Renaissance of U.S. chemical industry production

29.01.2013 -

Made in the USA - The United States is currently experiencing a re-industrialization that, until a few years ago, hardly anyone had thought possible. Car manufacturers such as Chrysler, GM, Nissan or Volkswagen and electronics giants like Samsung have started to build up new production capacities, or have announced to do so.

In other sectors such as the energy and the extractive industries, as well as the pharmaceutical industry and biotechnology, similar investment decisions are emerging. There is every indication that here a trend reversal is taking place, and that across a broad front.

According to an analysis by Accenture, investments of $1 trillion in total are planned in industrial production in the U.S. over the next four years, until 2016.

The reasons why the U.S. has gained attractiveness not only as a sales market, but especially as a production location are complex. First of all, labor costs have become less relevant as an argument for moving production to low-wage countries. Secondly, the physical proximity to customers and markets has become a more important factor. And thirdly, the intensive exploration and production of shale gas is the fuel that drives the train back to the USA. From this development the chemical industry is benefitting twice. The expansion of capacities in the customer industries leads to an increased demand for chemical products, and their own production costs decrease due to the low gas price.

Low Wages are Not Important Any Longer

In the past - in addition to the proximity to new markets - it was often the significantly lower labor costs, which prompted the companies to relocate large parts of the production to emerging economies like China, India or Brazil. As a result, some 5 million jobs were lost in the U.S. over the decade between the years 2000 and 2010. It is not likely that many of those jobs in the mass production of consumer goods in electronics or textile industry will be shifted back. Meanwhile, however, in industries with high added value, such as the capital goods or the automotive industries and the chemical industry as their supplier, other criteria offset the advantage of wages as low as possible. Moreover, also this factor will become less relevant, because the dynamic has changed.

The unit labor costs in America have been stagnating for more than a decade, compared to those of major trading partners. For the next few years up to 2016, a moderate increase of 0.5% is predicted, whereas an increase by more than 8% per year is expected for China, and yet at least almost 2.5% for India. In addition, as a result of the continuously advancing automation and the use of increasingly sophisticated robots the productivity in the U.S. has risen much faster than the wage level.

Proximity to Customers is Getting More Important

One factor that has become increasingly important is the proximity to the consumer. Not only is it becoming continuously more difficult to predict economic cycles, also the purchasing behavior and the taste of the customers can change from one day to the next. In such a volatile market environment, no manufacturer can afford to produce large quantities of goods for stock and then transport them over long distances - especially with transport costs tending to increase. The Japanese car manufacturers were the first to understand that and started to build up production sites in their major export markets early. Meanwhile, customer proximity as it is demanded today is practiced by most industries and is one of the main reasons for the current increase in capacities by the automobile industry in the U.S.. The most recent example is the construction of a new plant in Chattanooga by Volkswagen which started operation in 2011.

The principle to manufacture where the market is has a lot of advantages. Thus, it allows a closer cooperation between the development and the manufacturing of new products and a better adjustment of the specifications of new developments to the needs of the customers. Furthermore, in the case of quality problems reaction times are shorter than if the contract supplier were located on another continent.

Low Gas Price is An Accelerator

The catalyst for the renaissance of industrial production in the U.S. is, no doubt, the cheap gas. The discovery and exploitation of large shale gas deposits has led to a massive price decline. In the year 2011, the gas price in the United States was 40% lower than in China, 50% lower than in Brazil and 85% lower than in India. Moreover, the latter countries cover the large part of their energy requirements from oil and coal, and only a small fraction from gas. In North America, however, the share of gas in energy consumption is between 24% and 30%.

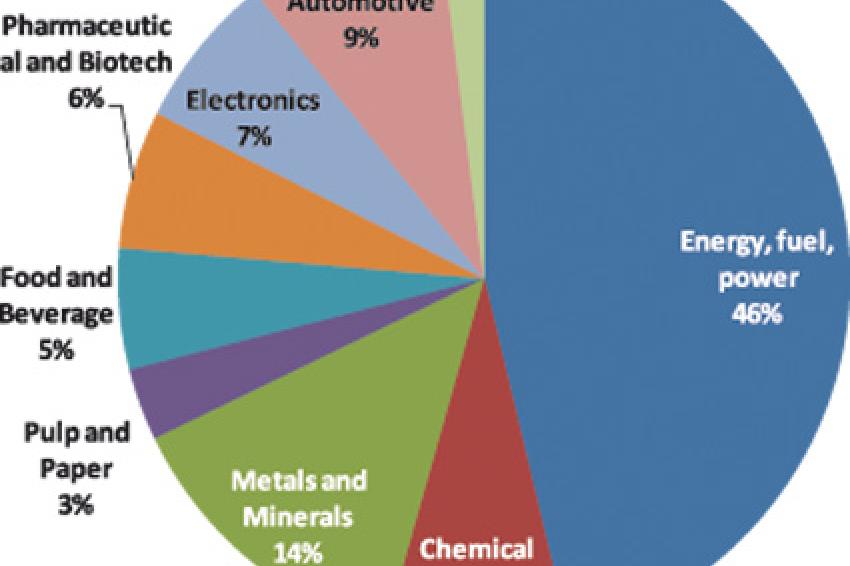

While potentially all sectors of industry with production sites in the United States benefit from this price advantage, the chemical industry actually profits in two ways: The energy needed for the manufacturing process is cheap and a lot of pre-products that are based on natural gas become cheaper as well. According to present calculations, as a consequence the ethylene production in the U.S. could rise by up to 30% until 2017. A number of large chemical companies such as Chevron Phillips Chemical, Shell Chemicals and Dow Chemical have, meanwhile, announced to expand their capacities in America. This is hardly surprising if one keeps in mind that, for the manufacturing process and the pre-products, three quarters of the demand of the chemical industry in the United States is covered from natural gas and that the chemical production is even more energy-intensive than paper, metal, plastics or rubber production.

New Markets vs. Old Markets

Has the gold-rush mood in the BRIC countries evaporated? The answer is no, but the indicated trends suggest a more nuanced picture. The re-industrialization of the U.S. is creating new opportunities also for German manufacturers who are obviously going to take them, as a survey by Accenture among 120 German companies with subsidiaries in the U.S. suggests. According to this survey, two thirds of the interviewed managers expect that the U.S. market will become more important for their companies. However, the possibilities resulting from this need to be analyzed accurately, in order to achieve an accordingly high return on investments in new capacities. Then, due to the revived competitiveness, North America could once again become the "place to be".