Setting the Sights on Process Efficiency

Automation Solutions to Help Increase Productivity

The process automation industry has been confronted with a series of new technologies in recent years such as wireless data transmission, Ethernet and Asset Management Systems. Seamless integration of these technologies into the installed base is one of the biggest challenges facing the industry. Automation suppliers have become welcome partners in the drive to boost process efficiency. Automation solutions such as intelligent control strategies and online analysis can help minimize raw material and energy consumption.

The Road to Process Improvement

Particularly in the U.S. and Europe, the main emphasis in the power generation and conventional chemical industry is on modernization and efficiency improvement of older facilities. Users want to cut raw material and energy consumption, reduce reject rates, increase yields and control production on the basis of pre-defined product characteristics. Today, the objective is not just to get the process up and running in the first place, but rather to get the best out of existing facilities. The only way to achieve this is to deploy high-precision process control systems and reduce downtime. Automation equipment is the ideal tool for optimizing energy and raw material utilization. It is also the ideal solution for ensuring compliance with environmental regulations and centralizing operational or maintenance activities to make optimum use of human resources.

A number of operational excellence projects have been launched recently in the process industry. Online analytical technology enables users to determine the exact composition of intermediates and final products, and it is a very useful tool for extracting valuable information from the process, which can then be used for process control. A whole series of other solutions are used on these projects, for example specific control strategies, intelligent diagnostic modules and highly-accurate process modeling. The advantage is that substantial savings can be achieved with relatively little effort. The list of process improvements includes higher throughput, lower inventory levels, reduced lab analysis costs, faster product release, less off-spec product and higher system availability. Experience shows that the payback period is between two and twelve months.

Instrumentation and control systems can also help cut raw material and energy consumption. Energy efficiency has become a hot topic in other industries, but existing opportunities in the process industry have only been exploited to a limited extent. Experts believe that the potential savings could be as high as 25%, although automation alone is not the only answer. These savings can only be achieved if everyone involved (i.e. process engineering and automation engineering) pulls in the same direction. The opportunities are not limited to the main energy-intensive processes. Enhancements to auxiliary systems such as speed control on pumps and fans could produce savings of between 30 and 70%.

Sensors play an important role, because they support high-precision consumption data acquisition as well as highly accurate temperature profiles and process flow control. With careful monitoring, engineers can identify opportunities for increasing energy efficiency.

Device Integration Increases the Workload

Sensors provide crucial process management data. Users have high expectations for these components which operate at the lowest level of the automation hierarchy. Data should be collected in real-time from all parts of the system without affecting system behavior in any way. The sensors should be rugged, require minimum calibration and maintenance, be compatible with software upgrades and provide many years of reliable service. Device integration in particular is a source of skepticism and increasing concern in the user community. Installation is often complex and requires a lot of effort. A certain lack of long term stability is also regarded as a weakness of field device integration. Users often select a device which has the right software for the system environment but not necessarily for the task at hand. Integration difficulties are likely to increase in the future. Users already face the next challenge of adding wireless or Ethernet components to their automation systems. Manufacturers have to comply with more stringent requirements as well. Technology continues to drive the development of new sensors, but international regulations, guidelines and standards are often an impediment to progress. A new flow meter that is being designed for the international market may have to comply with more than a hundred standards. The effort which companies have to invest to comply with certification and audit requirements has increased at a disproportional rate, and these activities have now become nearly as time-consuming and costly as the actual development activity. ACHEMA 2009 is an ideal platform where manufacturers and users can get together to discuss ways of reducing the effort in the further development of sensors.

It may be just a small step from digital field devices to field bus technology, but this technology is developing at a slow pace in Europe. According to information provided by ZVEI, the majority of projects (80%) are still HART based, but Profibus (12%) and Fieldbus are becoming more popular. At present, users appear to be more comfortable with field bus technology than they were just a few years ago.

The Future Is Wireless?

Wireless technology is also a hot topic in the process automation industry. Manufacturers emphasize the value-add aspect, but users are still reluctant to make the switch. Particularly on projects where the instrumentation that is being installed or refurbished is located a long distance away from the control center, wireless signal transmission is cheaper and can be deployed faster than cable-based systems. Typical applications include sensors that are installed outdoors, at remote tank farms or in drinking water systems which have widely dispersed networks of deep wells. In these tasks wireless solutions are being used more frequently for data acquisition. In Eastern Europe and Asia, the infrastructure is often not able to keep pace with economic development, and wireless is an attractive alternative. However, opinions differ when it comes to choosing the right standard. Agreement on the Wireless HART standard in September 2007 raised expectations that an adequate selection of wireless products, technologies and applications would soon be available. The first implementations of Wireless HART will undoubtedly be on display at ACHEMA. However, critics point out that this standard is more likely to hinder or delay the deployment of more appropriate and comprehensive wireless technologies for a variety of network-based wireless applications. These critics claim that wire-based technology was transferred without modification to the wireless world, and this can result in operational limitations, especially on systems with a high user count. Wireless HART only supports the HART protocol, whereas the ISA 100 standard for example was developed to support a number of different protocols including HART, Profibus and Fieldbus.

The issue of power distribution also remains unresolved. Up to this point, data can only be sent over a wireless link. Power is normally supplied to the modules by line voltage or batteries. Research on sensors with autonomous power supply is underway at universities and companies around the world. A practical approach is the use of solar panels for energy supply. However, when you consider for example the relatively high power consumption of a Coriolis flowmeter, a number of innovation cycles will probably be necessary before devices that do not rely on an external power source will start to appear on the market.

Total Networking

Automation is moving away from the centralized control model. Distributed architecture is now becoming the solution of choice. This opens the door to Ethernet at all levels of the automation paradigm. Ethernet supports seamless communication between the control system and the field level. Other advantages include a greater choice of topologies, high data rates and better performance. Ethernet has replaced most legacy proprietary systems that used to handle communications between control systems, MES systems (Manufacturing Execution Systems), package units, HMIs (Human-Machine Interfaces), etc. non-proprietary communication between different systems has now become a reality.

In the traditional field bus segment, users are still satisfied with existing systems such as Profibus PA (process automation), FF and HART. However given the fact that intensive work on Industrial Ethernet for process automation is currently underway at the two largest field bus organizations, Profibus International and the Fieldbus Foundation, and working groups are already developing adaptations, it will not be long before Ethernet solutions begin to appear at the field level.

Outlook

New communications technologies like Ethernet and wireless are shaking the foundations of conventional control systems engineering. Users will see a gradual phase-out of the traditional automation pyramid which categorizes techniques and systems of control system engineering in different levels of industrial manufacturing. The barriers between business and field level applications will continue to fall, and insular automation solutions on the production floor will become a rarity. The IT and automation worlds will continue to converge, and that is something which will not always be welcomed by users. The innovation cycles are in the three to four year range as opposed to 20 years in the process automation industry. This is just one of the factors which is making field device integration more difficult.

Deployment of state-of-the-art communications technology also increases the security risks. In the past, proprietary control system solutions and a relatively low level of integration into the conventional IT world made malicious attacks (viruses, etc.) very unlikely. In today's world, IT applications have access deep into the control systems. Links are created between the Internet and the control systems to support applications such as remote diagnosis. It may be comforting to know that most cases of unauthorized access and virus attack (65%) are caused by a lack of risk and security awareness on the part of workers and managers. Increasing the level of awareness should alleviate the problem. Nevertheless, users are demanding that information security has to be one of the fundamental design goals during the development of automation solutions.

Despite the drawbacks, users do not want to forgo the advantages of state-of-the-art communications technology. They regard it as a factor which drives the development of new services and applications and increases system flexibility. Users see opportunities to deploy the latest technology in applications where conventional solutions are unsuitable or not cost-effective. However, new technology must play by the established rules of the game in the process automation industry: reliability, availability, sustainability and investment protection are as indispensable as ever.

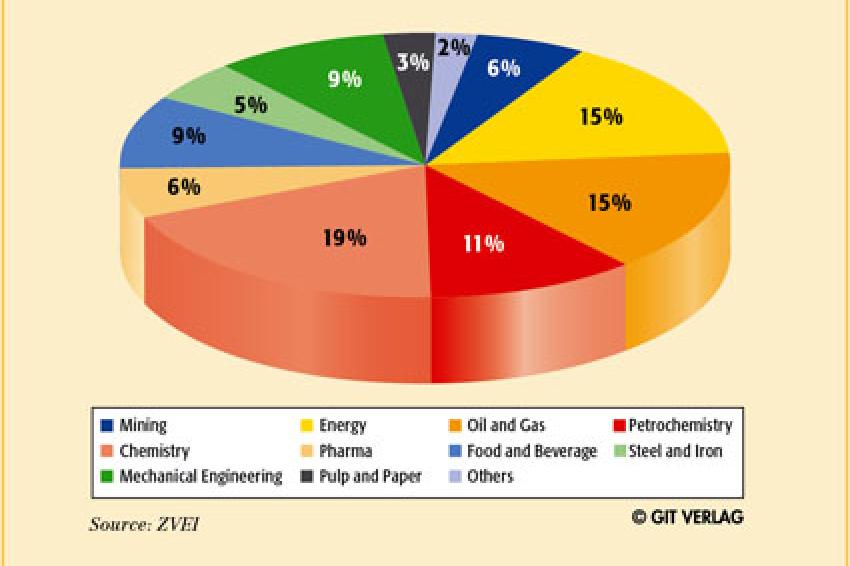

Worldwide Process Automation Market 2007 (Total €67 Billion)

German automation manufacturers have not seriously been affected by the current economic crisis, and they remain cautiously optimistic. Turnover increased by nearly 11% in 2007 to more than €42.8 billion, and sales were up again during the first three quarters of 2008. The German Electrical and Electronic Manufacturers Association (ZVEI) expects that full-year growth for 2008 will be in the 5-6% range. From the above mentioned total turnover of German automation manufacturers the German process automation industry reached €15.4 billion in 2007. The U.S., Japan and Germany are the largest producers in the €67 billion worldwide process automation market. Industry experts are cautiously optimistic about the outlook for 2009, and they expect that turnover in the German process automation industry will increase by 4-5 %. Growth will also occur throughout the world. China, India and Russia will continue to be high growth markets, but the Middle East has now moved into first place. Within the European context, the German process automation industry is expanding at an above-average rate.

However, it is difficult to provide accurate forecasts despite the fact that the pipelines remain full and many equipment producers already have orders on the books for the next two or three years or even further out. ZVEI expects that, apart from Japan and the U.S., business conditions will remain favorable. According to information furnished by ZVEI, the petrochemical industry (oil & gas production and oil refining) is the largest market segment, accounting for a quarter of world turnover. Thus, even though costs have been increasing because of energy and raw material prices, the industries that benefit of this development are also excellent process automation customers which have had exceptionally good years recently. Business with the oil & gas sector has been outstanding, as companies have invested heavily in conventional oil production, upstream operations and modernization of oil production facilities. More and more oil & gas reserves that were not profitable in the past are now being developed. The same applies to the LPG sector (Liquefied Petroleum Gas). The need for pipelines, highly efficient refineries and LPG terminals is driving demand in this industry. Process automation suppliers also benefit from strong economies in countries that have a large mining industry (6% share of the world automation market) such as Chile, Canada, South Africa and East Asia. Some of these projects are linked to production facilities in the industrialized nations. Growth is also strong in the power generation (14%), chemical (19%), food, beverage and tobacco (9%) and pharmaceutical (6%) industries. The paper and cellulose industry, where turn-over stagnated (3%), was the only exception.