Essential Ingredients

Classification of Organic Chemicals and Its Effect on the Pharmaceutical Industry

Understanding The Source - Classification of today's supply chain - regarding all organic chemicals involved in the manufacturing of an API - is a useful tool for demonstrating where current good manufacturing practice (cGMP) is established and where organic chemicals are only used by their analytical purity. With this classification, sourcing in the pharmaceutical industry will be better understood.

Chemical raw materials, which are needed in the synthesis of an active pharmaceutical ingredient (API), originate from a huge pool of organic chemicals. Classification of organic chemicals helps demonstrate how the chemicals are linked with the supply chain in the pharmaceutical industry. So risks, advantages and open questions can be addressed in due time.

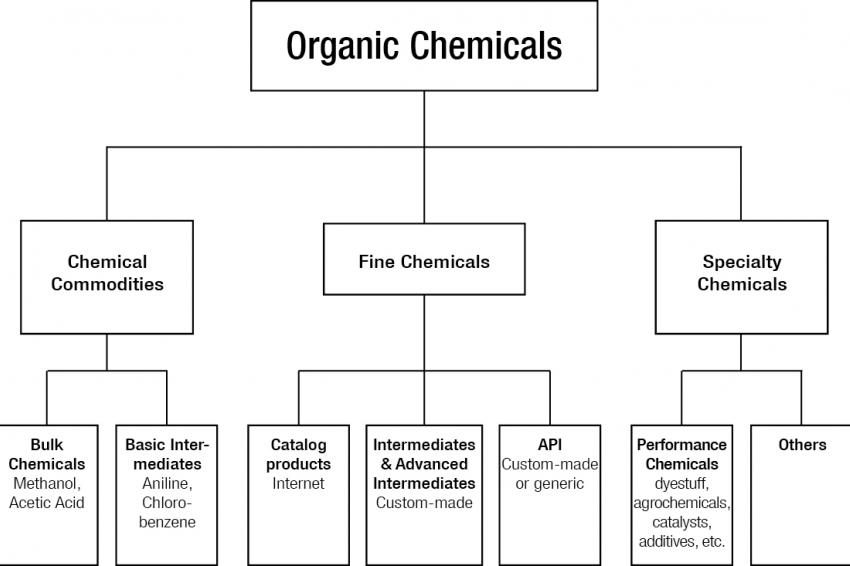

A precise classification/definition of organic chemicals is not feasible. A pragmatic approach is a subdivision into three categories, namely chemical commodities, fine chemicals and specialty chemicals (Fig. 1). They account for about 40%, 5% and 55%, respectively, of the global market of organic chemicals, which was about $2.5 billion in 2012.

Chemical Commodities

Chemical commodities are low-price, large-volume products. They have a standardized specification and can be further subdivided into bulk chemicals and basic intermediates.

Bulk chemicals: Most of the organic solvents, such as methanol, toluene and acetone, are classified as commodities and are used in the manufacturing of APIs. These products are inexpensive and readily available from Western companies with consistently high quality. Thus, pharmaceutical companies can use them without further restriction.

Basic intermediates: High-volume products such as chlorinated benzene, phenols and pyridines dominate this class.

If such chemicals are used in the regulated part of the synthesis, chances are low to find a supplier that will manufacture according to cGMP. The reasons are similar to those for bulk chemicals.

Pharmaceutical companies may be able to source premium basic intermediates with up to 99.9% purity (e.g., gas chromatography [GC] or high-performance liquid chromatography [HPLC] purity), but nevertheless most of the requirements of cGMP are missing.

What to do? Close your eyes and believe that these suppliers have experience in this kind of chemistry and that premium quality will answer all questions?

Or define a basic GMP for those manufacturers? Check out Peter Pollak's book "Fine Chemicals," 2nd edition, Wiley, 2011.

Fine Chemicals

Fine chemicals are normally produced in limited quantities (less than 1,000 tons/year) and sold for more than $10/kg with established product specifications. The fine chemicals are the most interesting part for the pharma industry and can be divided into catalog products; intermediates (IM) and advanced IM, custom-made; and API, custom-made or generic.

Catalog products: Catalog products are offered on the Internet. Purchasing has to check whether the offered products are produced in lab scale, pilot-plant scale or production scale. If the product is already scaled up and the potential supplier has appropriate equipment for manufacturing in production scale, it can be attractive as a supplier to the pharmaceutical industry. Nevertheless, pharmaceutical companies must carefully check what kind of GMP is necessary. Environmental, health and safety (EHS) standards and analytical methods also have to be checked.

Pricing for the product is easy because information about the chemical process itself is known and can be used for a first quotation by the manufacturer. Furthermore, it is advantageous if the product is already at production scale, so quality is already settled and will not change during up-scaling from lab to production scale. Another advantage of catalog product is that no research and process development by the pharmaceutical company is necessary as the product is already available.

IM and advanced IM, custom-made: During phase I it would be perfect to have at least two suppliers for chemical raw materials in place. At that time some pharmaceutical companies start to cooperate with a preferred supplier or enter into a strategic partnership with potential suppliers. This kind of cooperation can be an option when both partners know and trust each other.

A partnership usually starts as follows:

After in-house process development on lab scale and pilot scale by the pharmaceutical company, a technical package will be transferred to the preferred supplier under a confidentiality disclosure agreement (CDA).

During phase I, little is known of the chemical process itself, especially the risks in increasing production and further process development. Often final product specification is unclear because the analytical methods are not well-developed at that time. Furthermore, the following problems are not discussed:

- The need for the development of the analytical method itself.

- Change in the basic raw materials source or suppliers.

- Realizing that high quality in the early steps can minimize the purification in the late steps.

Regarding cGMP and EHS requirements, the preferred supplier should be well-established. As a qualified supplier for regulated advanced IM, it must have flawless inspection records.

Since the lab work required for preparing different small samples is usually not adequately compensated, the initial phase of a new project is normally not attractive and can be justified only in the context of the overall relationship.

For preferred suppliers, the initial phase is not attractive because they often have to deliver many samples in small quantities for different tests of the API. Preferred suppliers believe that market launch will lead to big business. Unfortunately, many projects drop down in phase I or phase II, even in phase III.

On the other hand, management in the pharmaceutical industry expects to get the best total cost of ownership at the lowest risk, according to the preferred supplier concept.

API, custom-made or generic: This concept is attractive when a pharmaceutical company has decided that API manufacturing is not its core competence and it has to be outsourced.

To avoid any risks, the potential supplier has to be inspected carefully. The supplier should have a history in API manufacturing. The pharmaceutical company should have a clear procedure in place for managing the technical transfer.

Again, generic suppliers' fulfillment of cGMP must be checked. If this work isn't done carefully, it can become a huge problem.

Specialty Chemicals

Performance chemicals are the most important subcategory of specialty chemicals. Whereas fine chemicals need a clear specification when sold in the market, and can be classified as "what they are", performance chemicals are sold on the basis of "what they can do." Whether pharmaceuticals should also be classified as performance chemicals is somewhat controversial. In this article, APIs (drug substances) are classified as fine chemicals.

Looking into the subcategories, enzymes and catalysts are becoming more and more important in the pharmaceutical industry. The literature pays a lot of attention to these, e.g., catalysts for asymmetric hydrogenation. Specialized companies are offering these catalysts or are able to develop specific ones.

The chemical structure of those catalysts usually is a highly sophisticated molecule. They are complexes of precious metals with chiral ligands (organic molecules). The chemical purity as well as the optical purity is essential for the performance of the catalyst. The performance can be measured by turnover number (TON) and turnover frequency (TOF).

The catalyst usually is tailor-made and specially developed for a dedicated reaction. In the meantime, companies can be found offering this kind of service. The development of such a catalyst can be very expensive. This usually is worth the investment only for valuable and large-scale APIs.

If a catalyst is available and can be used directly for a new process, the pharmaceutical company should use the catalyst even if it does not deliver optimal results. The saving of development cost and time justifies the lower performance. Fortunately, the ligands normally should not be manufactured according to cGMP.

Contact

Rotego Chem