Activist Investor Ackman Exits Valeant

15.03.2017 -

US activist investor Bill Ackman is pulling the plug on his Pershing Square Capital Management hedge fund’s loss-making engagement in drugmaker Valeant. After the close of trading on Mar. 13, Pershing Square announced it had sold around 27 million shares in the company that it had been trying to push to greater heights since 2015.

Ackman said he and Stephen Fraidin, a Pershing Square vice chairman, will remain on Valeant’s board until the company’s annual meeting but will not seek re-election. The billionaire took a seat on the Valeant board a year ago, when one of the pharmaceutical produce’s directors stepped down in concert with CEO Michael J. Pearson.

On news of Ackman’s appointment in March 2016, Valeant’ shares rallied after falling for months. At the time, he said his fund would take a “much more proactive role” at Valeant to protect its investment. Last year Pershing Square was believed to hold a stake upwards of 9%e in the drugmaker based in Canada and managed from the US, but latest reports put the figure at just over 5%.

The hedge fund was one of the driving forces behind the former CEO’s failed quest to acquire Botox maker Allergan – the Botox maker was grabbed up in November 2014 by Ireland-based Actavis, (which subsequently changed its name to Allergan).

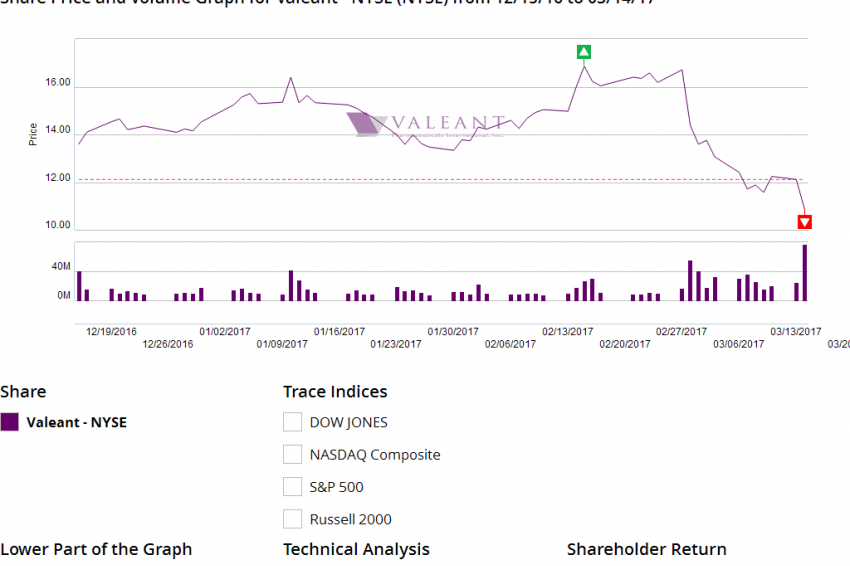

During the months following the collapse of Valeant’s bid for Allergan and the negative publicity surrounding alleged price-fixing deals and questionable accounting practices at the Canada-based firm, Ackman continued to try unsuccessfully to turn the rudder around. On Mar. 13, Valeant’s shares closed at $12.11, down from a high of $257 in the summer of 2015.

In a statement explaining the move, Pershing Square said the Valeant investment required a “disproportionately large amount of time and resources.” It added that the “large tax loss” to be realized from the share sale “will enable us to dedicate more time to our other portfolio companies and new investment opportunities.” Ackman’s fund is said to have paid an average of $190 for its Valeant shares.