Cross-Border Buys

M&A: India Offers Opportunities for Thorough Investors

M&A in the Indian Chemical Industry - In 2011, United Phosphorus of India acquired a majority stake in Brazilian agrochemical company DVA Agro. This was the company's ninth outbound transaction since 2005 and like most of the others, was intended to give them ready market access to Brazil. In the same year, Japan-based Arysta's purchase of a stake in India's Devidayal (Sales) Ltd. gave them access to the Indian market.

Although both transactions had a common objective - market access - the ambitions of the acquirers were very different; in the former case, a large India-based multinational aspirant was aggressively pushing its "go global" strategy, and in the latter one of the world's largest chemical companies was seeking to participate in the India growth story.

Transaction Chemistry: Trends in Chemicals M&A in India

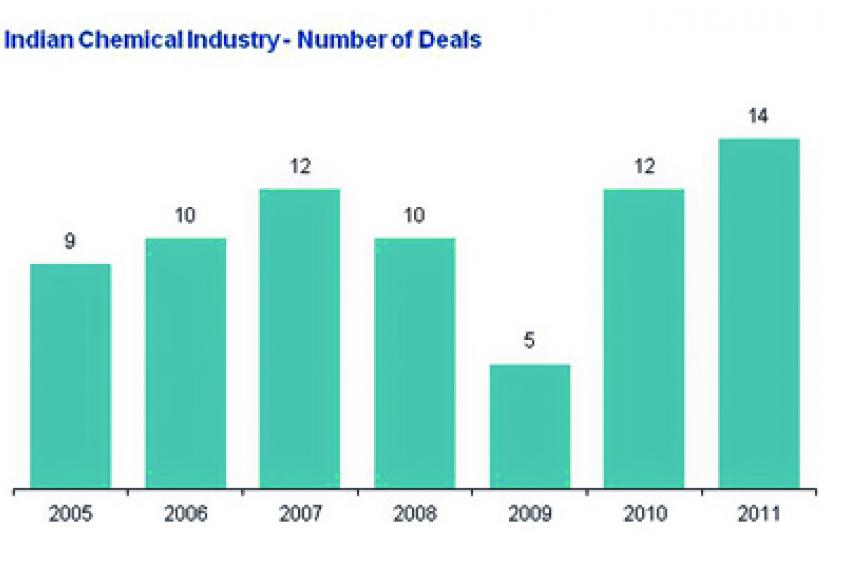

Over the past decade, India has been an active market for M&A in the chemicals sector, and barring the economic slowdown period, deal activity has increased gradually.

However, the dominant M&A theme has been cross-border transactions as Indian companies seek access to international markets, products and technologies, and international companies seek to participate more actively in the domestic market.

Of the 33 outbound chemical deals announced between 2005 and 2011, the U.S. was by far the preferred market, followed by the U.K., Germany and emerging markets such as Brazil, China, Egypt and Malaysia. The following key themes characterized most of these deals:

- Access to new products. For example, Navin Flourine's acquisition of Manchester Organics' fluorination chemistries helped the buyer enhance capabilities to undertake more complex fluorination projects in its specialty fluorochemicals portfolio.

- Accessing new markets or strengthening market presence. For example, United Phosphorus' acquisitions of Sipcam Isagro and DVA Agro helped the company gain a formidable position in the Brazilian crop protection market.

- Capacity access and strategic sourcing. For example, Refex Refrigerants' acquisition of Singapore-based Kaltech Engineering & Refrigeration helped Refex source critical products from the company and improve profit margins. Sanmar's acquisition of Egypt-based Trust Chemical Industries and Tata Chemical's acquisition of U.K.-based Brunner Mond helped both buyers increase their caustic soda capacity in the respective regions.

The following underlying themes were evident in the 14 domestic chemical deals announced between 2005 and 2011:

- Capacity access. For example, VV Titanium Pigments' acquisition of Kilburn Chemicals gave it access to additional capacities for manufacturing titanium dioxide to meet its growing export demand from international markets. Similarly, Aditya Birla's purchase of Kanoria Chemicals' chlor-alkali business helped the buyer more than double its existing capacity.

- Private equity investments supporting high growth. For example, Jacob Ballas' investment in Vivimed Labs helped the company grow its niche personal care ingredients portfolio and also to set up a U.S. FDA-compliant pharmaceutical API plant.

- Strengthening the product portfolio. For example, Coromandel International's acquisition of a majority stake in Sabero Organics helped the company become less dependent on its subsidy-supported fertilizer business and diversify into pesticides.

The 25 inbound chemical transactions between 2005 and 2011 were motivated essentially by two key themes:

- India market entry. For example, Eliokem's acquisition of Apar Industries' polymer business helped the company establish a strong presence in India while helping to serve as a platform to introduce Eliokem's broader product portfolio into India.

- Complementary product access. For example, Huntsman's acquisition of Laffans Petrochemicals' ethylene oxide derivatives business helped the company establish a presence in a business complementary to Huntsman's amine-based international product portfolio.

As the number of deals has increased, so has the average deal value - indicating a clear buyer preference for larger assets - though this is biased significantly toward outbound deals; the average deal size for inbound transactions in 2005-11 was $42 million.

India Catalyzed: Growth Drivers for the Indian Chemical Industry

The $65 billion Indian chemical industry, growing at 9% per annum, comprises the following key segments:

- Basic chemicals, including organic and inorganic chemicals, petrochemicals, synthetic fibers, chlor-alkali, industrial gases and fertilizers

- Specialty chemicals, including colorants, paints, water treatment chemicals, personal care ingredients, construction chemicals, polymer additives, preservatives and other specialty chemicals

- Agrochemicals, including insecticides, herbicides and fungicides

Growth in the sector is being driven by:

- Rising consumption. Consumption levels in the Indian chemical industry are significantly lower than world averages. For example, pesticide consumption is 0.5 kg/hectare in India versus 16 kg/hectare globally. With sustained economic growth, India's consumption levels are expected to steadily align with global levels.

- Growth in downstream products. India's chemical industry consumes approximately 30% of its own production. High growth rates in industrial products like pipes, packaging materials and plastics are driving growth in the upstream chemical value chain.

- Reducing dependence on imports. India remains a net importer of chemicals, and the industry has historically focused more on meeting domestic needs rather than tapping the global market. This is beginning to change as domestic capacities are being built to reduce import dependence and increase exports.

- Inherent factor advantages. India has abundant availability of trained manpower and skilled technical professionals, who are available at a lower cost compared with those in mature markets. This makes the country an attractive outsourcing, manufacturing and R&D location.

- Enabling regulatory framework. The Indian government allows 100% foreign direct investment (FDI) in the chemicals industry except for some hazardous chemicals. The agricultural sector is also expected to continue receiving policy thrusts (subsidies and incentive schemes), which will positively affect inputs such as fertilizers and agrochemicals.

- Supply side changes. The Indian chemical industry is highly fragmented (the top 10 companies in India contribute less than 15% of industry revenues and the top 100, less than 40%) and as smaller companies struggle to find economies of scale, consolidation in the market will continue, presenting international companies with an attractive entry point to the Indian market. Larger chemical companies are expected to continue pursuing their "go global" agenda and seek outbound acquisitions.

The Formula: Closing a Transaction in India Successfully

Foreign investors and companies evaluating deals in the Indian market should keep in mind the following considerations:

Decision Making

The shareholding and operations are often under the control of various family members and key associates. This may result in multiple decision makers or influencers. It is important to identify the key decision makers and influencers early in the transaction.

Cultural Factors

Indian sellers tend to be ambiguous and less upfront about their expectations from the transaction. Pride, peer pressure, family and other social factors also play on the minds of the vendors. In order to avoid protected negotiations, it is advisable to hold explicit discussions on scope, early on, to avoid ambiguities. Consider tailoring the transaction to manage softer issues such as succession planning, non-compete and vendor earn-out arrangements.

Price Expectations

India is a fast-growing market and recent transactions have taken place at rich multiples to reflect the strong growth potential. Indian sellers are all too aware of these multiples and will negotiate a hard bargain. Furthermore, business plans are often highly inflated and do not support market opportunities. This makes valuation a tricky exercise and doing diligence on the business plan is time well spent.

Availability and Quality of Information

The ability or willingness to deliver standard financial and operational data on the company may not be up to the expectations of an international buyer. The Indian chemical market is not well researched, and insights on a company's focus markets and competitive positioning are often difficult to find or not reliable. It is advisable to conduct detailed primary research and interviews with customers to get a sense of ground realities.

Knowing Your Counterparties

It is always advisable to conduct detailed background checks on creditors, customers, suppliers and other key business stakeholders to avoid nasty surprises post-deal.

Regulatory Issues

Certain investments are subject to Foreign Direct Investment/Foreign Investment Promotion Board/Competition Commission of India regulations, and listed targets are subject to takeover guidelines. Such approvals and processes may take three to 12 months. As a result it is important to appropriately evaluate transaction structuring options to comply with the Competition Act and tax jurisdiction matters.

Legal Recourse

In case of disputes arising from the transaction, Indian courts and other regulatory agencies may take several years before giving any verdict. Investors should consider escrow accounts, robust warranties and indemnities and well-defined arbitration mechanisms to speed up compensation. Perhaps even arbitration jurisdictions in other countries.

Governance Issues

There are a host of areas where governance standards fall well short of those a blue chip multinational acquirer would expect. As a result, the following aspects should be examined carefully during due diligence:

- Situations where the company participates in government tenders or public-private partnerships

- Extensive use of cash payments

- Real estate transactions and commission payments

- Labor intensive operations that may not meet minimum wage requirements

- Family-owned conglomerates with extensive related-party transactions

Outlook

Growth prospects for the chemical industry in India remain strong. The fragmental structure of the industry will provide investors with interesting opportunities. The challenge is to seize these opportunities at an affordable price. This is only possible by getting to know the vendor and the company in detail before doing the deal.

Contact

KPMG AG Wirtschaftsprüfungsges.

Tersteegenstr. 19 -31

40474 Düsseldorf

Germany