Most people believed that ChemConnect, CheMatch, Elemica, and other online platforms would transform the chemical industry.

Now, almost 20 years later, we can see very little evidence of this. More than 90% of all chemicals are sold directly or through traders, agents or distributors, but not over online platforms.

Why is it that most chemical companies continue to buy and sell their products the same way they did two decades ago? Why are they forgoing the power and convenience of online platforms in favor of e-mails, faxes, phone calls, and handshakes? Why don’t they listen to their consultants? Haven’t they felt the urgency to “digitalize and optimize” like so many others have done, especially in their customer industries? Don’t they see the fundamental power shift from principals to customers in the chemical distribution supply chain?

“68% of chemicals worth $76 billion will be sold

online within the next five years.”

C2B Replaces B2B and B2C

Suppliers no longer approach the market through trade shows, marketing activities, and active sales. Customers increasingly search online and initiate digital contacts via websites, blogs, social networks, search engines, and commerce platforms. The principals and distributors they do not find online are no longer present in the relevant markets. Principals and distributors who miss this train should not be surprised that others are taking all the organic growth. Besides this risk of not being digitally visible there is also a strong trend of existing customers to increasingly require platform services. There is a latent risk of those customers migrating elsewhere over time if their principals or distributors are not responding properly to their request for digital convenience.

What do we mean by digital convenience? Product availability and the assurance that the product will be delivered on time, in full, and in compliance with specifications are the two most important buying criteria for most customers. Convenience, rather than price, comes third. The advantages of providing online convenience are quickly progressing. Take, for example, the purchase-to-pay or order-to-cash processes with principals or customers. The era of phone calls, faxes, and e-mails is nearly over, and orders will increasingly be handled through automatic order scanning and recognition (e.g., optical character recognition – OCR), directly via machine-to-machine portals (e.g., electronic data interchange – EDI) or over self-ordering commerce platforms.

It is estimated that almost all principal- and customer-centric processes will become “touchless” and digital. This will allow for quick product availability and credit status checks, prioritized product allocation in accordance with predefined business rules, and automatic delivery date confirmation. Picking, packing, shipping, and tracking will be done online and self-invoicing with payment tracking will become standard procedure. A supply chain “control tower” with a “management cockpit” allows for real-time visibility, reporting, and controlling. This will provide many advantages for the participants in the chain.

“There will most likely not be one “Chemazon”,

but a variety of successful solutions.”

Conditions Specific to Chemical Distribution Require Manual Interventions

Seamless, integrated end-to-end supply chains all sound well and good, but why have we seen only a few, isolated solutions in the market so far? In chemical distribution, unlike other online retail categories, there are specific obstacles. The quality of master data tends to be rather poor and the complexity of product attributes, regulatory requirements, specific packaging, delivery terms and conditions, and many other detailed needs is high. There are rarely standardized orders, a situation that gives rise to the need for manual intervention in order to compensate and ensure a fit with a distributor’s system requirements. In many cases, the product is not available at the right time, in the right place, and with the right packaging.

This in turn leads to many manual interventions and adjustments. Automated blocks are frequently applied to orders, examples being order limits, delivery blocks, credit checks/holds, etc. These also require manual intervention. What is more, there is often no internal agreement on how to deal with principals or customers that do not abide by the agreed terms and conditions. Last but not least, good use of best-in-class digital tools for further automation is often lacking. The complexity and the resulting frequent manual interventions are the real show-stopper. The effort to automate only pays off for readily available standard products with high order frequency. Thus, it is no surprise that AmazonBusiness, 1688 by Alibaba, and other online retailers focus on laboratory chemicals, consumables, standardized fine chemicals, and maintenance, repair und operations (MRO) services first, rather than on specialty chemicals or hazardous bulk chemicals. Automation will become cheaper, but a large part of the chemical distribution, where automation costs are not in proportion to the expected benefits, is expected to remain.

“Survival chances of current online platforms are

much higher than 20 years ago.”

Survival Chances of Online Platforms are Much Higher than 20 Years Ago

Currently we can observe a wave of new chemical online platforms, some of which are managed by chemical companies (e.g., Asellion by Covestro, OneTwoChem by Evonik, CheMondis by Lanxess), chemical distributors (e.g., DigiB by Brenntag, ChemBid by Büfa, ChemPoint by Univar), online retailers (e.g., 1688 by Alibaba, AmazonBusiness), and new Start-ups (e.g., Agilis, Carbanio, ChemNet, Chem-Space, GoBuyChem, Kemgo, Kemiex, Molbase, and Pinpools).

Will they suffer the same fate as those Start-ups 20 years ago? Today, the chances of success are significantly higher because the Internet is an everyday tool for most of us. Furthermore, bandwidth and computing power are much bigger and cheaper than ever before. Additionally, the power of principals is declining as the structure of the chemical industry becomes increasingly fragmented, offering a wider variety of supply sources. China is approaching 40% of the global share of chemicals supply. Last but not least, there is a plethora of digital on-premises and cloud solutions to overcome interfaces in IT systems and architectures within companies and end-to-end from principals to distributors to customers.

Data analytics supports planning, and wireless transponders on smart pallets enable track and trace – also for disaster recovery and business continuity. Blockchain technology has the potential to be used in direct financial transactions, peer-to-peer, without intermediaries. So why hasn’t the chemical industry jumped on the digital bandwagon yet?

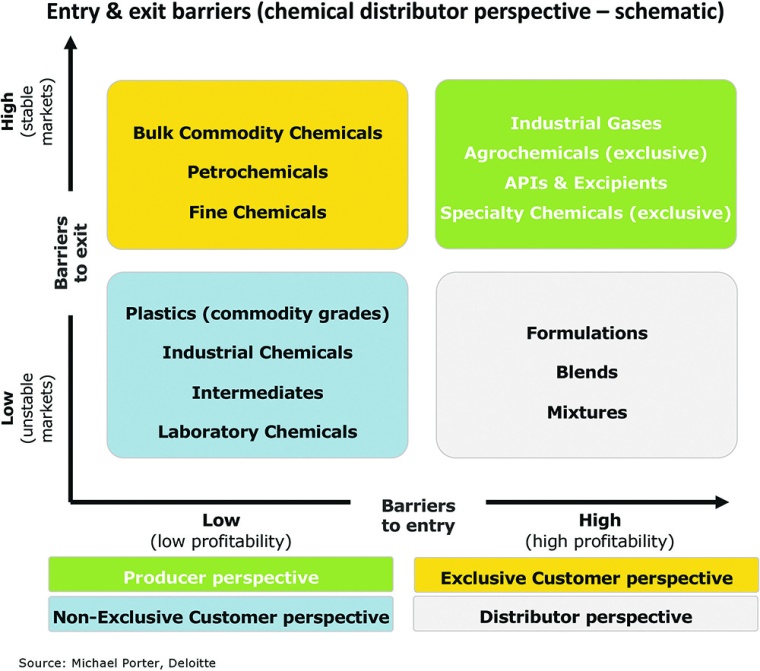

What is impeding people from investing in chemical e-commerce platforms is the money. What is preventing current players from being more successful are the high barriers for both entry and exit of existing players in the distribution chain. Let’s look at both.

Building and Maintaining an e-Commerce Platform Is Complex and Expensive

Despite the above-mentioned advances in digital technology, building and maintaining an e-commerce platform is complex, difficult, and expensive. Medium-sized companies and start-ups often lack the resources, expertise, critical mass, and practical knowledge to design, develop, test, launch, and maintain a fully equipped e-commerce platform. Besides experts in chemical distribution, they need software engineers, security experts, user interface designers, test engineers, and many more specialists. Even if they are able to bring together and orchestrate such a multifunctional team, it takes at least a year and a half to two years to develop the strategy, select the right staff and partners, acquire the tools, and then build the actual product. By then, technology has moved on and needs have changed. It is difficult to justify the cost, effort, and time to develop what the software industry calls a “minimum viable solution” which may never deliver the desired value and then requires more investment and more time.

While large principals may have the resources and have built online platforms, these were either made for their own product portfolio or outside their portfolio. In the first case, customers are not likely to shop on several suppliers’ portals to find what they need, and in the second case it is difficult to believe that those commerce engines are built altruistically without benefiting the principal’s own product portfolio and sales. In both cases, building an online platform is not the core competence of a chemicals producer.

Others are building the platforms with the goal of digitalizing existing supply chains and established business practices. This limits risk and increases acceptance, but it falls short of what digitalization can do to make processes better and cheaper.

Many off-the-shelf online solutions are not able to support the different needs of the chemical buy and sell processes. They work only as an online product finder or an online agent/trader for spot volumes. A commercial transaction currently works only if it is a truly standardized product (e.g., standard packaging, lot sizing, payment terms, minimum order value, transparent prices plus surcharges, online ordering only, touchless order fulfillment, and e-services only). Giving guarantees (e.g., supply security, sampling, claims management, onsite support) is currently more an exception than a rule.

“Those who have the money to build an online

platform do not reap the benefits.”

Barriers to Entry and Exit Impede Rapid Adoption of Online Platforms

Chemical producers typically face high entry and exit barriers. Entry barriers are physical dependencies (e.g., pipelines, Verbund effects, access to qualified warehouses, production assets, means of transportation), favorable infrastructure (raw materials, energy, economies of scope, sufficient capital and skilled people), high regulatory requirements (license to operate, registration, general compliance, tariffs and duties), and switching costs (exclusive distribution and supply agreements).

Customers typically do have low entry barriers; however, for those products purchased under exclusive distribution rights or which are single-sourced, exit barriers are high.

Chemical distributors typically face low entry and exit barriers, but there are significant exceptions, namely if they:

- have exclusive supply agreements or sole supply customers;

- formulate, blend, and mix products tailored to their customer needs;

- provide application technology or product development services;

- organize the return of packaging materials or provide recycling or waste management services;

- provide financing or vendor-managed inventory solutions;

- provide regulatory services to help their customers remain compliant;

- carry out fourth-party-logistics (4PL) services;

- provide quality, environmental, health, or safety management services.

In a Digital World, Chemical Distributors Need to Become More Customer Centric

In the current market environment, chemical distributors that have focused on exclusive distribution rights with key principals have, on average, achieved faster growth and, especially, higher profitability than others.

This focus on exclusive distribution rights with key principals should be maintained, but the differentiation in a digital world is at the customer end. Investing in customer centricity, i.e., fulfilling the needs of customers for online services (e.g., product finder, easy sample ordering, online tutorials, track-and-trace functionality, touchless ordering and processing, online reporting, and improvement proposals) should be the focus of chemical distributors going online.

There will most likely not be one “Chemazon”, but a variety of successful solutions:

Principals will operate their web shops around their differentiated top products, cross-selling complementary products and services online (e.g., online system houses for polyurethanes).

Logistics providers will offer end-to-end supply chain services in bulk products (liquids: acids, lyes, solvents; and solids: fertilizers, salts, oxides, sulfur) and develop the missing sales services either with Start-ups/internally or in collaboration with e-retailers, such as AmazonBusiness and 1688 by Alibaba.

E-Retailers will focus on non-hazardous, factory-packed C-products that enjoy regular, frequent demand (e.g., small quantities of lab chemicals, consumables, process chemicals, etc.) where hazardous materials regulations are still manageable. For bulk products they will cooperate with logistics providers.

Start-ups will offer online product finding services (“who supplies what?”), conduct auctions, and become a matchmaker to substitute the traditional trading and drop-ship businesses, especially for spot, bulk chemicals. They could also be the neutral commerce platform for multiple mid-sized chemical distributors or complementary principals. Consolidation may come as well, but at a later stage in the lifecycle of business digitalization.

Chemical distributors will operate joint web shops with their principals, especially where they have an exclusive distribution agreement in place. They will focus on industries and application markets and offer online marketplaces where customers need different products from different principals (e.g., coatings, adhesives, sealants & elastomers (CASE), textiles, leather & paper chemicals (TLP), life sciences (food & feed ingredients, agrochemicals, pharmaceuticals), cosmetics, care chemicals, water chemicals, etc.). They might not do that by themselves, but as a subscription service to a start-up or another platform.