Pharmalogistic Tendencies to a Patient Centric Distribution Network

CHEManager International: Camelot did a new survey in 2014-2015 about the topic pharma logistics. Now it is nearly finished. What has been one of the most surprising results?

A. Gmür: Camelot does a biannual survey on the actual pharma business climate and trends. This issue was focusing additionally on the actual trends for pharma logistics. For me, the most surprising result was to see that approximately two-thirds of the pharma companies that answered the survey have currently ongoing initiatives in changing logistics organization and process setup. Approximately half of the respondents have additionally ongoing initiatives focusing on network redesign and logistics IT setup.

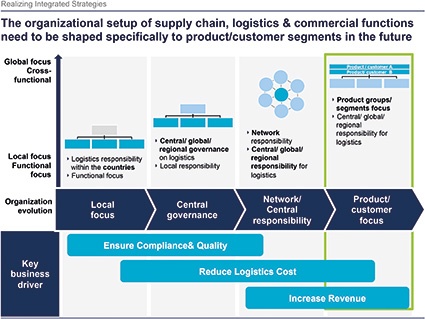

C. Reuter: This is confirming what we have observed in recent projects, where we recognize that logistics topics have increased in significance for the pharma companies. We can see a trend to more regional and global organization for logistics, compared with the past where distribution was focused more strongly on local or country setup.

A. Gmür: Asking the companies for their key logistics market trends impacting the logistics at the moment the majority is seeing a challenge in products, which required active temperature control as well as traceability and security requirements.

Looking at pharma logistics, what are the main differences comparing with other industries, for example automotive or even chemistry?

A. Gmür: Well, the main difference is here the direct impact to the patient, if logistics fails. He or she can decrease his or her life experience dramatically — in the worst case he or she can die! Let me explain this with the example of vaccines. You have products, which have to stay within a temperature range of 2 to 8°C; otherwise a protein chain in the drug could “break” and the product is not able to function anymore as it should in the human body. You may have only one chance to take the drug — so it is all about quality. Quality you have to ensure and to monitor over the whole process starting from sourcing, production, storage and distribution. There is not always an airbag for a second chance.

C. Reuter: Organizing and monitoring these quality requirements along the whole supply chain is a real challenge for the pharmaceutical industry in our days. It is important to understand the logistics market and anticipate the latest available technology into your supply chain. Though, always bear in mind that using a new technology with the target to enhance the logistics and supply-chain quality comes always with a risk, which you have to evaluate and to ensure that it is ready for pharma use. To mention some: central real-time vehicle transport temperature monitoring, new packaging solutions to guarantee temperatures, serialization and cross-company standard barcode usage on labels to prevent mix-ups, and so on.

This in a highly regulated environment of local and international health-care authorities — everything has to be documented according to compliance and quality rules. Not to forget the risk of counterfeit products — so I see security along the supply chain as another important topic for pharma logistics, which was confirmed in our survey.

Can you tell us about the market potential of pharma logistics in Germany, in Europe and worldwide?

C. Reuter: We are very excited to see how the logistics market is going to develop in the next five to eight years. We see it as a very prosperous market for the logistics players. For example, the enhanced GDP — good distribution practice — requirements foster a temperature-controlled distribution network offer for 15 to 25°C — not always available in all countries yet. The new development for a more patient-centric distribution and service-focused network strategy of the pharmaceutical industry requires other distribution services to the patient. This offers great opportunities for the players to enhance and offer their logistics service portfolio.

A. Gmür: We see three key types of players in the pharmaceutical market: Pharmaceutical companies, which organize primary transportation and their manufacturing network themselves; smaller, specialized logistics providers, which are close to pharma companies and often have grown with the pharmaceutical company or joint ventures; and pure logistics service providers (LSPs) for warehousing and/or transportation are covering primary and/or secondary distribution services.

C. Reuter: Not to forget, of course, distributors and wholesalers, which also offer logistics service and cover the last mile.

A. Gmür: The market is enormous and the margin very interesting for classical LSPs compared with their classic business. In our study we have seen that the majority of the pharma logistics is already outsourced and approximately a third of the respondents are expecting to increase outsourcing to logistics providers until 2020. The question is how the logistics players are developing their business concept — keyword horizontal and vertical growth.

Is outsourcing still on the radar of pharma logistics as part of the supply-chain strategy?

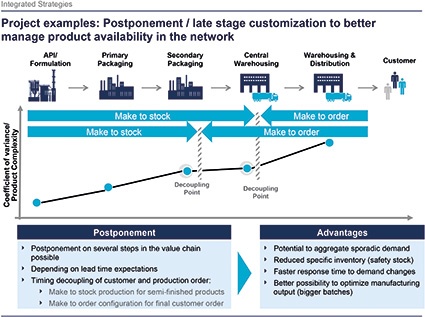

A. Gmür: Outsourcing is already a fixed part in the supply-chain setup of most companies. Mainly transportation services are outsourced, followed by warehousing and OTC services. A new exciting area is showing up slowly at the horizon — value-added services resulting from enhanced postponement strategies of the companies. A very exciting concept for the potential of decreasing logistics cost and it provides a faster reaction to the market.

Can you give us a little more information on the concept in general?

C. Reuter: Everyone buying medicine knows the inner leaflet and maybe paid attention to the labels on the package of the product and the paper box. Today these components of the packaging are mostly prepacked, labeled and distributed to a local distribution center specific for one market. So you produce for example 1,000 for the German market, 500 for the French market, etc., and store them in local distribution centers. But now the effective sales show 800 for Germany and 700 for France. One market is over-, one under-supplied. With a postponement concept, e.g., unspecific blister packs would be stored at a central regional distribution center and repacked in order to faster react to demand changes in the secondary distribution chain.

A. Gmür: We feel this will be a focus topic for pharma logistics driven by a more patient-centric distribution network — that is the future!

Patient-centric distribution network sounds unfamiliar to me — please give some more details to our readers.

A. Gmür: Several trends in the pharma landscape drive the appearance of patient-centric models’ respective “beyond the pill” services. Patient-centric models gain added value by providing extended services for patients and stakeholders acting directly around the patient. In our pharma survey we asked the participants about the key market trends for the next three to five years. Key new market trends compared with the current situation identified were an expected increase of patient individualized treatments/medications versus standard drugs and an increase of additional patient-specific services, e.g., prescription management, consulting services, products kits, and so on.

C. Reuter: Digital transformation — also on the customer side — will make new information available that can be used to modify business models or their outcome. Imagine what the new wearables, smart watches, could do in the future, starting from measuring patient pulse and temperature, reminding to take medicines or order new ones, tracking the location and delivering differently and more directly to the patients! This will change the business and intra-company collaboration.

Collaboration is the key, sure. But what will change in the company’s organization?

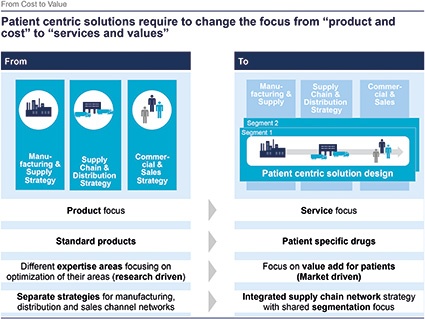

A. Gmür: Today many of the pharma companies still have silo thinking and have, for example, individual strategies for their supply network and distribution network. Our observation, which was confirmed in the survey, is that many companies also have no regular process to align commercial and sales strategies with distribution or supply strategies. Coordination between these organizational silos is for many companies done on an ad-hoc basis. However, a patient-centric solution needs a cross-silo design to be successful — meaning you have a vertical management coordinating over the silos.

Has this development an impact on the thinking of how logistics as part of supply-chain management (SCM) should work in the future?

C. Reuter: Of course — transition from a cost focus to value/service focus requires new end-to-end solutions. Paradigm shifts will be the consequence for the supply chain. Closer integration of commercial, distribution, supply-chain and manufacturing strategies is the key to generate additional revenue. Deriving integrated strategies and implementation require organizational and mindset transitions — overcome functional silos. Changes in organization, processes and self-understanding need a clear and well-timed road map.

Company

Camelot Management Consultants AGTheodor-Heuss-Anlage 12

68165 Mannheim

most read

The Future of Demand for Chemicals

The chemical industry is shifting to sustainability-related products, with demand growing 4.5 times faster than conventional ones. Companies must revise their market strategies to capitalize on this opportunity.

Pharma Outlook 2025

The environment for pharma in 2025 is diverse and challenging: New treatment options are being brought to market in ever shorter cycles.

ISPE Good Practice Guide: Validation 4.0

The Validation 4.0 Guide provides a comprehensive approach to ensuring product quality and patient safety throughout a pharmaceutical product's lifecycle.

Q1 2025 Chemical Industry: Diverging Trends

The first quarter of 2025 highlights a continued divergence between the European and US chemical industries.

“Access to Talent is a Crucial Factor”

In an interview with CHEManager, Edgardo Hernandez, President of Lilly Manufacturing, explains the strategy behind the ambitious investment project.