethane-cracker additions planned by 2018, only 5 million to 6 million tpy will come online while only two of the PDH plants are currently firm with start-up dates of late 2015 to early 2016.

Therefore, with additional capacity and the continuation of feedstock switching, we expect U.S. ethane consumption to grow from 990,000 barrels per day (bpd) last year to 1.3 million bpd in 2020 (fig. 1).

Overbuilding a Real Danger

Several global petrochemical players have taken a proactive approach to the emergence of shale and are considering building world-scale crackers on the U.S. Gulf Coast. However, even within North America, competition is emerging, with several companies already carrying out debottlenecking upgrades while others plan to develop new greenfield sites.

Most U.S. ethylene exports head to Canada, South America and increasingly Asia. We would expect U.S. petchem players to continue to tap the South American market, especially considering that Brazilian projects remain bogged down in financial- and construction-management issues. However, one potential issue is that plans for polyethylene capacity lag behind ethylene capacities. Converting ethylene to polyethylene and other derivatives reduces freight costs, as polymers are cheaper and easier to transport.

Wet Shale Plays to Power NGL Output

In terms of crude, despite recent impressive growth, we are more conservative in our outlook than other industry agencies. We believe that the concentration of the shale oil boom to mostly two plays (Bakken and Eagle Ford) and the high decline rates associated with shale wells will temper supply increases. Production from fracked wells deteriorates rapidly with output declining by up to 60% in the first six months.

However, we remain bullish in terms of NGL production. Firstly, we expect natural gas prices to climb throughout the rest of the decade because of increasing domestic consumption and growing liquefied natural gas (LNG) exports, although prices should remain at below half of international prices. We expect this uptick in prices to incentivize producers to boost investment and production.

Secondly, we expect existing shale wells to continue exhibiting growing output of NGLs, while the recent trend of producers exploiting wetter plays is set to continue.

Together, we see these factors lifting U.S. natural gas production to almost 14 million barrels of oil equivalent in 2020 (see figure 2). As a byproduct of this natural gas production, we expect NGL output to grow impressively for the remainder of the decade, with output expected to hit 3.17 million bpd in 2020 from 2.58 million bpd last year, which will help to drive ethane, LPG and naphtha's share in total U.S. product supply to almost 18% in 2020 (fig. 3).

Additionally, we anticipate U.S. LPG supplies to grow from 1.62 million bpd last year to around 2.1 million bpd in 2020. Over the same time period, we see LPG demand growing by 100,000 bpd mainly due to the start-up of at least two PDH plants along the Gulf Coast in 2015 and 2016. Therefore, we predict that U.S. LPG exports will grow from 330,000 bpd last year to around 690,000 bpd in 2020 - with the majority of this growth by 2015 - while prices should trend upward from current levels, closer to parity with crude. Looking ahead, by the middle of the decade we would expect that some additional terminal capacity such as that planned by Sunoco and Occidental in addition to current firm projects - by Enterprise and Targa - would need to come online to provide relief to the U.S.'s supply overhang.

Ethane Exports Limited by Infrastructure

Still, the future of the well-developed U.S. LPG market differs somewhat from that of ethane. Although ethane can be shipped, it is very expensive and requires special, pressurized ships and it will take several more years before any meaningful trade flows are established. In recent years, any substantial growth in ethane exports has been constrained by a lack of infrastructure and designated cargo ships. However, several firms are beginning to make strides in this respect. In addition to Ineos - which was previously the only firm to have signed an agreement to secure ethane from the U.S. - Sabic and Borealis have completed deals to use U.S. ethane at their European crackers. In Asia, interest is also growing, with India's Reliance Industries recently ordering six very large ethane carriers to transport U.S. ethane to its new Jamnagar cracker, due online in late 2016. It is hardly surprising that firms are interested in cracking U.S. ethane. Despite the costs of shipping, alteration to cracking units and the construction of import terminals as well as related infrastructure, the cost advantage currently is still sufficient to incentivize such deals. At the time of writing the price spread was seen at $450 per tonne (Platts) even though naphtha prices were at a four-year low.

However, one important aspect to note here is that increasing natural gas-linked ethane prices may reduce the attractiveness of ethane exports, although we would still expect that ethane will remain at a sizeable discount to international crude prices. Nevertheless, it is safe to say that fellow European petrochemical players as well as U.S. ethane producers will be monitoring these developments with great attention.

Naphtha Exports Set to Grow

In terms of naphtha, we expect that U.S. petchem players may further reduce the use of the product, but in order to prevent tightness in the aromatics and propylene markets, we expect its use not to fall much lower than the 8%-10% level.

However, as light shale oil output - which is naphtha-rich - continues to grow and refiners alter their set-ups to boost runs of light crude, naphtha production is set for a period of growth.

Along with the addition of several condensate splitters - that produce between 50%-70% naphtha - we expect U.S. naphtha production to reach 455,000 bpd by 2020, up from 290,000 bpd seen last year. This rise would make the U.S. one of the world's largest naphtha exporters along with Algeria, Russia and the Middle East. Although this abundance of supplies may weigh on U.S. naphtha prices, we would expect prices to remain only slightly discounted to international crude prices.

The Race is On

In conclusion, in recent years the U.S. has become a net exporter of total refined products - mostly because of transportation fuels such as gasoline and diesel - while in the coming years we expect that growth will be driven by petrochemical feedstock exports such as LPG and naphtha (fig. 4).

Nevertheless, it should be noted that from 2015/16 onwards we see the recent strong growth in US LPG exports slowing down based on rising domestic demand and less dynamic supply, which will disappoint quite a lot of hopes in Asia and Europe for cheap and abundant LPG supplies. Meanwhile, the expansion of the U.S. ethane cracker fleet will increase pressure on European and Asian naphtha-based crackers, especially Japan, and will have Middle Eastern players - who may see higher ethane prices in the coming years - looking over their shoulders.

However, the bonanza will surely not last long if all the planned projects are completed. Thus we would expect that the sprint to capitalize on the unique cost advantage of the U.S. will see a thinning field as players drop away. Additionally, the capacity of the U.S. downstream petrochemical industry to absorb a flood of ethylene may not be sufficient while a lack of polyethylene capacity may limit the country's ability to tap export markets.

Contact

JBC Energy GmbH

Wollzeile 6 -8

1010 Wien

Austria

+43/1/5134922