Germany Weighs Merits of Growing China Trade

As April winds down and major German chemical companies hold their annual shareholder meetings, questions are being asked whether about the country is tying its trade too closely to with China and repeating the same mistakes it made earlier by becoming dependent on Russian gas.

The Bloomberg news agency reported on Apr. 27 that Chancellor Olaf Scholz and Economics Minister Robert Habeck were weighing plans to limit the export of chemicals for semiconductors from Germany — a major move that would have an enormous impact on chemical producers such as Merck and BASF.

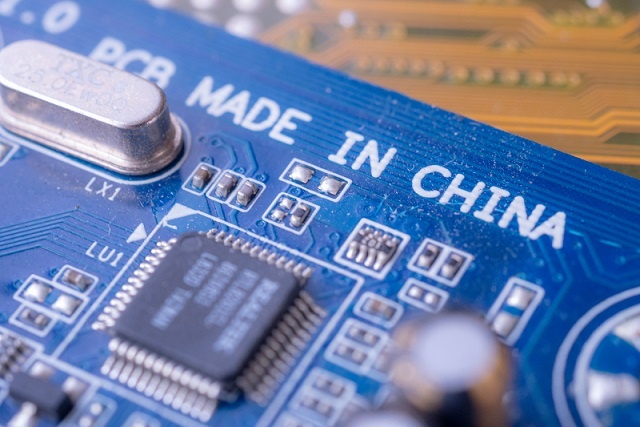

Bloomberg’s sources said the proposal is part of a package of measures that would cut off China’s access to goods and services needed for the production of advanced semiconductors.

Fears are growing about what would happen to German companies supplying the lucrative Asian market if China invaded Taiwan, is the beating heart of the world’ semiconductor industry.

On the news, BASF shares — which already have lost 25% of their value this year, to the dismay of shareholders — lost a further 4% in early trading, but Merck initially emerged unscathed. Neither Germany’s political leaders nor the companies named confirmed the reports.

If Germany does move forward with the plans, it would join the US as well as other European countries such as the Netherlands, in pushing for a global blockade of China’s access to key technologies.

Strangling the country’s already limited supply line could thwart China’s ability to advance its own industry, commentators said, while noting that China is Germany’s is largest trading partner, and the European country’s trade deficit is increasing.

Germany has no advanced chip-making technologies, but the two chemical producers engaged in trade with China supply the global industry, with Merck claiming to be the only company ”deeply experienced” in every step of the semiconductor value chain,” and BASF a leading exporter of chemicals and solutions for semiconductor processes.

At the chemical giant’s 2023 annual general meeting in Mannheim, BASF’s shareholders gave CEO Martin Brudermüller a run for his money, peppering him with questions about what would happen if China turned inward and closed others out after years of luring western partners to its shores. Not unexpectedly, the answer was, the chances outweigh the risks.

In a telephone conference, BASF oil and gas subsidiary Wintershall’s CEO Mario Mehren had to explain why the risks sometimes have their way and his company is still in Russia — which accounts for 50% of its business — despite announcing plans to withdraw this past January.

The withdrawal is complicated, Mehren said, remarking that the Russian government had “virtually expropriated” its offshoot Wintershall Dea, a joint venture with Russian oligarchs.

Author: Dede Williams, Freealnce Journalist