Breakthrough Supply Chains for the Pharmaceutical Industry

06.03.2024 - The pharmaceutical industry is a truly global and complex network of ingredients and materials suppliers, manufacturers, distributors for a variety of products ranging from vaccines to antibiotics and to therapeutic drugs for customers/patients.

While the top 20 multinational pharma brands are well known, the supply chains were largely unknown prior to the Covid pandemic. Global events and disruptions are motivating executives to reassess their supply chains and look for innovation and change. Breakthrough supply chains reflect future visions and open up opportunities for transformation.

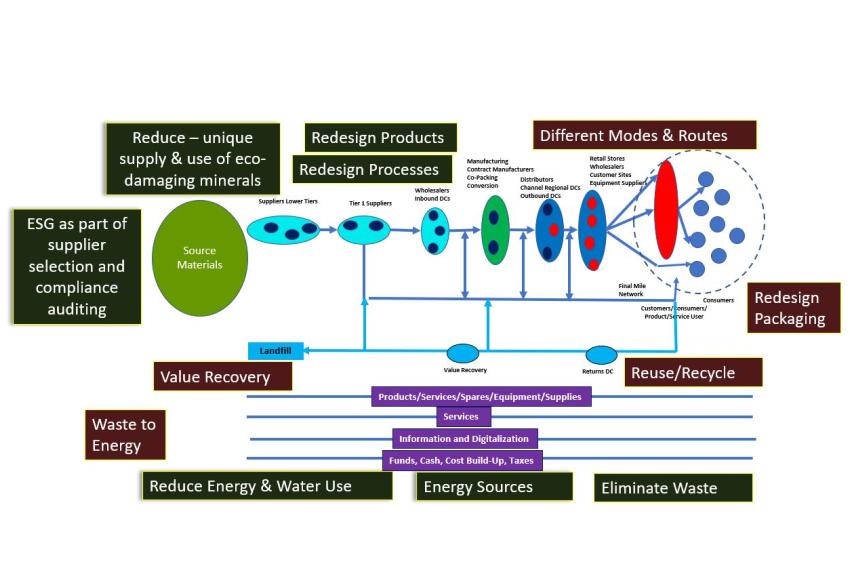

Breakthrough supply chains are defined as composed of holistic end-to-end views of sourcing through to customers, patients, and consumers; and new innovations that meet critical business and societal needs. They involve reimagination, reinvention, and redesign, to meet the uncertainties present in the new era. They require the application of “breakthrough thinking” to navigate the challenges and changes that are associated with national security and intellectual policies, customer needs, risks, the rapid evolution of new technologies, and other critical factors. As such, supply chains today are highly complicated and complex in detail (cf. figure).

“Breakthrough supply chains reflect

future visions and open up opportunities

for transformation.“

The pharma industry has been largely protected from serious disruptions and other occasional challenges by holding substantial inventories and incurring relatively lower-cost supply chain logistics operations. This comfort level was significantly interrupted, however, by the global Covid pandemic when supply chains becoming highly visible and at the top of societal concerns. The vulnerability of pharma supply chains was highlighted, even as Pharma companies adapted well to the health security and critical societal needs for medicines (especially as compared to certain other industries and product shortages).

Similar to leaders in other industries, pharma leaders are better understanding their end-to-end supply chains. Strategic questions have begun to enter C-suites and stakeholder meetings, as concerns are being raised about global issues such as sustainability, resilience, risks, and the assurance of supply. These views are facilitating end-to-end views in addition to the functional needs of each of the mega processes: plan – buy – make – move – distribute – sell.

New Visions and Innovative Solutions

The end-to-end views, which include visibility and real-time transparency, require attention and measurement of the integrated nature of the four flows of material/product; information/data; cash; and work/skills. They also require comprehensive global supply chain planning. Total supply chain cost, time, and product availability are all the results of end-to-end supply chain integration. Further, a company’s value creation is now more understood to be driven largely by its end-to-end supply chain performance. Operations costs, profitable growth, and capital efficiency are major drivers of value.

“A company’s value creation

is now more understood to be driven largely

by its end-to-end supply chain performance.”

Pharma supply chain leaders are also realizing that the often-believed uniqueness of sourcing APIs (active pharmaceutical ingredients) and excipients, formulations, and packaging are really not so different than other complex supply chains. The high-tech and electronics industries, for example, require global sourcing, hundreds of components including essential semiconductors, final assembly, and varieties of packaging that supply chain leaders have been challenged with for decades.

Pharma supply chain leaders are dealing with most global issues that all industries face. These concerns have reached executive agendas, stakeholder questions, and quarterly earnings reports. Geopolitical issues have created disruptions and risks in global supply chains that are unprecedented, and unanticipated constraints are higher than ever. Trade disputes have impacted duties and tariffs in cross-border shipments. Cyberattacks have caused disruptions in business continuity. National industrial policies have changed the business incentives and protections in many countries. There are several more examples of uncertainties that require new visions and innovative solutions.

Advanced Supply Chain Management

The development of new strategies, decision roadmaps, and operating playbooks that yield redesigned global supply chains are demanding that new thinking be applied to the appropriate goals and objectives of each company’s supply chain, as well as its processes and structure. We refer to this as ‘breakthrough thinking’, as it is critical for executives and public policy makers to use in redesigning supply chains.

Breakthrough thinking involves two categories of thoughts, principles, and knowledge. The first is to recognize the myths of supply chains and adapt the lessons learned over the past four decades from the beginning of the creation of the supply chain term and the end-to-end concept:

Myth 1: Supply chain is synonymous with logistics. Logistics refers to the physical operations of products and materials. Supply chains are far broader, they deal with the four flows and business operations, and they involve business and operations strategies more than ever before.

Myth 2: Supply chains are only about cost and expense control. The lowest costs of sourcing, production, transportation, distribution, and delivery should not drive supply chain actions. Rather, supply chains are a source of competitive advantage. Decisions on sourcing and production must take into account the geopolitical, resilience, sustainability, and total supply chain cost and service.

Myth 3: Advanced technologies, including digitalization and artificial intelligence (AI), will replace people as supply chains are automated. While new technologies are available and in development that will help the speed, cost, service, and quality of supply chains, the talents of people will always be needed for strategies, service levels, and customer satisfaction. Smart managers are needed to adapt to market changes and insure high degrees of execution performance, as well as the trade-off decisions regarding the environment, sourcing, security, customer service, profitability, and resilience.

In effect, lessons learned are driving breakthrough thinking from the past optimization of costs and working capital to today’s intelligent ‘supply-aware and customer-centric’ performance.

The second category of thoughts, principles, and knowledge applies breakthrough thinking to deal with the new business and societal requirements and the uncertainties, volatility, and frequency of global market changes. The pharma industry is subjected to these realities especially as drugs come off patent, and customers, patients, and consumers have choices among brands and generics.

Let us consider selected breakthrough thinking as it applies to pharma companies:

The Customers. Pharma products are sold through multiple sales channels to several customer categories: wholesale distributors; pharmacies; health care providers; consumers; patients, and others. Advanced supply chains are driven more by customer satisfaction than production planning, which translates into network designs from the customer as well as supply forward. Customer satisfaction is a primary driver of product preferences and ordering behaviors.

The Supply Base. Sourcing and manufacturing strategies impact global locations, international requirements, and an assured supply. Current and future trends are driving strategies of re-shoring, near-shoring, friend-shoring, and regionalization and localization of certain supply chain operations. Achieving supplier resilience requires tiers of suppliers – for APIs: raw materials, solvents, reagents, etc.; for Excipients: inactive product ingredients; and for Packaging (primary and secondary). These are all considered trading partners. Advanced supply chains establish collaboration methods among the network partners and provide for system integrations. End-to-end visibility begins with the shared demand plan and the integrated supply plan to meet the demand.

Further, as certain nations acknowledge pharma as a ‘strategic sector’, we will see increased monitoring and, in some cases, restrictive conditions, which can be both incentive-based and protective.

Information, Data, and Analytics. New technologies for supply chain planning and execution are promising to greatly improve supply chain performance. To achieve the desired level of ‘data-driven breakthrough supply chains’, it is imperative for the pharma sector to continue its path of digitalization, exploiting the merits of constantly emerging new technologies. advanced analytics based on combining AI, big data, blockchain, IoT, robotics, and other technologies with modern cloud- and industry-tailored delivery models like spatial web will continue to be built into key supply chain planning, execution, and monitoring applications. These span across manufacturing, inventory, order, transport, and warehouse management to control towers and ai-supported ‘nerve centers’. This will enable improved end-to-end visibility of goods, cash, and data flows making better operational and strategic decisions.

Well-established EU, FDA and GS1 standards will continue to serve as a foundation for this. Vital principles of GMP and ISO compliance (e.g. software validation) will remain in force.

Logistics services providers will continue to play a key role in providing advanced data-driven supply chain capabilities and platforms for end-to-end collaboration.

Risk, Resilience and Sustainability. As we stated earlier, increasing risks are likely to impact supply chains today and tomorrow. While resilience is a must-have, comprehensive risk management and mitigation is the only way to minimize the dangers without investing substantial capital to duplicate partners and flows and build strong redundancies. Future supply chain redesigns are already underway to relocate suppliers and producers, and contract manufacturers are being used for more sourcing. Breakthrough thinking in these areas can build in flexibility, end-to-end optionality, cybersecurity, and other innovations. Moreover, sustainability will continue to be a critical objective, and new technologies will be introduced to decarbonize supply chains.

Measures that Matter. Dashboards, control towers, and other technological advances such as AI-supported nerve centers are providing real-time visibility into the flows of goods, information, cash and work; however, the challenges are not how measures are made visible, but rather, what do we measure and why? Breakthrough thinking needs to identify those measures that are most important for the management level reviewing them. Basically, there are three types:

- measures to understand: what is happening?

- measures to motivate: what is needed in execution?

- measures to enable action: what can be done?

Thus, measures must proactively alert management of not only the need to take action, but also the available options and pros and cons. Service levels, for example, are most important to pharma leaders, even though total costs and lead times also matter.

Pharma Moving Forward in the New Global Era

The trends and challenges driving the changes in advanced supply chain management provide guidance to pharma executives and planners, but specific issues in pharma supply chain transformations require care in their resolution. The lessons learned in the global pandemic about demand and supply, while event-driven, provided motivation to work on improving supply chain strategies and operations.

Demand planning has become more volatile and complex when we move to end-to-end supply chain management. Functional silos must convert to collaborative integrated business planners involving all trading partners and ecosystem stakeholders. Past orders are poor proxies for future demand, as the pandemic clearly proved.

Similarly, supply variability must be solved through tighter trading partner connections and collaboration. API, excipients, and packaging must all become assured supply, and safety stocks must be driven by supply, and not demand.

Corporate goals – sustainability, business continuity, ESG, and national supply chain laws/acts – will need to be enabled by supply chains. Thus, supply chain considerations must be built into these public policy goals. Our thoughts earlier in this article provide guidance for progress in meeting goals that are adopted as reasonable.

We see the continued involvement of National Governments in the industry, especially to insure supply of essential drugs and protective equipment. Increased collaboration among governments and pharma companies, if executed properly, could benefit common interests. A fundamental common understanding of the complexities of supply chains and needed specialization will be critical.

Resilience is likely to be the most visible in pharma supply chains. The global trends toward near-shoring, re-shoring, and friend-shoring will affect the redesign of pharma supply chains from end-to-end. Sources of ingredients must be available closer to pharma production, no matter where that is located. And, production must be available closer to demand, wherever that is located.

In fact, the pharma companies have a range of viable options for network redesigns. We expect to see changes in diversification of suppliers, producers, and logistics flows that mitigate risks and improve service to the various customers, patients, and consumers. This will change international sourcing, with suppliers relocating closer to producers and the regionalization of product supply.

Last but certainly not least is the continued adoption of advanced technologies that further innovate supply chain management. Artificial Intelligence (AI) has amazing potential for not only improving demand planning, but also supply planning, such that synchronization of these mission-critical processes is finally a reality. Supply chain speed, and the speed of recovery, will yield substantial benefits to all stakeholders.

The adoption of new technologies, the redesign of supply and distribution networks, and other supply chain innovations, will require capital investment by the industry. New strategies and visions will guide the priority investments which need to bring returns in talent, processes, and supply chain performance.

To accelerate their digitalization journey, pharma companies should continue to apply means of iterative business and IT innovation (e.g. PDCA cycles, MVP development and SCRUM).

Exciting times are ahead for pharma supply chain leaders and managers. With no shortage of challenges, and the continuing availability of feasible solutions, smart decision-making will be the key to business and societal success.

Wolfgang Partsch, Managing Partner, Dr. Partsch & Partner, Gruenwald, Germany

Gene Tyndall, Partner, eMate Consulting, Atlanta, GA, USA

Holger Klug, Consultant, Wiesbaden, Germany