German Chemical Industry

The Perfect Investment Location for Process Industries

Germany is a global heavyweight as a location for the production of chemicals and associated process industries, ranking first in Europe. The German chemical industry has benefited more strongly than its European competitors from the economic upswing over the past five years. Growing at over 4% per year on average, it has significantly outpaced the U.S., Japan and the other main chemical-producing nations of Europe.

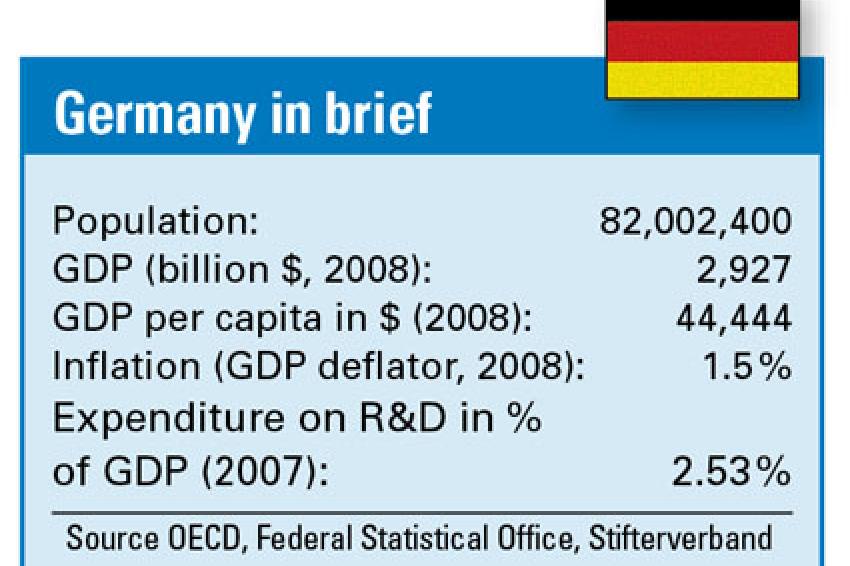

Several factors have been instrumental in this encouraging trend. One is the country's proximity to the faster-growing markets in Central and Eastern Europe, especially now that many countries there have become members of the enlarged European Union. In domestic terms, Germany also offers an attractive market and location to invest. With 80 million inhabitants, it is the EU's largest country by population and one of the world's top economies.

Challenge And Change

But maintaining such world-class performance is not easy. German companies have often been at the forefront of change and have maintained their global prominence. The country's top producers account for no less than six of the top 40 chemical companies, headed up by such illustrious names as BASF, Bayer, Evonik Industries, Linde, Merck and Lanxess.

Global players, such as Dow Chemical, Ineos and Sabic, have a significant production base in the country and continue to invest here. Years of investment and production optimization have resulted in a network of highly integrated production sites, linked by good logistical infrastructure and enjoying first class energy supply and service provision.

By forming site management companies whose core business is the supply of utilities and who therefore have a direct interest in the maintenance and development of their assets, the chemical sites have ensured that they offer state-of-the-art infrastructure for investors to tap into.

Tough Choices

In an era of rapidly globalizing production, multinational and even regionally-based companies have embraced international development as a strategy to drive growth. But in these competitive times, selecting a new production site is a critical decision. Payback time and long-term profitability of investments depend largely on the initial cost of the project and then the ongoing costs of utilities and site services.

Gone are the days when an investor would choose a greenfield site and expect to build not only the production plant but also the required support infrastructure. Exceptions can be found in the Middle East, but in developed regions such as Europe and the U.S., greenfield development is largely a thing of the past.

Today, companies are looking for the cost savings and synergies that can be found by investing alongside existing producers, to share many of the facilities already in place. This trend has been enabled and even encouraged by the restructuring of the chemical industry in Europe, which has led to the opening up of single-company chemical complexes to multiple occupancy and even ownership. Germany is a prime example of what is now on offer to the international investor.

Not only the chemical producers are seeing the benefits of making investments in these chemical sites. Other process industries are beginning to see the advantages, too, as they realize the benefits gained by sharing infrastructure, site services and logistical capabilities of the sites. In fact, the industrial environment is so attractive to investors from related process industries that manufacturers of paper and board, glass, new lightweight materials, as well as materials and fuels derived from renewable resources are beginning to co-locate their facilities alongside chemicals.

Synergies

The main benefits for the overseas investor are to be derived from the infrastructural synergies within the chemical industry's production complexes. There are some 55 chemical producing sites in Germany with no fewer than 40 organized as chemical parks. This chemical parks and sites concept makes it easier for investors to come and "plug into" the infrastructural requirement, a much more cost-effective option than a greenfield investment.

The integration offered in terms of raw materials supply, energy and steam provision, waste and water treatment and shared maintenance and logistical services, is a real boon to potential investors and one that the site marketing arms are all too ready to promote. In fact, the offerings of the "plug & play" sites can fulfil the needs of many manufacturers from the process industry and processors of downstream products, such as plastics and composites.

Knowledge of managing complex processes has been developed at these sites over many decades. New investors - especially innovative start-ups - will benefit by tapping into such resources. In addition, some chemical parks are members of innovation clusters. These clusters are often formed to support and speed up innovation in existing sectors, but increasingly they are being established by the government to stimulate expertise in technology platforms such as biotechnology, nanotechnology, solar technology and the hydrogen economy.

Business Models

The many chemical sites and parks in Germany offer a wide range of flexible business models and incentives to attract investors to their location. If they choose, the investors can merely buy or lease land from the site owner and establish their own production unit.

At the other extreme, the business model might consist of a site operator investing in and operating a new plant for the investor, on a custom or toll manufacturing basis. In some cases, the contract will specify use of the site services as a prerequisite for the investment; in others the investor may be allowed to buy in services on a competitive basis. Alternatively, the site operator may offer to tender for services on a competitive basis with a short list of suppliers, on behalf of the investor.

The ultimate goal, of course, is to create added value at the site, for all parties concerned.

Incentives for Investors

Funds are provided by the German government, the individual federal states, and the EU. These are predominantly aimed at new investments geared towards fostering economic growth. Germany has €26.3 billion from the EU (co-financed using means obtained from German national and regional budgets) at its disposal until 2013. In addition, Germany and its individual states make their own incentives funds available.

There are a number of incentives programs available which can be grouped into two overall packages:

- The investment incentives package with different measures to reimburse investment costs; or

- The operational incentives package to subsidize expenditures after the investment has been settled.

Each package consists of a different number of programs, ranging from cash incentives for the reimbursement of capital expenditures to incentives for R&D.

Innovation

Germany's engineering industry identified energy efficiency as a global mega-trend a long time ago. All customer groups are able to benefit from the innovative capacities of German engineering. Efficiency is a key selling point in international plant construction and is playing an increasingly important roles.

Germany's engineers are also paving the way to a solar future. It is their expertise that is making the industrial production of new energies such as wind power and photovoltaic possible in the first place thus increasing their competitiveness versus conventional technologies.

Forward thinking companies from the process industry that take particular interest in the issues and solutions thrown up by the challenges of securing an efficient and modern energy supply would be well advised to invest in Germany. This would position them at the cutting edge of efforts to find future-oriented solutions - besides, of course, allowing them to reap part of the rewards.