Dealing with Price Volatility

It sometimes seems that everyone running a business always thinks that times are tougher now than they used to be. For producers — and buyers — of commodity chemicals, this thinking will take the more specific form of concerns about increased price volatility.

Have prices of commodity chemicals really become more volatile recently? And, if so, what does this mean for those dealing with them?

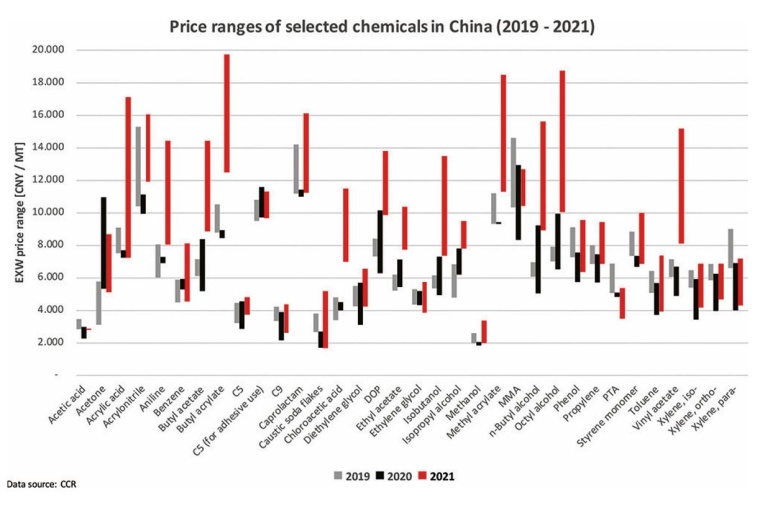

Let us look at the first question — have the prices of commodity chemicals in China become more volatile in the past three years? To answer the question, we examined prices of 34 commodity chemicals from January 2019 to December 2021. The data is shown in the figure.

Analysis of Price Fluctuations

For the observation period from 2019 to 2021, the figure shows the price range for each year. It is immediately apparent that on average the price ranges for 2021 are wider than for the two previous years, indicating larger price fluctuations. Another observation is the general extent of the price fluctuations — some chemicals reach maximum prices more than three times the minimum ones.

In addition, the general trend here is a slight price decrease during 2019 followed by a more substantial price decrease in 2020 and a substantial increase in 2021. While this is partly due to aspects specific to each chemical, a broader rationale is the oil price development — the average annual oil price dropped from $ 57 per barrel in 2019 to $ 40 per barrel in 2020 and then increased to about $ 68 per barrel in average in 2021.

We also performed a separate analysis using the relative standard deviation as a measure of volatility. In 2019, this measure was comparatively low for almost all products. In 2020, volatility increased substantially for about one third of the products. Finally, in 2021 almost all products show increased price volatility. For individual products such as caustic soda — affected by production curbs as some chlor-alkali producers have been asked by local authorities to lower production rates as part of the country’s dual control policy on energy consumption and intensity — the volatility increases are extreme.

“The volatility of the prices

of basic chemicals in China

has substantially increased recently.”

So, it seems despite our initial skepticism about people always assuming things are worsening, they are probably right in this case. The volatility of the prices of basic chemicals in China has substantially increased recently. One reason for this increased volatility certainty is Covid-19. However, it is quite possible that increased price volatility is a longer-term trend that will stay with us even once Covid-19 is more or less under control.

Impact for Chemical Companies

What does this mean for companies purchasing these chemicals? Obviously, dealing with chemicals with highly volatile prices brings specific challenges, which we will discuss below along with some potential solutions.

First of all, substantially varying input costs have a big impact on the pricing of chemical products. In order to obtain stable profit margins, this means both aiming to reduce the variations in the prices of the chemical raw materials and to pass on at least some of these variations to the end customers.

Long-term contracts for commodity chemicals based on a fixed price are one way of achieving such a stabilization. However, given the very high impact of oil price changes on basic organic chemicals, it may be difficult to find a producer of such basic chemicals willing to agree to fixed prices.

A more realistic proposition is hedging based on a proxy, such as crude oil. Such hedging with futures contracts is a financial tool to reduce the effects of fluctuating raw materials. As this allows the participation of financial players not involved in the production of chemicals themselves, the options offered will be much broader.

Upstream integration is another option, although more of a theoretical one. While in principle it reduces the exposure to relative volatility via increasing the share of value creation, it also puts a company much closer to the source of volatility.

Of course, volatile input prices are less of an issue if these can simply be passed on to end customers. This can be fairly straightforward for chemicals close to the ultimate raw material crude oil, as the price of crude oil is highly transparent, and it affects a large range of products, some of which having high visibility (e. g., petroleum prices at gas stations). Passing on these input costs can even be done on a formal basis, e. g., pricing based on an index. In an extreme case, a chemical company will only act as a toll producer, thus shifting the risk of varying raw materials entirely on the customer — though this will likely be accompanied by lower margins.

Other such options can broadly be summarized as increasing the overall share of value creation (which diminishes the relative fluctuation in raw materials costs). In practice, this can be achieved by integrating further steps downstream in the value chain, or similarly by offering more differentiated products. In both cases, as the overall value created by the chemical company increases, the relative impact of upstream price fluctuations decreases.

Stock Levels

Another issue affecting buyers of commodity chemicals with high price volatility is related to stock levels both of raw materials and of finished goods. Depending on the going market price of these materials, capital costs may vary substantially. This issue may be dealt with by periodically recalculating stock levels based on current prices of raw materials and finished products, thus identifying the net working capital that is the best compromise between capital costs and capability of delivering goods within the timeframe required by customers.

Related to this issue is the difficulty to do appropriate planning, as some of the main input variables for this planning are undergoing strong fluctuations. Depending on the price of main input materials, an expansion of production capacity may either be a highly sensible step or have negative effects on overall profits. This similarly applies to the economics of smaller process improvements, e. g., a capital investment that leads to a yield increase of an end product.

Scenario Planning

A sensible step is to define a few scenarios using different price levels as starting point. Based on the outcome of these scenario calculations along with an estimate of the likeliness of each scenario, a rational decision can be made. Considering scenarios — and updating them frequently — will also prepare a company for enacting changes more quickly should the overall situation change rapidly.

This issue is even more serious if the end product of a chemical manufacturer can be produced via different production processes using different raw materials. In this case, a change in the relative prices of the different raw materials may well lead to the currently employed production process becoming uncompetitive in the market. Again, scenario planning offers at least a partial solution. In rare cases, it may even be possible to establish several production processes based on different raw materials, thus giving the company options in case of diverging raw materials prices.

Unusual events like the current pandemic are less foreseeable, but market and macro-economic trends should be monitored to get early grasps of cyclic swings (e. g., chemical growth versus GDP, customer and end-use consumers purchasing behavior, international trade, capacity utilization and announced capital expenditures or lack of them).

As our analysis of recent commodity chemicals price developments in China shows, volatility of prices has been increasing recently, and it is far from clear whether this is only a temporary effect. As a consequence, companies requiring such commodity chemicals should examine options and strategies to deal with this volatility. This will allow them to stay profitable despite huge variations in the prices of their end products.

Authors:

Kai Pflug, CEO, Management Consulting — Chemicals, Shanghai, China

Ralf-Roman Rietz, Strategic Advisor, Shanghai, China

most read

BASF Sells Majority Stake in Coatings Business

BASF sells a majority stake in its coatings business to the investor Carlyle.

Ratcliffe: Chemical Industry in Europe at a Tipping Point

Ineos CEO Ineos calls on European politicians to save the chemical industry.

VCI Welcomes US-EU Customs Deal

The German Chemical Industry Association (VCI) welcomes the fact that Ursula von der Leyen, President of the European Commission, and US President Donald Trump have averted the danger of a trade war for the time being.

Orion Announced Plans to Shut Down Carbon Black Plants

Carbon black manufacturer Orion Engineered Carbons plans to rationalize production lines in North and South America and EMEA.

Novo Nordisk to Cut 9,000 Jobs Globally in Major Restructuring

Novo Nordisk announced a global workforce reduction of approximately 9,000 positions to streamline operations and reinvest DKK 8 billion (€1 billion) in growth opportunities for diabetes and obesity treatments.