European Pharmaceutical Outlook 2020

Financial Risk Profiles under Scrutiny Given Bullish Business Outlook

Successful innovation and emerging-market demand are underpinning growth in an industry which benefits from powerful secular trends such as ageing populations and more affluent lifestyles. The “patent cliff”, i.e. expiring blockbuster-drug patents, are less of a threat to revenues than they were in the past. In addition, the much-discussed pricing reforms in the US healthcare sector are yet to bear fruit and are unlikely to in 2020. The US policy-making agenda will be overshadowed by the November presidential election.

In Europe, uncertainties in the wake of Brexit persist, especially concerning potential supply-chain disruptions, depending on how well the second phase of exit negotiations turns out. The UK pharmaceutical sector receives about 70% of imports from Europe. The vaccines sub-sector is even more vulnerable to Brexit-related disruption as there are only two sizeable vaccines producers in Europe: the UK’s GSK and France’s Sanofi.

With business risks benign for the credit outlook of European pharmaceutical companies, management’s financial policies will largely determine companies’ individual financial risk profiles. Pharmaceutical companies in the US will continue to have a more aggressive approach in terms of returning cash to shareholders.

Business Risk Profile

Global prescription drug sales will see a compound annual growth rate (CAGR) of 6.9% for the 5 years between 2019 to 2024, as projected by research firm EvaluatePharma. In dollar terms, such growth puts worldwide pharma revenues at around $900 million in 2020 – a large sum but modest relative to total healthcare spending. For example, spending in the US, the world’s largest healthcare market, is likely to be around $ 4 trillion in 2020. In other words, spending on prescription drugs, at about 10-15% of the total, is small compared with that on hospital care and clinical services, which make up more than 50% of total healthcare spending.

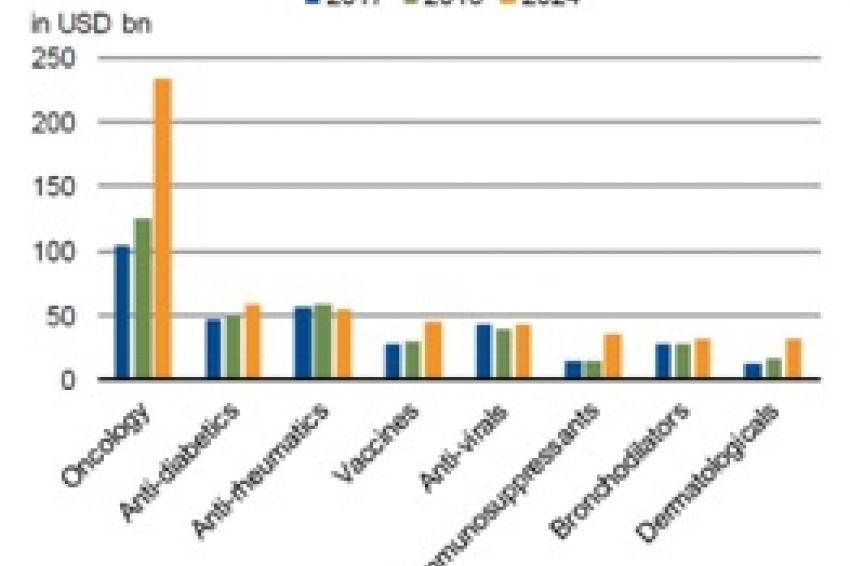

There are a number of reasons for the robust sales growth expected for the pharmaceutical sector, which we have flagged in previous publications, such as demographics, innovation, emerging-markets demand, and rare diseases.

In essence, the sector’s risk environment is gradually becoming more benign, assuming pharmaceutical firms maintain their successful R&D strategies. Operating risk in the sector is a function of how well the revenues lost to top-selling drugs coming off-patent are replaced with those generated by new products, whether through mergers or in-house R&D. This “patent cliff” has become less steep in the past 10 years or so due to the concerted innovative push by the industry and the diminishing economic cost of expired patents.

The industry’s more positive risk outlook has two sides: innovation and patent expiry.

Innovation

The industry has managed to develop a number of truly innovative products in promising treatment areas such as:

- Immuno-oncology (leading drugs Keytruda from Merck Inc. via acquisition of Schering Plough; Opdivo/BristolMyers Squibb)

- Cell therapies (leading drugs Kymriah/Novartis; Yescarta/Gilead Sciences)

- Gene therapies (Zolgensma/Novartis via acquisition of Avexis; Luxturna/Roche Holding via acquisition of Spark Therapeutics)

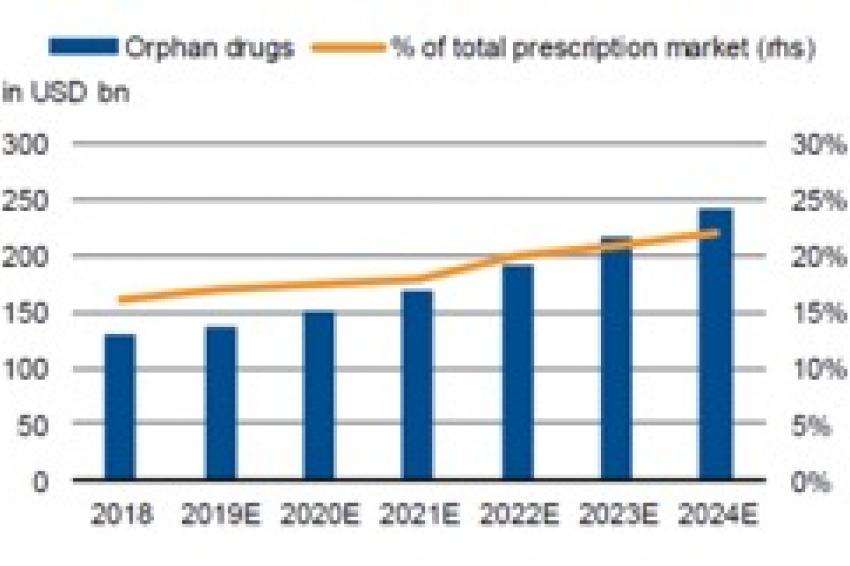

In addition, the pharmaceutical segment of rare diseases (“orphan drugs” – those with fewer than 200,000 patients in the US and fewer than around 250,000 in Europe) recorded a significant 11% in sales growth in 2018 and is expected to deliver a CAGR of 12% between 2019 and 2024 (Fig. 1), about twice the level projected for the total pharma market. The sector is niche, but some of its characteristics are compelling compared with sectors aimed at large patient populations: the smaller number of competing products, significantly less patent risk, a faster approval process, and longer exclusivity.

A significant upswing in FDA (Food and Drug Administration) approval rates in the US over recent years should sustain the orphan-drug trend. Orphan drugs accounted for about 60% of all drug approvals in 2018, according to the FDA. The combination of promising new indications, breakthrough therapies and a large number of orphan drug approvals should underpin significant sales growth in the future.

Patent Expiry

The other side of the coin in the pharmaceutical sector’s growth – and one of the main risks embedded in the business model – is what happens when a top-selling drug loses patent protection, paving the way for competitors to make generic copies.

The following equation used to hold true: the larger the sales of the drug, the greater the potential damage for the company that developed the drug in terms of revenue and particularly EBITDA (in absolute terms). In just a few years, up to 80% of an innovative drug’s annual sales could be erased by generic competition.

Today, modern biological drugs, such as antibodies, cannot be replicated by generic manufacturers just by copying the mix of individual chemical ingredients, as was typical with previous drugs. Biological drugs often consist of proteins which are commonly developed in living chicken eggs. Such a complex process is difficult to replicate, leading to generic versions with less than 100% equivalence to the original product. Many patients and doctors are reluctant to accept the potential risk associated with generic biologicals, particularly for life-threatening diseases, even with a sizeable discount in price.

The upshot is that the loss of patent protection is less of a threat to sales. The gap between theoretical sales at risk and the actual drop-off in sales has widened, helped by customer loyalty to patented treatments as well as other factors such as the combination of delivery devices with anti-asthma medication. Orphan drugs also fall into this category of “protected” products, albeit for different reasons (see above).

Taking the year 2022 as an example, forecasts show a big gap between the industry’s total commercial exposure to patent expiry based on a worst-case scenario ($40 billion) and the expected impact of half that amount.

Financial Risk Profile

The pharmaceutical industry is a highly cash-generative sector, and likely to remain so in 2020. Due to high levels of operating profitability – little has changed for most players during the past decade – free cash flow generation (defined as operating cash flow after net capital expenditure and changes in working capital) accounts for more than €5 billion a year for most of the big-pharma players.

The industry has a high cash conversion rate – from EBITDA into free operating cash flow – of 60-70% compared with that of other industries. The rate of AB InBev, the world’s largest beer maker, is around 40% despite generating similar EBITDA margins. Such high cash conversion reflects the pharma sector’s low capital-intensity, with modest capital expenditure and working capital. As long as the industry can maintain its superior profitability, with EBITDA margins north of 35% – which itself is a function of the ability to stay innovative – we foresee no change to the industry’s tendency to generate large amounts of free cash.

That said, most companies’ financial risk profiles will continue to be determined by their financial policies. In this regard, we believe that US pharmaceutical companies tend to be much more aggressive than their European counterparts in terms of discretionary spending. This can be explained in part by the greater focus on “family thinking” than on shareholder value by companies outside of the US. The so-called financialization of the industry – aggressive shareholder remuneration (dividends and share buybacks) and high-multiple acquisitions, often at the same time – has become a feature of the US sector, whereas European companies tend to be more conservative (Fig. 4).

The contrast in financial policies between the five US big-pharma companies and the two in Europe, plus mid-sized family-owned “hybrid” Merck KGaA (chemicals and pharma) is stark – though 2017 was an exceptional year for the US companies, as the Tax Cuts and Jobs Act resulted in one-off transition tax on the undistributed earnings of foreign subsidiaries