The link between carbohydrate crop and crude oil prices

A new agricultural price regime

Diversifying Feedstocks - In recent years, there has been a growing interest in manufacturing bio-based chemicals from the major carbohydrate crops via fermentation technologies as producers have searched for alternative sources to petroleum-based feedstocks in the hope of decoupling their raw material costs from rising and volatile crude oil prices.

However, we might suggest this hope could be largely in vain. While risk exposure to fluctuations in raw material supply is improved by diversifying feedstocks, carbohydrate crops are not the solution to rising and volatile costs because, as we will illustrate in this article, their long term prices are not independent of crude oil prices.

The new price regime

Crop prices have traditionally been influenced by crude oil prices due to the links that arise through the cost of producing crops. In addition to the energy required in field operations, the cost of fertilizers and other chemical inputs has meant that crude oil prices have always had an impact on the prices of carbohydrate crops.

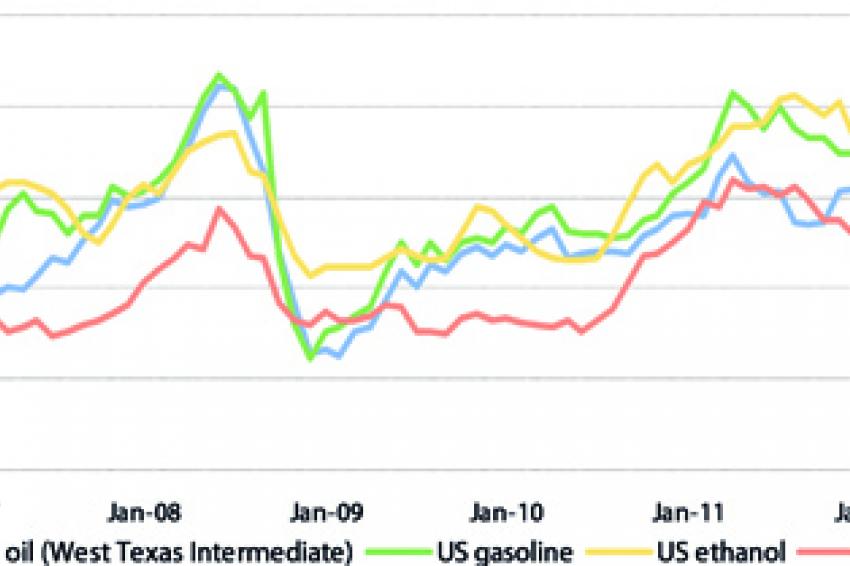

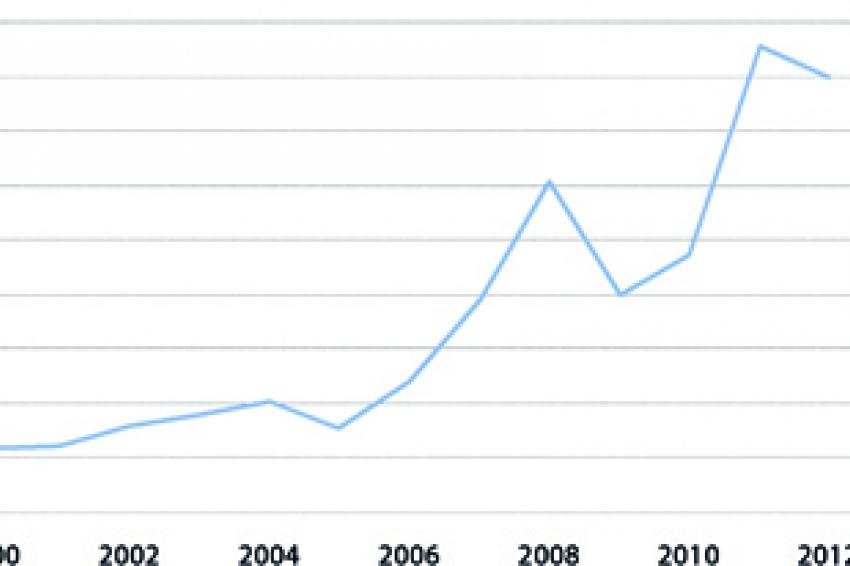

More recently, a new important link has emerged between carbohydrate crop and crude oil prices. This is due to the increasing production of bio-ethanol from carbohydrate crops which has risen tremendously since 2000 (Figure 1) and added significant demand for these crops within a relatively short period of time.

This new source of demand has established a new price regime between crude oil and carbohydrate crop prices. Movements in the crude oil price are reflected in changes in carbohydrate prices as bio-ethanol competes with gasoline in markets where discretionary blending/substitution with gasoline is possible. So, the price dynamics of the energy markets transmit to the carbohydrate crop markets. However, this link is not obvious in the short term as the institutional involvement in the fuel markets implies that carbohydrate crop prices may deviate greatly from crude oil prices.

In this article, we describe the dynamics behind the new price regimes of maize and sugar. (Note: We will refer to bio-ethanol as ethanol in the rest of this article).

Maize

The US is the largest maize producer globally and accounts for 40% of global output. This means that the US bio-fuel policy has a huge impact on the global maize market. One of the key elements of this policy, the Renewable Fuel Standard (RFS) program regulations, was implemented in 2005. It mandated certain volumes of gasoline to be replaced by ethanol. Fiscal incentives were introduced and a market for Renewable Identification Numbers (RINs), the tradeable certificates attached to each drop of bio-fuel, was established.

These measures propelled progress in the US renewable energy sector and, although the fiscal incentives expired at the end of 2011, the RFS and RINs remain in place, continuing to steer developments in the industry.

An important effect of this policy was to establish a broad link between crude oil, gasoline and ethanol prices in the country (Figure 2). This correlation emerged because ethanol has been competitive on price with gasoline and there has been discretionary blending on top of mandated use. Discretionary blending was constrained to 10% until the end of 2011. It has been raised to 15% since then. Looking ahead, discretionary blending could play a more influential role when blends higher than 10% become more common. In all, while there is little evidence to suggest that ethanol or maize prices are directly linked to gasoline or oil prices, demand for maize to fulfill the ethanol mandate is supporting maize prices.

Sugar

Traditionally, the price of this carbohydrate raw material on the global market was mainly dictated by its production cost in Brazil. The country is the one of the world's lowest cost producer and largest exporter of the product.

However, the last few years have seen a fundamental change in global sugar price dynamics. This change was brought about by the rapid growth in Brazil's flex-fuel vehicle (FFVs) sector since the mid-2000s. FFVs can run on either gasoline or ethanol (produced from sugarcane in Brazil).

Over time, the expanding ethanol demand from the FFV fleet has led to the establishment of a relationship between ethanol and gasoline prices. This means that, in addition to Brazil's production costs, sugar prices are now influenced by crude oil prices via the ethanol sector in Brazil. If the sugar price falls below its ethanol equivalent, Brazilian millers are able to divert cane away from sugar into ethanol.

This switching is possible because most of the sugarcane mills in the country are integrated, which means that ethanol is produced from sugarcane as an integrated part of the sugar production process. Depending on the relative prices of sugar and ethanol, sugarcane millers can alter their product mix (within capacity constraint).

The result of these dynamics is that the interaction between Brazil's ethanol market and world oil prices has now become an important driver of global sugar prices in the long run. This relationship is illustrated in Figure 3.

This link is weaker in the short run as domestic gasoline prices do not follow global crude oil prices. This is because of the government's influence which means that the Brazilian gasoline price has not changed since the beginning of 2006, despite the phenomenal volatility witnessed by global crude oil prices over the same period.

The reason why the support ethanol prices provide to sugar prices has increased so much in recent years is the strengthening of the Brazilian currency, which has inflated gasoline (and therefore ethanol) prices in US dollar terms. This, coupled with strong demand from the FFV fleet, means that the support provided to sugar prices by the ethanol market more than doubled since 2009!

Conclusions

The link between crude oil prices and carbohydrate crop prices is far from direct, but there is little doubt that energy prices have influenced carbohydrate crop prices in recent years. In the near future, demand growth from the food, feed, ethanol and bio-chemical sectors is expected to outstrip supply. This will support crop prices at high levels which are required to encourage growth.

While the new price regime is expected to continue into the future, the impact of crude oil prices on the various carbohydrate crops will be different because of the varying dynamics explained above.

LMC International has been forecasting crop prices for over 30 years. The establishment of the new price regime means that we now also consider crude oil prices when forecasting carbohydrate crop prices. Figure 4 illustrates this point for maize, highlighting the wide range of maize prices associated with different crude oil price scenarios.

Players in the chemical industry seeking to divorce their feedstock supply chains from crude oil price volatility will need to recognize this new price regime and determine if there truly is a cost incentive associated with switching from petroleum-based raw materials and into carbohydrate crops.

Contact

LMC International Ltd.

14-16 George Street

Oxford, OX1 2AF

+44/1865/791737

+441865/791739