The “Merger Endgame”

A Surge of Mega Deals Will Reshape the Chemicals Industry

After robust yet modest chemicals M&A activity in 2016, expectations for the year ahead are high. The value of completed deals in 2016 decreased slightly against 2015 to around $100 billion. However, the pipeline of M&A deals is at a record level, with more than $300 billion of potential transactions. This is more than twice the value of the pipeline at the end of 2015 (which itself was an all-time high) and more than the combined deal activity of 2014, 2015, and 2016.

This strong M&A pipeline is driven by a handful of mega deals, each of which will break deal-size records if completed. In the decade leading up to last year, not one deal had exceeded the $20 billion mark. As of early 2017, four deals individually valued at between $40 billion and $70 billion are under way.

Drivers of Deal Activity

At the heart of this trend is an acceleration toward greater scale in chemicals value chains and segments. In area after area, companies have focused their portfolios to reach higher levels of consolidation and are reaping the benefits of market reach, capability, and efficiency through M&A.

The shift is most prominent in industrial gases where the top five companies represent 86 percent of the revenues generated by the top 20 companies, even without considering the announced deals. Air Liquide closed its acquisition of competitor Airgas in the middle of 2016 for $13 billion—the largest deal completed that year—and at the end of 2016, Praxair and Linde announced their intent to merge, a deal that would be valued at $43 billion.

In agrochemicals, multiple deals are under way or have been announced, including Dow Chemical and DuPont’s merger, Bayer’s acquisition of Monsanto, and ChemChina’s acquisition of Syngenta. Similar M&A activity is happening in fertilizers, paints, and coatings. In paints, the race for the merger endgame is in progress, with Sherwin-Williams intending to acquire Valspar. And in fertilizers, Potash is planning the acquisition of Agrium.

While these mega deals will likely face hurdles, particularly from antitrust authorities, it is currently anticipated that major deals in the pipeline will be approved and completed during 2017.

M&A Outlook

Looking ahead, we expect consolidation to accelerate further in chemicals segments where customer industries exhibit high levels of consolidation or are trending in this direction, including segments such as consumer goods, automotive, electronics and coatings.

In addition, deal activity is spurred by chemicals companies’ balance sheets and investment portfolio decisions. A slowing demand outlook combined with high investor expectations leads companies to turn to M&A as an alternative to organic investment options that don’t provide the required returns. In our survey of chemicals executives conducted for the A.T. Kearney Chemicals Executive M&A Report 2017, more than half the respondents saw these factors as important drivers of deal activity.

Moreover, diversified chemicals companies are increasingly shifting their portfolios toward more specialty pure play models, incentivized by the higher multiples investors award to specialty and solution-focused chemicals companies. A prime example of this trend is the merger of Dow Chemical and DuPont, where the company will be split into three parts with two solution and specialty businesses and one feedstock-oriented business.

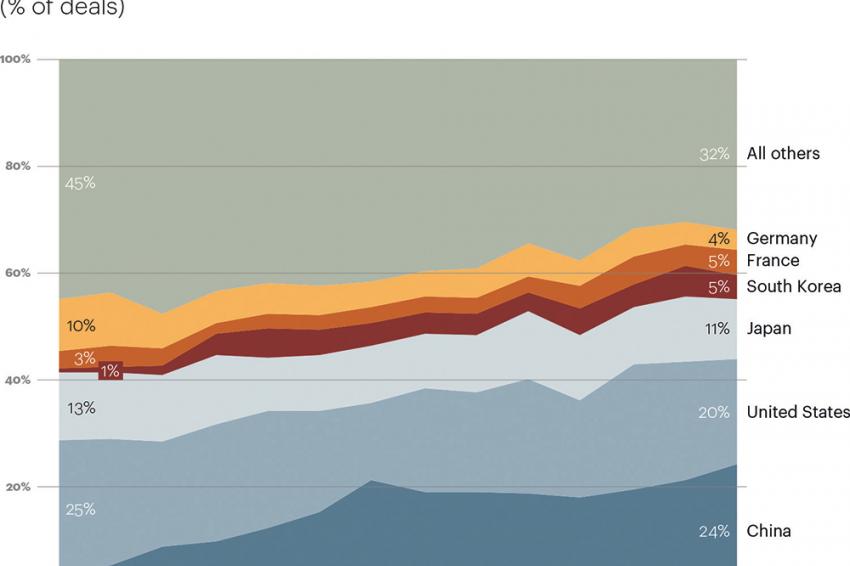

China has steadily increased its share of global deal volume to become the number one country of origin for transactions, representing 24 percent of all deals. This reflects the pattern of emerging market firms seeking access to advanced technologies, services, application know-how and customers — a factor that A.T. Kearney’s study identifies as the most important driver for future activity. Already in 2016, the number of completed deals with an emerging market acquirer and a developed market target more than doubled compared to the previous year while the total number of deals remained stable.

We expect this trend to continue as government-driven consolidation in industries such as steel, coal, and chemicals in China creates more national champions that in turn pursue international growth strategies through M&A. A prominent example is ChemChina and its group. They have been building a strong position in agrochemicals by acquiring Syngenta and Adama as well as establishing the company in rubbers and plastics by acquiring Pirelli, complemented with the acquisition of machinery company Krauss Maffei. We expect similar trends to continue in India, although at more muted levels.

Although currently a small share of activity, chemicals activity in the Middle East is also expected to pick up as companies expand their chemicals portfolios, partly driven by the uptake of direct oil-to-chemicals processes, which provide favorable economics for crude oil producers. This could trigger joint ventures and partnerships with North American, European, or Chinese companies, but it could also prompt acquisitions, with a focus on gaining access to global markets.

New Levels of Uncertainty

While these signs all point toward more M&A, several disruptors could radically change the direction of the industry, chief among them macroeconomic factors related to trade and tariffs, taxation, economic growth, and interest rates. With new levels of uncertainty brought on by political upsets such as Brexit and the US election, chemicals companies are facing difficult questions about what their environment will look like in the next 12 to 24 months. The executives we surveyed say economic volatility is the strongest impediment to M&A growth.

The potential for chemicals M&A activity in 2017 to reach its highest level ever raises two questions: Which chemicals chains will be the next to consolidate? What further deal activity could this trigger? In the words of Airgas CEO Pascal Vinet, such moves may reinforce “the need for others to reassess their position and continue to adapt.” His words about whether we have seen the last mega deal in the industrial gas market also seem appropriate for other chemicals chains and segments: “It is difficult to imagine, but never say never.”