Pricing Strategies

A Basis for Systematic Profit Generation

When the Price is Right - Pressure on margins, strong competition and high quality expectations of customers are typical determinants in the chemical industry. The Chemical Monitor of Homburg & Partner, a half-yearly survey among deciders in the chemical industry, confirms the importance of a pricing strategy: More than 50% of respondents attach a high value to having one. But many companies still do not create and implement a well-developed pricing strategy.

Recently, we experienced the margin of a newly launched product lagging far behind its potential because of the absence of a thorough pricing strategy. The initial list price was based on an insufficient analysis of the willingness to pay. As a result, the quoted price for the product was too low, and because of unexpectedly fast competitor adaptation, the company was unable to increase the price.

Why Is a Pricing Strategy So Important?

Companies should develop an effective pricing strategy for several reasons. With regard to the previous example, a thorough pricing strategy, including the relative price/value positioning in the market, is indispensable for skimming customers' willingness to pay - a pricing strategy helps keep a company's margin up. As another example, if a pricing strategy is developed as a response to relevant impact variables, it enables long-term planning of profitability - offering a better overall strategic positioning of the company in the long run. Without a pricing strategy, a consumption of the market potential would happen just by chance.

However, there is more than one correct strategy. The "right" pricing strategy for any situation can be derived based on an analysis of the individual market and business conditions.

How to Develop a Pricing Strategy?

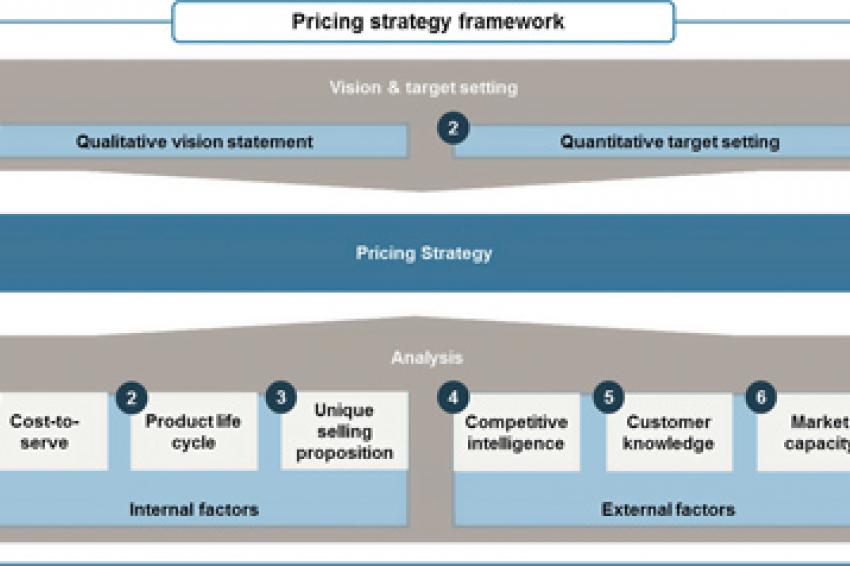

A pragmatic approach and hence recommendations for a well-founded pricing strategy can be based on a top-down/bottom-up approach - a combination of vision and target setting (top-down) and internal and external factor analysis (bottom-up) creating the pricing strategy framework.

Although the needed information for a thorough pricing strategy is typically available within the organization, our impression is that few companies systematically take advantage of it. Often pricing strategies have grown from historical roots and are based on sales force experiences, but an intuitive approach is not sufficient for such important decisions. To ensure the success of a pricing strategy, a systematic approach with defined objectives involving all relevant analysis items is essential.

Which Aspects to Consider?

Both perspectives - top-down and bottom-up - can be subdivided into specific factors of interest, which need to be analyzed systematically. In the first step, the vision and the targets of the pricing strategy need to be defined. In the second step, major internal and external factors affecting the development of the pricing strategy should be analyzed focusing on three main criteria for each factor.

Step 1: Define the Vision and Targets Driving the Pricing Strategy

Vision and targets have to be strictly aligned with the overall goals and the strategy of the company - thus, it is a top-management responsibility. A vision builds the qualitative pillar of the pricing strategy, reflecting the overall goals of the business. For example, a company that is the market leader based on a high level of quality might state its vision as follows: "We act as the pricing leader in the market, focusing on our high level of quality, and do not participate in price competition." Pricing targets create the quantitative pillar of the pricing strategy, supporting the target values of the overall business strategy. Exemplary quantitative targets could be to establish an absolute price level of, e.g., €3.50/kg for a specific product group or to reach a minimum contribution margin of, e.g., 50% for all product groups.

Step 2: Analyze the Internal and External Factors Affecting the Pricing Strategy

To analyze the internal factors, the three major aspects - cost-to-serve, the product life cycle (PLC) and the unique selling propositions (USPs) - have to be considered. Knowing a company's relative cost-to-serve gives must-have insights into the range of possibilities to respond to competitive pricing pressure. Also, for the different PLC stages, different strategies are recommendable and can be evaluated with regard to a company's PLC structure. Additionally, knowing and carefully quantifying USPs is essential in order to skim customers' willingness to pay.

Three key aspects for the analysis of the external factors should be considered - competitive intelligence, customer knowledge and market capacity. By gaining comprehensive knowledge about competitors (e.g., strategy, price position, pricing role) and customers (e.g., customer value, perceived value, willingness to pay), niche markets can be identified for successful positioning. Last but not least, knowledge about existing and planned production capacities in the market must be obtained to understand the effects of supply and demand on prices.

What Is The Outcome?

Combining the insights of the bottom-up/top-down approach helps capture a well-developed, thorough picture of the relevant internal and external determinants. Based on these insights, all relevant criteria for the determination of the pricing strategy are given; they identify the most appropriate individual pricing strategy, such as premium, skimming or penetration.

Overall, price strategic decision-making, if based on a substantial information base, enables systematic profit generation and supports the realization of a company's full earnings potential.

Contact

Prof. Homburg GmbH

Willy-Brandt-Platz 5-7

68161 Mannheim

Germany

+49 621 1582 0

+49 621 1582 102