South America’s Chemical Industry in Recession

As the Economic Low Point seems to have been reached in Brazil and Argentina, Long-term Growth Prospects are Positive

The South American countries were beacons of hope for the world economy until the 2008/2009 global economic crisis. Brazil, the region’s largest country, was even mentioned in the same breath as China, India and Russia. The growth rates spoke for themselves. The gross domestic product (GDP) of the region grew an average of around 3.4% per year between 2000 and 2008. After the global financial crisis, however, the momentum slowed significantly. In the period 2010-2015, growth amounted to only around 2.0% per year.

Most recently, the GDP shrank again in the wake of the various crises – especially due to the strong recession in Brazil. The region once again has to deal with a decline in the economic performance in the current year (fig. 1). High dependence on commodity exports combined with sharply falling commodity prices is now taking its toll. Investments are being postponed and foreign direct investments are backing out. Added to this is the devaluation of currencies and the fear of interest rate hikes in the United States.

South American economies also remain susceptible to crises because the industrial sector is too small and not sufficiently diversified to have a supporting effect. Thus, the industrial and mining ratio in Brazil is only 12%. In Argentina and Chile, these two sectors have in fact a total ratio of approximately 20%. In Chile, the copper mining ratio alone is around 8% of the GDP.

There is little hope that the industry ratio will increase quickly. On the contrary: the growth of South American industry has slowed significantly since the crisis, and the region’s production has even been in decline since 2013 (fig. 2). Volume is lacking, in terms of both competitiveness and products that are in demand on the world market.

Homemade Problems in Many Countries

The reasons for the weak growth are varied. In Brazil, the present government has made conditions fairer through social programs, but Brazil's dependency has been deepened even more by commodity exports and nothing has been done to improve international competitiveness; education, security, and infrastructure have received little attention. Likewise, the reform of the political system that allows private campaign financing has been neglected – the main reason for the rampant corruption currently being observed.

In addition to its high dependence on the export of raw materials, Chile suffers as a result of China’s weakness. The Asian giant is the country’s main trading partner, followed by the United States and the European Union. Low commodity prices also put a strain on investments. In 2015, investments in the mining sector dropped by 20%. Chile also has a general problem with competitiveness. The productivity of the country has grown by an average of only 0.2% over the past 25 years – too little to remain competitive.

Argentina is still coming to terms with its second national bankruptcy in a little more than a decade. There has been hardly any growth in this country in the past few years. The investment climate is poor, and the devaluation of the peso has weighed on consumer spending. Nevertheless, the change in the government at the beginning of the year is raising hopes among investors.

Falling Demand for Chemical Products

Until 2011, the chemical industry benefited from the economic recovery in South America. The need for chemicals rose dynamically at an average of 7.5% per year, but in the wake of the recent crises, demand has decreased.

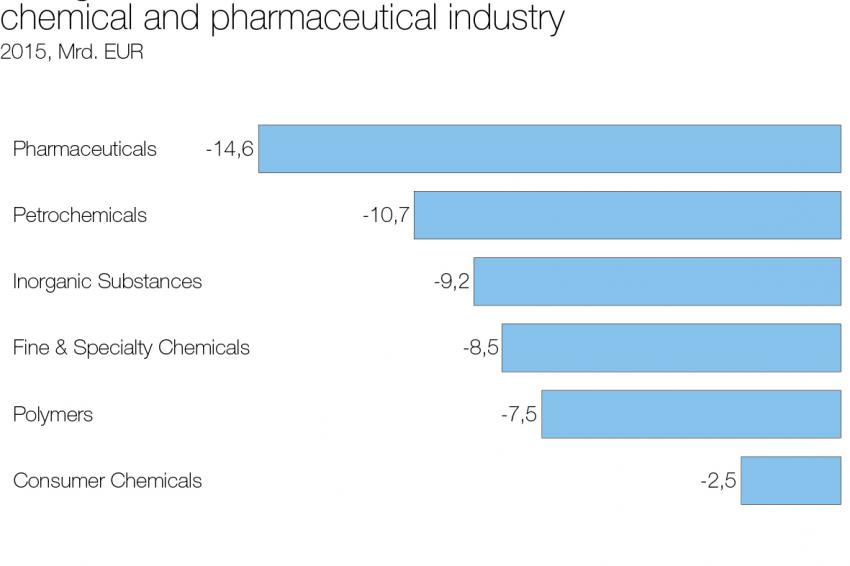

South America is a net importer of chemicals and pharmaceuticals. The trade deficit was €53 billion in 2015. The production capacities in almost all sectors of the region are inadequate to meet the demand for chemicals on the continent (fig. 3). The growing trade deficit for chemicals makes it clear that the chemical sector has to fight the problems typical for South America: in many places, companies complain about a poor infrastructure, bureaucracy and corruption.

Due to its natural resources, South America's chemical industry produces mainly raw materials. The ratio of basic chemicals in 2015 was around 50% and this was on the rise. Fine and specialty chemicals and pharmaceuticals follow, with a ratio of around 20%. The consumer chemicals sector is the smallest with a ratio of 13%.

German Chemical Industry Commits to Business in South America

In the past decade, South America has gained in significance as an export market for the German chemical industry. Approximately 3% of the total chemical and pharmaceutical exports went to South America in 2015. This corresponds to goods worth almost €5 billion. Exports of German chemical companies to the region grew apace until 2011 but leveled off in the wake of economic turmoil. In 2016, exports by German companies to South America are likely to decline slightly as a result of weaker growth in the region.

South America remains interesting to the German chemical sector as an investment target. Currently the continent represents about 3.5% of all direct investments of the industry. In total, 118 subsidiaries of German chemical companies were active in South America in 2014. They generated a turnover of €14.1 billion and employed 39,000 employees.

Outlook: Long-term Growth Prospects are Positive

The economic low point now seems to have been reached in Brazil and Argentina. GDP and industrial production will be able to improve slightly in the coming months. This has a stabilizing effect on the entire region. In the long term, the chemical industry association VCI expects that South America can overcome its various structural problems. This should allow the continent to continue to develop its attractiveness as an investment location and market in the future. After all, the conditions for dynamic growth are good: the population is growing in many South American countries and a growing middle class can promote the expansion of consumer-oriented industrial products and services. A rising standard of living can also lead to an increase in private consumption. Last but not least, countries such as Brazil and Chile have considerable deposits of raw materials that can be used to increase the importance of these countries as commodity exporters.

Contact

VCI Verband Chem.- Ind. e.V

Mainzer Landstr. 55

60329 Frankfurt

Germany

+49 69 2556 0

+49 69 2556 1471