Orphan Drugs

A Smart Target for Generics?

New Markets - An estimated 25 million people in the U.S. suffer from rare diseases, known in the pharmaceutical industry as "orphan diseases". While the prevalence of each individual orphan disease is, by definition, low (affecting less than 200,000 Americans total), researchers have identified over 7000 orphan diseases to date and these numbers continue to grow each year.

Traditionally it has been in the best financial interest of pharmaceutical companies to focus research and development efforts on drugs targeting common diseases to maximize the potential patient base and thus the potential to recoup drug development costs and generate profits. Recognizing this, the U.S. government passed the Orphan Drug Act (ODA) of 1983 to incentivize the development and commercialization of drugs to treat rare diseases.

Orphan Drug Act

The ODA provides federal tax credits of up to 50% of orphan drug research costs, seven year exclusivity on drug sales for the first company to receive FDA marketing approval, shorter clinical trial times and waivers for certain FDA fees including drug approval application and annual product fees.

The ODA has produced the desired effect of stimulating focus on developing therapies to treat orphan diseases as well as serving as the blueprint for similar pieces of legislation passed in other regions of the world. The European Union, for example, passed its orphan drug legislation in 2000 allowing designated products up to ten years of marketing exclusivity, as well as protocol assistance and possible fee waivers.

Today, orphan drug designations and approvals are being sought at record levels. According to a recent Thomson Reuters review of the economic power of orphan drugs the compound annual growth rate of the orphan drug market between 2001 and 2010 was actually higher than that of a control group of non-orphan drugs. With the high price tags, government incentives and high rates of regulatory success, orphan drugs have blockbuster potential for innovator companies. But does innovator success with this niche group of drugs translate to large profits for the companies that manufacture active substances and lower-cost generic versions of these therapies?

Orphan Drug Exclusivity

Many of the orphan drugs developed and approved in the wake of the ODA legislation taking effect have recently lost their orphan drug exclusivity (ODE); this trend will continue over the coming years as an additional 70 ODEs expire during the next six years (see figure 1). These products represent opportunities for manufacturers of both generic medicines and the active pharmaceutical ingredients (APIs) contained in generic drug products. Orphan drugs losing exclusivity often have high price tags and low marketing costs because they are produced in small quantities for a very specific patient population.

Because ODEs are not tied to patents, generics manufacturers can develop and often launch a drug protected by an ODE so long as the drug is approved for a different, non-infringing application. In fact, according to research compiled by Thomson Reuters, manufacturers are already producing or capable of producing commercial quantities of many of the APIs associated with drugs currently protected by ODEs (see Table 1).

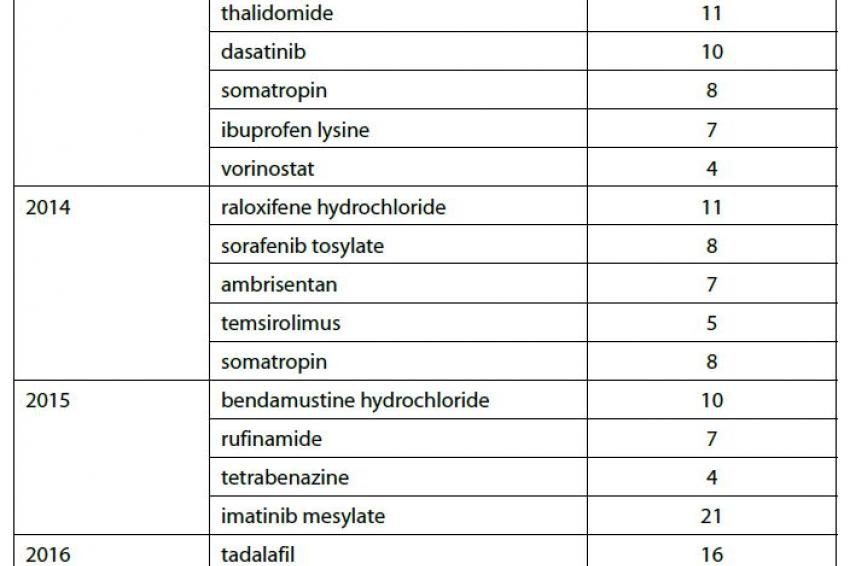

Table 1 shows a small sample of the ODEs that expire over the next few years and the number of API manufacturers who currently have these drugs under development or commercially available according to information in Thomson Reuters Newport Premium.

This list represents a variety of different therapeutic areas, mechanisms of action and revenue potentials. Imatinib mesylate, for example, is a blockbuster oral-dose drug approved to treat nine different cancers and boasting over $4 billion in worldwide sales during the FY ending March 2012. Imatinib has been granted orphan drug exclusivity 4 times since 2001, most recently for arterial hypertension in 2010. In addition to the ODEs, imatinib has patent constraints protecting it from generic competition until late 2015.

Conversely, decitabine is a parenteral treatment for myelodysplastic syndromes and had less than $250 million in worldwide sales during the same fiscal year in which imatinib generated greater than 16 times those sales figures. Decitabine has been granted orphan drug exclusivity for sickle cell anemia and acute myelogenous leukemia (AML); the yet-unexpired ODE for AML is the only barrier preventing generic competition. What imatinib and decitabine have in common is that at least 20 API manufacturers currently are capable of producing commercial quantities or have the product under development.

API manufacturers recognize different types of opportunities in orphan drugs, from blockbusters with high-volume, high-sales potential to niche products requiring high-quality rare chemical substances with the potential to command high prices even in the genericized market.

Incentives for Innovation in Pharma

Obviously, incentivizing legislation like the US Orphan Drug Act is directed toward innovator companies and perks such as tax credits and fast-track approvals are not provided to generic companies who make copycat versions of orphan drugs. The extended market exclusivity the ODA provides can actually be seen as a deterrent to generic competition, as in some cases this exclusivity delays generics from entering the market. Yet, as seen in Table 1, many manufacturers are already developing APIs for orphan drugs that have yet to lose their exclusivity.

As discussed above some orphan drugs like imatinib are approved for multiple indications and are not used solely to treat rare diseases. Many of these drugs are billion dollar blockbusters and are targeted by generics in spite of, not because of, their orphan drug designations. However, even niche orphan drugs that are developed as therapy for a specific rare disease may be viable targets for generic competitors.

High priced innovator drugs and limited market competition allow generic companies to demand relatively high prices for orphan drug copycats. Innovator companies often release an orphan drug only in select countries; this opens the opportunity for generic manufacturers to target larger, global patient populations and perhaps control some smaller markets.

Orphan drugs traditionally have strong safety profiles compared to non-orphan drugs; the risk of targeting an orphan drug only to see it pulled from the market due to safety concerns is extremely small. Orphan drugs for rare cancers make up nearly 40% of orphan drugs designated in the US and Europe; these therapies often end up being designated for one or several additional indications thus increasing the potential market. Finally, innovator companies assume great upfront risk and cost in developing orphan drugs in the hopes that they will be rewarded with reimbursements and approvals following orphan drug designation. Generic companies take a much smaller gamble than the manufacturers of the pioneer product because they know the approval fate of the drug prior to investing development dollars and they don't need to deal with the large cost and complications associated with finding patient populations on whom to run efficacy trials.

Outlook

The Orphan Drug Act and related global legislation have been highly successful in directing interest and motivation toward the treatment of rare diseases; in the US alone over 2,000 molecules have received orphan drug designation and the FDA has approved more than 350 orphan drugs since the ODA went into effect in 1983. As many ODEs are moving toward expiry, generics and API manufacturers are poised to cash in on these once-ignored now profitable markets.

Contact

Thomson Reuters

215 Commercial Str.

Portland, Maine 04101

+1 207 8719700

+1 207 8719800