Emerging Materials Technologies

A Data-driven Analysis of Future Technologies in the Chemical Industry

What are currently some of the most important emerging technologies in chemistry? Who develops them? Who cooperates with whom? And what are some of the resultant business models? We used data-driven methods to analyze these questions.

A simple web search, for instance for “chemistry emerging technologies”, brings up list-like articles that briefly describe such emerging technologies, usually about ten or so. Such lists are published by organizations such as ACS, IUPAC, relevant journals, the World Economic Forum, or strategy consultants. And these lists provide interesting material for discussion. However, it is usually not easy or impossible to find out why the technologies listed are being described and not others. This is not meant as a critique. It's just a certain approach to the question asked at the beginning.

The aim of this article is to propose a different, data-driven, approach.

The Method

First of all, we can rephrase the question asked at the beginning. Rather than looking for “important emerging technologies,” we're interested in “fastest-growing emerging technologies” here. “Important” is very difficult to quantify, and it always depends on the context. What’s important to one company or product may not matter much to another. By contrast, we can quantify growth. Relevant R&D growth signals are, for example, increasing venture capital investments in a technology, more patent applications, more publications in scientific journals and preprints, and increasing public R&D investments.

For this article, we used the software we develop and operate at Mergeflow to analyze these R&D growth signals. This software collects and analyzes R&D contents from the web and other sources, including venture investments, patents, scientific publications, project profiles of public R&D programs, and news. All information is collected worldwide, not limited to specific geographic regions. The contents are then analyzed in a fully automated way, using machine learning and natural language processing (NLP). For example, the software can recognize whether a group of words describes a person, an organization or an investment event, or which topics a document deals with.

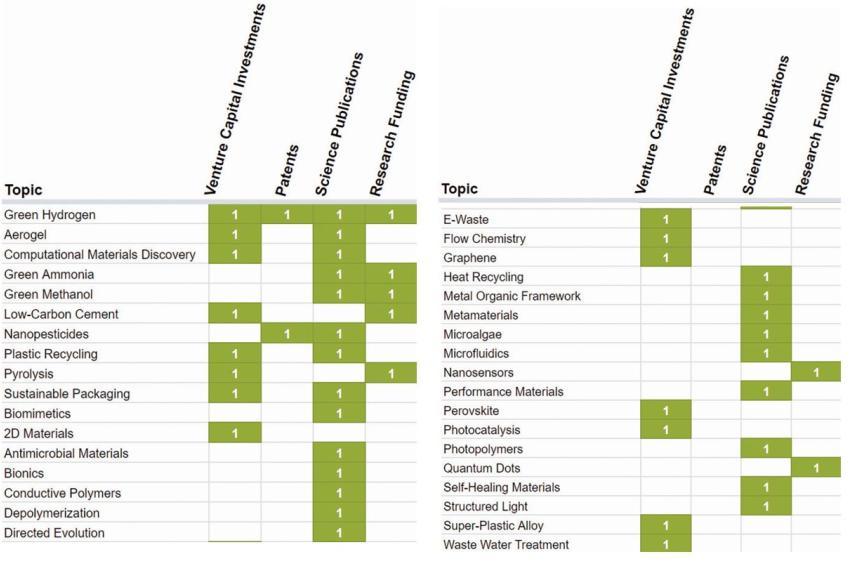

In total, we analyzed 52 emerging technologies for this article. These technologies include materials (e.g. aerogels, 2D materials, quantum dots) and processes (e.g. pyrolysis, plastics recycling, wastewater treatment), as well as topics that cannot be clearly assigned (e.g. green hydrogen, which is involves methods, materials, etc.).

Further details of the method are described below.

Overview of the Results

The table below shows topics that have experienced strong growth in one or more of our R&D growth signals (venture investments, patents, science publications, and research funding). “Strong growth” is marked by “1” in the table below. The table does not include those topics that did not show strong growth in any of the topics.

You can see that green hydrogen is the only topic currently showing strong growth in all four R&D growth signals.

Two definitions in this context:

“Currently” means “in the last twelve months, compared to the four years before”.

"Strong growth" is calculated as follows:

- How many publications (for patents and scientific publications) and how much investment (for venture and public R&D investments; all converted to $) were there in the topic in the last 12 months and the previous four years in total?

- Was the “last 12 months” figure of a topic greater than 20% of the total? The reasoning here is that with equal distribution one would see 100% / 5 years = 20% per year.

- Was the absolute number for “last 12 months” for a topic greater than any absolute number for any previous year for that topic?

If both question (2) and question (3) are answered with “yes”, the topic shows “strong growth”. It is important to note that we are only looking at growth here, not volume. The volume of a topic (either in terms of number of publications or investment sums) is independent of this. For example, the topic antimicrobial materials is one of the largest in absolute terms (investments, number of publications and patents). But it only showed strong growth in scientific publications, not in any of the other signals we looked at.

Results on Selected Topics

What is behind these numbers? What companies are there and what do they do? Who are the researchers behind the scientific publications?

It would be beyond the scope of this article to address these questions for all growth topics. So, we selected three example technologies: green hydrogen, the only topic that shows strong growth in all three signals; as well as aerogel and computational materials discovery.

Green Hydrogen

“Green” here means that the hydrogen is obtained electrolytically and with renewable energy, and not, for example, from natural gas, or using non-renewable energy sources. Here are two examples of solutions in this area:

Nespresso Capsules for Airplanes

Universal Hydrogen has developed a logistics system for hydrogen in aviation. The green produced hydrogen is filled into capsules. Transport routes and equipment already in place for baggage handling are used to transport the capsules to and from the airport. In addition, existing aircraft types can be converted to hydrogen propulsion. The aim is to start passenger operations in regional traffic in 2025, initially with the widespread aircraft types ATR72 and Dash-8. This speed of development is only realistic since existing systems and aircraft types can be used.

In total, Universal Hydrogen has raised $85 million in venture capital to date. Investors include Mitsubishi HC Capital, Tencent, Stratos, GE Aviation, Playground Global, Fortescue Future Industries, Coatue, Global Founders Capital, Plug Power, Airbus Ventures and JetBlue Technology Ventures, Toyota AI Ventures, Sojitz Corporation, and Future Shape.

Green Hydrogen for Heavy Industry

Especially in capital-intensive technology sectors such as chemistry, initial investments in companies often come from public R&D programs. These include, for example, the EU's Horizon 2020 program and the US administration's SBIR program (Small Business Innovation Research). While the Horizon 2020 program typically funds large project consortia, the SBIR program funds individual, usually smaller, companies.

An example here is Celadyne, a spin-off from the University of Texas, Austin. Celadyne develops novel membranes for electrolytic hydrogen production. The target market is primarily industrial applications, such as heavy-duty transport and industrial manufacturing.

In 2019 and 2020, Celadyne received funding from the US Department of Defense through the SBIR program. Celadyne is collaborating with Argonne National Laboratory and Breakthrough Energy, among others, and received venture capital from Shell Ventures in April 2021.

Aerogel

Aerogels are solids that can be manufactured with different properties (e.g. brittle, elastic, transparent, electrically conductive). Due to their low thermal conductivity, they are also very suitable as insulation material, for example. They can also be used as filters.

The Warmest Jacket on Earth

Based on an aerogel material developed by NASA to insulate spacecrafts, Oros has developed what they say is “the warmest jacket on earth”. What makes the jackets special is that they are not just warm but also very thin, lightweight and breathable. They offer a high degree of freedom of movement and a small pack size. Other materials such as down or Thinsulate cannot achieve this combination of properties.

To date, Oros has raised $16.5 million in venture capital. Investors include Elizabeth Street Ventures, and Enlightenment Capital. Oros was founded in 2015 as part of a Kickstarter crowdfunding campaign. Oros is now active worldwide via internet-based direct sales.

Aerogels in Aviation: Insulation, Batteries, Filters

One of Mergeflow’s analytics modules recognizes people's names in text. This makes it possible, for instance, to extract co-author networks from texts. These co-author networks are a proxy for collaboration networks in research. Citation networks are usually not, since citation usually does not mean collaboration. However, we are interested in collaboration networks here, so co-author networks are more appropriate for our purposes.

The image below shows part of a collaboration network in the field of aerogels. The data is based on relevant journal and preprint publications. The larger a node in the network, the more publications a person has; the thicker the line between two nodes, the more joint publications by two people.

Barbara Milow plays a central role in the network. Barbara Milow heads the "Aerogels" department at the Institute for Materials Research at the German Aerospace Center (DLR).

One focus area of Barbara Milow’s group is the development of novel cathodes for lithium-sulfur batteries using carbon aerogels. Other topics include silica and thermoset aerogels as insulating materials, and biopolymer aerogels as (air) filters.

Computational Materials Discovery

Computational materials discovery uses methods such as machine learning and high-throughput screening to discover new materials or material properties. These methods combine software, robotics and other hardware technologies to achieve great advantages in terms of speed, scalability and costs.

Identifying Bioactive Peptides Using Machine Learning

Nuritas develops and operates a software platform that identifies bioactive, naturally occurring peptides. The predictions of the software platform are then verified in their own laboratory and in clinical studies.

Bioactive peptides are among the most important messenger substances in the human body. Nuritas focuses on peptides that can be used preventively, particularly against chronic diseases.

In November 2021, Nuritas received $45 million in venture investments. Investors include Cleveland Avenue, Wheatsheaf Group, the European Circular Bioeconomy Fund (ECBF), Vertex Holdings and Nutresa Ventures. Nuritas cooperates with BASF, Johnson & Johnson and Sumitomo Chemical, among others.

Cooperation between Industry and Academia

Patents can provide indications of cooperation, e.g., between companies and academic research institutions. In order to be able to discover such indications in a more scalable way, Mergeflow includes an algorithm that recognizes the names of companies and organizations (e.g. universities or research institutes).

An example in the area of computational materials discovery is the cooperation between Samsung, MIT and the University of California, Berkeley. The thematic focus of the cooperation is the development of new battery systems, supported by computational methods. A central person in this network is Gerbrand Ceder, Professor at the University of California, Berkeley (and formerly MIT). Besides Kristin Persson, Gerbrand Ceder is also the initiator of the Materials Project, a database containing information mostly on energy storage materials.

Caveats of the Method

As with any other method, there are also some caveats to be considered with our method. Here are the most important ones:

Completeness

We do not claim completeness. The list of technologies analyzed here comes from the list articles mentioned at the beginning and other studies, conversations, and also from analyses that we ran with our software. As an example of such an analysis, we used our software to address the question “which topics and phrases occur more often in chemical patents, scientific publications or Venture capital investments, compared to other technology sectors or industries?”.

Distinguishing Chemical vs. Non-chemical Technologies

"Is this a chemical technology, or not?"

This question cannot always be answered unequivocally. The line between chemistry and other technology sectors is often blurry. For example, we have decided not to include tissue engineering or CRISPR here, although one could certainly make the case that these technologies also play a role in chemistry (or chemistry plays a role in these technologies).

Scope of the Topics

Probably each and every topic discussed here could also be scoped differently. However, the aim here is not to deal exhaustively with all the intricacies of all topics. Rather, our goal was to try to come up with a first useful approximation.

Interdependencies between Topics

Related to the previous point, topics are not always independent of each other. For example, green hydrogen and green ammonia are related. This means that the analysis results for these two, and some other topics as well, are not independent of one another. Again, our goal here is a first approximation, not an exhaustive analysis.

Author: Florian Wolf, Mergeflow AG, Munich, Germany

_________________________________

STUDY ON EMERGING TECHNOLOGIES

The full analysis of the 52 Emerging Technologies in Chemistry and supplementary data on these and the other topics are available online.

PERSONAL DETAILS

Florian Wolf is founder and CEO of the Munich, Germany-based software company Mergeflow, which develops and offers a technology and innovation analysis platform. Wolf has a PhD in Cognitive Sciences from MIT and was a Research Associate in Computer Science and Genetics at the University of Cambridge. He is a member of the Global Panel at MIT Technology Review.

Downloads

Contact

Mergeflow AG

Effnerstr. 39a

81679 München