Using Start-up Data to Make Informed Decisions in Emerging Electronics Markets

19.01.2015 -

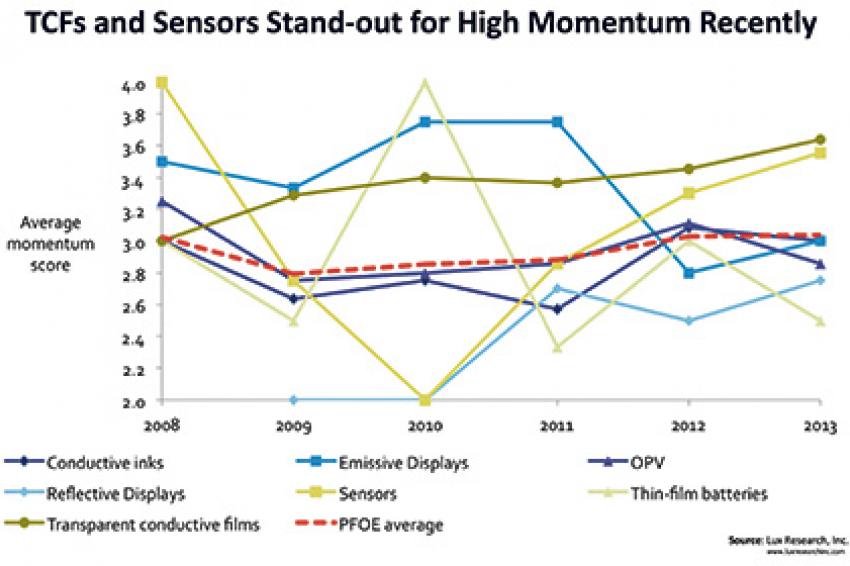

The two most common questions Lux Research receives in printed, flexible, and organic electronics are "What's hot?" and "When can we make money?" To answer these questions in a new way, Lux Research used their new Member Site and the nearly 500 company profiles in the Printed, Flexible, and Organic Electronics service between 2008 and 2013 to look for trends in our data, primarily on start-ups and small emerging companies. (see the Lux Research report "What's Hot and Timing Moves in Printed, Flexible, and Organic Electronics"). Each company was evaluated with a one-to-five score on 10 scorecard metrics, and capture quantitative technology performance metrics, as well as statistics like revenue, employee count, and profitability. Years of aggregated company data was analyzed to discern trends and understanding of industry dynamics, to help our clients make well-informed decisions about market and partnership opportunities. In particular, momentum scores, based on a company's recent commercial progress, as an indicator of what fields are "hot" were looked at - not those that are (merely) generating lots of hype, but ones actually generating concrete results.

This quantitative foundation can help take the guess-work out of strategy and decision making in emerging technologies. When a field like transparent conductive films (TCFs) shows near-term commercial opportunity, corporate players need to understand today's key developers and how to enter the supply chain. In contrast, fields that are far from commercial maturity, such as thin-film batteries and organic photovoltaics (OPV), call for a different approach - and may present opportunities to capitalize on the misfortune of those that have mistimed the market.

TCFs and sensors are hot - thin-film batteries, organic photovoltaics, and reflective displays not

Lux Research looked at the average momentum of technology developers in seven different technology categories - conductive inks, emissive displays, organic photovoltaics (OPV), reflective displays, sensors, thin-film batteries, and TCFs - from 2008 to 2013. TCFs and sensors are hot now, with both averaging 3.6 momentum scores (out of 5) in 2013. TCFs have been slowly and steadily increasing since 2008, rising each year from an average score of 3.0 in 2008 up to 3.6 in 2013. This upward climb has coincided with solution-processed TCFs coming to market, most notably with materials from Cambrios making their way into products like LG's all-in-one PC. Sensors, on the other hand, have had a volatile history, being the highest scoring (4.0) category of 2008, falling to one of the two lowest (2.0) in 2010, and rebounding quickly up to 3.6 in 2013.

In contrast, thin-film batteries, reflective displays, and organic photovoltaics entered 2014 with below average momentum. Thin-film batteries finished 2013 with the lowest average momentum score, 2.5, of any of the categories, despite some past flashes of promise, particularly in 2010 when, among other milestones, Infinite Power Solutions closed a $20 million funding rounds and released its first series of products. Organic photovoltaics have hovered right around the printed, flexible, and organic electronics average, not seeing any highs from added hype or technology development over this time. Reflective displays, with a score of 2.8, were slightly below average in 2013, but have been overall on the upswing since scoring at the bottom in 2009 and 2010.

Technology Performance Correlates to Commercial Success -Only in Maturing Fields

To answer "When can we make money?," Lux Research examined what companies look like when they are still years away from a meaningful market opportunity and what they look like when they are primed for commercialization. The relationship between a company's size (revenue and employees) and its product performance was analyzed, based on the "Key Metrics" included in each company profile - efficiency for OPV, energy density for thin-film batteries, and sheet resistance/transparency for TCFs.

Within TCFs, the top revenue-generating TCF developers all have products in their portfolio at 25 Ω/sq or less, but the impact of transparency is less pronounced. Among the firms that can offer such low sheet resistance films (below 25 Ω/sq), there are several companies with more than $1 million in revenue, though their transparency values range from 86% to 96%.

No such correlation between technology performance and company growth exists in OPV and thin-film batteries. Several OPV companies, like Dyesol, Konarka, Heliatek, and G24 Innovations, have had more than 70 employees, but these companies do not have standout technology; all except for Heliatek have cells below 8% efficiency. Similarly, the top thin-film battery companies by employee count - Cymbet, Infinite Power Solutions and Prologium - have products with energy densities from 40 Wh/L to 400 Wh/L, meaning they are in the lower half of all developers on technical performance.

Different Technology Areas Call for Different Strategies

For near-term opportunities like TCFs, supply chain and top developer assessments are vital. Here, firms need to go to downstream to films to capture more value. Films present a market greater than $700 million 2017, while inks will only account for 16% of that total, albeit at higher margins than films.

The longer term proposition of OPV and thin-film batteries dictate a different approach. Within these areas, it is too early to engage in commercial partnerships, but academia is a hot-bed of OPV research, and is actually the most widely researched academic area in all of PFOE, accounting for nearly half of all recent PFOE publications (see the Lux Research report "Getting Full Credit from Academic Partnerships: The Top Technologies, Regions, and Universities").

On the other hand, thin-film batteries are an attractive area to find value in overfunded start-ups. The venture community overfunded many thin-film battery technology developers, such as Cymbet ($104 million invested), Infinite Power Solutions ($100 million), and Solicore ($72 million). Many overfunded companies in printed, flexible, and organic electronics - such as Kovio, Plextronics, and Konarka - were acquired in distress for small fractions of the total investment that previously went into them. Some of these thin-film battery firms may be posed to follow in their wake, so monitor over-extended developers for distress.

Contact

Lux Research Inc.

234 Congress St., 5th

Boston, MA 02110

+1 617 5025314

+1 617 5025301