The Global Footprint of the Chemical Industry

Catalyzing Growth and Addressing Sustainability Challenges

A new report, published by the International Council of Chemical Associations (ICCA) and based on a study by Oxford Economics, provides a detailed assessment of the chemical industry’s activities across the globe and to quantifies their total economic impact. The findings outlined in this report paint an important picture of the industry’s contribution to the global economy. The analysis focuses on two key measures of economic value: the number of jobs sustained each year by the global chemical industry, and its contribution to the amount of gross domestic product (GDP) that different nations generate.

As well as directly creating jobs and economic activity in virtually every country of the world, the chemical industry sustains further employment and growth via “multiplier effects” in the countries’ wider economies. To quantify these contributions, the economic impact assessment took into account not only the size of the industry itself (its direct impact), but also its indirect and induced impacts, which relate to economic activity in its supply chain – including complex international linkages – and wage-funded staff spending, respectively.

The Economic Value of the Global Chemical Industry

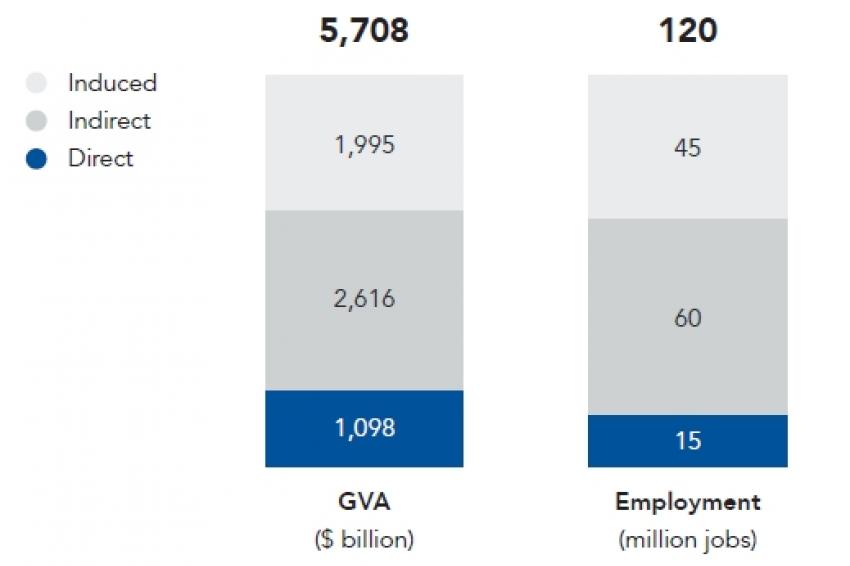

The chemical industry’s global economic impact in 2017 was substantial. Its total annual contribution to global GDP was an estimated $5.7 trillion, sustained through a combination of its direct, indirect, and induced economic channels. This equates to 7.1% of the world’s GDP in 2017 (see fig. 1).

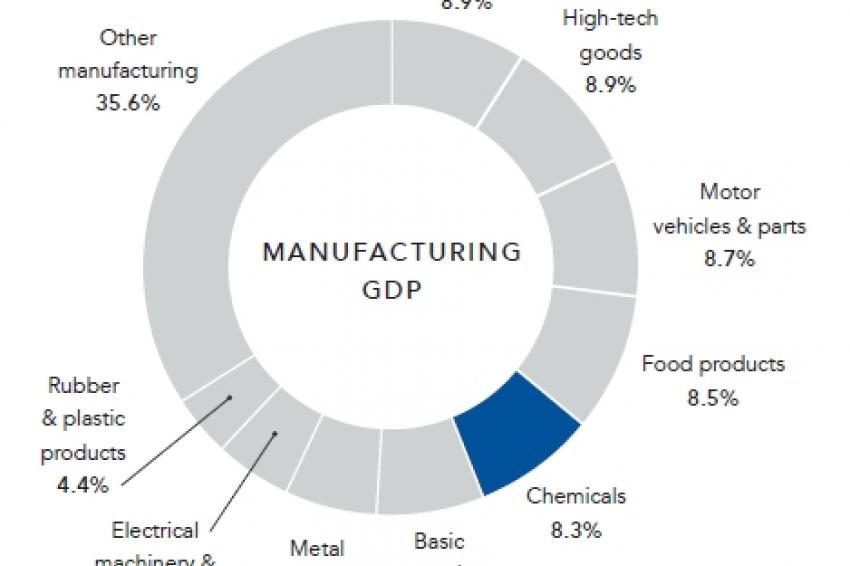

Of this total, the chemical industry itself is found to have directly added $1.1 trillion to global GDP in 2017, while directly employing 15 million people. This makes it the fifth-largest global manufacturing sector, in terms of its direct annual contribution to GDP (making up 8.3% of global manufacturing’s total economic value). Comparing the chemical industry’s direct and total employment impacts implies that, for every person directly employed in the industry, seven jobs are supported elsewhere in the global economy. In terms of GDP, the results show that for every $1 generated by the industry itself, a further $4.20 is generated elsewhere in the global economy.

Companies in the chemical industry have invested an estimated $3.0 trillion with their suppliers in 2017, buying goods and services used in the manufacture of their products. Almost two-thirds of this amount was spent by chemical companies in the Asia-Pacific region. This supply chain spending (indirect impact) supported an estimated $2.6 trillion contribution to global GDP in 2017, and 60 million jobs – spread across goods and services providers in a wide range of industries, from mining to wholesale trade.

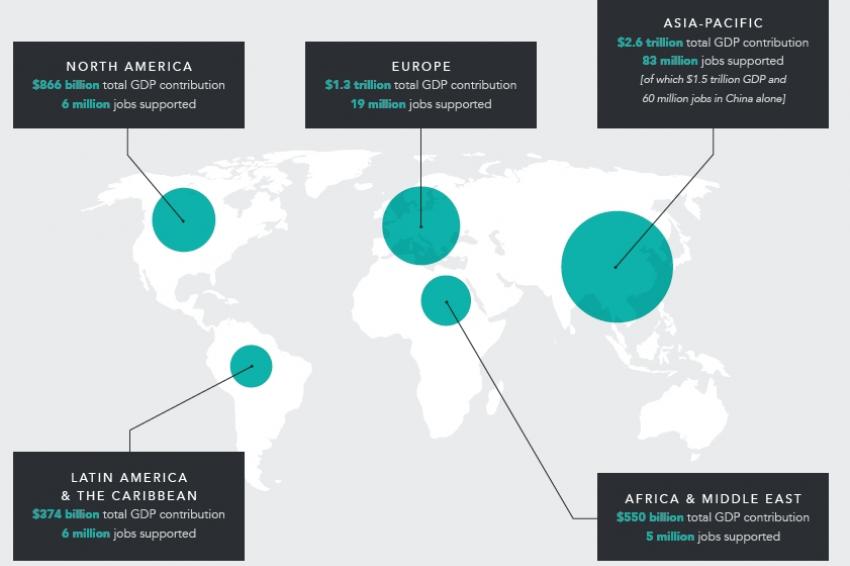

The analysis, divided into five global regions, finds that the Asia-Pacific chemical industry made the largest annual contribution to GDP and jobs in 2017. According to the results published in this report, it generated 45% of the industry’s total annual economic value, and 69% of all jobs supported (see fig. 2). Europe made the next most important contribution globally, followed by North America.

On average, every $1 of gross value added (GVA) created directly by the chemical industry supported an additional $4.20 contribution elsewhere in the global economy in 2017 (see fig. 3). Furthermore, due to the industry’s high levels of productivity, the sector’s employment multiplier is even greater. For every employee in the industry itself, seven jobs are supported elsewhere in the global economy. Figure 4 shows that each and every sector of the global economy benefits from the existence of the chemical industry.

Direct Impacts

Not only do chemical manufacturers transform raw materials into some of the final products consumers use every day, the industry also provides inputs to a broad range of sectors, from agriculture to transportation. In 2017, the chemical industry generated sales (gross output) worth some $4.1 trillion, of which $1.1 trillion represented GVA.

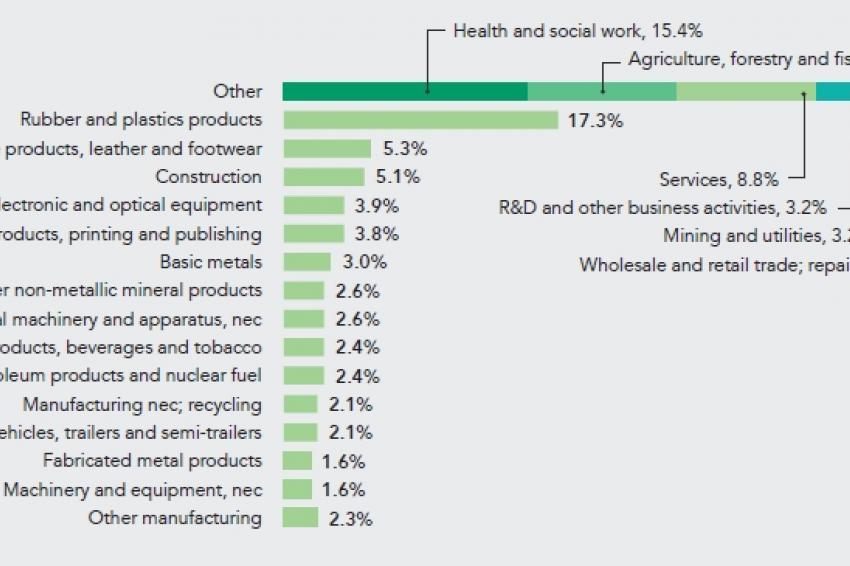

Given that the chemical industry supplies inputs to almost all sectors of the economy, its prosperity also has important implications for downstream chemicals users (i.e., the users and buyers of its products). Beyond chemical manufacturers themselves, the biggest industrial users of chemicals are the rubber & plastics, textiles, construction, computer production, and pulp & paper sectors (see fig. 5). In all, nearly 58% of the global chemicals sold to downstream users go to other industrial sectors. The remainder goes to other branches of the global economy such as health and social work, agriculture, and services.

Combining all these revenues, the chemical industry directly made an estimated $1.1 trillion gross value added contribution to global GDP in 2017. This direct GVA accounted for 27% of the industry’s total sales. Chemicals are thus the fifth-largest component of the manufacturing sector’s total value added, after machinery & equipment, high-tech goods, motor vehicles, and food products (see fig. 6).

By region, Asia Pacific (APAC) lead the way here, creating 51% of the worldwide chemical industry’s GVA in 2017. In this region, the industry represented 2.1% of total GDP. North America and Europe follow, with 21 and 17% of the total, respectively. In both regions, however, the size of the industry is just above 1% of total annual GDP.

The chemical industry directly employed 15 million people worldwide in 2017. This included over 11 million people in APAC (77% of the total), almost 2 million in Europe (11%), and over 600,000 in North America (4%). Indeed, it is estimated that 0.7% of all employment in APAC is directly created by the chemical industry.

Indirect and Induced Impacts

The economic impact of the chemical industry extends much further than just its direct impact. Supply chain and wage-spending economic benefits must also be considered, and these impacts demonstrate the breadth of the industry’s upstream economic reach.

The chemical sector spent $3.0 trillion on goods and services from suppliers worldwide in 2017. A third of this spending goes back into the chemical industry (e.g. as chemical firms purchase chemical inputs from other companies to include in their production process), as expected.6 Other major beneficiaries of the chemical industry’s supply-chain spending are mining, including oil and gas extraction (14% of the total), and wholesale & retail trade (11%).

In regional terms, the Asian chemical industry accounted for $1.9 trillion of these supply-chain purchases, followed by the European industry ($0.6 trillion) and North America ($0.4 trillion).

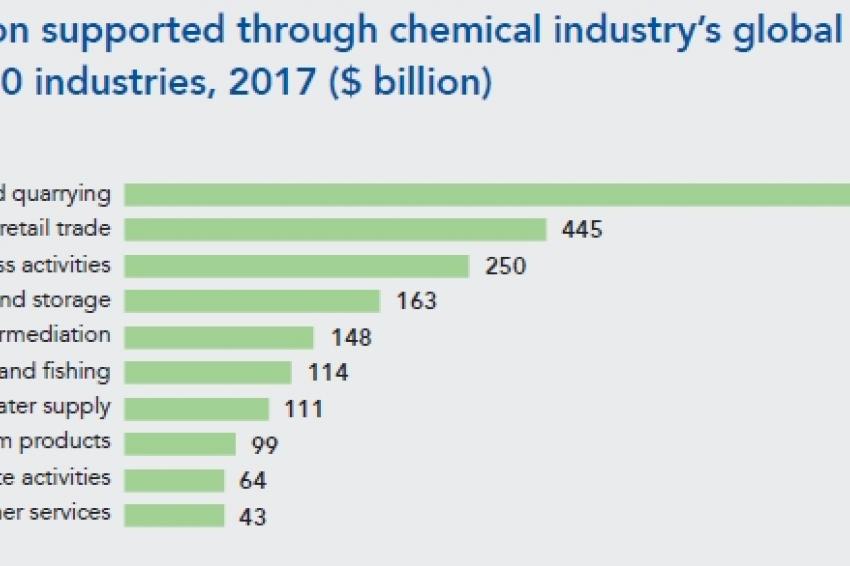

The results show that this supply-chain spending had the greatest impact in the mining, and wholesale & retail sectors, supporting $679 and $445 billion of GVA respectively in 2017 (see fig. 7). The chemical sector supported a further $250 billion in the R&D & other business activities sector. Across all non-chemical sectors, we find the supply-chain spending of the chemical industry supported a $2.6 trillion contribution to global GDP in 2017 – of which roughly half was in the Asia-Pacific region.

In addition to the income received by workers employed directly by chemical companies, the industry also sustains labor income in its supply chain and in the consumer-facing global economy, through the induced channel. In 2017, the authors of the study estimate that a further $939 billion and $779 billion in labor income was supported by the chemical industry through its indirect and payroll-induced channels, respectively.

The R&D Footprint of the Chemical Industry

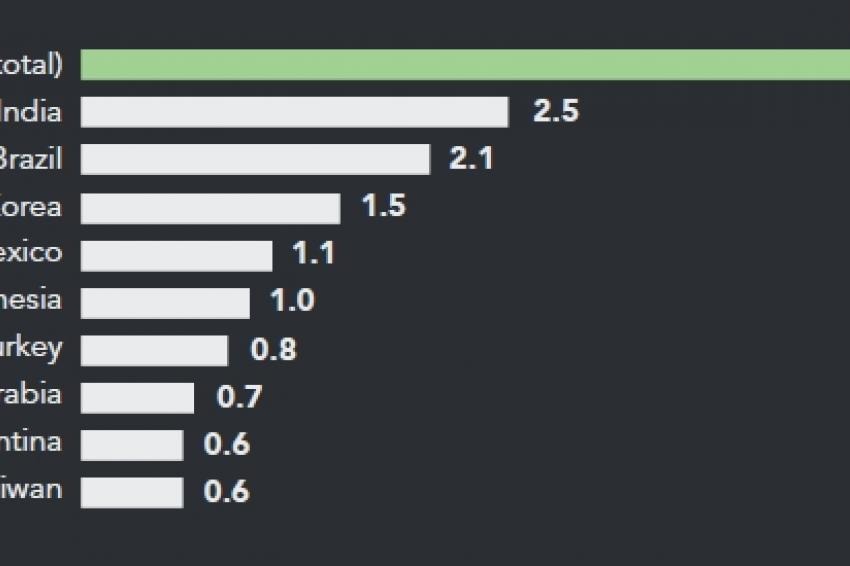

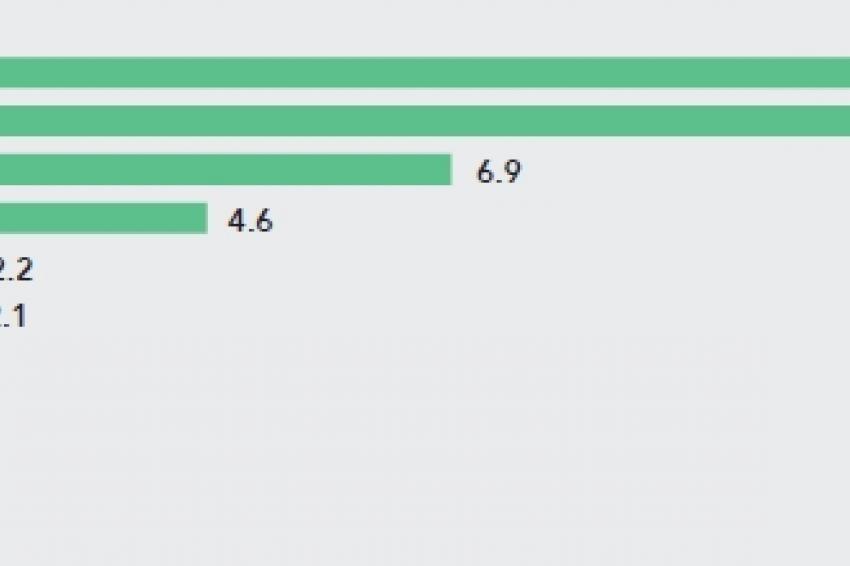

The chemical sector invested $51 billion in R&D in 2017. China was home to the largest chemical R&D spend, with an investment of $14.6 billion, followed by the US and Japan, with a $12.1 and a $6.9 billion investment, respectively (Fig. 8).

In total, accounting for all the channels of impact, it was calculated that this R&D investment supported 1.7 million jobs and a $92 billion contribution to worldwide GDP in 2017.

The benefits to society of research and development spending, however, are much broader than these jobs and GDP contribution. R&D spending generates long-term benefits for society at large. The chemical sector’s research boosts the global economy through the development of new technology, processes, and products that enhance efficiency and productivity, and can have wider social benefits.

While the industry’s R&D efforts are obviously aimed at commercialization of research results, societal benefits by far outweigh the private financial returns from innovation. Patents are a formal channel of dissemination of knowledge, processes, and products, as they encourage innovation, and the publication of any invention. In the US, the basic chemicals industry is characterized by above-average patent intensity.

Furthermore, the innovations that emerge from such R&D activity invariably offer “spillover” benefits that spread far wider than the chemical sector itself, raising productivity levels across the global economy. The chemical industry’s innovation and R&D activities often lead to the development of new products and processes, and (as explained above) patents are a formal channel for the dissemination of such innovation.

In the US, the chemical sector is one of the most patent-intensive sectors, alongside electronics.21 US patent data are readily available and therefore frequently used to construct a measure of patent intensity. The patent intensity of the basic chemical industry was recorded to be 0.027 - roughly in line with medical appliances and electric motors, generators and transformers.

It should be noted that chemical products also fuel innovations and patents in other industries, i.e. photovoltaic cells for electricity production, lightweight vehicle parts, germ-resistant coatings for medical instruments, etc.

International Council of Chemical Associations (ICCA)