Merck Sells Consumer Health to P&G

20.04.2018 -

Germany’s Merck KGaA has signed an agreement to sell its global consumer health business to Procter & Gamble (P&G) for around €3.4 billion, or $4.2 billion, in cash. The acquisition is said to be one of the biggest that P&G has done in recent years.

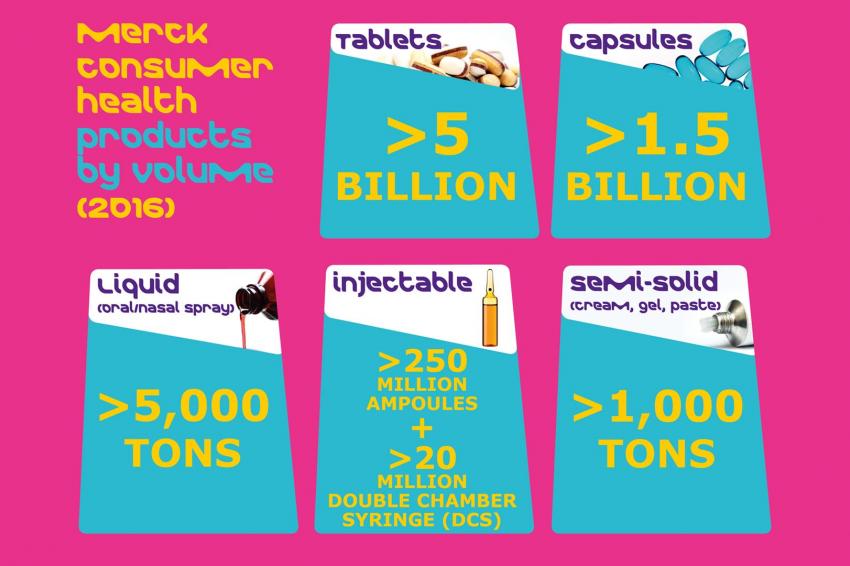

The deal adds Merck’s vitamin and food supplements, such as Seven Seas, to P&G’s over-the-counter (OTC) medicines, which include brands like Vicks cough and cold products. Net sales of Merck’s consumer health business were €911 million in 2017, achieving organic growth of 6% between 2015 and 2017, which the German group said was faster than the market’s growth of around 4% in the same period.

Merck put its consumer health business on the market last September in order to focus on prescription drugs. The transaction, which remains subject to regulatory approvals and certain other customary conditions, is expected to close by the fourth quarter.

The Darmstadt-based group said it intends to use the net proceeds primarily to accelerate deleveraging, while at the same time, increasing its flexibility to strengthen its three remaining business units.

“The divestment of the consumer health business is an important step in Merck’s strategic focus on innovation-driven businesses within healthcare, life science and performance materials,” said Merck CEO Stefan Oschmann.

P&G said it likes the steady, broad-based growth of the OTC healthcare market, adding that the leading brands of Merck’s consumer health business will complement its personal health care business very well. “This acquisition helps us continue to drive sales and profit growth for P&G by providing the capabilities and portfolio scale we need to operate a winning global OTC business,” said Tom Finn, president of P&G Global Personal Health Care.

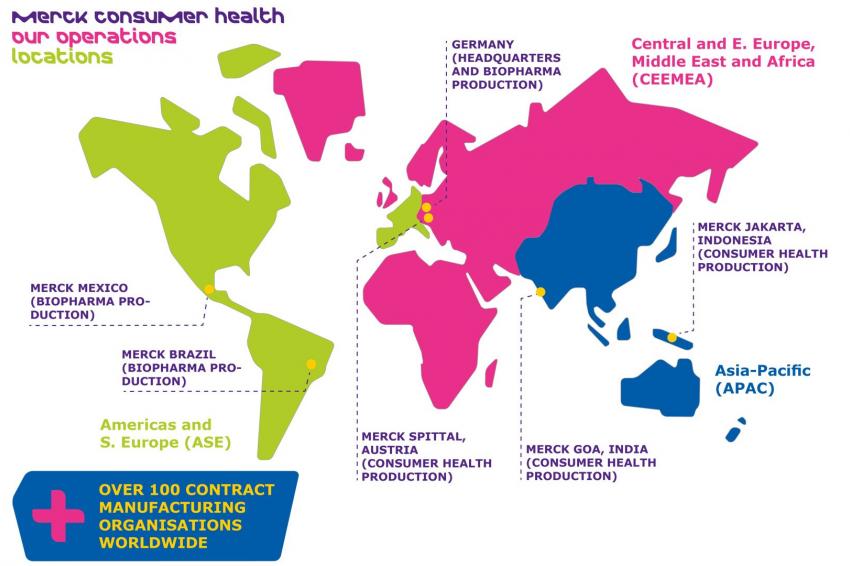

The transaction will be executed through the sale of Merck’s shares in a number of legal entities as well as various asset sales, The German group’s consumer health business operates in 44 countries and manufactures more than 900 products. It has two consumer health-managed production sites at Spittal, Austria, and Goa, India.

The sale does not yet include the French consumer health activities. P&G has made a binding offer to acquire the shares and assets of this business after consultations with the relevant works council representatives.

For the Indian operation, it P&G will acquire Merck’s majority shareholding in Merck Ltd. (India) and subsequently make a mandatory tender offer to minority shareholders.

Approximately 3,300 employees, mainly from consumer health, are expected to transfer to P&G. As part of the transaction, Merck and P&G have agreed to a number of manufacturing, supply, and service agreements.

Pfizer also put its consumer healthcare business up for sale last year but with no takers so far. GlaxoSmithKline was seen as the front runner for the assets but withdraw its interest last month having decided instead to buy Novartis out of their consumer healthcare joint venture. The $13 billion deal is much less than the potential $20 billion price tag for Pfizer’s business.

Reckitt Benckiser also dropped out of the race for Pfizer’s consumer healthcare division last month and Johnson & Johnson withdrew in January.

Pfizer told Reuters news agency last month that it continued to evaluate potential alternatives for the business, which included a spin-off, sale or other transaction, as well as retaining it, adding that it expected to make a decision in 2018.