Chemical Distribution: Three Attractive Markets

Food, Pharma and Cosmetics Particularly Appealing for Chemical Distributors

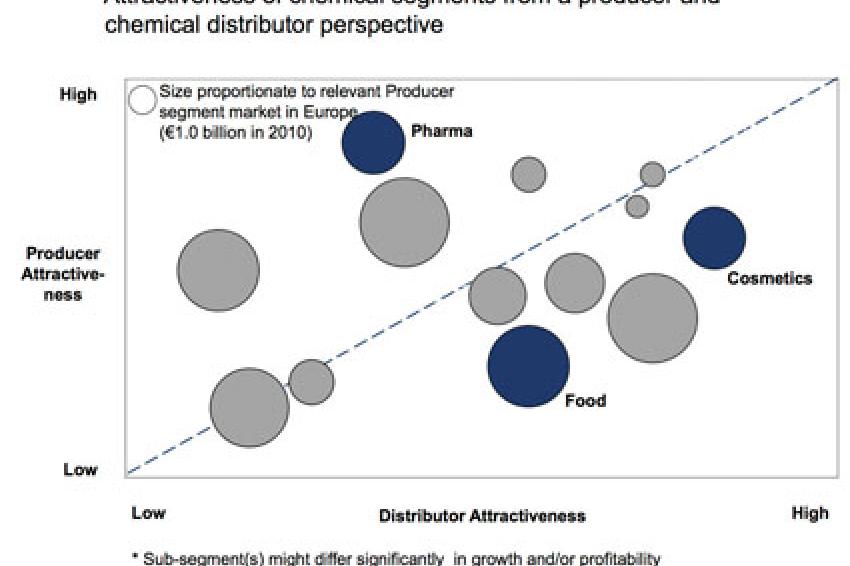

Desirable Markets - The area of life sciences covers nutrition, health and wellness of animals and humans. As such, several segments of this industry are attractive to chemical distributors, in particular pharmaceuticals, food, and cosmetics. Chemical distributors supply these segments with ingredients, additives, excipients and processing aids. From a producer's perspective, the attractiveness of these segments is typically defined by relevant market size, growth, profitability and sustainability.

By those measures, pharmaceuticals are more attractive to producers as a segment than are cosmetics and food. However, when we rank the segments from the perspective of a chemical distributor, we find on average that the most attractive segment is cosmetics, followed by food and then pharmaceuticals.

The Slide, Funnel and Hourglass

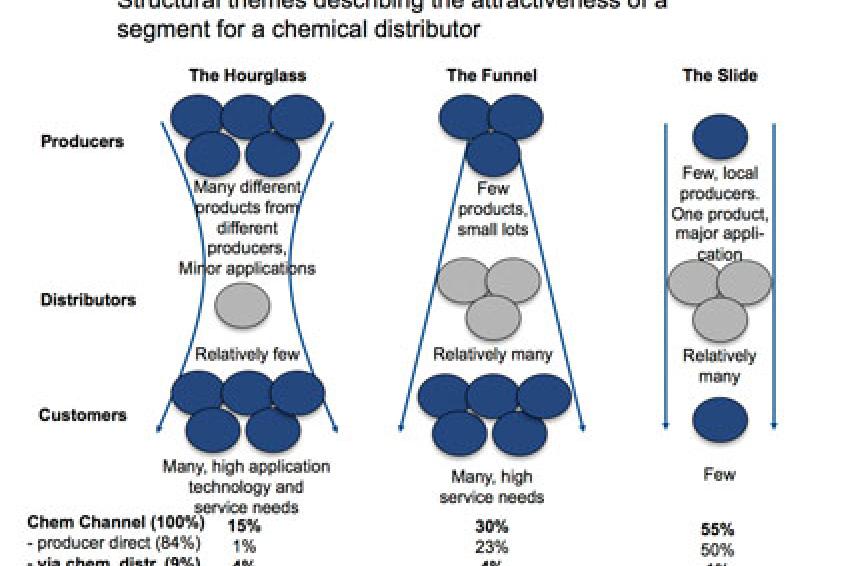

Why is it the case that producers and chemical distributors value the attractiveness of those segments differently? The answer can be found in the structural strength of a chemical distributor as an intermediary party between producers and customers, irrespective of the size, growth, profitability and partly sustainability of the specific segments from a producer perspective.

Eighty-four percent of European chemical sales are done directly, 7% through agents or traders, and 9% via chemical distributors. Schematically we can describe the structural strength of a chemical distributor along three patterns: the Slide, the Funnel and the Hourglass.

In Slide structures, less than 2% of chemicals are distributed via chemical distributors. In this category, the distributor adds limited value as only an additional intermediary between supplier and customer.

In Funnel structures, 17% of chemicals are sold via chemical distributors. Here, the distributor share is higher because chemical distributors can provide services that the producers cannot, including providing A- and B-customers with small product quantities (bulk breaking), special supply chain - logistics or financial services, and servicing small C- and D-customers. This is especially true when the chemical distributor provides additional marketing and technical services or when the chemical distributor covers a region or product application that the producer cannot or does not want to serve.

The most attractive structure for a chemical distributor is the Hourglass situation, where about 27% of all Hourglass revenues involve distributors. In the Hourglass situation, distributors work not only with the C- and D-customer base of the Funnel situation, but also bundle different products from different suppliers, act as importer of non-local products and serve the marketing and sales arm for minor product applications. This requires chemical distributors to offer technical, application technology, analytical, and other lab services. In the Hourglass, chemical distributors enjoy a very strong and sustainable position, marked by high growth and profitability, irrespective of the dynamics of the producer market segments.

The Hourglass in 3 Life Science Segments

Pharmaceuticals

There are three categories of distributed chemicals in the pharma chain: (1) active pharmaceutical ingredients (APIs) from bulk active intermediates (BAIs) and base- or petrochemicals; (2) solvents, additives and processing aids that are used by merchant or captive API-producers; and (3) excipients for formulators. For a general chemical distributor, only categories B and C offer an attractive structure. This is because category A faces very high regulatory (U.S. FDA, cGMP, dossiers) entry barriers and long cycle times.

Only specialized distributors, like Helm, Alfred E.Tiefenbacher or Welding, just to name a few, with dossier and specific competences, have a strong position in this segment. Additionally, there is the real risk of API-producers leaving Europe for Asia. Traditional chemical distributors can do business with categories B and C, but there are relatively high regulatory entry barriers, and the position is not scalable. Thus this segment offers opportunities for specialized distributors and for distributors who are already in this segment, but only a limited market entry and expansion potential.

Food

There are four major areas for the distribution of chemicals into the food chain: (1) fertilizers and (2) plant protection agents for the agricultural seed and plantation markets; (3) veterinary chemicals for the protection of animals; and (4) food ingredients and food processing aids for food production. Fertilizers are bulk commodities that are either served directly or via traders.

Plant protection agents and veterinary chemicals are very specific products that are sold mostly direct into the customer channels. Food Ingredients, however, are attractive for chemical distributors. Different ingredients from different producers, a limited number of active distributors in the food segment, a relatively high technical service need, and changing needs (low fat, low cholesterol, probiotic, etc.) in a customer market that is very fragmented create an attractive market segment for chemical distributors.

Cosmetics

Cosmetics is the most attractive segment for chemical distribution. The value of chemicals in cosmetics is about the same as in pharmaceuticals, but chemicals in cosmetics account for one-quarter of value, whereas in pharmaceuticals, chemicals account for less than 10% of value. Surfactants account for 30% of the chemicals in cosmetics, but there are many more chemicals, like active ingredients (5%, i.e. vitamins, polysaccharides, proteins/peptides, enzymes); additives (17%, preservatives, emollients, UV-absorbers, waterproofing agents); colors (3%); fragrances (20%); excipients/ binders (3%); chelating agents (12%); and (specialty) solvents (10%).

Relatively few chemical distributors bundle those different products from different international producers. From a pure business volume perspective, the top 10 big soapers (Beiersdorf, Colgate, Estée Lauder, Henkel, J&J, Kao, L'Oréal, P&G, Shiseido and Unilever) are attractive. Additionally, the other, more fragmented customer half of the cosmetics industry is also very attractive, as it needs to follow or set fashion trends and needs additional technical and lab services, which gives the distributor a larger share of the value chain.

Summary

The life sciences industry - and especially pharmaceuticals, food and cosmetics - contains segments that are generally attractive for chemical distributors, as they are sizable, profitable and sustainable in Europe. What makes a segment attractive to a distributor may not be the same as what makes a segment attractive to a producer. Instead, the attractiveness of a sector depends on the degree of Hourglass structure between producers and customers. Segments with fashion elements (short life cycles) are more attractive than segments with high entry barriers and long life cycles.

Opportunities for distributors are typically higher in side chains (additives, excipients, processing aids) and with the main chain only when there are several different ingredients. Single ingredients, like in APIs are attractive for specialty distributors that fulfill the specific needs (e.g. dossiers, cGMP, FDA).

Contact

AlixPartners GmbH

Bleichstr. 8-10

40211 Düsseldorf

Germany

+49 211 975510

+49 211 975510 01