Steady in the Long Term Despite the Crisis

The Chemical Industry Must up its Resilience now – also to Weather Future Crises

The result shows: The current crisis is forcing companies to increase their resilience. The entire value chain, exposure to the end industry, and technical, commercial and digital capabilities must be put to the test in order to respond more effectively to changes in the markets in the future.

Impact of the Pandemic on Sales, Profitability and Production

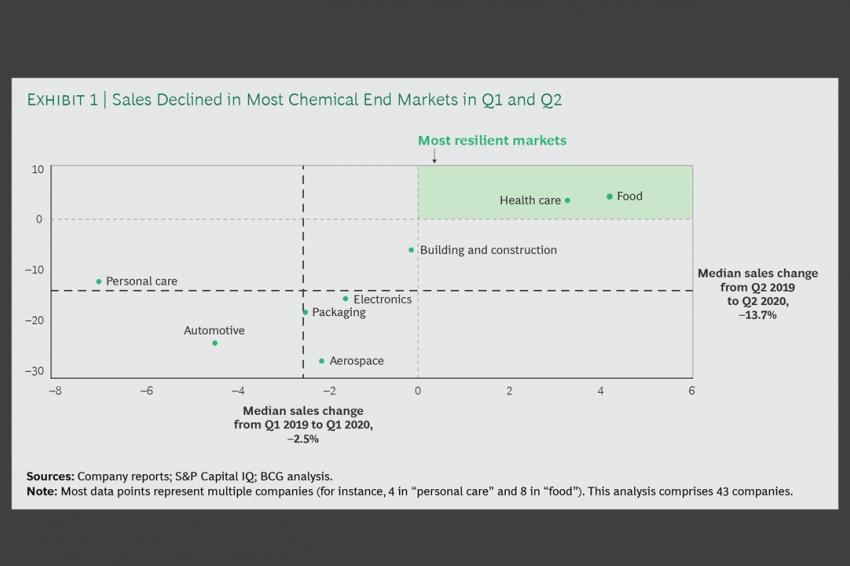

The chemical industry's key end markets were affected differently by the pandemic. Pharmaceutical manufacturers and suppliers to the food industry were among the winners, with average sales increases of 4% in the first half of 2020. By contrast, companies serving the automotive and aerospace industries saw sales plummet by an average of between 15 and 20% in that period. Looking at the profitability of the segments, a similar picture emerges: of 20 chemical product segments studied by BCG, only agrochemicals and food ingredients posted an increase of their EBITDA.

The markets also developed differently from region to region. The Global Chemical Production Index (GCPI) by the American Chemistry Council (ACC) shows that although production in Europe declined in the summer, it was up 10% year-on-year again in December. China and India also recovered from production declines in the first half of the year, ending the year up 13% (China) and 5% (India). North America, on the other hand, is recovering much more slowly and had not yet reached pre-Covid levels by the end of 2020.

The long-term impact of the Covid shock depends on whether demand in the segment in question has fallen or risen because there are structural reasons for it, or whether it is a temporary phenomenon. For example, companies in the composites or engineering plastics sectors were already challenged by declines in demand before the pandemic. The Covid-19 crisis has exacerbated this, while the construction chemicals or personal care sectors have not been hit at all.

“By and large, the Covid-19 crises did not cause the existing strengths and weaknesses of chemical companies but brought them more clearly to light.”

Long-term Development of the Industry Continues

The Covid moment followed a stable, but by no means outstanding, growth period: between 2015 and 2019, the chemical industry's total shareholder return (TSR; takes into account the change in share price as well as its underlying drivers such as change in sales, margin, trading multiples, and cash-flow effects over a given period) developed below all industries’ average, with an annual increase of 8%. By comparison, financial institutions achieved a TSR of 20% over the same period, and technology companies 18%. The automotive industry brought up the rear in BCG's TSR ranking, with a five-year TSR of zero.

This metric also shows significant differences between individual regions and sub-segments. European chemical companies had the best TSR between 2015 and 2019 at 11%. The focused specialties segments performed best in this region with a 14% TSR – as in previous five-year periods, in which these segments outperformed the base chemicals and multi specialties segments. Sales also had a positive impact on TSR: In Europe, the chemical industry´s sales grew by 4% during the period under review.

The development in North America was quite different: the weakness of the chemical industry there is also reflected in the comparatively low TSR of 5%. The low oil price has almost leveled out the cost advantages offered by shale gas, and as a result, investments have been cut back. In addition, the trade conflict with China has weighed heavily on US base chemicals companies. Sales stagnated accordingly. International Flavor & Fragrances and Sherwin Williams bucked the trend, with annual sales growth of 10%.

Company Size also Influences TSR

Strikingly, large chemical companies with a market capitalization of over $7 billion performed significantly better in terms of TSR than medium-sized chemical companies with a market capitalization of between $1 billion and $7 billion. The industry's large players consistently occupy the midfield, while mid-sized companies are in the bottom fifth. Among the top performers, with a five-year TSR of 32% and a ten-year TSR of 23% is Sika, a Swiss company that has become a global leader in construction chemicals through an effective M&A strategy. Lonza has also positioned itself well in the fast-growing pharmaceutical ingredients market.

In addition, three Indian companies outperformed: Berger Paints (five-year TSR 30%), Pidilite (30%) and Asian Paints (21%). This was certainly due to India's remarkable economic rise, but all three were hit particularly hard by the Covid-19 crisis: In the second quarter of this year, they suffered a drop in sales of more than 40%.

The pandemic appears to be accelerating these long-term trends. Chemical companies contributing to the pharmaceutical and healthcare value chain had the highest TSRs in the first half of this year. The food ingredients and electronic chemicals segments also recovered quickly after the slump in the first months of 2020 and showed positive TSRs again from mid-2020. These segments are particularly resilient because they are less asset-intensive, their dependence on commodity cycles is lower, and they are less sensitive to macroeconomic fluctuations – as they capitalize on long-term consumer trends. This makes them particularly attractive for investors. The commodities products segments, here for example vinyl chloride, synthetic rubber or fertilizers, are quite different. Companies in these segments already had low TSRs before the Covid-19 crisis. With the pandemic, these then fell again, in some cases by double digits.

“To be successful, the chemical industry must increasingly use digital technologies and innovate its business models.”

Falling Yields Weigh on the Sector

Another metric that points to a fundamental challenge is return on capital employed (ROCE). The decline in ROCE had been accelerating even before the pandemic. Combined with lower cash flows, this can have a negative impact on the valuation of existing investments and the consideration of future investments. One way to stop this trend is to improve margins through higher plant utilization, a better product mix or a reduction in transaction costs. Many chemical companies are already doing this. Less common, but quite effective, is increasing asset productivity, e.g. by managing capital allocation so that preferably those businesses, products and regions with the highest returns receive capital. Changing the allocation model would also mean rigorously reviewing new capital projects, introducing asset-friendly business models – including make-or-buy – and divesting poorly performing assets. A combination of these measures will put chemical companies on a path to better ROCE and can provide a TSR boost to the industry.

Learning from the Crisis for the Future

By and large, the Covid-19 crises did not cause the existing strengths and weaknesses of chemical companies but brought them more clearly to light.

The enormous speed of the demand and supply disruptions of the first 6 months of 2020 does show how important it is to be able to reduce costs quickly, e.g. through a high proportion of variable costs or by pursuing a leaner CAPEX strategy (e.g. fewer integrated value chains, more asset sharing/leasing). Regionalizing supply chains reduces the risk of failure. To be successful, the chemical industry must increasingly use digital technologies and innovate its business models. Most chemical companies use digital technologies only as a means to reduce costs. Neither in the important go-to-market area nor in product and application development has digitalization played a significant role so far. Agile R&D functions are also crucial to success. The pandemic has once again clearly shown that needs are not static. Therefore, chemical companies need to align their development efforts with ever-changing needs.

Those who are most adept at dealing with an uncertain present will have the greatest chance of generating value in the future.

Authors:

Kontakt

BCG The Boston Consulting Group GmbH

Ludwigstr. 21

80539 München

Deutschland