T.A. Cook Study Shows Potential to Win Customers in Turnaround/Shutdown Projects

28.07.2011 -

All Encompassing - A T.A. Cook survey is the first study to address the supply and demand ends for shutdown/turnaround (TAR) projects in the process industry and provides an all-encompassing and detailed market overview for Germany, Austria and Switzerland.

Large industrial plants, like those operated by the chemical industry, must be shut down and undergo general overhaul at regular intervals for both legal and technical reasons. In the petrochemical industry, this is usually referred to as a shutdown/turnaround project. The survey published in May 2010 was designed to identify development potential of this market segment on the one hand and to create greater market transparency at the supply and demand ends on the other.

Shutdown/Turnaround Projects an Attractive Business

The survey shows that the market volume for turnaround/shutdown services amounts to €610 million per annum.

"The market volume for this specialized service is surprisingly large and therefore interesting for technical service providers," said head of studies Mateus Siwek. Total demand among refineries amounts to around €2.1 billion over a shutdown cycle of five years. On an annualized and adjusted basis, this translates to around €345 million. The demand for crackers (olefin plants) was found to be €76 million, while petrochemical plants account for around €188 million per year.

In order to determine the market volume, 39 petrochemical production sites and 159 providers of technical services were analyzed and polled in detail. Deriving from this group, a total of 99 interviews, almost 50%, were evaluated. All of the participants were active in the petrochemical or chemical industry. Sixty three percent of the interviewees stated that they also offered their services in the energy sector. Twenty four percent of the respondents were CEOs, 40% executives and 26 considered themselves to be turnaround experts.

The number of shutdown projects in the market segment reviewed totals to around 70 each year. For the period from 2010 to 2020, the survey identified a total of 108 major turnaround projects (each with a volume of more than €30 million). It can be seen that the years 2011, 2013, 2016, 2017 and 2019 will see a smaller number of relevant TAR projects.

New Market Opportunities Despite a Declining Market Volume

The survey also identified several trends, which were verified in form of a Delphi survey with selected experts. All in all, the experts expected overall demand for technical services for turnarounds to decline by 20% by 2020.

"The most important drivers of this development are the declining demand for petrochemical products and the relocation of plant capacities to the Middle East and Asia," Siwek said.

Only part of the declining demand can be explained by global economic tension. Another key factor is the growth of implementing measures to improve energy efficiency and the use of green technologies for energy production. Declining demand leads to an oversupply of processing capacity.

"On the other hand, order volume for projects can be expected to increase between 2011 and 2016 as a result of increased investment spendings by plant operators," Siwek said.

The investment backlog of the past years led to a suspension of investment and the postponement of turnaround projects. Hence, newcomers in the turnaround/shutdown market are likely to have a good chance of winning new contracts, also due to the fact that 50% of plant operators regularly change one of their main contractors. However, the temporary need to catch up will not lead to a sustainable recovery of order volumes.

A Few Specialists Dominate The Market

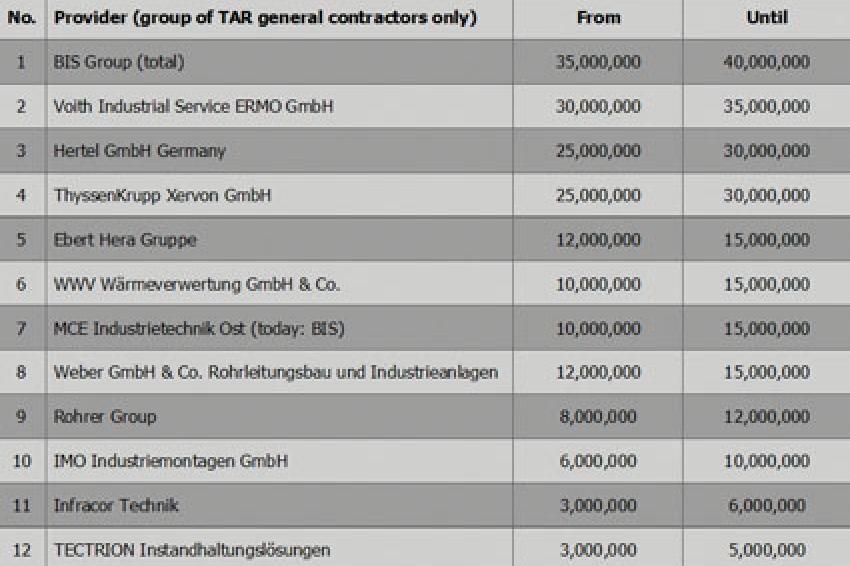

At the moment, the market is still dominated by so-called "turnaround providers with general contractor competence." Turnover of this provider group is estimated to be around €180 million to €230 million per year (fig. 1). This means that 7% of providers (out of 159 firms surveyed) account for around 30% of the total market volume. A detailed look at the competing providers shows that the group of "TAR providers with general contractor competence" has the highest awareness of all the groups. As part of the survey, all service providers were asked to identify their three largest competitors. The most frequent answers were TKX, Voith ERMO and the BIS Group, followed by MCE Ost, Ebert Hera and WWV Wärmeverwertung Merseburg.

Taking relative turnover, resources and competencies into consideration, three TAR-specific groups (fig. 2) can be identified. The market is dominated by TKX, Voith ERMO and the BIS Group. Voith and the BIS Group are, to a certain degree, TAR newcomers and have moved up to the group of leading TAR firms through the acquisition of MCE (today: BIS Group) and ERMO (today: Voith Industrial Services). The BIS Group has become the TAR firm recording the highest turnover, primarily through acquisitions. All three providers are generally equally well-positioned. In terms of their target group, TKX and the BIS Group have a broader base than Voith ERMO because the latter focuses particularly on refinery customers. The survey showed that according to plant operators Voith ERMO offers the most attractive TAR project business model.

WWV, Ebert Hera, Hertel and Weber rank midfield. With the exception of Hertel, these are all medium-sized enterprises that are very well capable of executing TAR projects as general contractors. As main contractors they coordinate a wide range of subcontractors when requested by their customers. Hertel and Ebert Hera pursue a proactive market expansion course because both companies increase their market share by acquisitions and investments. Weber and WWV primarily generate growth from successful customer relations.

The third group is made up of Infracor and Tectrion. These two companies control their local market as service providers for chemical parks. It remains to be seen whether they will manage to open up customer groups outside their locations through their cooperation networks or whether they will cooperate with other "TAR general contractor firms" in the medium term. It is very likely that it will be difficult for reasons of competition to execute large TAR projects (which require a great deal of resources) with all three providers at the same time. Operators will develop new execution models which will generate very attractive growth prospects for medium-sized enterprises.

Resources Are Not As Limited As Believed

From the plant operators' perspective, the increase in resource problems as seen on the market in recent years was primarily due to the fact that the market was determined by large-scale shutdowns. Another bottleneck factor in this context is the limited time slots for turnaround projects (spring, autumn). Answers by plant operators give evidence that they estimate the number of available TAR metal workers (mechanical trades) on the German market to be around 1,500. However, resources are in fact not as limited as believed:

The analysis of providers shows that around 1,100 mobile professionals are permanently available for TAR projects. They are supplemented by another 2,000 qualified pipe fitters who are contractually integrated into TAR projects via the group of staff providing companies or specialized subcontractors. It can be calculated that, all in all, around 3,000 workers specialized in mechanical work for TAR projects are available on the market.

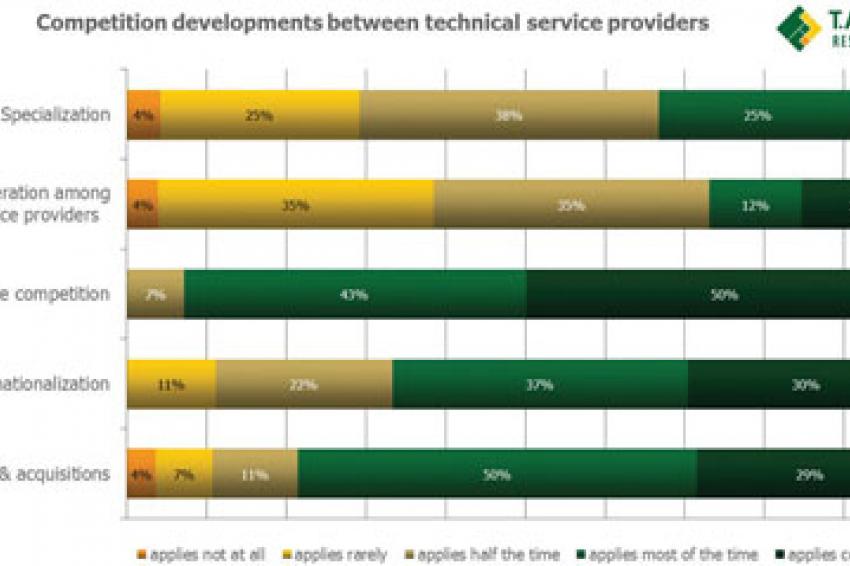

It can be stated that the market is currently undergoing a change. New providers of technical services are using the arising chances to establish a foothold in the market, and operators of petrochemical plants are rethinking their traditional strategies of executing turnarounds. It is not just providers of technical services who wore badly affected by declining orders due to the crisis, many operators of petrochemical plants also suffered losses. The premature assumption that reduced production volumes and smaller margins lead to the execution of maintenance work and turnaround projects ahead of schedule did not materialize.

All manufacturers are currently keeping a close eye on their cashflow and avoid spending on anything that is not absolutely necessary. This has also had major repercussions on project business. Most suppliers are expecting more mergers and strong price competition. The T.A. Cook study offers a basis for decision making by providing condensed information about the market for technical services.

Market Study "Technical Services for Turnarounds in Petrochemical Plants"

D-A-CH, English

You can order a copy of the study at the price of €4,400 plus VAT. Just send email with your mailing and invoice address to markus.caspari@wiley.com

You can also send a fax to +49 (0) 6151-8090-145 and/or you can use the PDF order form at www.chemanager-online.com/turnaround-study.

Contact

T.A. Cook & Partner Consultants GmbH

Leipziger Platz 1

10117 Berlin

Germany

+49 (0)30 884307-0

+49 (0)30 884307-30