Organic and Natural Ingredients

A New Era in Home Care and Personal Care, M&A Affects Market Dynamics

With increasing global environmental consciousness, sustainability is gaining focus across business practices. Europe, especially Western Europe, has positioned itself at the center of the green evolution with high levels of consumer awareness and accountability resulting in better acceptance of green products.

Home-care and personal-care markets are highly consumer-driven and thus susceptible to a high level of dynamism with changing end-user preferences. "Go Green" has become an often repeated tagline, and people are bringing home green products and sustainable practices. Thus, organic and natural products are quickly gaining traction in the home-care and personal-care markets.

Overall sustainability in water usage and waste disposal weigh heavily on home-care products. Harmful environmental effects of many ingredients in home-care products such as detergents and dishwashers are continuously publicized, spiking consumer interest. Rising concerns about environmental pollution and depleting carbon resources drive the public to switch to greener lifestyles that help them reduce their environmental footprint.

Similarly, European consumers are becoming conscious about harmful side effects of synthetic cosmetics and increasingly demand natural products. Thus, increasing adoption of greener end products drives demand for innovative ingredients that are naturally sourced and effectively processed to ensure the same performance attributes of existing synthetic alternatives.

What is the Drive?

- Organic and Natural Ingredients Act as a Source of Innovation - End product manufacturers are always on the lookout for novelty in ingredients for marketing claims as well as for delivering better performance. Innovations in the personal-care ingredients segment are centered on identifying new sources for active ingredients, and this acts as an incentive for ingredient manufacturers to explore natural sources to support their customers in innovation. The home-care ingredients segment largely directs its research to increasing overall sustainability benefit, and overcoming challenges such as improving compatibility for low-temperature cleaning and enhancing product performance. Naturally derived ingredients such as enzymes are increasingly explored for overcoming these industry challenges.

- Increasing End-User Consciousness of Ingredients - End users of personal-care products are becoming increasingly interested in and aware of the ingredients in personal-care products through the Internet and personal-care magazines. Extensive discussions on social media about the toxic effects of many personal-care ingredients such as parabens have made end users highly conscious of their personal-care purchases. Increasing end-user awareness is gradually increasing customer preference for organic and natural products, as they are perceived as safer alternatives to synthetic products.

What are the Challenges?

- Price Pressures from Commoditized Ingredients - Cost associated with procurement and processing of organic and natural raw materials into specialty ingredients is higher than that for synthetic chemical-based ingredients, a part of which is transferred to customers. Main cost additions include higher raw materials cost (usually a higher concentration is required than synthetic ingredients to provide the desired efficacy) and operational cost due to the extra downstream processing required to ensure purity and efficacy of natural ingredients.

- Formulation Challenges Restrain Adoption of Natural and Organic Personal Care Products - Because of processing difficulties and restrictions on processing steps to secure Eco labels, natural formulations sometimes tend to be pasty or coarse and therefore might not match up to the look and feel of synthetic formulations.

Regulatory Overview

With increasing consumer interest in organic and natural products, producers need to enable customers to differentiate truly natural products from the array of self-proclaimed natural and organic products, which do not give a clear indication of the natural/organic content of the product. The logos of many certifying bodies such as Ecocert (France), BDIH (Germany), Soil Association (UK), Natrue and Nordic Swan, among which Ecocert is the most well-recognized, provide a unified identity to natural and organic ingredients and finished products in the home-care and personal-care markets.

The wide array of certifications in the market creates confusion among end consumers and slows the pace of market development. With the aim of harmonizing the different labels into a unified standard for personal care, the Cosmos standard was developed and the guidelines published in January 2011. The effort toward unification of standards and labels (the implementation of the Cosmos standard) is planned to be completed by 2015; until then ingredients will be accepted under different certifying bodies. After 2015, all new ingredients will be automatically certified under the Cosmos standard.

Current Market Scenario

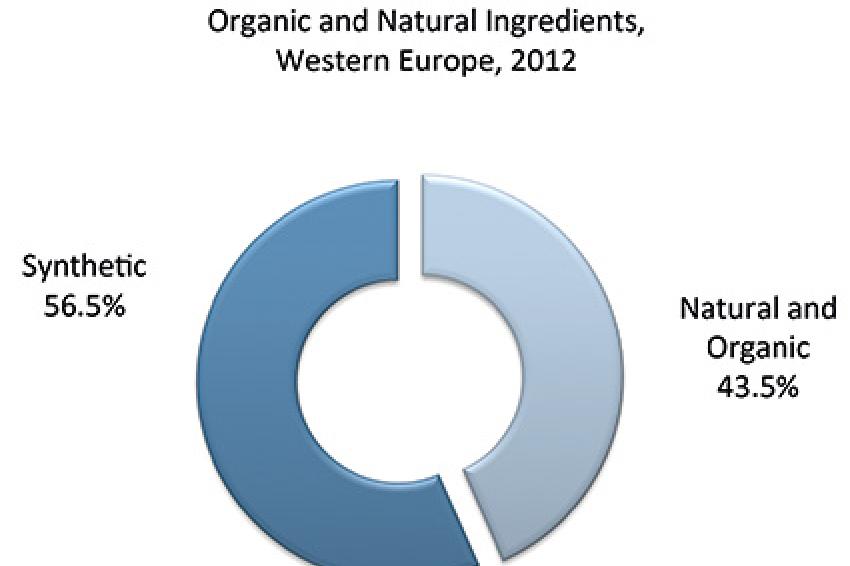

The total Western European organic and natural ingredients market for home and personal care generated revenues of $659.2 million in 2012.

Higher penetration of organic and natural ingredients in the home care segment is the result of high usage of oleo chemicals such as surfactants and fabric enhancers in home-care products. Enzymes have also made great strides as soil-release agents in home-care formulations. The natural-based active ingredients market for personal care is fast-growing, with huge focus on product innovation. Anti-aging and moisturizing ingredients are the segments with high penetration of natural and organic ingredients, mainly because of high market demand and easy availability of oleo chemical-derived refined glycerin as a natural moisturizing ingredient.

Competitive Landscape

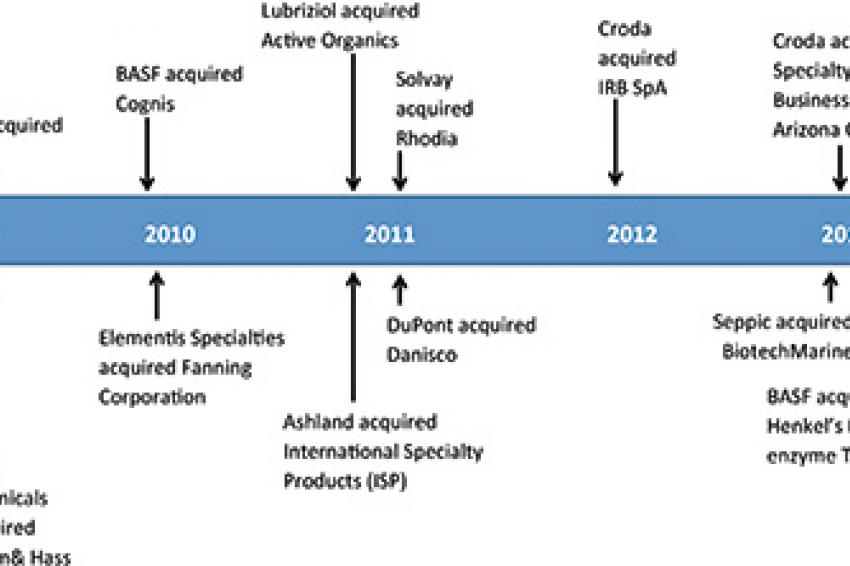

Gone are the times when specialty natural extract companies were the sole suppliers of natural-based and organic ingredients for home and personal care. Intense mergers and acquisitions (M&A) activities with oleo chemical and natural extract companies have enabled specialty chemical companies to gain significant penetration into the natural and organic market space. This has resulted in organic growth of the market and also paved the way for healthy competition. The coming years are set to witness more market consolidation and integration of specialty chemical companies and natural extract companies.

Future - Where is the Market Headed?

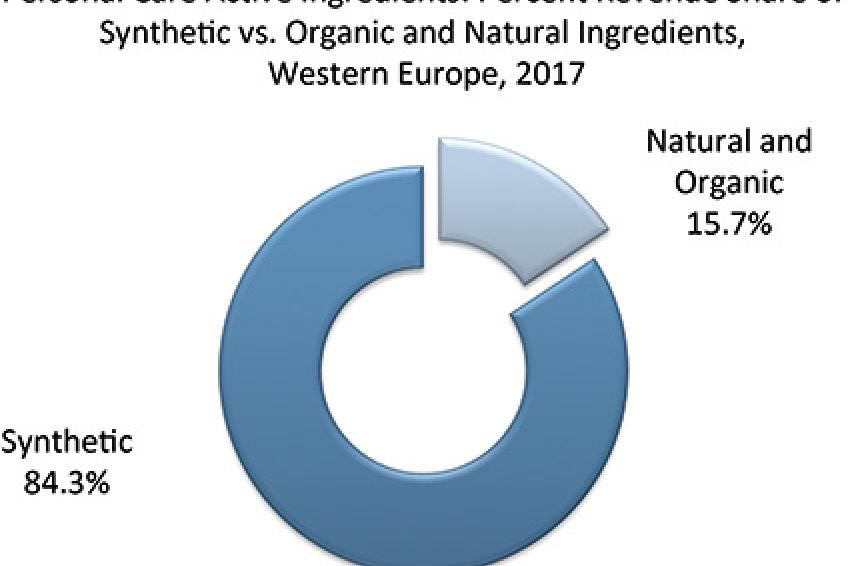

The natural and organic ingredients market is poised for good growth in the home-care and personal-care markets, at a compound annual growth rate (CAGR) of 5.0% between 2012 and 2017.

In personal care, anti-aging ingredients are the major focus for most ingredient manufacturers to differentiate and innovate. Initially, the anti-aging ingredients market had been focused on masking or preventing the signs of aging, thereby focusing on consumers older than 40. However, because of increasing beauty consciousness, the over-30 age group is also a target for anti-aging products.

In home care, surfactants and enzymes are expected to experience maximum growth. End markets such as car care, furniture cleaning and air care, although currently niche applications for organic and natural ingredients, are expected to catch up with the green movement and open up new market opportunities. Moreover, increasing success in developing enzymes stable in liquid detergent formulations is expected to drive the market, as liquid detergents are highly preferred in the European market.

Contact

Frost & Sullivan

Clemensstr. 9

60487 Frankfurt

Germany

+49 69 7703343

+49 69 234566