Secrets to Successful Partnerships

Partnering Strategies in Bio-based Fuels and Materials

In commercializing bio-based fuels and materials, technology developers and corporations constantly hover between competition and cooperation. Nimble innovators quickly transform basic science into nascent commercial products - a feat that eludes corporations. But, the challenge of scale requires enormous injections of cash, aid in engineering and distribution that only larger entities can muster. Looking at four basic models of partnership, we point out strategies for mutual success.

Most biotech innovations spring from "technology developers" - the start-ups that seed technologies to commercialize research. Faced with immense capital requirements, engineering issues, and the need for distribution channels, developers seek corporations to help achieve the colossal scale necessary to commercialize their technologies, while corporations depend on developers to maintain a vibrant innovation pipeline.

To test perceptions of value on each side of these partnerships, Lux Research conducted interviews with 15 technology developers (average 60 employees and pre-revenue) and 15 corporations (minimum of 100,000 employees and $3 billion in 2009 revenue) active in bio-based fuels and materials (BBFM). We found that:

- Partners disagree on key drivers of value.

Both sides disagree on specific factors that drive value. Technology developers believe that their product flexibility, unit cost projections and company's maturity are key factors for attracting corporate partners, while corporations place no value on these factors. This divergence in perceptions of value leads to an imbalance in contributions from either side, resulting in significant delays in scaling up technologies. - Both sides seek long-term alliances, and agree on what brings value.

Despite disagreement on the drivers for value, both sides agree on what they value. Developers and corporations both look for strategic, long-term partners. Additionally, both sides agree that corporations' market knowledge and developers' additions to future technology portfolios bring the most value.

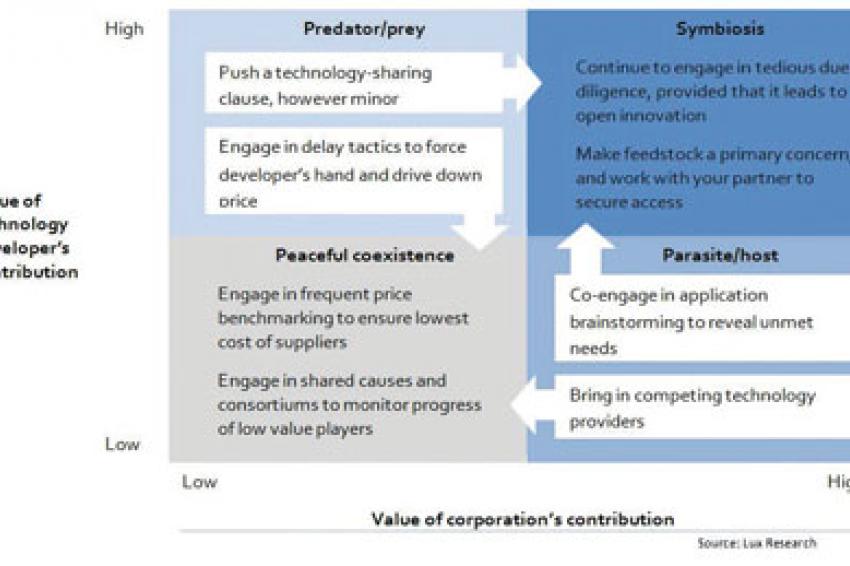

Depending on the relative contributions of the two partners, relationships between developers and corporations belong to one of four categories, (Fig. 1) each proffering its own unique advantages and drawbacks (Fig. 2).

Strategies for Successful Partnerships

In this manifest environment, ideal relationships are characterized by a convergence of perceptions, where either side perceives the other's contribution as equal to its own in value: the cases of "symbiosis" or "peaceful coexistence." In real terms, however, the corporate partner with its cash and channels to market often calls the shots and hence the onus of engineering such ideal partnerships ultimately falls upon it. Here we offer four strategies to help corporations make this happen (Fig. 3):

- Build on strategic partnerships for deeper symbiosis.

Focus on joint applications development, and lock competitors out of the innovation. In Algenol's alliance with Dow Chemical, Dow is contributing its expertise in plastics to develop advanced photobioreactor material, while Algenol will produce next generation ethanol for Dow onsite. - If access to technology is denied, bring down the price point.

Employ delay tactics to correct pricing, or push a technology sharing clause, however minor. Consider Chevron's partnership with Bioselect Galveston Bay Biodiesel. After an early stage minority investment, Chevron, dissatisfied with existing price points, refused to fund further construction of Galveston Bay's biodiesel plant, citing that participation in future rounds was non-binding. The disagreement resulted in a public lawsuit, leading Galveston Bay to lower investment price points. - Engage in application brainstorming with promising strategic partners to expose needs.

Encourage developers to snap out of the "biofuels" trance and closely look at biochemicals. Take Syntec Biofuels, which develops catalysts to thermochemically produce ethanol, methanol, and butanol from biomass. Corporations approached by such developers with premature but promising technologies should engage now to promote non-fuel products, eventually coaxing the partnership into "symbiosis," or priming the developer for acquisition. - Maintain peaceful co-existence through ongoing monitoring.

Some developers are too young to gauge, yet offer potentially ground-shifting technologies. Corporations should monitor such entities through networking and engaging in shared causes and consortiums. In particular, screen for changes in developers' management teams as a sign of change in business strategy. Consider Qteros and its consolidated bioprocessing technology. Although promising, the company was still far from meaningful scale for a corporate partner. In early 2010, it replaced its CEO Bill Frey with former Verenium executive Dan McCarthy to "accelerate progress" (translation: hasten funding). The company will use this fund raise to validate its technology at pilot scale (10,000 liters per year), significantly increasing its partnership value to corporations.

As corporations and technology developers seek to create more favorable collaborations, we expect the current "fully vertically-integrated" mindset to evolve into an interlocking, symbiotic model. Consider the partnerships between Codexis , Iogen, and Royal Dutch Shell. Each company sticks to its own core competency: Codexis designs the biocatalysts, Iogen designs and optimizes cellulosic ethanol production process, and Shell injects capital, scale-up know-how, and distribution channels. Instead of dabbling in (or trying to acquire expertise in) areas in which it has no inherent capabilities, each company plays a strategic role in the overall commercialization process while minimizing unnecessary costs. As Warren Buffett once said, "You stick to what you know. That's where the money is."

Contact

Lux Research Inc.

234 Congress St., 5th

Boston, MA 02110

+1 617 5025314

+1 617 5025301