C3X Survey Highlights Paths to Growth in the Chemical Industry

31.05.2012 -

Value Chains - A.T. Kearney, CHEManager Europe and Westfälische Wilhelms-Universität Münster (Institute of Business Administration at the Department of Chemistry and Pharmacy) recently completed their Chemical Customer Connectivity Index 2012, the sixth such survey conducted since 2008. One of the chief findings of this survey was: The future belongs to those who are able to exploit all benefits of supplier customer collaboration across value chains. According to the survey participants, the value creation potential is tremendous: For European chemical players alone, it can trigger additional sales of up to € 25 billion in the long run.

Both manufacturers and customers reported that in the last twelve months demand for their products has grown, albeit at a slower pace than during the same time period the year before. More than every other participant reported a year-on-year growth of up to 10 %. Only some participants (6 %) experienced significantly higher growth.

Outlook: Moderate Growth and Moderate Raw Material Price Increases

For the coming 12 months, virtually all survey participants expect their business to continue to grow. More than two thirds of them believe growth will be at the same level as the year before. Raw material prices are expected to follow suit at around the same level (up to 10 %). However, compared to our Chemical Customer Connectivity Index 2011 the supply situation seems to be slightly more relaxed: Only 10 % of all panel participants expect significantly higher raw material prices compared to the last 12 months. Interestingly, panel participants from the US saw (and expect) lower increases in raw material prices as well as an improved raw material supply situation in their region.

Dr. Tobias Lewe, Partner in the Chemicals and Oil Practice at A.T. Kearney explains: "Raw material prices already reflect market expectations with respect to the future impact of shale gas derivatives in North America. The US is expected to shift from being a net importer to a net exporter of chemicals and chemical raw materials."

Volatility is Here to Stay

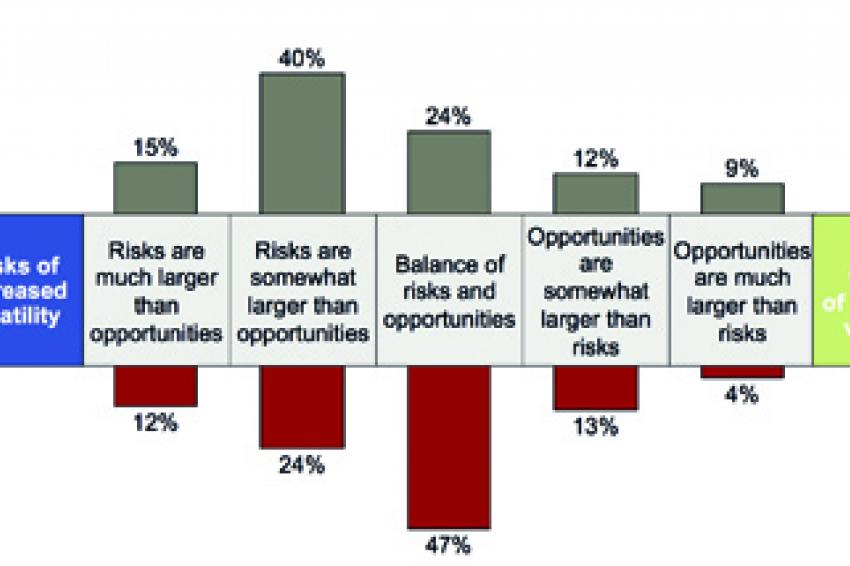

In spite of the stable and rather positive economic climate, there is no doubt that volatility will continue to significantly impact chemical markets in the future. While manufacturers consider risks and opportunities of volatility to be relatively balanced, the majority of chemical customers (55 %) feel threatened by higher volatility.

Lewe explains: "Volatility has increasingly become an issue over recent years. Driven by the global financial crisis in 2008, manufacturers have started to establish appropriate processes and tools to enable them to respond quickly to volatility and to mitigate exposure arising from it."

Collaboration: The New Recipe for Success

Managing volatility across the value chain and seeking value improvements by better managing the interfaces to suppliers and direct customers have together made collaboration the new mantra for growth.

"Most players have optimized the interfaces to their suppliers or customers independently of each other. It's now time for chemical players to find ways to optimize collaboration along value chains in a comprehensive way," says Robert Renard, Manager in the Chemicals and Oil Practice at A.T. Kearney.

And this is a point all panel participants are highlighting: 90 % of manufacturers expect collaboration with customers to be high or very high in five years' time (today: 74 %). Chemical customers support this view (82 % in five years compared to 55 % today).

First Benefits After Two to Three Years

By far the majority of manufacturers and customers measure expected benefits from improved collaboration over a longer time horizon (two to three years). Renard explains: "Collaborative partnerships at a strategic level require adaptations to business models, even possibly changes in corporate culture, and a long time before initial benefits can be captured."

What Drives and What Hinders Collaboration

From a manufacturers' perspective, it is mainly the customers who trigger collaboration.

Further impetus is provided by the need for partners to jointly manage the impact of long-term developments and changes to the ecosystem, such as the development of new energy storage or energy efficiency solutions. These require a variety of different capabilities that typically cannot be provided by one company alone.

With regard to the obstacles to collaboration, manufacturers (52 %) and customers (33 %) agree that people represent the most important shortcoming - either through limited HR numbers or their having the wrong talent for the purpose. As Renard explains, "Adding resources or increasing qualification for selected management functions is often hard to achieve, especially for companies that are already experiencing difficulties filling vacancies."

There is another approach to address this challenge, though: Companies that successfully manage to select and focus on a few top partnerships instead of being caught in a slow and complex transformation process with multiple partners are likely to achieve large parts of the potential fast.

Collaboration Processes Defined, but not Strictly Deployed

Three quarters of manufacturers say that they have defined structured collaboration processes with their customers. Only 40 % of them, however, see these processes consistently applied today. The same picture can be observed on the customer side.

To quote Renard: "Applying these strategic processes strictly will increasingly make a difference. Obviously this has not yet been the case, which means there is an urgent need to develop repeatable and scalable collaboration capabilities, with a special focus on developing game changing collaboration skills."

Most Incentivizing Collaboration Benefits: Growth and Innovation

For all participants the most promising benefit of collaboration relates to growth and innovation: two thirds of manufacturers and customers expect collaboration to provide a breakthrough or have a high impact on growth and innovation.

With regard to the impact of collaboration on cost reduction, risk management and capital optimization, the majority of manufacturers expect it to be moderate or incremental.

With regard to the customers, nearly half of them expect the impact on cost reduction to be high, while the impact on risk management and capital optimization is predominantly expected to be moderate or incremental.

Billions of Top-line Benefits Expected

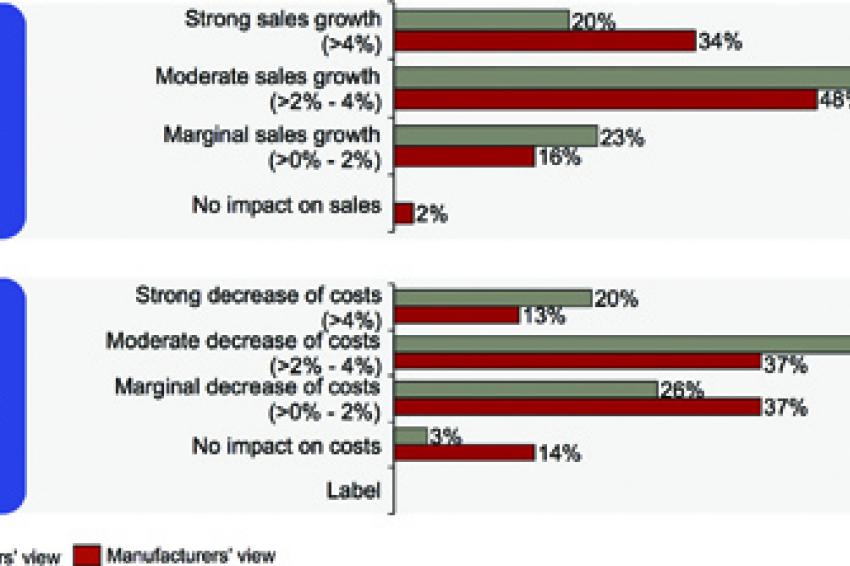

When asked about top-line sales benefits expected from increased collaboration, half of the manufacturers (48 %) and slightly more than half of the customers (57 %) said they expect improved collaboration to lead to a growth in sales of 2 to 4 %. Every third manufacturer and every fifth customer expects a boost of 4 % and more.

Linking these expectations back to the European chemical industries' annual revenues of some € 600 billion, collaboration might trigger additional sales of € 12 to € 25 billion in the mid- to long term.

On top of this, almost half of manufacturers (47 %) and nearly two thirds of the customers (64 %) expect collaboration to result in a cost benefit of at least 2 % to 4 %.

Room for Improvement at the Customer Interface

How do manufacturers today strengthen their customer relationships? They do so mainly by offering improved pricing excellence (73 %) - which is also considered a top three priority by their customers (70 %).

Beyond that, manufacturers put a lot of effort into internal topics such as improving customer and market intelligence (70 %) or sales force efficiency (66 %). These topics, however, rank at the bottom of their customers' list of priorities (33 % and 24 %, respectively).

Sustainability continues to be a hotly debated topic: Only 34 % of manufacturers consider environmental sustainability a key buying criterion for their customers; while in fact roughly every other customer (52 %) bases their purchasing decision on it.

With regard to alternative, that is, renewable, raw materials, manufacturers are still missing out on an important opportunity to address their customers' wishes. In fact, it is the factor where the biggest gap persists compared to manufacturers' efforts. Higher sensitivity of end consumers to environmental aspects, but also increasing crude oil prices and the scarcity of traditional raw materials (especially in Europe), might contribute to this.

Innovation: Unfulfilled Expectations

Manufacturers are focusing their innovation efforts on several key aspects, with gaining recognition as an innovation leader (78 %) and offering new product features (72 %) and new applications (62 %) to customers in line with their requirements among the main ones. In addition, customers expect to be offered new chemical products (71 %); this, however, is recognized by only 37 % of manufacturers.

Compared to 2011, the share of revenues that manufacturers spend on innovation decreased: While the share of top spenders that spend more than 10 % on innovation remained stable, the number of companies that spend 5 to 10 % halved. Moreover, in 2011 virtually no company spent less than 2 % on innovation while 15 % are doing so now.

As Tobias Lewe sees it, "Innovation has not been delivering anywhere near what it promises, especially in respect of customers' increasing appetite for step-changing innovations, such as new, differentiating products or even breakthrough technologies. As a result, manufacturers have proportionally reduced their spendings on innovation while targeting higher innovation efficiency. Better collaboration across the value chain will help to focus innovation spend in the right areas."

About C3X

The objective of C3X is to analyze the chemical industry from the vantage points of chemical companies and their customers. The survey captures the views of senior executives from leading European chemical companies and of decision-makers in customer industries working at the interface to their suppliers. Participants in this sixth C3X survey, which was conducted in March and April 2012, included executives from more than 15 European countries as well as from the US and China, representing chemicals firms and client companies - a total of more than 150 executives in all. The customer industries cover a variety of different sectors, ranging from the automotive and food industries to the cosmetics sector.