02.09.2024 • Topics

Expert Statement: Ashu Tandon, Aragen

The evolution of the CDMO sector is propelled by rising manufacturing standards, the advent of groundbreaking therapies, and a shift towards personalized medicine.

Read more with free registration

Register now for free and get full access to all exclusive articles from chemanager-online.com. With our newsletter we regularly send you top news from the chemistry industry as well as the latest e-issue.

most read

Lead or Lag: Europe’s AI Materials Race

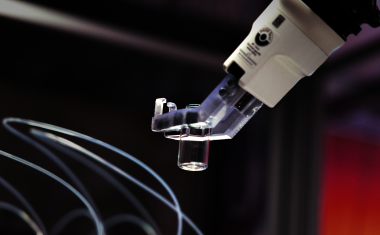

How AI and Robotics are reshaping the race for materials discovery.

20 Years of CHEManager International

Incredible but true: CHEManager International is celebrating its 20th anniversary!

Pharma 4.0—the Key Enabler for Successful Digital Transformation in Pharma

Part 3: Seven Theses for successful Digitalization in Pharma

US Tariffs Fatal for European Pharma

Trump's tariff policy is a considerable burden and a break with previous practice.

Relocation of Chemicals Production Footprint in Full Swing

A new Horváth study based on interviews with CxOs of Europe’s top chemical corporations reveals: The majority of board members expects no or only weak growth for the current year.