The Materials Revolution

Companies in the materials industry – including chemical companies – are seeing a revolution that is likely to drive a new wave of growth. To succeed, however, they will need to rethink their value chains, expand manufacturing in the region, and take advantage of digitally powered approaches to innovation.

Companies in the materials industry — including chemical companies — are seeing a revolution that is likely to drive a new wave of growth. For European chemical companies in particular, it will bring opportunities to adopt new business models and compete more effectively in global markets. To succeed, however, they will need to rethink their value chains, expand manufacturing in the region, and take advantage of digitally powered approaches to innovation.

There are certainly challenges ahead, but the opportunity is substantial. The materials revolution will be transformational, driving progress toward addressing some of the world’s most fundamental issues — from helping to provide affordable green energy to building the circular economy — to better the planet for its citizens.

New Materials, New Opportunities

The expanding variety of innovative products we’re now seeing includes self-healing materials that can recover from scratches and cracks; metal foams that are lighter than traditional metals while providing the same strength; and willow glass that is strong, lightweight and conformable, and can be used in ultra-thin displays and flexible solar cells. Smart materials, such as shape-memory polymers, can be deformed and then returned to their original shape in a controlled fashion using light, electricity or other stimuli — and one, vanadium oxide, “remembers” its exposure to such stimuli, allowing it to respond more quickly to later exposures.

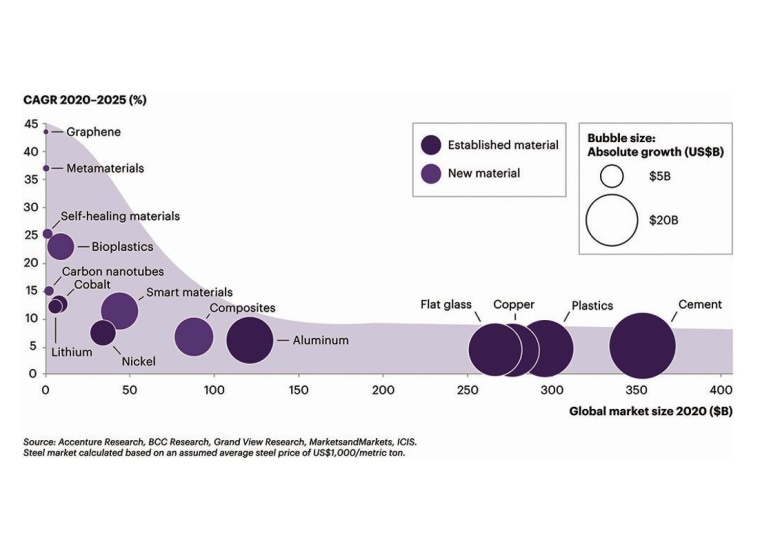

New materials will enable new uses and create new markets, thus opening the door to new sources of growth for chemical companies. Indeed, Accenture’s research indicates that growth rates for new materials will be higher than those of traditional materials in the coming years (fig. 1) — creating an estimated $150 billion growth opportunity by 2025.

This opportunity is linked to fundamental changes we’re seeing in the materials markets across three key dimensions: the convergence of material classes; the convergence of material and digital properties; and a shift to smarter, more sustainable materials.

Convergence of material classes. Our analysis of patent filings over the last four decades shows that innovation in materials has involved the increased convergence of material classes — that is, patents have tended to cite more than one material. In 1980, 70% of materials patents cited just one material, and 6% cited three or more; by 2020, just 46% cited one material, and 24% cited three or more.

Convergence of material and digital properties. Traditionally, innovation in materials focused on optimizing properties such as heat resistance, tensile strength or resistance to corrosion. However, our patent analysis shows a new pattern — an increase in patents for materials that have digital and smart properties. In 2020, 24% of patents referred to smart and digital properties of the material versus 4% in 1980, indicating an increased convergence of material and digital properties.

Shift to sustainability. There is a growing emphasis on materials that can help address environmental challenges and support the energy transition, according to our analysis. While patented solutions that combine material classes have typically been regarded as more difficult to recycle and less sustainable, the share of multi-material patents citing enhanced sustainability properties has actually risen from 2.4% to 8.7% during the 1980 to 2020 period — an indication of the growing connection between sustainability and innovative materials.

How Change Will Happen

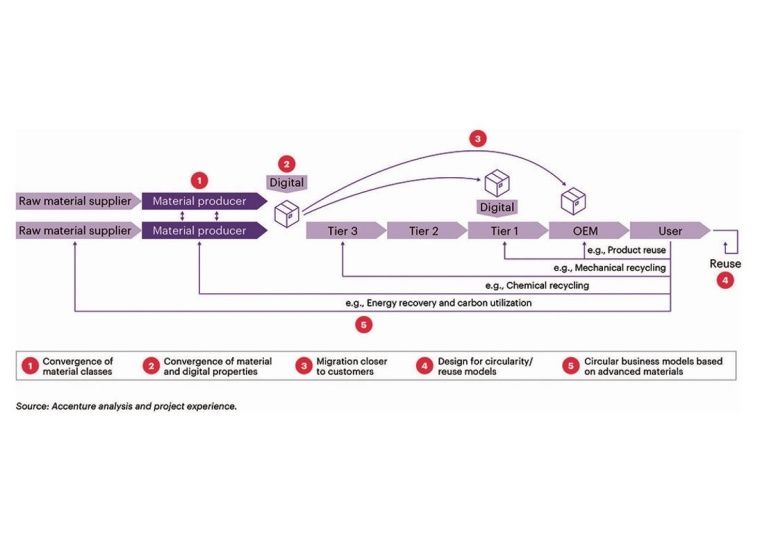

The effective creation, production and delivery of new materials will require the reshaping and reinvention of value chains (fig. 2). A significant amount of development and marketing will need to move closer to end customers to drive and accelerate innovation, disrupting existing value chains, such as the traditional structure of an original equipment manufacturer (OEM) and Tier 1, 2 and 3 suppliers. And the growing emphasis on circularity will create opportunities for companies to adopt new business models that use new materials to enable more reuse, mechanical and chemical recycling, energy recovery and carbon utilization.

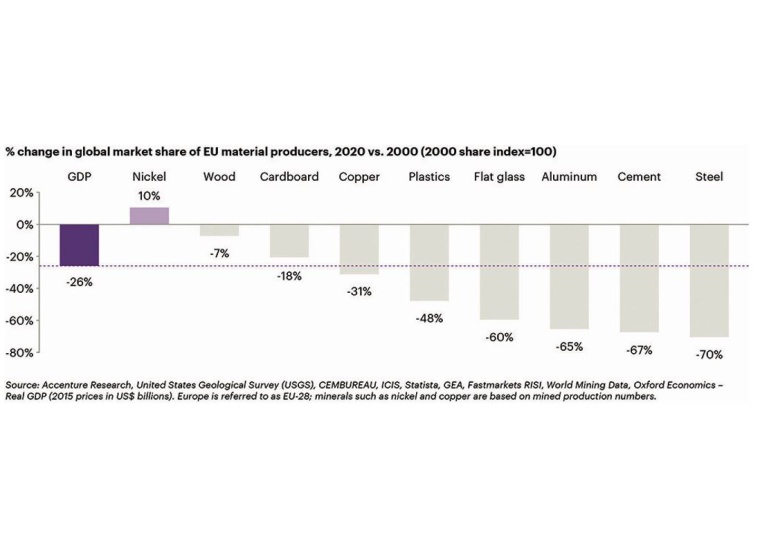

Innovation is often based on further developments of existing materials, which means it relies largely on existing production capabilities — and for European chemical and other materials companies, that presents a challenge. Over the last two decades, Europe’s share of global markets across almost all classes of materials has declined — much of this being lost to China (fig. 3). This is not just a result of having a reduced share of global GDP as in many materials categories, reductions in market share have significantly outpaced the loss of GDP share. For example, the European share of steel and cement has declined 70% and 67%, respectively, compared to a 26% drop of GDP share. This indicates that Europe could find itself with relatively less manufacturing capacity to draw on in the race for innovative materials.

On the other hand, the materials industry in Europe has other ways to benefit. It can consider working closely with startups, which play a significant role in the development of new materials. Europe has a sizable base of these startups, which represent a growing pool of talent, knowledge and capabilities — and the industry has an opportunity to collaborate with them to advance innovation. That means that companies and governments should work to generate environments that foster startups in order to strengthen the region’s ability to produce new materials.

At the same time, European companies can draw on today’s increasingly powerful “science technology” (science tech) to improve innovation efforts. Science tech builds on cloud, data, analytics, artificial intelligence and automation to allow virtual rather than physical experimentation with new materials, bringing greater speed and better targeting to innovation. An Accenture analysis of priority patents shows that filings based on traditional development approaches in fields such as steel, cement, glass and so forth declined or grew only slightly in the past few years. At the same time, those involving disruptive innovations derived through computational chemistry — a type of science tech — increased more than 100%.

For chemical companies, the opportunity of the materials revolution is simply too big to ignore. It will not only provide new products to bring to market, it will also change the competitive landscape by allowing European chemical and other materials companies to compete on innovation, rather than simply costs. And it will enable the sector to play a vital role in driving the energy transition forward and building the circular economy.

Bernd Elser, a Managing Director and Global Chemicals Lead, Accenture, Frankfurt am Main, Germany

most read

Merck Acquires Chromatography Business from JSR Life Sciences

Merck to acquire the chromatography business of JSR Life Sciences, a leading provider of CDMO services, preclinical and translational clinical research, and bioprocessing solutions.

VCI Welcomes US-EU Customs Deal

The German Chemical Industry Association (VCI) welcomes the fact that Ursula von der Leyen, President of the European Commission, and US President Donald Trump have averted the danger of a trade war for the time being.

Orion Announced Plans to Shut Down Carbon Black Plants

Carbon black manufacturer Orion Engineered Carbons plans to rationalize production lines in North and South America and EMEA.

Dow to Shut Down Three Upstream European Assets

Building on the April 2025 announcement, Dow will take actions across its three operating segments to support European profitability, resulting in the closure of sites in Germany and the UK.