Opportunities for Western CDMOs in China

Siegfried’s View on the Evolution of the Chinese Pharmaceutical Environment

As part of its journey toward being a full-fledged advanced economy, the role and presence of China within the pharmaceutical industry has rapidly evolved throughout the recent years driven by targeted and developing policies. Over the last few decades, thanks to its investment-led model and leveraging its record-breaking urbanization and industrialization rate, China has risen to a leading position as a manufacturer in all major industries, including pharma.

However, some of the key growth drivers behind it are now slowing down as urbanization rate decreases and labor rates increase. Recent data show that the model is running out of steam as capital productivity and corporate returns are falling, while low cost competition is increasing.

To address this, China now needs to move beyond being the world’s greatest source of low-cost manufacturing capacity and “climb up” to a higher added value tier by focusing more on R&D/innovation on one end and sales/service on the other.

Such context has contributed to generating new government initiatives, as China Manufacturing 2025, aimed at steering the economy towards the new targets through policies specifically looking at emerging and innovative industries such as bio/pharma.

This may in our view provide opportunities (along with challenges) within our industry and in particular for CDMOs.

Growth-Driving Policies

Within the Chinese pharma environment, over the last three decades, one of the key growth-driving policies has been the Healthcare Reform led by the China Food and Drug Administration (CFDA), which has increasingly looked to international models to best organize its processes and institutions, until June 2017, when it officially joined the International Council for Harmonization of Technical Requirements for Pharmaceuticals for Human Use (ICH).

An important step in this path towards adopting “western models” in healthcare management has been China’s establishment of a pilot marketing authorization holder (MAH) system.

The internationally available drug licensing system can be divided into two categories: the first category separates drug market licensing and production license management, which can be observed in the European and North American pharmaceutical systems. The second category, which is used in China, is a merger of the two different licenses into one.

Since November 2015, ten Chinese provinces joined a 3-year marketing authorization holder system (MAH) pilot program ending by the end of 2018. The concept is quite similar to pre-existing systems in the rest of the world and provides to Chinese pharmaceutical research and development institutes, as well as individuals, the option to apply for a drug product license independent from the manufacturing license. Recently, the Chinese authorities have expanded the program’s scope to include international applicants and license holders.

China’s Pharma Market

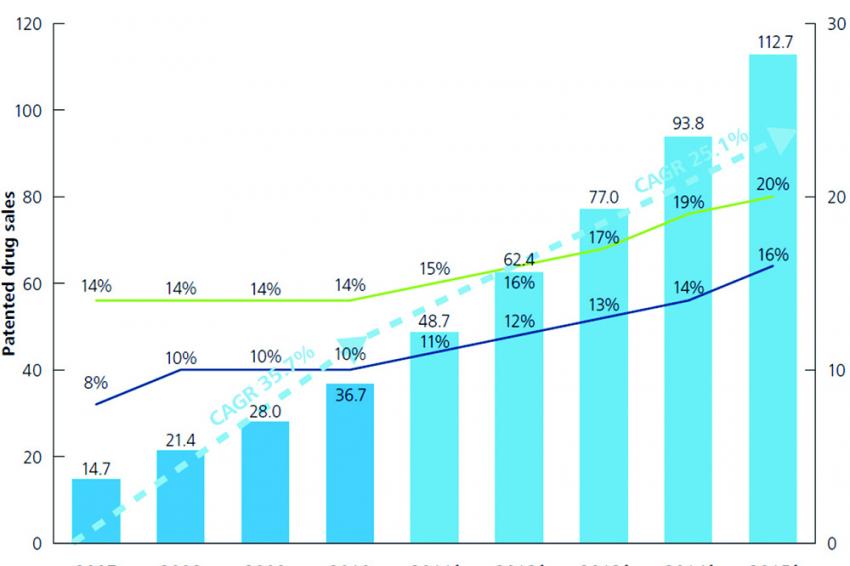

Fueled by the above reform initiative the Chinese pharma market has undergone a sharp growth over the last decade with a CAGR of 25.9% between 2007 and 2010 and of 15.5% thereafter to an estimated value of $107 billion by 2016.

An increasing share of the market has been taken by patented drugs, growing from an 8% in 2007 to a 16% share in 2016, encouraging data indicating that in the future novel branded therapies will gain further market presence. These trends combined with Chinese consumers’ traditional confidence in “Western Products” will likely help foreign pharma access to the local market. If, in addition, improved IP protection will actually be perceived by international innovators, then we could expect an increasing draw for global Pharma and its innovative products.

In fact, some of the top 20 global pharmaceutical companies have already expanded their R&D footprint in China (e.g. Pfizer, GSK, Novo Nordisk and BMS) also motivated by the requirement of carrying out domestic clinical trials in order to obtain regulatory/marketing approvals (although multi-regional clinical trial data are accepted to support market entry with certain conditions for preferential approval and examination for rare diseases).

Along with all these supporting policies, the government has on the other end recently implemented a number of enforcing initiatives aimed at aligning the industries to the nation’s new standards and expectations. In particular, in the last 2 years the Chinese authorities have renewed their commitment to addressing the growing issue of air pollution through a campaign of strict enforcement of environmental regulations. As a result, since April 2017, approximately 149,000 plants nationwide across all industries were forced to shut-down, while temporary interruptions affected an estimated 40% of Chinese factories. The pharmaceutical industry was not immune to this wave with thousands of manufacturing sites affected and consequent supply chain disruptions worldwide, which are continuing to these days.

Siegfried’s Presence in China

Since the very first steps of its growth strategy and driven by the intent of becoming a fully integrated CDMO on a global level, Siegfried’s vision has been to consider this evolution of the Chinese pharmaceutical environment as an attractive opportunity for horizontal and vertical integration of its value proposition. Through the establishment of our site in Nantong in 2012, Siegfried completed the build-up of its global manufacturing network with a site offering complementary benefits and significant synergies vs. the pre-existing facilities in Europe and North America. Located in a state-of-the-art industrial park (NETDA) and easily accessible from Shanghai or the nearby YangZi river port, the Nantong facility offers not only the typical lower cost back integration option for manufacturing intermediates, but also a lifecycle management opportunity for our client’s API as well as an option for Chinese market entry. In line with the observed evolution of the Chinese economy, we designed the site to be a full-fledged GMP API manufacturing plant in line with the most current western standards, from an engineering, regulatory and environmental standpoint, ready to operate in full compliance with the higher standards and more restrictive regulations of nowadays China. Examples of such context and vision are the establishment in Nantong of our own waste water treatment and solvent recovery facilities, allowing us to minimize the discharge to the shared industrial park system.

From the early days of our presence in China, our view has been to position ourselves within the world’s fastest growing economy (and pharma market) and to contribute to its development by bringing, together with our clients, high value added and innovative products, rather than just leveraging the low cost opportunity, which is not surprisingly showing to be a very transient benefit given the rapid economic development and the consequent rise of the living standards.

In that sense we have built local R&D and pilot capabilities to support introduction of new projects and process development/optimization.

Figure 2 shows how the domestic demand for custom manufacturing has developed over the course of the last years and, more importantly, how it is expected to grow in the future. Clearly, these figures make the case for a presence in China and represent an attractive opportunity for a CDMO with global reach like Siegfried

Outlook

In conclusion, although some significant challenges still remain with respect to actual approval timelines, changing regulatory requirements, price pressure, labor efficiency and IP protection (e.g. recent US Trade Representative (USTR) complaint at WTO on Chinese patent regulations) we believe that the Chinese and global pharmaceutical industry will develop an increasing demand for local higher value services (e.g. manufacturing of innovative/patented drugs), while the higher standards enforcement is increasing Western CMOs competitiveness and attractiveness.

References to this article are available from the author.