Surfactant Industry's Quest for Environmental Responsibility

Surfactants, a portmanteau of “surface” and “active” agent, play a pivotal role in various industries. These molecules are designed to work at interfaces, with the most common interface being the boundary between oil and water.

They are instrumental in cleaning, constituting a significant portion of the surfactant market, which amounts to roughly $40 billion. This market encompasses household cleaning (especially laundry), personal care products, industrial and institutional cleaning, as well as a range of other industrial applications in sectors like agriculture, oil and gas drilling, metalworking, construction, food production, healthcare, mining, paints and coatings, transportation, and firefighting.

What defines a molecule as a surfactant is its amphiphilic nature. In simple terms, surfactants have both hydrophilic (water-attracting) and hydrophobic (water-repelling) components. Typically, a hydrophobic tail, often an alkyl or alkyl-aryl moiety, is connected to a hydrophilic head, which could be a sulfate, sulfonate, or ethoxylate. This combination gives rise to the familiar tadpole-shaped representation of surfactant molecules.

Sustainability Challenge: Surfactants face a considerable sustainability challenge, echoing similar issues in various markets. The sustainability of surfactants can be analyzed using the acronym EMUD, which stands for extraction, manufacture, use, and disposal. The environmental impact of surfactants hinges on their sources, production methods, usage patterns, and disposal options. Let’s delve into each of these phases:

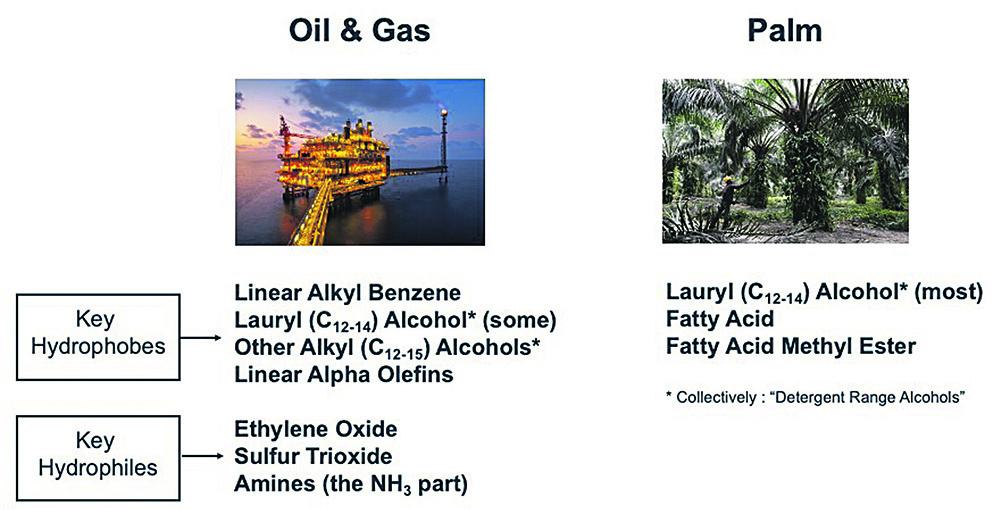

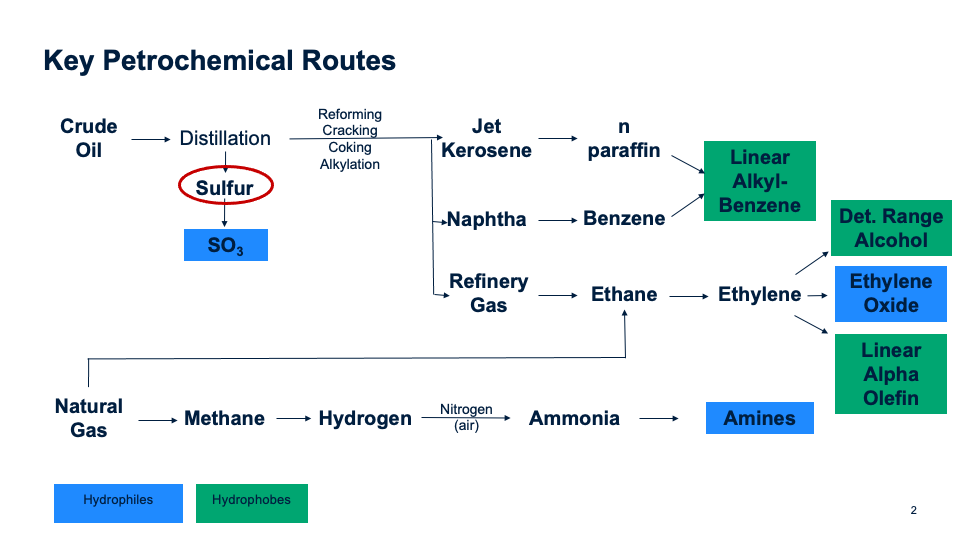

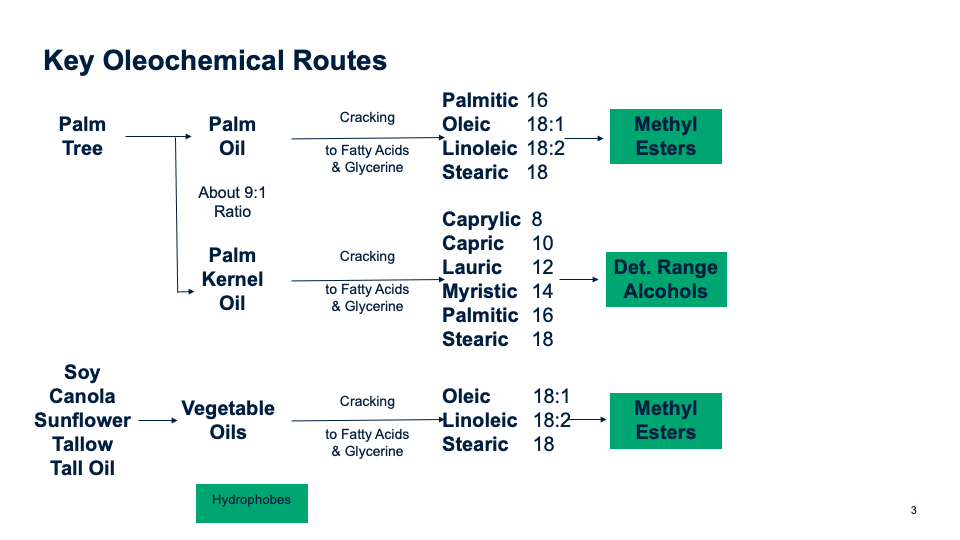

- Extraction: Over 90% of surfactants today originate from either petrochemical feedstock derived from oil and gas fields or oleochemical feedstocks obtained from palm plantations. These sources have raised concerns regarding their environmental impact, including their carbon footprint. The growing use of palm products, especially in Western Europe, has also raised biodiversity concerns in regions where oil palm trees are cultivated. These concerns have spurred the search for an alternative supply chain that is neither petrochemical nor oleochemical.

- Manufacture: The manufacturing technology in the surfactant supply chain is typically mature and efficient in terms of yield, energy consumption, emissions, and capital cost. Well-established engineering companies and chemical giants dominate this sector. Regulatory scrutiny is present, as exemplified by the US EPA’s recent proposal to strengthen emissions standards for chemical plants, focusing on ethylene oxide. This has led to increased interest in co-located pipeline supply arrangements for ethoxylation used in surfactants.

- Use: The largest environmental impact of surfactants is realized during the use phase, which primarily occurs in homes. Whether in washing machines, showers, or bathtubs, surfactants are prevalent. Studies have shown that laundry detergent and shampoo, both significant users of surfactants, have a substantial carbon footprint. Factors such as energy consumption for heating water, detergent dosage, and wash temperature play a crucial role. An essential recent development to improve sustainability has been the increased adoption of cold-water washes in household laundry.

- Disposal: After use, surfactants, along with the consumer products in which they are formulated, often find their way down the drain. Biodegradability is a significant concern in this context. Most surfactants used today are biodegradable in aerobic conditions, and since 2005, all surfactants used in detergents in the EU must demonstrate ultimate biodegradability.

Derivation of hydrophobes and hydrophiles. © Neil A. Burns LLC

Driving Forces for Change: The push for sustainability in the surfactant industry is driven by consumers, regulators, and companies:

- Consumers: have become increasingly curious about the products they buy and their environmental impact. The market for sustainable products, including those in laundry, haircare, bath & shower, and cosmetics, has continued to grow. A study found that products with sustainability-related claims experienced higher growth rates.

- Regulators: have responded to consumer trends by passing laws aimed at forcing sustainability improvements. For instance, New York State has implemented legislation to limit the presence of dioxane in various household cleaning, personal care, and cosmetic products. Dioxane is a known contaminant in surfactants.

- Companies: particularly in the retail and consumer goods sectors, have voluntarily imposed their own sustainability standards, impacting the surfactant supply chain. Large companies like Walmart and Unilever have taken steps to eliminate certain ingredients from their products and replace fossil-derived carbon with renewable or recycled sources.

Key petrochemical routes for surfactants feedstocks. © Neil A. Burns LLC

Responses to the Sustainability Challenge: The surfactant industry has responded to the sustainability challenge through various innovative approaches:

- Biobased Feedstocks: There has been a shift towards using bio-based feedstocks in surfactants, with a focus on sustainability. This transition began in the early 1990s with the increased adoption of bio-based alcohols as hydrophobic components. The palm-based products in this category have seen substantial growth in the past three decades.

- Fermentation: In the mid-2000s, companies explored fermentation as a means to develop alternative feedstocks for surfactants. The goal was to create hydrophobes from sugars, avoiding the use of petrochemical or oleochemical sources. While this approach faced initial cost challenges, it has recently seen renewed interest, particularly in the field of biosurfactants.

- Carbon Capture: Technology for capturing and utilizing carbon dioxide (CO2) emissions has been explored as a way to reduce environmental impact. Companies like LanzaTech specialize in carbon capture and utilization (CCU) technology, converting CO2 and waste gases into products, including surfactants. This approach has gained traction in the industry.

- Circularity: The concept of circularity involves reusing products or waste streams in the production of goods, minimizing waste. While waste streams in surfactants have found limited use, some companies are starting to utilize inedible materials like molasses and sugar-cane residues.

- Biosurfactants: These surfactants are produced by living organisms, distinct from plant-based bio-surfactants. The most developed class of biosurfactants includes glycolipids, which have both hydrophilic and hydrophobic components. Companies like Evonik, Holiferm, and Jeneil are actively engaged in commercial activity in this field.

- Bio Mass Balance (BMB): BMB allows the use of renewable resources, such as biomass or bio-naphtha, as a feedstock in the chemical industry. This approach replaces a portion of the fossil raw materials with renewable ones, reducing the carbon footprint. Thus, the end-products have the same quality and performance as their fossil counterparts, but with a lower carbon footprint and a higher share of mass-balance certified bio-based content. Major companies in the surfactant industry have adopted BMB methods to improve sustainability. For example, CEPSA recently launched NextLAB, a BMB version of Linear Alkyl Benzene, which has been converted to LAS and used by Unilever in various cleaning products under the Persil, Sunlight and Cif brands. In January of 2023, Shell and Henkel signed an agreement in which Shell would use BMB methods to make surfactants from 200,000 MT of renewable feedstocks, which Henkel would then use in cleaning brands such as Persil, Purex and All. BASF has a well-developed BMB program across a number of value chains, including surfactants, as has Ineos for ethylene oxide.

Key oleochemical routes for surfactants feedstocks © Neil A. Burns LLC

What’s Next

In response to the sustainability challenge, the surfactant industry will continue to witness developments:

Biosurfactants are expected to gain further ground in the market, with large companies investing in this sector.

The adoption of Artificial Intelligence and Machine Learning methods for innovation in surfactants is likely to increase, with major players in the industry already investing in this area.

Overall, innovation remains a driving force in the surfactants industry, offering solutions to sustainability challenges. We look forward to a lot more of it in this dynamic global market.

Author: Neil A. Burns, Neil A. Burns LLC

“The environmental impact of surfactants hinges on their sources, production methods, usage patterns, and disposal options.”