Adhesives and Sealants Are Gaining in Demand

The Specialty Chemical Products Necessary in Innovative Designs

Sticking Together - Adhesives and sealants are specialty chemical products whose demand is increasing steadily - not only in well-established applications but even more so in innovative and high-tech end-use markets. While they are designed and expected to perform in increasingly sophisticated applications, their importance is evidenced typically when their service fails.

The Global Demand

The global usage of adhesives and sealants represented a market of 12.2 million tons of formulated products in 2010 and a value of €30 billion. Within the total chemical market, adhesives and sealants hold a share of less than 1% and are viewed as a specialty market.

The worldwide economic crisis in 2008 and 2009 caused the level of the global demand for adhesives and sealants to drop 5-6%. Growth resumed in 2010, which was supported by a recovery in the industrialized nations and a strong upswing in the emerging markets (China, Brazil, India, Eastern Europe).

In 2010 the Asia-Pacific (APAC) region reached a demand volume similar to that in the Europe-Middle East-Africa (EMEA) region. Together the two regions controlled 70% of the world demand for adhesives and sealants, followed by the Americas.

The growth projections 2010-2013 include a particular strong growth expected in the APAC region, which will make it the largest global market in 2013. While the global demand for adhesives and sealants is projected to average an annual growth of 4-4.5%, the demand in China and India is expected to grow at nearly twice the rate of the global demand.

Market Segments

The market for adhesives and sealants is comprised of thousands of end uses. The realm of market applications expands as new end uses keep developing, driven by the need for new and innovative attachment solutions.

According to the Classification of Adhesives and Sealants established by the industry associations such as FEICA (Association of European Adhesives and Sealants Manufacturers in Brussels) and the ASC (Adhesive and Sealant Council in the U.S.) the market is divided up in eight broad market segments. These market segments can in turn be broken down into many sub-segments.

When looking at the total market, adhesives account for about 75% of the volume consumed and sealants 25%.

Adhesive And Sealant Products

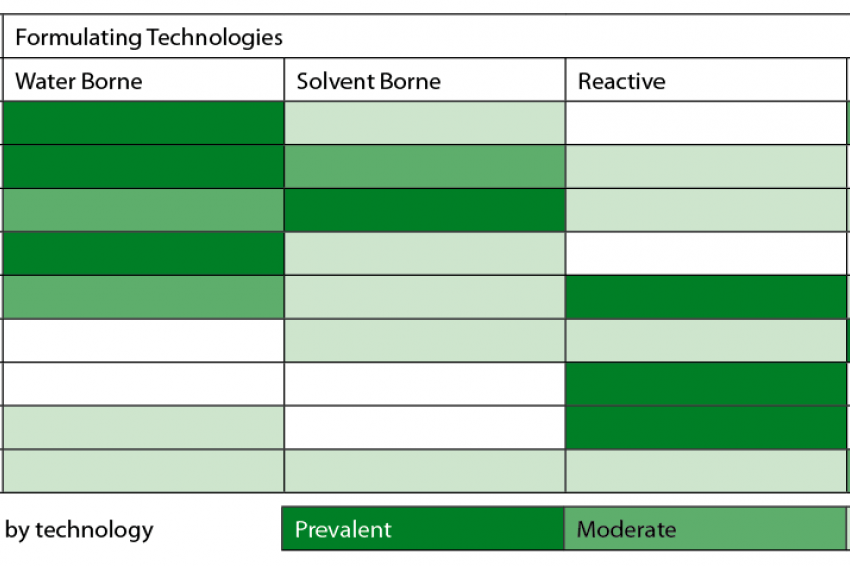

Adhesives and sealants are also classified by the technologies and by the polymers used for formulating the products. Four technologies and about 15 polymer classes serve as bases for meeting the bonding and sealing performance requirements worldwide.

Technologies

Water-borne systems account for more than 50% of the global demand for adhesives and sealants. Their primary use is in converting/packaging and building/construction applications, and their growth is about equal to the average growth rate defined for the entire market.

Solvent-borne systems are primarily used in contact adhesives in construction applications, as well as in adhesives for footwear, leather and various assembly applications. The usage of solvent borne adhesives is increasingly restricted by VOC regulations. Therefore the demand for this technology is growing below the average rate projected for the adhesive and sealant market. Solvent-borne systems tend to be substituted by safer water borne, reactive and hot melt products.

Reactive systems are chemically reactive adhesives and sealants. These systems are growing at a sustained rate as the technology prevails in sealant formulations and in structural adhesive bonding. Reactive systems are available as one and two-part systems.

Hot melts are 100% solids systems that find primary application in packaging/converting, woodworking/joinery and other product assembly adhesives. The demand for this technology is growing at a rate higher than the industry average.

Raw Materials

Four major raw material classes - vinyls, acrylics, rubber (natural and synthetic) and polyurethanes serve as polymer bases for nearly two-thirds of the adhesives and sealants consumed worldwide. These polymers can be used in various technologies and their usage is spread across many market applications. In some end uses, the demand for these polymers qualifies as mature and is growing more slowly than the total market.

Other competing polymers are gaining gradual market share. Epoxies, silicones, natural products such as starches and dextrins, and the block copolymers belong to the next tier of raw materials that are more market-application specific. They usually experience above-average growth through market penetration and the displacement of commoditized raw materials.

Other raw material types include reactive modified acrylics, cyanaoacylates and anaerobics, silane modified polymers, polysulfides and various polyolefins. These raw materials represent for the most part high-value added polymers used in niche markets.

Market Trends

The growth of the emerging markets has not only a positive impact on the volumes of adhesives and sealants consumed (especially in the construction and industrial sectors) but also on the level of technological demand. The new industrial plants being installed and infrastructure developments taking place in the emerging markets tend to call for modern, state-of-the-art bonding and fastening techniques, which has a leap-frogging effect on the demand for adhesives and sealants.

In addition to the positive macroeconomic effects of the geographic growth, the effort to improve energy efficiency and reduce CO2 emissions is also a major force driving the demand for adhesives and sealants. The following end-use market trends are providing for a long-term sustainable growth of the demand worldwide:

-

The increasing use of new light-weight assembly materials used in the transportation and the wind energy (rotor blades) sectors requires adhesive bonding rather than mechanical fastening.

-

Improved building energy efficiency is stimulating the use of insulation panels as well as insulated windows. The attachment of panels together with the production and installation of insulated windows generate sustained demand for construction adhesives and sealants.

-

The miniaturization trend and complex designs seen in industrial and consumer goods creates an assembly challenge. Adhesives are increasingly displacing the use of mechanical fasteners for bonding elements that are difficult to reach and where space is restricted - mobile phones being a typical example.

-

Noise and vibration damping in mechanical engineering and in the transportation sector are growing in importance and creating new applications for adhesives and sealants.

On a less positive note, the adhesive and sealant industry is also experiencing the current negative effects of rising raw material and energy costs as well as the raw material supply disruptions.

Contact

CHEM Research GmbH

Hamburger Allee 26 -28

60486 Frankfurt

Germany

+49 69 970841 13

+49 69 970841 41