Securing Product Supply in the Pharmaceutical Industry

Pharma Management Radar Examines Business Climate and Success Factors in the Pharmaceutical Industry

Europe's pharmaceutical industry is in the midst of fundamental change and threats appear from a wide-range of sources: demand and growth potential is increasingly shifting to the so called "Pharmerging" markets and the generic segment, price pressure is at an all-time high, regulatory hurdles are increasing and value chain challenges are proving hard to overcome. Extensive adjustments to business models are necessary, and it seems that at the moment, especially in the area of product supply, reliability is a critical problem spot for globally active pharmaceutical companies.

This is the picture that emerges from the first Camelot Management Consultants PHARMA Management Radar survey, a bi-annual survey that serves to examine the general climate in the pharmaceutical industry and, additionally, takes an in-depth look at varying management topics. In a four-week period during February and March 2013, almost 60 executives from globally active pharmaceutical companies based in 16 countries and spread over four continents, participated in the online survey. Companies with a business model predominantly characterized by developing and/or commercializing innovative medicines ("Innovators") comprised roughly two-thirds of respondents; one-third were participants from companies predominantly active in the generics segment ("Generics"). Survey participants represent almost two-thirds of the global Top 20 pharmaceutical companies. The focus topic of the first Pharma Management Radar is Product Supply Reliability.

2012 Review and Outlook

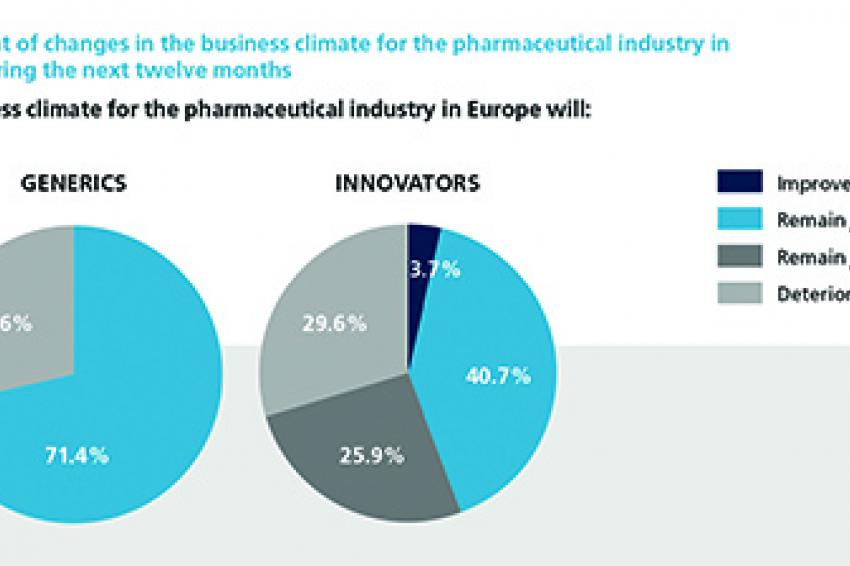

Although 2012 may well be considered as one of the more tumultuous years in the pharmaceutical industry's history, the surveyed experts were generally quite positive in their estimation of the current business climate. Interestingly, they were more subdued when considering the business climate in the next 12 months. Not only is no significant improvement expected for the pharmaceutical industry, one-third of respondents are even anticipating deterioration. Shaken by their experience of patent expiration, this sentiment is particularly pronounced among Innovators, with more than half of all respondents downbeat about the sector's business prospects over the next twelve months. The producers of Generics have a strongly more positive assessment. Heightened competition and price pressure dampen the 2013 business development outlook of Innovators, with only a very small fraction of below 5% expecting sales to grow by more than 10% in fiscal year 2013 compared with the previous year. More than half of the participating Innovators anticipate either only modest sales growth of 0-5% or even a reduction in sales performance. Generics, in contrast, are far more upbeat, with more than 85% of executives in this segment expecting sales to grow at rates above 5%, while almost 30% even expect significant growth above 10%.

Patents Terminating

While the end of patent exclusivities alone creates a difficult business environment for some companies, the pharmaceutical industry has experienced an extra jolt in the form of the Eurozone crisis. The severe economic difficulties encountered by Spain, Portugal, Italy and Greece have negatively impacted demand expectations for Southern Europe. At the same time, the crisis has thrown into sharp relief the promise of Eastern Europe. Innovators and Generics alike rank Eastern Europe as one of the top regions for demand growth worldwide. Some of the Eastern European countries have mastered the crisis of the Eurozone quite well and profit from comparably good macroeconomic framework data benefiting also the healthcare systems.

"Pharmerging" Markets

The so-called "Pharmerging" markets have also kept their appeal. Innovators see continued high demand growth particularly in China, Russia, Eastern Europe and Brazil. With rising purchasing power, a growing middle class and better healthcare systems, these are clearly the markets of the future. The highest growth rates in demand for Innovators are expected in Africa, albeit starting at a very low level.

New Investments

As can be expected, the investment focus of pharmaceutical companies for the next 12 months largely mirrors anticipated regional demand growth. Both Generics and Innovators plan to invest significantly in the USA/North America, still the world's largest pharmaceutical market. A significant share of Generics producers also plans to invest in Eastern Europe. Given that Innovators anticipate the strongest demand growth in Russia and China, they are investing strongly in these two countries.

Sourcing

External sourcing is an ongoing trend that has lost none of its strength. More than 70% of respondents expect to increase the volume of external sourcing in the next 12 months. Yet the challenges of increased external sourcing have not been completely mastered, particularly by Generics. Almost three-quarters of the participants from the Generics segment currently view insufficient product supply as the greatest risk to their business. Indeed, issues with important suppliers and insufficient product supply top the list of challenges that Generics say could severely impact their business.

Challenges

Innovators however worry about a whole clutch of fiscal and political threats. Most Innovators rank government regulation/healthcare system directives as their top business risk over the next twelve months. One-third of them also worry about the Eurozone crisis. One-quarter also view the withdrawal of legal/political recognition of patent protection as one of their greatest risks, as evidenced by current developments which show that these concerns are to be taken seriously. Among Innovators, the predominant trend by far is the focus on product innovation, which was the top answer for more than two-thirds of respondents, followed with some distance by "Supply Chain Agility". Research collaboration is seen as the most promising answer to the need to increase the output of product innovation.

A pharmaceutical company's business model plays a large role in shaping where risks and opportunities will be seen. Based on the survey, it is clear that Innovators largely see danger in external factors that are chiefly out of their control and in many instances political, while Generics are still most engaged with their own organization and the integration of external suppliers into their value chains.

Critical Success Factors

Given that Generics view product supply reliability as their greatest risk, it is worrisome that one-third of these surveyed executives feel that product supply reliability has deteriorated over the past two years. They are not alone in their estimation: Almost one-quarter of Innovators also feel that product supply reliability has decreased in the same time period. None of the interviewed experts believe product supply reliability has increased significantly.

Pharmaceutical companies are introducing a number of measures to tackle this problem, with risk management featuring prominently. More than 80% of participants from the generics segment think that risk management is the key to increasing the reliability of product supply. An additional central lever to improve supply chain reliability is improved information/data exchange with suppliers, which again highlights the ongoing outsourcing trend and its accompanying challenges.

As Sean O'Sullivan, European Supply Chain Manager at Mundipharma says: "Improving agility is the key to increasing the reliability of our product supply. The sustained trend towards external sourcing means that improved information and data exchange with suppliers has become essential for increasing the agility of modern supply chains."

Innovators are introducing a mixed batch of measures to increase product supply reliability. Since supply chain agility is promoted, it makes sense that respondents from this business model cite areas such as people, capabilities/skills, internal processes and information/data exchange with suppliers as those with the greatest potential for increasing their product supply reliability. The clear goal, however, of all these measures and programs is to guarantee successful product launches. Innovators are also introducing these improvement programs to increase customer service levels, prevent stock-outs and protect their value chains against demand volatility. Generics, in contrast, strive mainly for improved margins when introducing programs to increase the reliability of product supply

________________________________

Please register to participate in the next PHARMA Management Radar survey: www.pharmamanagementradar.com

Free copies of Camelot's studies on the global pharmaceutical industry can be found at www.camelot-mc.com/insights