Why Are Foreign Chemical Companies Growing More Slowly in China?

In China, Domestic Chemical Companies Achieve Faster Sales Growth than Multinationals

Several sources, both among our consulting clients and among industry experts, have remarked that recently, domestic chemical companies have been able to achieve faster sales growth than multinationals. Given the extremely high growth rate of domestic chemical companies reported by the China Petroleum and Chemical Industry Association (CPCIA) - an average annual growth of about 22% from 2009 to 2013 - this seems credible, but all industry participants do not accept the validity of this data.

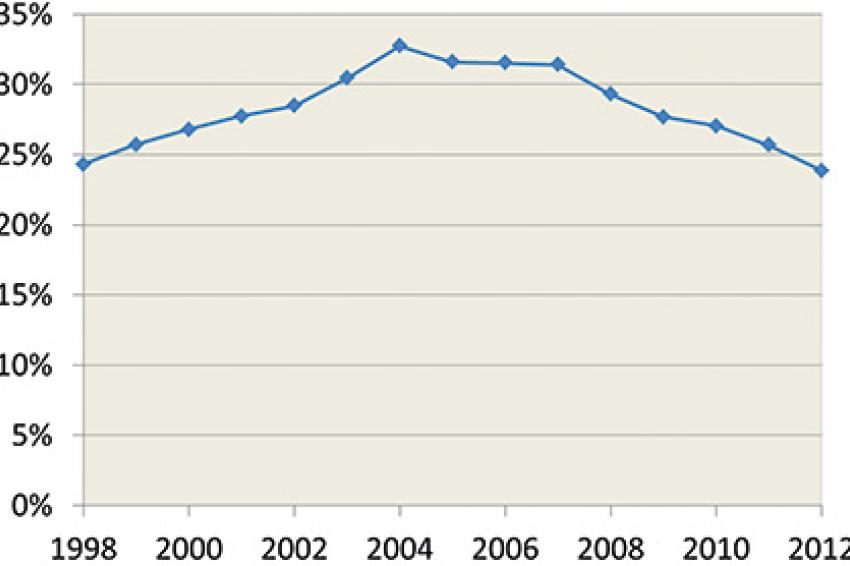

A stronger indication comes from the Chinese Statistical Yearbook. According to this source, the share of output of foreign companies reached its peak in 2004 at 32.7% and afterward continuously declined, reaching 23.9% in 2012 (fig. 1). Unfortunately this data is not specific to the chemical industry.

A calculation shows that such a big shift in foreign company output share is equivalent to an approximately 6% lower annual growth rate in this period (2004-2012). Unfortunately, this data is not specific to the chemical industry. However, assuming that the 6% growth difference is also true in chemicals, this would still leave foreign companies with an annual growth rate of 16% in this period - a rate that is certainly high enough to make up for the loss of market share.

Overall, we feel there is enough evidence - both anecdotal and based on general industry data - that foreign chemical companies indeed show lower growth than domestic ones. The question then is what the reasons for the difference are. We will first present a few potential explanations, and subsequently discuss them one by one.

Hypotheses for the lower growth rate of foreign companies include

- Preference of Chinese customers for low-cost products

- Increasing capability of Chinese companies to produce higher-quality products

- Particular growth of segments dominated by domestic companies, e.g., construction

- Government preference for buying from local companies

- Better local knowledge of domestic companies, e.g., regarding market situation, ways of promoting sales, offering local products, etc.

- Greater flexibility of domestic companies

- Greater focus of foreign companies on profits compared with revenue focus of domestic companies (particularly state-owned entities, or SOEs)

Low-cost Preference

Indeed in many Chinese markets end consumers have a stronger preference for low-cost (and usually corresponding lower quality) products than in other markets. This applies to consumer goods such as shoes and consumer electronics as well as to cars and individual materials used in construction (e.g., water pipes, coatings, etc.), all of which include materials produced by the chemical industry. However, as a stand-alone explanation, this is insufficient to explain the slower growth of multinational chemical companies. Undoubtedly the same low-cost preference existed in China at the peak share of foreign-owned production in 2004 - if anything, it has probably weakened somewhat as consumers have become wealthier.

Improved Local Products

However, combined with a second phenomenon the rationale is much more sensible. China's chemical companies have on average substantially increased the quality level and the variety of their products. In some areas, such as isocyanates, the last 10 years have seen a shift from distinctly substandard materials to those that are highly competitive - witness the ascent of Wanhua. The rapid improvement of Chinese chemical materials has partly been enabled by former employees of foreign companies joining local firms and utilizing their experience. As expected, the gains in sales for domestic companies are most visible in relatively mature segments, where chemical substances have been fairly unchanged in the last 10 years. This gave domestic companies the time to catch up with the foreign competition.

Domestic Segments

In some chemical segments, multinational companies may have direct or indirect disadvantages because of government regulation and lack of access to local raw materials. For example, participation in the booming segment of coal conversion to chemicals requires access to China's coal at low prices, which is not given to foreign companies. In petrochemicals, foreign companies are restricted to joint ventures without majority ownership - it is possible that this also creates some disadvantages in those steps in the chemical value chain that are directly based on output of the petrochemical industry.

"Buy Locally" Policy

The Chinese government prefers local buyers over foreign companies. The stimulus programs of the government, which focus heavily on infrastructure investment, thus favor domestic producers of, e.g., steel coatings, construction chemicals and transportation equipment. This preference may even be stronger on the provincial level, with individual provincial governments preferring suppliers located in their own province.

Better Local Knowledge

As foreign companies are still managed from outside of China, they do not have the same level of local market understanding as domestic chemical companies. For example, for German producers of chemicals it is still sometimes difficult to understand the local preference for lower prices over higher quality. As a consequence, chemical products produced by German companies tend to be somewhat overdesigned - the quality is higher than required by local customers. Of course, local companies also tend to have a better understanding of how to market their chemicals, how to deal with distributors, how to deal with local competitors, etc.

Greater Flexibility

Local chemical companies tend to be less rigid with regard to their products, their target markets, etc. For example, several Chinese urea producers responded to the existing overcapacity by moving toward fine chemicals. Other domestic chemical companies even engaged heavily in businesses outside of chemicals, in particular, in real estate and in finance. For foreign companies, both the limited local autonomy and the stronger belief in a long-term company strategy make such opportunistic shifts in business focus much less likely.

Focus on Sales Volume

In our experience, foreign companies focus strongly on profitability in their investments, for example, when investing in additional production capacity or in acquiring another company. In contrast, domestic companies - particularly state-owned entities - often seem to see sales increases as a goal in itself, even if not accompanied by additional profits. Management incentives in these companies emphasize the importance of stable employment and sales, not high profits - the low profit margins of many SOEs and the anecdotally reported surplus of staff in these companies are an indicator of this. Even for private domestic companies, profitability expectations tend to be much lower than for foreign companies.

In order to gain more insight, we also conducted a small poll among participants in the Chinese chemical industry (both Westerners and Chinese managers). They were asked to rank a number of possible factors, indicating which they assume to be the most important ones to explain the recent faster growth of domestic chemical companies. While the number of participants was small and no efforts were made to obtain a representative sample, the results (fig. 2) are nevertheless probably indicative of the current industry perception.

Conclusion

The improved quality of domestic chemical production and the acceptance of lower profit margins are the likely two most important reasons for the higher growth of domestic chemical companies. The expert poll confirmed this hypothesis. Surprisingly, though lower prices of domestic companies are certainly important, they are regarded as slightly less relevant than these first two factors. The same is true for those potential reasons, implying a better market understanding of domestic companies, such as more locally adapted products and marketing measures. Other explanations that have been suggested by some consultancies - such as the low participation of Western companies in the construction segment or the government preference to buy from local companies - are regarded to have limited relevance for the chemicals sector.

A few years ago, we wondered who would win the game for the Chinese mid-market. At present, it seems local players are ahead. However, the Chinese willingness to accept low margins may become a problem for local players as the market matures. In a mature market, firms will be judged much more by their margins than by their growth prospects. Thus the jury is still out on who will eventually benefit from the current developments.

Kontakt

Managm. Consult. Chemicals

RM1302, 13/F CRE Bldg.

Wanchai, Hong Kong

China

+86 1368 1873992