Operational Excellence

Seeking a Sustainable Structure in European Refining and Petrochemicals

Shifts In Global Competition - The European refining and petrochemicals industry faces significant structural challenges. A declining demand for many refinery products and petrochemicals in Western Europe and, additionally, an overcapacity in many petrochemical products has created a structural cost pressure on often-underutilized assets.

Although typically fully depreciated, well-maintained and run, and often integrated into a larger product, logistics and energy network, these assets are often subscale when it comes to competing with resource-advantaged, world-scale assets in the Middle East and, soon, in the United States, thanks to America's current shale gas and oil boom, and corresponding petrochemical investments.

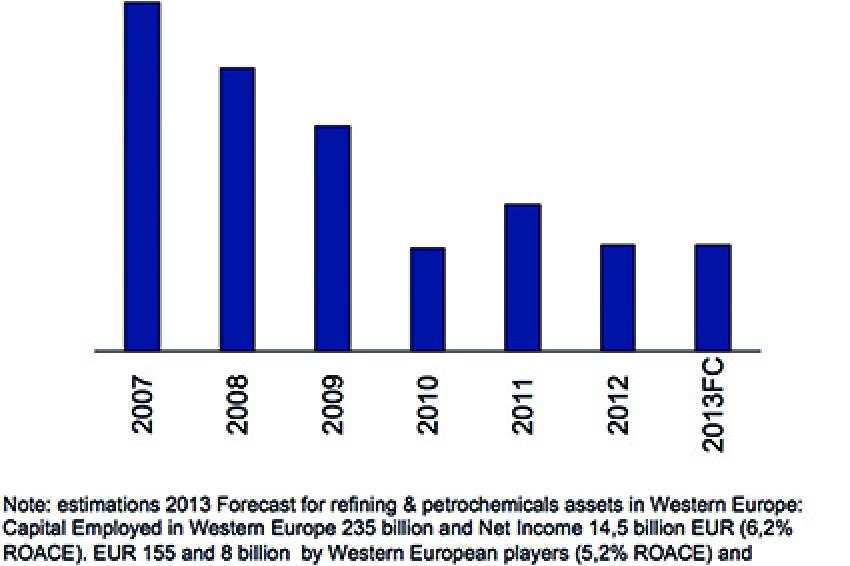

In refining, European capacities have been reduced from 840 million barrels per year in 2007 to 650 million in 2012, reflecting the increasing fuel efficiency in transportation, continued general energy savings and new alternative (non-oil) energy sources for heating. This trend is likely to continue with a further 1% to 2% annual decline in demand, at least for the next five years. In petrochemicals, the capacities for naphtha crackers and for the derivatives from that cracking, especially polymers, have not been reduced in line with the demand reduction and increasing imports of petrochemicals into Western Europe.

As a consequence of those demand and supply trends, profitability in the integrated refining-petrochemicals industry, as measured by return on average capital employed (ROACE), has declined significantly over the past five years.

In Western Europe, the average profitability level of refining and petrochemicals is only at 6% ROACE. This is less than half the global average and less than a third of the American profitability level. If the Western European companies do not react, the profitability levels in refining and petrochemicals stay structurally low and do not earn a proper return over the cost of capital. It is necessary to define a roadmap to bring profitability levels in Western European refining and petrochemicals back to a healthy and sustainable level. AlixPartners have identified three levers to achieve that goal, which could structurally double profitability levels from 6% to 12% ROACE:

- Performance excellence - 1.5% cost savings and increased reliability/availability

- Integration of refining and petrochemicals - 2% product, logistics and energy integration, sourcing synergies, and other scale and scope effects at co-located sites

- Structural transformation - 2.5% structural effects through focusing on attractive product-market segments and appropriate pricing, restructuring or transformation of the business and operating model and asset footprint

1. Performance Excellence

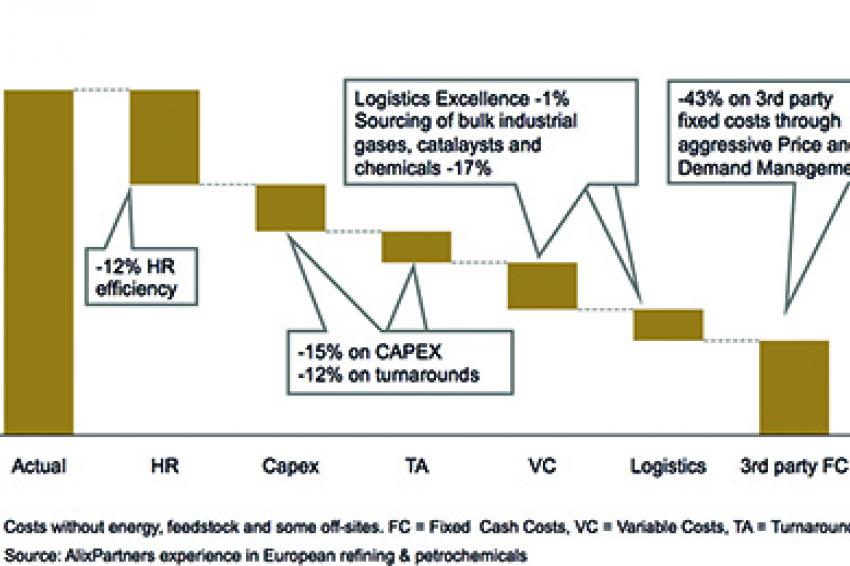

In refineries, but especially in petrochemicals and plastics, many cost-cutting and performance improvement initiatives have been undertaken in order to improve operational excellence. However, from our project experience, there are approximately 1.5% points of additional performance potential in existing structures.

Performance excellence should rest on three pillars:

- HSE performance: Ensure compliance and minimize risks and authorities requirements. The main challenges are organizational efficiency and cultural change: Getting every employee in each of his or her daily actions and decisions to understand the risks, report issues to the relevant party and ensure action is taken.

- Ability to operate at the desired capacity: Ensure equipment delivers the proper product within the proper specs when the margins are available. Margins fluctuate a lot, and flexibility of production decisions to capture pockets of margins should not be blocked by unplanned slowdowns or stops. The organization should be able to manage on a daily, weekly, monthly, quarterly basis problem-solving and performance enhancement combining in most cases process, maintenance and operation teams.

- Cost management: Energy and cost reduction are the results of top-down and bottom-up actions. Obviously, capital expenditures (CAPEX) allocation is key to these two topics but is not sufficient. On the energy side, faster vapor-leak control, operating procedures, start-up procedures, etc. can influence energy costs by several percentage-points, pro or con. On the cost side, the bulk of the challenge is operations staffing and maintenance costs. Ownership of the equipment status, first level maintenance by operations team, proper start-up procedure and adequate priority management on a daily basis can strongly influence maintenance costs. For the logistics costs, restructuring the logistics function and empowering it to manage supply and costs is critical. On the variable cost side, classical sourcing challenging incumbents should be organized including capitalizing on new projects/new constructions to challenge current contracts.

In essence, there are often too many - partly conflicting - initiatives launched from the top, which are not properly prioritized and implemented at a working level. Increasing the number of initiatives further is the wrong way; empowering local people to define specific master plans to optimize their local performance is the right thing to do. Empowerment of supervisors and middle management is key to success.

A well-balanced approach is crucial. Overly ambitious, unilateral cost reductions, which do not take into account unwanted "ripple effects" on other costs, harm the overall profitability.

2. Refining And Petrochemicals Integration

Refining, naphtha cracker operations and polymers are typically run as independent profit centers, which has created more transparency in performance evaluation and entrepreneurial ownership. There is, however, a limit of what performance excellence within those individual businesses can contribute to the overall performance. Especially in co-located refining-petrochemical sites there are synergies between those businesses, which can unlock additional performance and thus value potential. The obvious exchange of products between refineries and petrochemical plants offers product, logistics and energy synergies, which can be captured between the different units. This is naphtha, ethane, LPG, propylene, fuel oil and BTX from the refinery to the petrochemical plant and hydrogen, low sulfur fuel oil and pyrolysis gasoline in the other direction. Besides, there is an additional synergy potential by bundling similar services, especially in maintenance, inspection and CAPEX projects.

3. Structural Transformation

Besides those operational excellence activities within the current business, there is a need to think about a structural transformation to make the refining and petrochemicals business sustainable. A focus on long-term attractive product-market segments is an important lever. For a refiner the chemical markets gain in importance. Naphtha crackers achieve their integrated product margin more and more via higher C4+ derivatives and petrochemicals and polymer players have to rethink, if they should serve all product-application markets in all regions, or if they should focus on those segments where they can differentiate and add more value than their peers. Pricing along the value chain is an additional lever, which often offers an additional performance potential.

However, without an adaptation of the asset footprint those effects are helpful, but not sufficient to achieve a profitable and sustainable situation. Decisions on temporary shutdowns, mothballing, restructuring and redefinition of activities are additionally needed. With the further deteriorating market-competitive environment and with the decreasing restructuring costs and at least some legislative EU-support for industrial reusage (tank farm, bio refinery, etc.) it is recommended to revise those alternative restructuring or turnaround options. Besides operatorship there is also an option to decide on best ownership. Minority positions might be given up, as other players - especially from the Middle East and Eastern Europe - are looking for market entry opportunities into Western Europe.

By pulling all three levers, it could be possible to double the average Western European profitability on capital employed within the next three years. Most important, these kinds of improvements are necessary to achieve a sustainable business model for the refining and petrochemicals industry in Western Europe.

Kontakt

AlixPartners GmbH

Bleichstr. 8-10

40211 Düsseldorf

Deutschland

+49 211 975510

+49 211 975510 01