Regaining Competitiveness in the Global Market

CEFIC Describes a Strategy to Unlock a Competitive, Low Carbon and Energy Efficient Future for the EU Chemical Industry

The European chemical industry is of major importance for economic development and wealth, providing modern products and materials and enabling solutions in virtually all sectors. Nearly two-thirds of EU chemicals are supplied to the EU industrial sector, including construction. The big industrial users of chemicals are rubber and plastics, construction, pulp and paper, and the automotive industry.

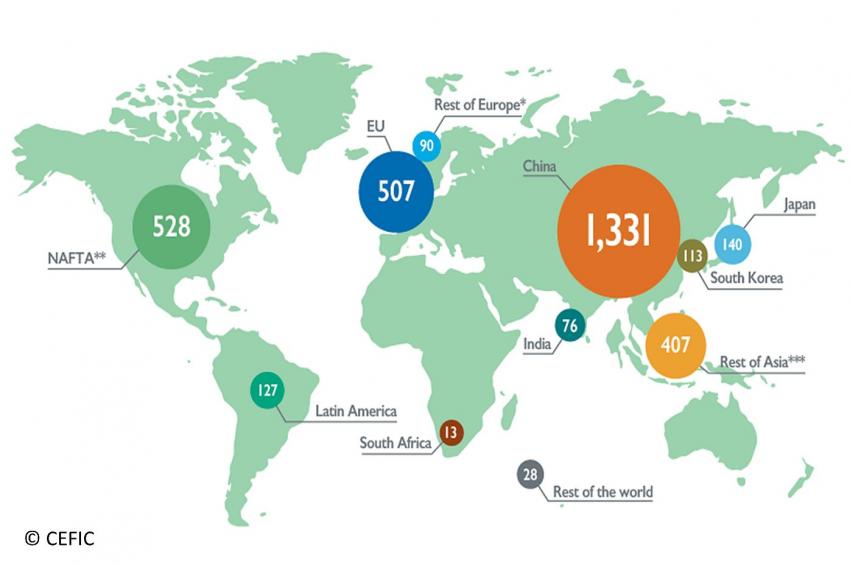

With a workforce of 1.2 million and sales of €507 billion (2016), the EU chemicals sector is one of the largest industrial sectors and an important source of direct and indirect employment in many regions of the European Union.

Europe Has Its Own “Success Story”

The European chemical industry is a wealth generating sector of the economy; it is a valuable part of Europe’s economic infrastructure. Having ridden out the recession, the European chemical industry is continuing its recovery. It aims to provide solutions for the achievement of a competitive, low carbon and circular economy in Europe and beyond. In many ways, the European chemical industry is highly successful. Traditionally, it has been a world leader in chemicals production. Today, with 15.1% market share (data 2016), the EU chemical industry ranks second, along with the United States (14.2%). China continues to dominate chemicals world ranking in 2016, and contributed to nearly 40% of global chemicals sales.

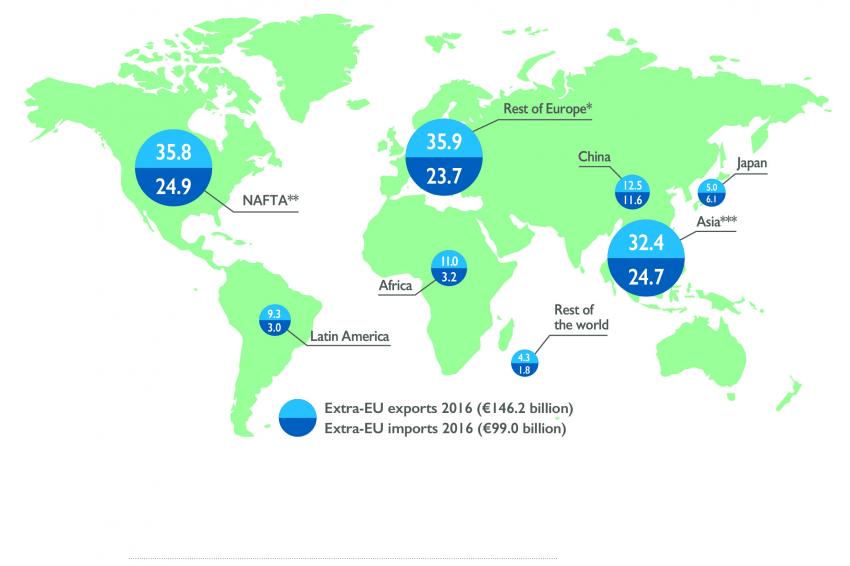

Europe Still Has a Healthy Trade Surplus of Chemicals

As a historically important player in the global chemicals market, the EU chemical industry continues to benefit from trade opportunities, the trade surplus with non-EU area reached a significant level in 2016 (€47.3 billion). The EU area is still the largest chemicals exporting region in the world. It has also the world’s largest chemicals surplus. Trading chemicals around the world stimulates competition, provides an incentive to develop new markets through innovation and stimulates production efficiency. The two largest chemicals trade partners of the European Union are the USA and China; taking together, they contributed to nearly one-third of extra-EU global chemicals trade. To stimulate the trade business environment, the EU institutions can do much. An ambitious, balanced and free trade agenda with key trading partners is really needed to help our sector to play its part on a global basis, and to boost trade and economic growth via the open market agreements.

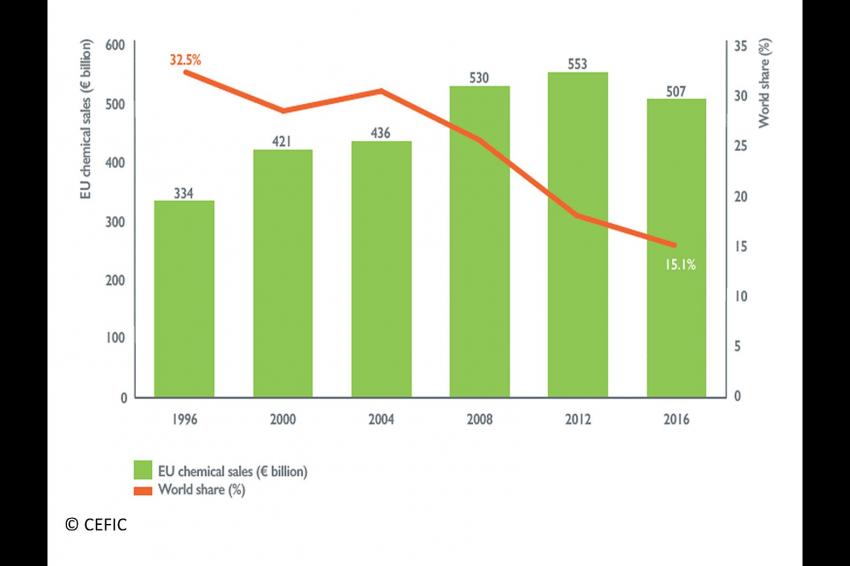

Chemicals Made in Europe Are Losing World Market Share

While European chemical sales have continued to grow over the past 20 years, Europe’s share of global sales over the same period has declined dramatically. EU chemical sales increase by more than 50% in 20 years, while its world market share halves from 32% in 1996 to 15% in 2016. The loss of EU chemicals market share decrease is primarily due to declining competitiveness, as opposed to slow-growing destination markets. This is a so-called “dilution effect”, a trend expected to continue in the future. Data analysis showed strong chemical demand growth in China, and other emerging countries and low growth in Europe and North America, where Europe sells most of its chemicals. Overall growth of chemicals demand and production as well as faster growth in emerging regions is a trend that is expected to continue in the future. Growth in post-recession Europe remains low, mainly due to mature markets and an ageing population.

Investments in new production capacity increasingly flow to other parts of the world which leads to “investment leakage” in the chemicals industry. Recognizing the chemical industry’s strategic importance for a successful industrial strategy, China, the Middle East and India have all made successful efforts to build up large and increasingly sophisticated production facilities and attract high investments by putting industry at the very top of their political agendas. The same applies to the USA where the recent shift towards “America First” will inevitably have further strong impacts on their industrial policy. Consequently, the EU’s share of global chemicals production is decreasing in several segments.

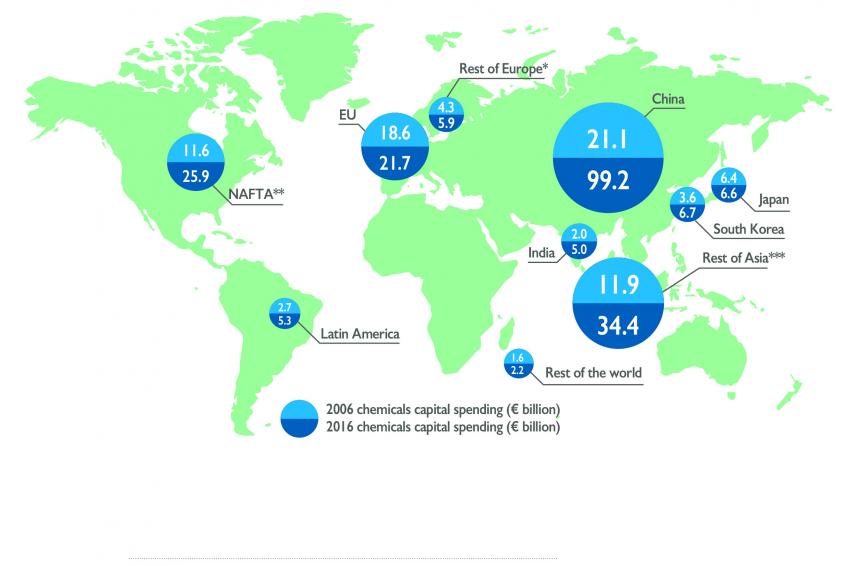

China Dominates World Chemicals Investment

Capital investment is a key factor in securing the future development of the chemical industry. And, in many cases, major equipment or plant renewals require long-term planning. Such investments are not only related to the improvement of productivity or introduction of new products but are also due to the need to comply with regulations or reduce operating costs. Data shows that chemical companies in the world invested a global value of €212.8 billion in 2016, up from €83.8 billion in 2006. On a global basis, the level of chemicals investment was 2.5 times higher in 2016 compared to 10 years ago. As expected, China continues to dominate world chemicals investment and is far away outpacing the other economies in the world. The European Union is still, however, lagging behind the main regions in the world. The EU investment market share has lost more than two-thirds of its original value in 20 years – down from 33.8% in 1996 to 10.2% in 2016. These results are totally in line with the declining EU market share of chemicals production illustrated above.

On the R&D spending side, the EU chemicals sector showed a similar story. The EU R&D market share has lost more than 25% of its original global market share in 20 years. The key question is: What can Europe do to reverse the depicted trend? Creating a favorable business environment and stimulating innovation and investment in Europe is more than necessity. To this end, Europe must act urgently to contribute to a real industrial renaissance by deploying the recently adopted EU industrial policy strategy.

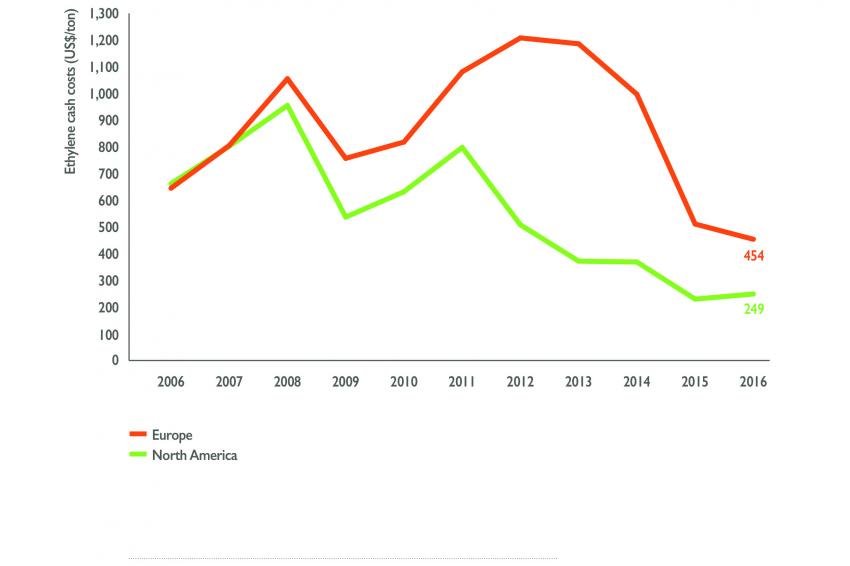

Coming back to the loss in competitiveness, there are other potential causes for this dilution effect: Energy and feedstock prices are a critical factor for the competitiveness of the chemical industry. The shale gas boom in the United States has reduced energy and feedstock costs greatly.

Feedstock Costs are the European Industry’s Achilles’ Heel

Energy costs are the European industry’s Achilles’ heel, especially compared to the oil and gas-rich Middle East, and more recently to the United States, riding on a shale gas boom. High EU energy and feedstock costs, compared to other regions, are a particular barrier to investment and are supported by having a fair ETS based on actual production and no tiering, and new a truly functioning well connected liberalized energy-only market and market development opportunities through building renovation measures. Better regulation that will also reduce regulatory burden, complexity and unpredictability, will help to maintain EU competitiveness and support investment and innovation.

Implications for an EU Industrial Policy Strategy

As shown, energy and feedstock prices are critical factors for the EU chemicals sector. Given the chemical industry’s role of providing the solutions needed to enable the transition to a low-carbon and circular economy, it is important that the chemical industry is taken into account when developing EU climate and circular economy policies that are to create jobs in Europe. Today, there is a strong risk that Europe’s transition to low-carbon and circular economies will hurt EU industrial production and benefit producers located elsewhere. Therefore, it is important that the EU strategy recognizes the importance of value chains and should ensure attractive operating conditions in Europe. To ensure Europe’s continued role in the global economy, the potential of individual European value chains to be integrated into global value chains should be clearly recognized, i.e. European suppliers should be able to compete globally and not just in Europe. It is crucial that the future EU Industrial Policy Strategy represents a coherent action plan that brings together and streamlines measures in a variety of EU policy areas and departmental responsibilities. For an Industrial Policy Strategy to be successful it must enable the industry to transform, by creating a favorable business environment that stimulates innovation and investment in Europe.