Navigating Uncertainty in the Biopharma Market

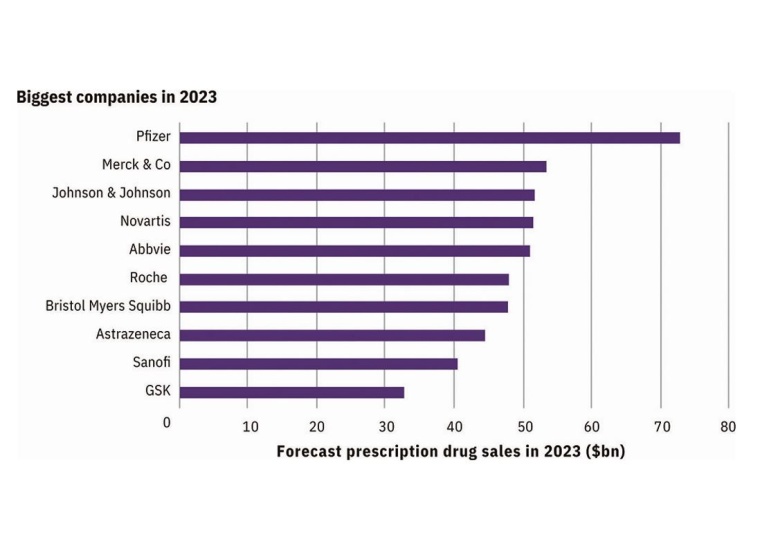

Biopharma companies are facing funding challenges in 2023 as interest rates rise and investors are becoming more risk adverse. There is hope on the horizon, say some analysts, while others project a prolonged slump due to inflation and global instability. Established pharmaceutical companies are often seen as safer investments, with larger developers expected to perform well in 2023, especially if litigation threats against drugs like Zantac disappear. However, concerns about revenue gaps continue for big companies like GSK and Sanofi, and their strategy and leadership will be closely monitored in the coming months.

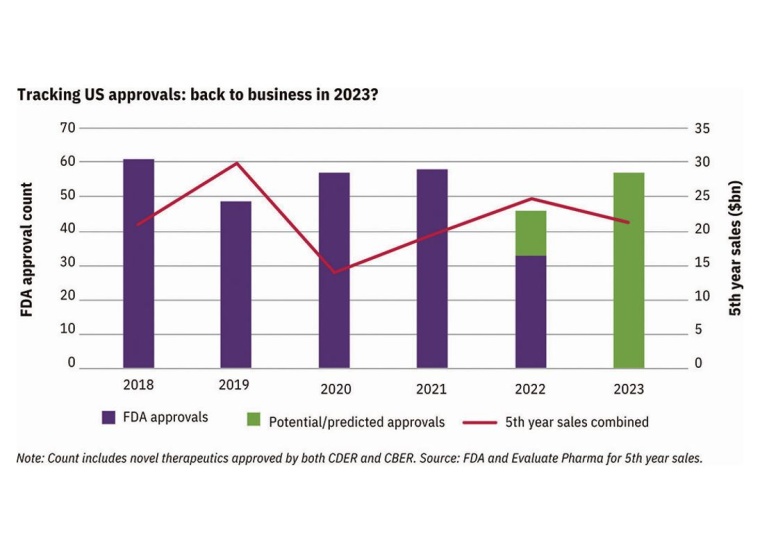

Lower valuations may be an asset to acquirers in 2023, but IPOs and venture funding is anticipated to be slow. To combat valuation struggles, clinical successes are critical for the biopharma sector this year. Potential areas for this are respiratory syncytial virus, Alzheimer’s disease, and cancer. It is expected that regulation approvals increase after the 2022 slump, according to Evaluate Omnium.

Evaluate Omnium, a specialized analysis and consulting firm focused on pharmaceutical and biotech matters, has published an industry outlook in its latest report, Evaluate Vantage 2023. This study offers valuable insights for company managers, industry professionals, and investors alike, providing essential information for navigating the complex landscape of the healthcare and biopharma sectors.

2023 Pharma Forecast: Drugs and Companies

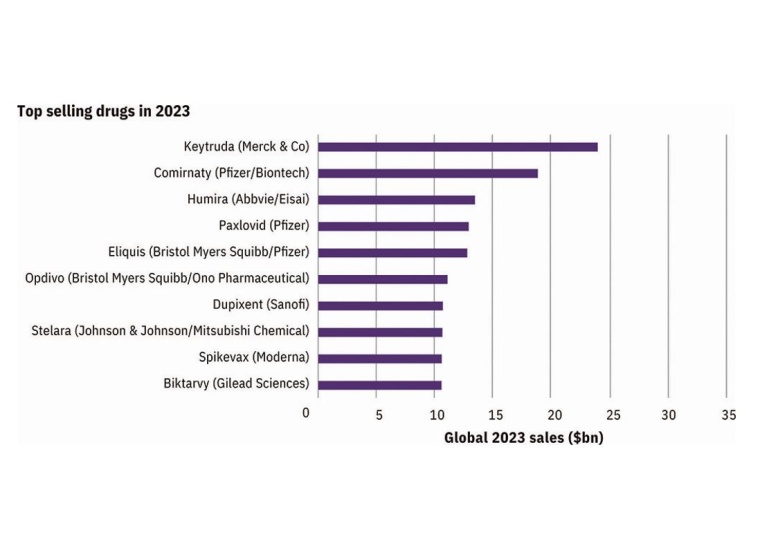

Next year’s pharmaceutical market is set to be dominated by mAbs (monoclonal antibodies) and vaccines, with Merck Sharpe & Dohme (MSD)’s Keytruda, a mAb cancer treatment, leading the way with an expected $3 billion in new sales. Uncertainty remains regarding the impact of Covid-19 on the industry. Two diabetes drugs to watch are Ozempic, which is forecasted to have strong sales growth, while supply issues pose a threat to Lilly’s newly launched Mounjaro. Competition between best-selling drugs and fulfilling demands will influence the market.

Pfizer’s Comirnaty and Paxlovid are expected to keep the company at the top of the prescription drug sales in 2023, outpacing MSD’s Keytruda. This dominance may not last long though, with the projected decline in demand for Covid-19 products. Novo Nordisk and Lilly both are seeing growth from their diabetes and obesity agents. Smaller companies such as CSL, Daiichi Sankyo, and Grifols are also expected to make an impact. AstraZeneca’s ranking is boosted by their success in oncology and their acquisition of Alexion with their fast-growing Ultomiris, a mAb autoimmune treatment.

Alzheimer’s, Antibodies, and Challenges Ahead

Next year, one of biopharma’s focuses will be on Alzheimer’s disease as Eisai and Lilly race to bring their antibodies to market. Lilly’s Donanemab is awaiting their pivotal trial readout expected mid-2023, but uncertainties remain around FDA approvals and reimbursement. Uncertainty is also on the horizon for predicting demand and securing reimbursement for gene therapies like Duchenne from Sarepta and Roche, a muscular dystrophy treatment. Respiratory syncytial virus vaccines are another product with potential opportunity this coming year, with GSK and Pfizer in the lead. The progress of Apellis’s geographic atrophy treatment should also be closely observed, given its additional data filings with the FDA, which delayed its progress by three additional months.

For projects already filed with regulators generating buzz, two novel anitbody-drug conjugates from Daiichi Sankyo are highly anticipated. A pivotal readout for one, Datopotamab deruxtecan, which Daiichi Sankyo partnered with AstraZeneca on, is expected this year. Talquetamab, an FDA Breakout Therapy in 2022, is another one to watch as J&J filed in December 2022 for its use for relapsed or refractory multiple myeloma. Karuna’s schizophrenia and Alzheimers treatment KarXT, secured a rare win in 2022 and should be filed for approval mid-year after Phase 3 clinical trials. FDA green light for clinical trials of Intellia and Regeneron’s NTLA-2001 is still awaited as caution around gene-editing projects persists. Despite concerns of its anti-Tigit mechanism, Roche and MSD’s mAb triagolumab remains of interest in 2023.

FDA Drug Approvals Rebound in 2023

Evaluate Omnium predicts a rebound in novel drug approvals this year, following the dip from 2022. This is reassuring as it indicates the recent FDA approval slowdown may be a temporary phenomenon. The focus this year is expected to be on stricter accelerated approvals, similar to what was seen in 2022 compared to previous years. Smaller pharmaceutical companies may face struggles as confirmatory phase 3 trials need to be in progress before accelerated approval can be deliberated. Changes to this pathway have developed where recent user fee reauthorization omitted extensive changes to the process. Despite this, advocates may push for reforms of the process further in the coming months.

Stock Market Hurdles: War, Interest Rates, and Reform

The industry is expected to continue being affected by issues such as the war in Ukraine, rising global interest rates, and concerns about drug price reform in the US. Last year’s mid-term elections in the US resulted in a discordant government, which impacts industry expectations for changes to the Inflation Reduction Act (IRA). Cash conservation efforts, portfolio prioritization, job cuts, and deals fueled by fear may hit many in the industry, particularly smaller companies. Concerning the stock market, some analysts believe the US biotech market has hit its bottom, while others anticipate further declines throughout 2023. This indicates potential challenges to those companies struggling with financing.

IPO Market Dips, Biotech Outlook Uncertain

The IPO (initial public offering) market, often a proxy for investor interest for high-risk enterprises, saw a downturn for biotech in 2022. Only 16 drug developers went public on western exchanges, with half raising over $100 million. This significant drop from previous years is forecast by some to continue in 2023, while others expect an uptick in offerings this year. Only the biotech Aelis Farma went public in Europe in 2022, although this low for the European market is not expected to continue. With the US looking to recover first, potential European-based companies are likely to turn to Nasdaq for their IPOs.

The past IPO market from 2020 and 2021 is often blamed for the underwhelming performance of recent biotech IPOs, but the downturn of the market overall also plays a factor. The 2022 market fared well; however, small deals dominate and many struggle to maintain their valuations post-float. The number of IPOs is expected to remain low until larger raises gain traction. The type of companies that receive investor support this year will be an important trend to follow, as the effect of the IRA on biotech versus small-molecule investments unfolds. The IRA disparity is blamed by some companies for the reprioritization of certain assets, potentially shifting the market towards biotech. Investors claim to have changed their valuation assessments accordingly. In the Evaluate Vantage Report they have split recent IPOs by technology type to help monitor this trend.

VCs Brace for Biotech Challenges

The venture capital (VC) world will face further challenges this year due to the ongoing biotech bear market. The closure of the IPO window impacted private financing, with crossover investors retreating and traditional VC facing exit struggles. In 2021, 16% of venture-backed companies received multiple rounds of financing, but last year we saw that number drop to 5%. The average number of financing rounds before going public or acquisition should also be watched. It is expected that acquisitions and mergers will predominate as the IPO window is nearly closed. Businesses will likely have to wait longer for buyouts like in 2022, where an average of nearly four rounds of investment was needed before a deal.

Biopharma Deals: Big Expectations, Mixed Results

In 2022, the biopharma merger and acquisition (M&A) landscape did not deliver the anticipated punch, but Horizon Therapeutics has confirmed initial interest from big players such as Amgen, Johnson & Johnson, and Sanofi. The estimated valuation of Horizon could be $25–30 billion, making it potentially the largest biopharma deal since AstraZeneca’s 2020 acquisition of Alexion. Evaluates report highlights Horizon, Biogen, and Vertex as desirable targets for this year. Despite hopes for a bigger year than 2022, most expect similar trends of decent mid-sized transactions and deals driven by desperation. Due to low valuations, more companies may face the choice of giving up or selling out, leading to potential reverse mergers and collaborations between contract firms and biotechs. A Seagan buyout looks more unlikely as its stock returns to levels seen before rumor of MSD’s interest. Biogen is also a potential target for acquisition due to its Alzheimer’s program, with Lilly being the only big pharma with another Alzheimer’s competitor close to market.

While Evaluate’s Vantage 2023 Report points to hopes for improved conditions in the biopharma industry in 2023, challenges such as funding difficulties, regulatory uncertainties, and market fluctuations are expected to persist. Biopharma companies will need to navigate these hurdles, focus on clinical successes, and closely monitor the changing landscape of the industry to thrive in the coming year. (cs)

most read

Merck Acquires Chromatography Business from JSR Life Sciences

Merck to acquire the chromatography business of JSR Life Sciences, a leading provider of CDMO services, preclinical and translational clinical research, and bioprocessing solutions.

Dow to Shut Down Three Upstream European Assets

Building on the April 2025 announcement, Dow will take actions across its three operating segments to support European profitability, resulting in the closure of sites in Germany and the UK.

Novo Nordisk to Cut 9,000 Jobs Globally in Major Restructuring

Novo Nordisk announced a global workforce reduction of approximately 9,000 positions to streamline operations and reinvest DKK 8 billion (€1 billion) in growth opportunities for diabetes and obesity treatments.

BASF Sells Majority Stake in Coatings Business

BASF sells a majority stake in its coatings business to the investor Carlyle.

VCI Welcomes US-EU Customs Deal

The German Chemical Industry Association (VCI) welcomes the fact that Ursula von der Leyen, President of the European Commission, and US President Donald Trump have averted the danger of a trade war for the time being.