Rewriting the Rules for Chemical Distribution

Having survived the pandemic so far in good condition, chemical distributors are well positioned to grow, provided they understand how the rules for winning have changed. Distributors that keep their customers’ needs front and center will be best positioned to succeed, regardless of what the future brings.

The needs of chemical producers have changed significantly over the past few years. So, too, have the rules for distributors that wish to win in today’s business environment. Unlike many industries, distributors have weathered the pandemic well and are poised for growth; they cannot be complacent. To make the most of the opportunity, they will need to deepen their capabilities significantly in some key areas.

To better understand how chemical distributors have fared over the past six years and what their future looks like, we compiled performance data and surveyed their producer customers worldwide. 400 senior executives from commodity and specialty companies took part in the survey, with a representative sample from the Americas, Europe, the Middle East and Africa, and Asia Pacific. The study has eight key findings.

1. Covid-19 has Had Little Negative Impact on Chemicals Distributors

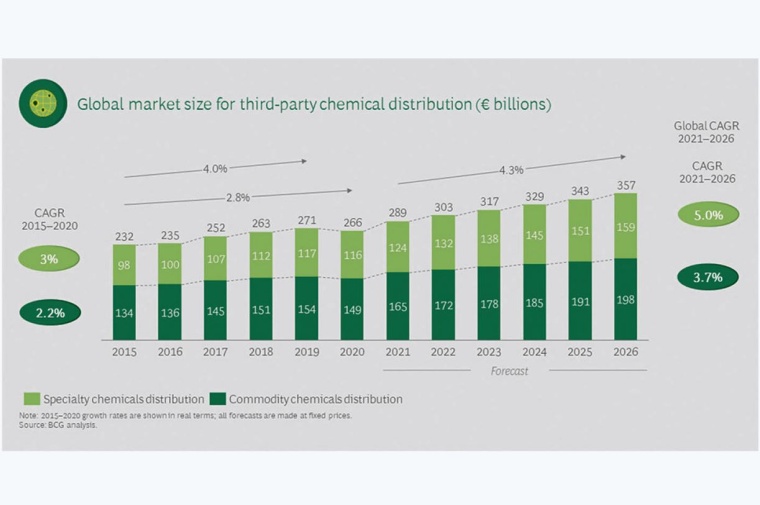

Between 2015 and 2020, the global chemical distribution market grew by a compound annual growth rate (CAGR) of approximately 3%, reaching nearly €270 billion (fig. 1). Surprisingly, in 2020, when the pandemic was in full force, the chemical distribution market shrank by only 2% to 3%; by contrast, manufacturing output declined by nearly 5%.

During the same five-year period, specialty distributors outperformed commodity distributors, with CAGRs of 3% and 2.2%, respectively. A few specialty distributors grew by more than 10% annually. Although both commodity and specialty segments contracted in 2020, the revenues of a few specialty distributors continued to grow by more than 30% year over year between 2019 and 2020.

“Given the growing importance of ESG,

distributors must embed sustainability

into the products and services they provide customers.”

Given that Covid-19 snarled supply chains across industries, why did the chemical distribution sector prove so resilient? Rising demand in underlying markets including food, pharmaceuticals, personal care, and livestock feed likely played a role. But the key reason for their resilience is the position chemical distributors hold in the value chain: they provide critical support services for producers and downstream customers alike.

Many distributors, for example, store manufacturers’ excess output in local warehouses or pan-regional networks. During times of unpredictable end-user demand, we would expect the need for such storage facilities to be high. Specialized distributors also provide producers with industry expertise, as the rise in outsourcing demonstrates (see #3 below).

At the same time, distributors can provide the downstream customer with reliable sources of supply because they have deep, multi-source supply networks. If distributors cannot procure a particular product from the usual producer, they often have backup sources to draw on.

2. The Growth Trajectory for Chemical Distributors Remains Positive

According to our newly updated model, the CAGR of the global chemical distribution market will accelerate to approx. 4% for the next five years. The strong market fundamentals seen over the past few years are unlikely to change in the mid- and long term. The APAC market will likely grow the most, with a 2021-26 CAGR of 5% to 6% due to increasing demand for chemical products in Asian markets, which is increasingly served by domestic producers as well as local chemical distributors. The North American and European markets are likely to experience lower growth, with a projected CAGR of 2% to 3%, which is on par with their GDP.

Specialty segments will continue expanding at a faster rate than commodity segments. According to our projections, the revenues of specialty and commodity distributors will grow at a CAGR of approximately 5% and 3.7%, respectively. The pandemic did not slow the high pace of M&A. Chemical distributors continue to use M&A as a crucial way to drive growth.

“As producers increasingly rely on

digital collaboration to do business,

distributors will need boost their digital capabilities.”

3. Outsourcing Rates Differ by Region, Product Focus and Segment

More than 70% of survey participants intend to increase their use of third-party distributors globally. According to our respondents, third-party distributors help expand geographic reach; expand reach to smaller customers; enable producers to increase focus on core business; improve service for some end-customers; and reduce operational and overhead costs. We expect that over the next five years the overall distribution outsourcing rate will continue growing slightly — 0.5% p.a., down from more than 1% p.a. in the past. But it will vary substantially between regions, product focus, segments, and even sub-segments.

4. Diversification is Picking up Speed

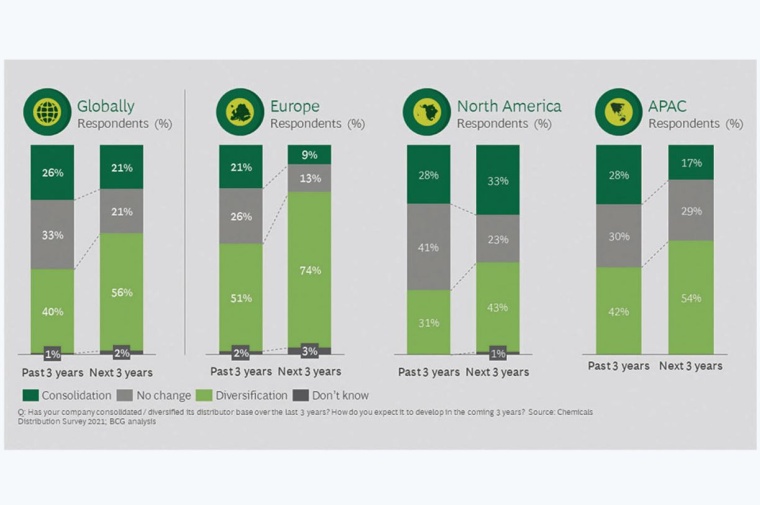

For many years, producers consolidated their portfolios of distributors worldwide to reduce supply chain complexity and cut costs. That is no longer the case. More than 40% of our respondents on average said they diversified their portfolios of distributors over the past three years. Nearly 60% expect to do so over the next three (see fig. 2). The push to diversify is particularly strong in Europe.

As markets become more competitive and customer expectations rise, producers are realizing that no single distributor can be best in class in all regions. The key, rather, is to find distributors with top capabilities in the regional and local-segment combinations that contribute the most to the producer’s bottom line. That means working with many different distribution companies — a trend at odds with efforts to reduce supply chain complexity. As the bar for relevant expertise rises, the shift to diversification is likely to continue.

5. Chemical Producers Switch to Different Distributors less Often

45% of producers worldwide said they were likely or very likely to switch distributors in 2018 (see fig. 3). By contrast, only about 17% said they are likely or very likely to switch currently. Nearly 35% said they are likely to change distributors in 2024. In times of crisis, producers look for stability and are loathe to switch partners. The numbers for switching are higher in Europe because companies there are looking for access to new regions and customers, distributors with better reputation, and compliance with new supply chain laws.We believe that 2021 is an outlier due to the pandemic, and that switching is on the wane: distribution partnerships have matured and become an essential part of doing business. The partners invest in each other when developing a relationship, esp. in specialty segments, making switching disruptive.

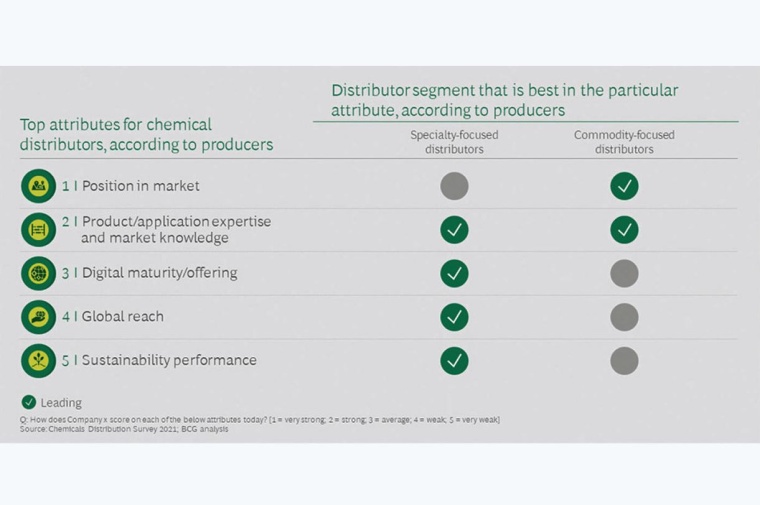

6. Distributors with a Strong Market Position and Expertise Score Highest

When asked to score distributors on a wide range of attributes, producers gave their highest scores to commodity distributors with a strong position in the market (see fig. 3). Both specialty and commodity distributors were considered equally strong for the attribute of next-highest importance – product and application expertise. Specialty distributors scored highest in the following dimensions of digital maturity/offering, global reach and sustainability performance. These findings suggest that specialty distributors would be well served to improve their position and knowledge of local markets, while commodity distributors should think about improving their digital and sustainability capabilities as well as global reach.

7. ESG is now Part of Producers’ Criteria for Selecting Distributors

Having become a key consideration for producers across the chemical industry, environmental, social, and corporate governance (ESG) is now playing a role in the distributor selection process. More than 90% of survey respondents said that they expect sustainability to be a major driver of distributor selection in the next three years. ESG considerations are especially critical in the specialty segment.

Some ESG criteria, such as low energy consumption and the fulfilment of highest government standards, will probably skyrocket in importance compared to other criteria. Capabilities in areas with KPIs such as emissions will also gain importance as producers look for ways to assess potential partners.

Emphasizing the urgency of sustainability in their product portfolios and brand positioning, many producers are increasingly looking for distributors that do the same. Distributors that embrace sustainability over the next few years will be poised to differentiate themselves and capture market share.

8. Digital Skills Become Table-Stakes

Producers are increasingly looking for distributors who can collaborate digitally with them. Customer relationship management (CRM) has seen the largest increase, from less than 20% of producers in 2018 to more than 50% today. Many producers were already working digitally with distributors when Covid-19 hit. The pandemic only accelerated the trend. Digital collaboration will continue to grow over the next three years. By 2024, approx. 85% of producers will be working digitally with distributors across a wide range of areas, from technical customer support to automatic reordering and replenishment.

“As producers look for localized expertise,

distributors will need to build expertise

in the specific geographic-segment combinations.”

Three Focus Areas

First, as producers look for localized expertise, distributors will need to build expertise in the specific geographic-segment combinations. In the past, distributors tried to become “jack of all trades,” with outstanding capabilities in all parts of the world, because that’s what producers were looking for. But as producers increasingly look for regional-segment specialists, distributors need to change their sights accordingly.

Second, given the growing importance of ESG, distributors must embed sustainability into the products and services they provide customers. It was not long ago that distributors treated ESG capabilities as simply “nice to have.” With the recent revelations about climate change, however, ESG expertise is now a “must have.” Equally important, as producers increasingly rely on digital collaboration to do business, distributors will need boost their digital capabilities – they are the only way to avoid disintermediation by producers looking to adopt a direct sales model.

Outlook

Having survived the pandemic so far in good condition, distributors are well positioned to grow, provided they understand how the rules for winning have changed. Distributors that keep their customers’ needs front and center will be best positioned to succeed, regardless of what the future brings.

Authors:

Tobias Mahnke, Managing Director and Partner, BCG, Munich, Germany

Christian Hoffmann, Partner and Director, BCG, Munich, Germany

Adam Rothman, Managing Director and Partner, BCG, Chicago, USA

Robert Blaudeck, Lead Knowledge Analyst, BCG, Munich, Germany

Yehia Amar, Project Leader, BCG, Frankfurt, Germany