The Age of Sustainability

A Decade of Ongoing Change to Come for Chemical Companies

Many people will chime in when it comes to environmental damages caused by the chemicals industry. Seveso 1976, Bhopal 1984, the Rhine contamination 1986, the Exxon Valdez accident in 1986 and the Deep Water Horizon blast in 2001 are only the ones that are in the public memory. Every chemicals company and supply chain in this industry has been part of an environmental discussion and been affected by it. However, a lot has changed since the 1980s when environmental topics became more business relevant in the chemicals industry and adjacent industries.

It started primarily in the Western hemisphere with high investments into environmental treatment plants and continued with stringent product safety measures and the development of alternative products. Some of these initiatives were used as protection against emerging countries and as measure to compensate for the cost of goods sold deficits, while most of them were used to reach sustainability goals. The effect of these measures is also reflected in the industry's greenhouse gas emissions. Since 1990, the emissions of the EU chemical industry have fallen nearly 60%.

Nevertheless, the implementation of measures aiming for increased sustainability takes time, is costly and directly translates to higher prices for more sustainable and environmentally friendly products. For many years, consumers were not willing to pay a premium for products with a lower carbon footprint. Thus, cheap products coming from China and India, produced under different conditions, competed with products manufactured under environmentally improved circumstances in the Western hemisphere. The carbon footprint was not an issue at all.

This perception has changed dramatically, mainly driven by governments and NGOs all around the world. The momentum was further accelerated by the Fukushima accident in 2011 which led many governments to rethink their position regarding the future protection of the environment. The Blue-Sky Initiative of the Chinese government started in 2017 is the latest example of such efforts. As a direct result, this has already and will continue to have a significant impact on the supply chain of chemical, agrochemical and pharmaceutical products. The discussion on e-mobility as the solution to reduce pollution from fossil-based engines has gained significant traction since 2018. It already has had and will continue to have an impact on the setup of many chemical companies, not only in the petrochemical space.

„A lack of sustainability will cause

a gap in competitiveness and

subsequently value of companies.”

Chemical companies, either small or large, will be fighting more than ever for acceptance in society and are expected to provide product solutions to today's and future problems. A lack of sustainability will cause a gap in competitiveness and subsequently value of companies.

Next Efforts to Improve the Carbon Footprint of Chemical Products

Sustainability has resulted from efforts over many years to improve the human-caused impact on the environment, which has worsened significantly over the last decades up until recently. Today the mid- and long-term targets are clear, one being the significant reduction of carbon dioxide emissions until 2050 as agreed to by most nations. In fact, 127 countries (responsible for 63% of global emissions) are considering or have already adopted net zero targets. Announcements with significant impact were recently made by China with its intention to reach carbon neutrality before 2060, which by itself reduced the below stated end of century estimates by 0.2 to 0.3°C. Furthermore, Joe Biden's administration aims for US carbon neutrality by 2050, which would reduce the global warming by another 0.1°C.

Taking the ambitious targets into consideration, it is no surprise that sustainability has also become an increased industry focus of investors in 2020 compared to prior years. But even though there is a broad consensus in politics, society and economy about what needs to be achieved, the paths to a “better world” are not underpinned by operational measures and are often scattered. What is missing are the concrete measures and actions to be taken and, above all, what they can be achieved with.

“A more orchestrated global initiative

is needed to make change happen.”

There is a significant disconnect between the targets and the chemical industry's as well as consumer's reality. Furthermore, a more orchestrated global initiative is needed to make change happen. Beyond geopolitical measures there are solutions to be developed by companies, and products to be offered that are affordable for consumers, even though it is clear that bio-based and sustainable products and supply chains will cost more than today's products. Currently green products tend to come with significant markups of on average 75-85% and often exceed the amount the average consumer is willing or able to pay.

Circular Economy and other Initiatives Towards Sustainability

Linear economy is responsible for more than 50% of landfill of the 2 billion tons of trash generated around the world, while 60% of the global methane emissions of 570 million tons are created in conjunction with human activities. In this respect targeted and enforced measures are crucial if sustainability should become reality. Here, the chemicals industry represents an important driver; since only 6.6% of the 138.9 million tons consumed chemical products in the EU are recycled today.

Circular economy is not a cure-all solution, but it is at least an effort and maybe a long-lasting approach to reduce waste and improve the eco-balance and thereby achieve better sustainability. However, the transformation towards a circular economy involves more than just recycling waste. It also involves a variety of measures and technologies that are utilized to, for instance, transform waste or plastic to oil, waste to energy, alternative or renewable feedstocks, second-generation fuels or Fischer-Tropsch synthesis to transform carbon dioxide into higher carbons. There is no one-size-fits-all approach. Large investments, improved technologies, and new and better materials to produce similar-performing consumer products will be needed. Furthermore, supply chains must be altered and adapted to create new or at least better value chains.

This will also affect chemical distributors in the future. The concept of simply purchasing material in China or India and distributing it at a premium in Europe or the US will not be good enough anymore. Large distributors have already started to change their pattern and product platforms. Likewise, fine chemicals and intermediates produced under limited sustainability aspects will not fuel the business concepts of the future that have the goal to establish a circular economy and to excel in future markets.

The circular transition for chemical companies relies on internal transformation that starts with a solid strategy and objectives followed by the decision on a portfolio of specific circular initiatives. The selection of initiatives should always be made based on a thoroughly conducted analysis of the company's current situation. Here, a visual representation of the value chain and material flow internally as well as within the broader ecosystem allows executives to identify the main weak points.

At all times it is essential that the respective leadership team fully supports the transition and promotes it throughout the organization since a successful strategy requires more than the efficient execution of formulated initiatives. Far-reaching internal change should always accompany the practical implementation.

“Reaching sustainability has become a key aspect

for chemical companies and

adjacent businesses along the product chain.”

Transformation via M&A

Time is ticking and decisions have to be made. In a nutshell, reaching sustainability has become a key aspect for chemical companies and adjacent businesses along the product chain with a high entry hurdle for everyone. And it does not stop there, as valuations and prices for companies will be impacted by sustainability criteria. According to a recent study (Pitch Book 2020, “Sustainable Investment Survey”), sustainability is a key criterion to achieve improved and long-term results – it boosts attractiveness of companies and, subsequently, transaction values.

This, however, means that a showcase just here and there will not be sufficient anymore. To transform a business, more than that is needed – more than a few products and more than just a strategy. It often requires structural transformations. This entails the question of how much time remains for transition as well as whether the costs can be borne by a company on its own. Most companies will need to evaluate whether the “make”-, meaning in-house development, or the “buy”-approach, meaning acquisition of skills, technologies or supply chains, is the right way to go. An alternative to both approaches could be the merger of companies either to be able to accomplish the huge investments by risk sharing, or in order to concentrate parts of the supply chain under the same roof. Examples are chemical and waste management companies which optimize their value chain.

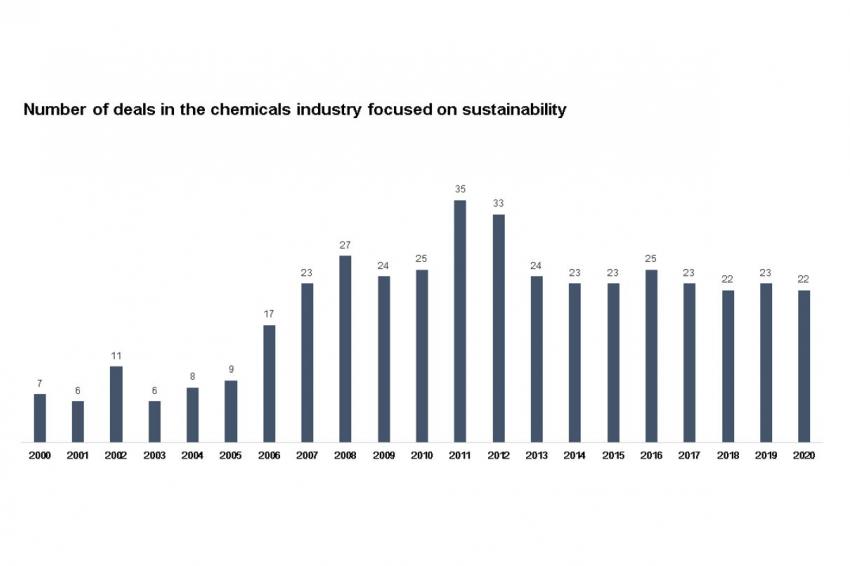

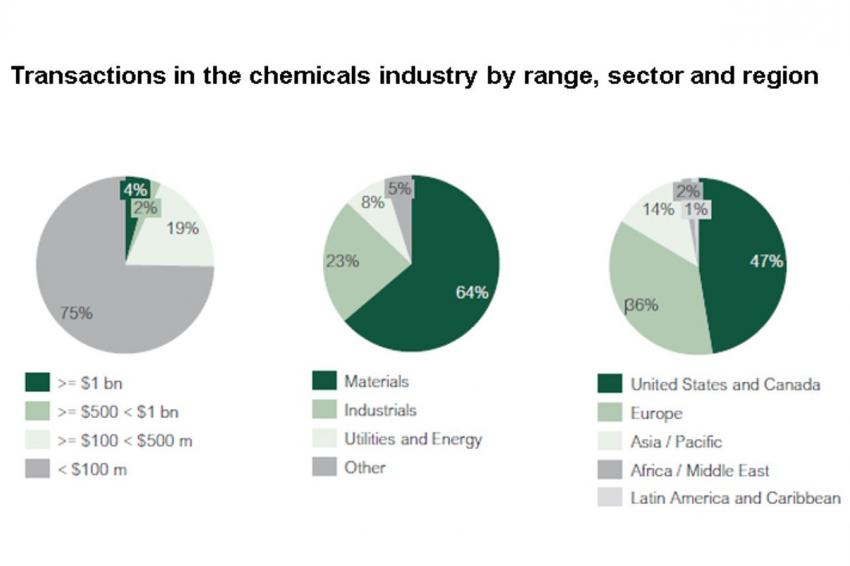

In this regard, M&A deals with sustainable aspects in the chemicals sector are on a constant level since the discussion gained traction. The greater portion of targets can be described as rather small, headquartered in the Western hemisphere with solutions mostly in materials and industrials sectors.

A value-generating transformation through M&A is an appropriate way to boost change while, at the same time, increasing the value of the company. Also, selling a company at the right time or merging it with another company is an option to climb the ladder of sustainability. These options must always be tailor-made and require a lot of industry expertise and business experience – locally as well as globally.

In addition, start-ups play an important role in a time where the chemical industry is striving for more sustainability. For them, the topic of a structured “exit value creation”, early enough to develop a company towards the future exit of the current shareholders is often not considered or at least underestimated. Very often it is more common to “dress the bride” 6-9 months before the sales process starts. However, developing an M&A process under more strategic and mid-term aspects accompanied by professionals is a different approach – it needs a mix of combined M&A experience, business development skills and management experience from the outside.

Finally, finding the right targets in the sustainability space, either start-ups or established companies, requires a lot of experience and industry know-how combined with access to a global network of M&A advisors.

Authors: Uwe Nickel and Artur Maibach, Proventis Partners AG, Zurich, Switzerland

_________________

A list of sources and references is available from the authors.