Chemical Parks in China

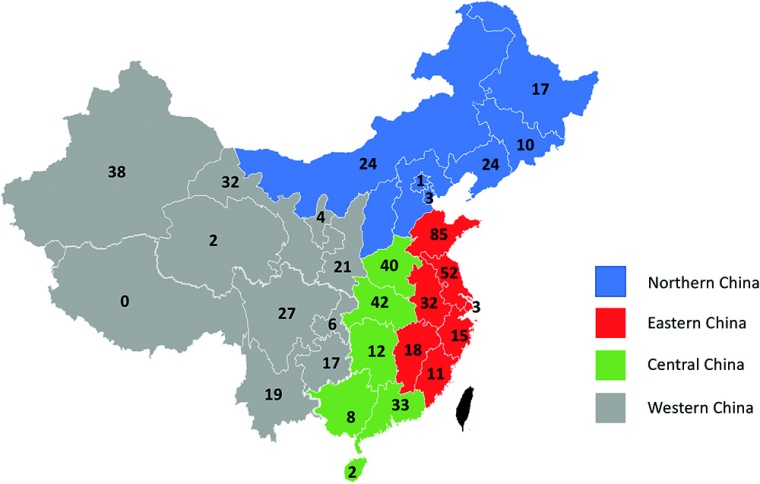

At the end of the year 2018, China had a total of 676 chemical parks. Of these, 57 are classified as national-level parks, 351 as provincial-level parks and 268 as municipal-level parks, the lowest level. While these parks are spread all over China, there is a higher concentration of parks in specific regions and provinces of China.

To be more specific, 32% of the chemical parks are in China’s Eastern region followed by 25% in the Western region, 22% in the Northern region and 21% in the Central region. As the map shows, Shandong province and Jiangsu province are the two provinces — both in the Eastern region — with the largest number of chemical parks.

The chemical parks also vary greatly by annual sales. 14 chemical parks can be classified as having extremely high sales of more than 100 billion RMB (about € 12.7 billion), 33 have sales between 50 and 100 billion RMB, 224 are of medium size with sales between 10 and 50 billion RMB while the remaining parks have annual sales below 10 billion RMB.

Importance of Chemical Parks in China Increased

The importance of chemical parks in China greatly increased within the framework of the 13th Five-Year Plan, which covers the period from 2016 to 2020. The plan aims at concentrating chemical production in chemical parks in an effort to allow better supervision of the industry and facilitate the implementation of tightened environmental protection. It mandates the massive relocation of chemical plants into such parks.

Somewhat ironically, some of the most serious recent accidents in China’s chemical industry have occurred in chemical parks. On Mar. 21, 2019, an explosion at the Xiangshui Eco-chemical Industrial Zone in Yancheng of Jiangsu Province killed 78 people and injured an additional 617. Government reports later uncovered showed that an earlier inspection by the State Administration of Work Safety found 13 safety problems, including extensive leaks, a lack of safety training, poor site management and a shortage of operating procedures and technical specifications. On the other hand, a gas factory which was the site of an explosion in July 2019 in which at least 15 people died was on Henan’s provincial list of top safety-compliant workplaces and had received a China Chemical Safety Association award for extraordinary contribution to chemical industry safety standards.

While these events point to chemical parks alone not being the sole solution to solving the environmental and safety issues of China’s chemical industry, government policy will clearly continue to shift chemical production into chemical parks. In addition, the government aims to put pressure on existing chemical parks to upgrade their standards and to reduce the number of parks. This may be necessary given that in June 2019, China’s proclaimed Safety Production Month, the Ministry of Emergency Management claims to have made unannounced visits to 34 chemical parks — only 5% of the total number. It seems that the current number of parks is too high for effective supervision.

Stricter Regulation

Provincial governments are also getting stricter in regulating chemical parks. For example, Jiangsu province not only closed down the Xiangshui chemical park mentioned above but plans to close a total of nine chemical parks. Other provinces including Shandong have also announced to reduce the number of chemical parks, and several have issued provincial guidelines tightening regulation of chemical parks and chemical production. Guangdong province in June 2019 issued a draft “Regional Safety Risk Assessment Guidelines for Chemical Industrial Parks”, which mandates a regional safety risk assessment for chemical industry parks at least once every 3 years, from the previous 5 years. In contrast to the past, it thus seems that the careers of provincial government officials now may benefit from tightening supervision. Indeed, industry representatives see this crackdown on the chemical industry as a substantial threat to the industry. For example, in August 2019, Fu Xiangsheng, the vice-chairman of the China Petroleum and Chemical Industry Federation (CPCIF), stated that “Blanket cuts at petrochemical industrial parks have much bigger impacts than the Sino-US trade war.”

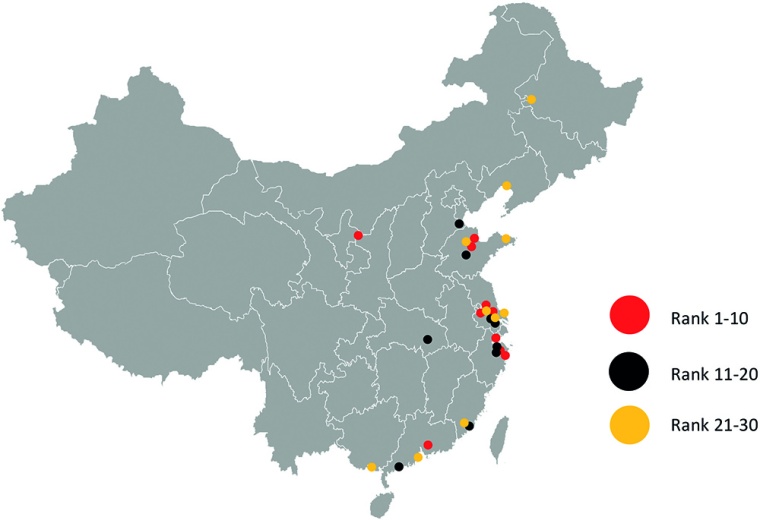

One way of promoting competition among chemical parks is the annual publication of a list of the top 30 chemical parks. The list is based on a number of criteria such as economic strength of the park, safety standards, innovation, sustainability and infrastructural support. This list gives a good indication of parks that have high standards and are unlikely to be threatened by closures. However, parks on this list will also have relatively high entry requirements for chemical companies, for example regarding investment level.

These top-ranked parks are not evenly distributed: Almost all of them are on China’s coast, and almost half (14 out of 30) are in the two provinces neighboring Shanghai, namely Zhejiang and Jiangsu.

Compared with the overall distribution of chemical parks as illustrated in Figure 1, this shows that the general quality of chemical parks in the more developed provinces particularly in Eastern China is far higher than those in inland provinces, of which only very few make the list.

Concept of Highly Integrated Chemical Parks

On a more holistic note, China also promotes the concept of highly integrated chemical parks. The Chemical Park Working Committee of the CPCIF states that “A world-class chemical park is a soul, an organic ecosystem, not a simple gathering of companies.” In typical Chinese fashion, this is to be achieved by the “6 Integrations” (the Chinese like these numbered lists of priorities). Specifically, this includes the integration of raw materials, logistics, safety, environmental protection, data and management services. While the practical effect of such somewhat nebulous, high-level concepts is sometimes hard to judge, it is worth mentioning that China has announced to promote emission treatment by third parties in chemical parks by, e. g., giving qualified businesses a reduced tax rate — potentially a consequence of the promotion of integrated environmental protection and management services.

Looking forward, it is likely that the number of chemical parks in China will shrink. The government has already announced that it intends to stabilize or even reduce the number of chemical parks to around 500. Therefore, unsuccessful and substandard chemical parks face the risk of being closed down within the next few years. An admittedly imperfect back-of-the-envelope calculation comparing Germany with China shows that China would need about 300 chemical parks compared to Germany’s 37, so despite the current huge demand for space in chemical parks, the current number may already be somewhat large.

High Standards and Good Reputation Has a Price Tag

Chemical companies searching for production sites in China therefore need to have a clear understanding of the current situation. While it will be mandatory to locate new production in chemical parks, this alone will not be sufficient to guarantee long-term site stability. Chemical companies are well advised to look for chemical parks with high standards and good reputation, even though such parks are likely to have higher investment and environmental protection requirements. The list of top 30 chemical parks issued by the CPCIF may be a starting point. Companies should also keep in mind that the current push towards relocation of chemical production into chemical parks puts substantial pressure on smaller domestic chemical companies, which may lack the funds for such a relocation. Identifying such companies and approaching them may therefore open up promising opportunities for acquisitions in China.

Company

Managm. Consult. ChemicalsRM1302, 13/F CRE Bldg.

Wanchai, Hong Kong

China

most read

Pharma 4.0 – the Key Enabler for Successful Digital Transformation in Pharma

Part 1: Building a Business Case for Pharma 4.0

Pharma 4.0—the Key Enabler for Successful Digital Transformation in Pharma

Part 3: Seven Theses for successful Digitalization in Pharma

Relocation of Chemicals Production Footprint in Full Swing

A new Horváth study based on interviews with CxOs of Europe’s top chemical corporations reveals: The majority of board members expects no or only weak growth for the current year.

Q1 2025 Chemical Industry: Diverging Trends

The first quarter of 2025 highlights a continued divergence between the European and US chemical industries.

20 Years of CHEManager International

Incredible but true: CHEManager International is celebrating its 20th anniversary!