API Sourcing in China and India

Is Asia the Only Option for the Future?

Paradigm Shift - The number of API manufacturers in India and China focused on supplying active ingredients to regulated markets has grown considerably over the past few years.

Much of this growth can be attributed to the increasing focus by dose companies based in regulated markets to find ways of lowering costs, including those for active ingredients. Many of these new API manufacturers in India and China have also invested in finished dose development and manufacturing, frequently utilizing their own active ingredients.

However, these regions that once offered significantly lower costs are experiencing a rise in energy and labor costs, in addition to re-emerging competition from established European API manufacturers and speculation about the emergence of a second-wave of even-lower cost sourcing destinations.

Chinese and Indian API Manufacturing Industries

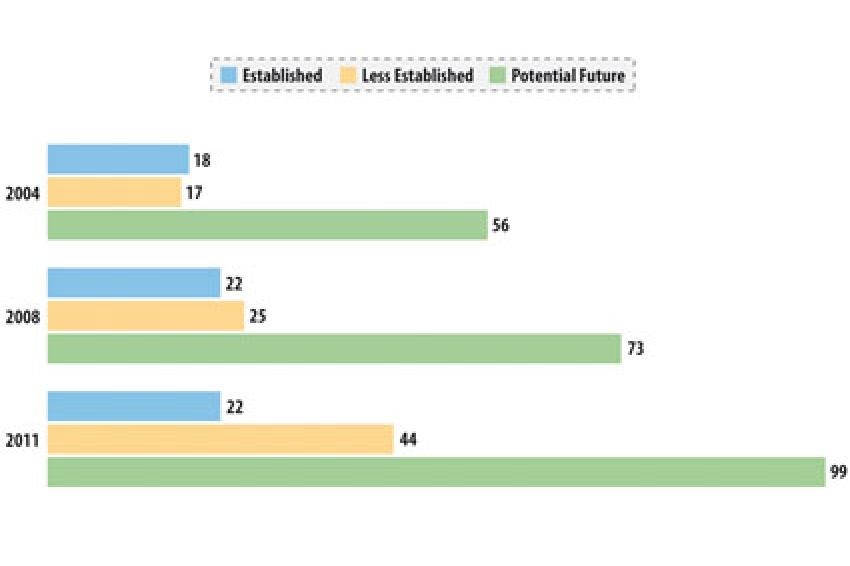

Thomson Reuters assesses the capabilities and experience of API manufacturers according to a proprietary scheme based on objective regulatory data. Companies range from those focused on supplying their local market to companies with years of experience supplying highly regulated markets. Although a large number of the companies in India and China continue to be locally focused, many have invested in facility upgrades and supplying regulated markets (fig. 1-2).

When sourcing from India, the cost advantages range from basic research and development to finished dose formulation. There are vast reserves of local labor and chemistry talent, the language is not a barrier, and intellectual property protection is improving. The number of U.S. Food and Drug Administration (FDA) approved API and finished dose facilities in India is large and continues to grow.

Many Indian companies have moved from supplying API into the U.S. and the EU to supplying finished doses. There has been an almost exponential increase in the number of Indian companies' Abbreviated New Drug Application (ANDA) approvals over the past 10 years.

When sourcing from China, there is massive scale and capacity available and the Chinese government continues to invest strongly in the local manufacturing industry. China has seemingly unlimited supplies of capable, talented scientists and engineers, as well as better infrastructure than India. The number of U.S. FDA inspected facilities in China has increased over the past few years and companies are continuing to invest in quality upgrades. China also has easier access to a wide variety of intermediates and chemicals.

Where China has surpassed India is in its classes of fermentation-based APIs, intermediates and many base chemicals. At the end of 2010, the first Chinese ANDA was approved and additional filings by Chinese companies are awaiting approval. At present, four Chinese groups hold a combined 13 ANDAs with final U.S. FDA approval.

The geographical shift in API sourcing over the past decade is quite apparent when we look at U.S. Drug Master File (DMF) filings by region. Although filing a DMF doesn't necessarily mean that a company is supplying the product into the U.S., the notable rise in the number of U.S. DMFs held by Indian companies and the gains that Chinese companies have made is quite significant (fig. 3).

The number of U.S. FDA inspections of facilities in these regions has also risen dramatically. In 2004, less than 10 companies in India and China were inspected, while in 2009 the number had risen to over 50 companies being inspected. Almost half of the COSs filed in the past few years have been filed by companies from India and China (fig. 4).

Even with the significant growth of the Indian and Chinese sourcing markets, there are challenges as well. Salaries in China and India are increasing much faster when compared to regulated markets. The high turnover of personnel in China and India also adds to labor costs. Environmental compliance is a major expense in China, and factories that cannot invest in sufficient upgrades are closing. In China, the language barrier continues to be an issue, while poor infrastructure is a problem in India. Furthermore, when sourcing from India and China, there is a lack of senior level talent in certain areas such as quality assurance and project management. There is also a pervasive focus on short-term rather than long-term returns.

European Comeback

In addition to the rising manufacturing costs in India and China, recent sourcing issues involving India and China and import bans have placed European API manufacturers in a better position to compete. It is worth pointing out that almost all of the suspended COSs are linked to companies from these two countries as well because they failed or refused inspections. The increasing finished dose manufacturing in India has also offered opportunities for European manufacturers to supply API to Indian companies formulating products bound for the U.S. and EU markets.

Over the next few years, European API manufacturers with strong technological capabilities in niche areas will also be in a position to take advantage of the many small volume APIs coming off patent after 2015. Companies in regulated markets have also made themselves more competitive by entering into joint ventures with emerging market players or building manufacturing facilities in emerging markets, allowing them to circumvent patents and supplementary protection certificates.

Emerging Markets

Rising costs in India and China have also prompted companies to consider other countries as sourcing alternatives. However, when compared to the over 1,500 API manufacturers in India and China, there is little API manufacturing in other emerging markets, such as Latin America and Russia. Part of the Russian government's planned $1.3 billion investment into the Russian pharmaceutical market is intended to improve and increase local API production.

At this time, only 15% of the API consumed in the Russia is produced locally. Additionally, the low number of facilities that have implemented GMP will be a considerable obstacle to supplying API into regulated markets. Today, most of the manufacturers in the second wave of emerging markets offer little experience in regulated markets, and there is no indication of better price at acceptable quality than in India or China. Companies looking at alternative sourcing options may have better luck in Eastern Europe, South Korea or Taiwan.

Industry competition will continue to push both API and dose manufacturers to search for lower costs and strategic advantages. However, we believe that there will also be increased focus on quality and reliability, ultimately leading to a more level playing field between India, China and Europe.

Molly and Bob will be giving a presentation on this subject at the CPhI Pre Show Conference on Oct. 24 at 12 p.m.

Contact

Thomson Reuters

215 Commercial Str.

Portland, Maine 04101

+1 207 8719700

+1 207 8719800