Chemicals 4.0 — Bringing the Industry to the Next Level

Growing Complexity Puts Focus on the Future

IT has always been a key success factor, hasn’t it? And what about industry-specific characteristics? Is Industry 4.0 relevant for this industry with its different nature of production? Or is it limited to automotive?

To understand the effect of Industry 4.0 on the chemical industry, it is best to discuss this concept from a value lever perspective rather than a technical point of view. Countries such as the US with its Industrial Internet Consortium (IIC) are highly ambitious. If Germany wants to maintain its leading role in Industry 4.0 as well as in chemicals, there is no time for “happy engineering.”

Beyond Happy Engineering

Chemical markets are becoming more complex. Industry trends like global demand shift, consolidation and commoditization are the pacemakers for this development, which the chemical industry must address. In addition, uncertainties such as political revolutions or pandemics as well as unforeseen wild cards, such as terror attacks or infrastructure breakdowns, challenge the chemical industry. Twenty years ago, studies showed that such development leads to significantly higher need for coordination within the chain. If chemical companies do not manage appropriately this ends up in a lack of integration as well as erosion of competitive edge.

On the other hand, Industry 4.0 provides the opportunity to enhance integration and strengthen competitiveness of chemical companies. Industry 4.0 means managing value-added networks in an agile and comprehensive fashion, while leveraging new technologies such as cyber physical systems (CPS), cloud computing, low-cost sensors or additive manufacturing. Conclusively, CPS and other technologies are a necessary precondition; however, applying such technologies on a stand-alone basis is not sufficient for guaranteeing its commercial viability and strategic fit.

While a kind of happy engineering was driving the Industry 4.0 discussion at the very beginning, it is key that its value-added and competitive influence focuses on the future. Furthermore, the chemical industry’s specific characteristics have to be taken into account. This industry is typically characterized by continuous production, as opposed to discrete production in other non-process industries. Furthermore, the business of chemical companies is characterized by significant asset intensity as well as logistics and energy cost.

Approaches to Chemicals 4.0

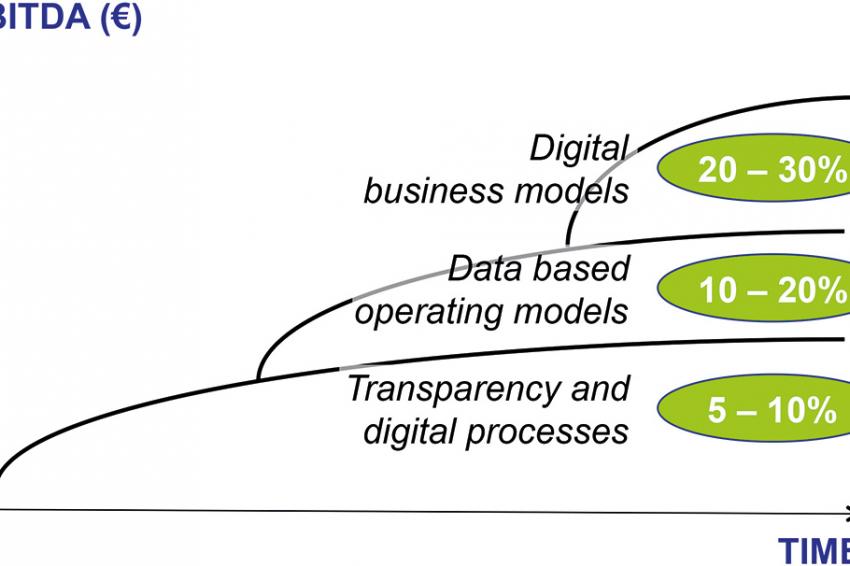

Three approaches determine the digitization for the chemical industry: process transparency, data-based operating models as well as digital business models (fig. 1). The logic of the three approaches is materializing in many industries being digitalized. It can be applied to the chemical industry as long as specific industry characteristics are being considered.

The approaches shown in figure 1 build on each other and are cascaded, which means digital business models require data-based operations as well as transparency. While new digital business models show the highest commercial significance, many chemical companies are still in the transparency phase.

For the chemical industry, Chemicals 4.0 is an innovative management concept that leverages Internet technologies, systematically. It is the response to what Industry 4.0 means for the chemical industry but not limited to it. In addition, it provides support for responding to other challenges, like CO2 emissions and German “Energiewende.” This multisolution character makes Chemicals 4.0 very effective and puts it on the CEO agenda in the chemical industry. It thus brings chemical operations and businesses to the next level. Furthermore, it potentially supports selected key trends, such as individualization of customer behavior and market consolidation. For this reason, Chemicals 4.0 can be considered a driver of market dynamics in the industry.

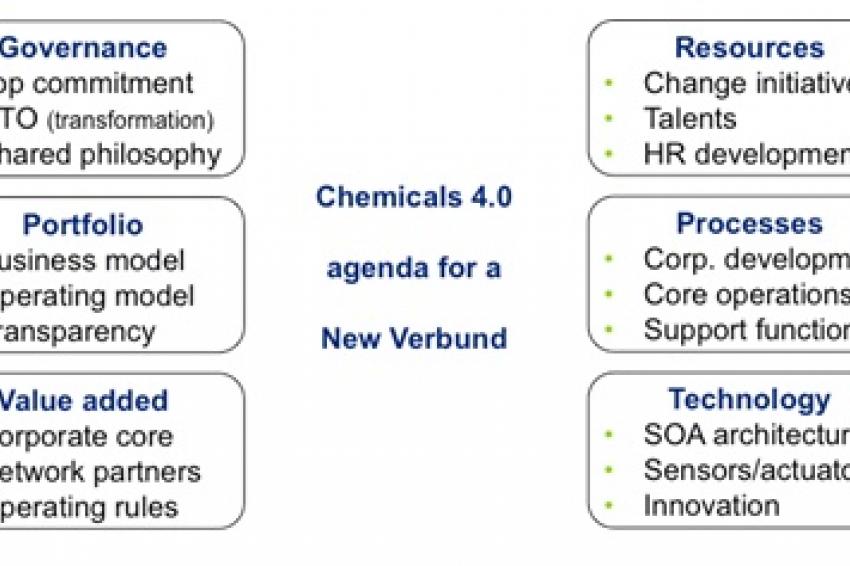

What is the effect for the German “Verbund” strategy of chemical companies? Focused business models are more and more replacing integrated value chains. The ongoing portfolio development of the chemical industry — because of the global demand shift, commoditization and market consolidation among others — challenges the traditional Verbund strategy. In this context, Chemicals 4.0 offers the vision of a New Verbund (fig. 2). In addition to the integrated management of vertical and horizontal synergies, a more self-organized coordination through the Internet of Things (IoT) gains traction and facilitates synergies as well as flexibility on an arms-lengths basis and through business objects. The Verbund strategy evolves from a focus on site synergies to value-chain networks, and from corporate boundaries to virtual partnerships, conclusively.

Over and beyond Chemicals 4.0 operations, business model evolution will consider product individualization as well as service customization in the future. This is because Internet technologies are facilitating so-called long tail strategies. Besides a long tail of individualized products and customized services, a pricing long tail generates value (fig. 3). These three dimensions together determine the so-called triple long tail strategy.

Making Chemicals 4.0 Happen

In order to achieve real momentum and address the topic, comprehensively, the digital transformation has to be initiated systematically. The Chemicals 4.0 journey, thus, has to cover proper governance, offering portfolio, processes, capabilities and human resources as well as IT infrastructure, among others (fig. 4). Only a holistic approach makes sure chemicals companies leverage the New Verbund sufficiently, as opposed to covering the topic for alibi purposes.

Given the new character of Chemicals 4.0, we need to follow up with this topic in order to leverage lessons from its execution. Concepts have to be refined and sharpened, solutions to be proven and early successes to be multiplied to strengthen momentum. Maintaining the leadership position of Germany’s chemical industry will not come without a cost but will take high efforts of all stakeholders.