European Chemicals Pulse Check

Chemical Value Chains at Risk of Shifting to Non-European Countries

Representatives of the European chemical industry expect a shift away from Europe, especially for energy-intensive production steps. The biggest beneficiary of this change is the USA, as Deloitte’s latest European Chemicals Pulse Check shows.

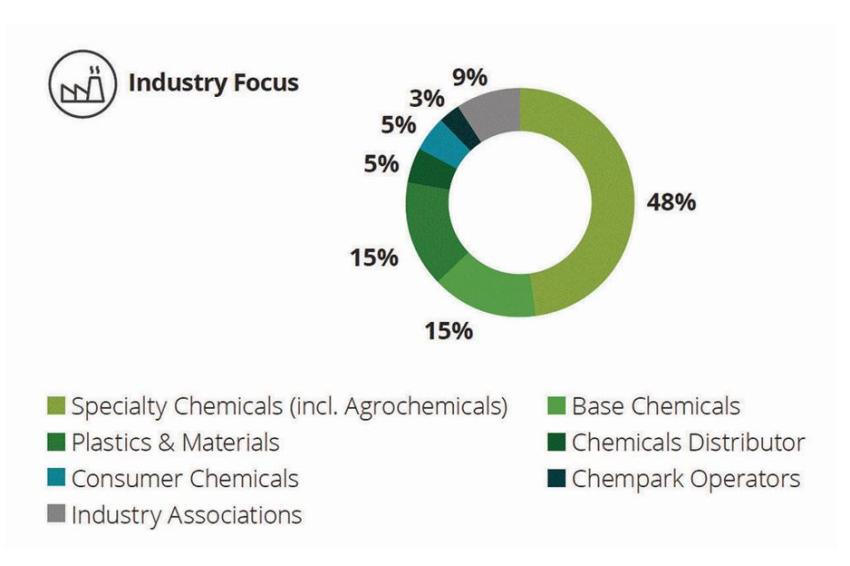

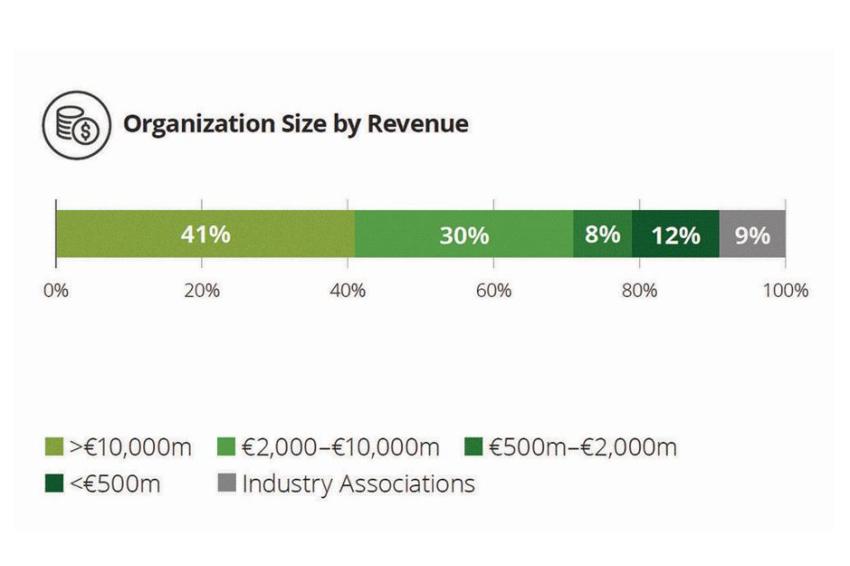

For their report, Deloitte surveyed 66 senior executives from the European chemical industry and sector associations in April 2023. The survey participants represent different branches of the sector, such as base chemicals, specialty chemicals and plastics & materials. 41% of respondents work in companies with revenue of more than €10 billion. 30% represent companies with revenue between €2 billion and €10 billion.

“2023 and 2024 will be key years for the chemicals industry in Europe.”

81% of respondents expect that parts of the chemicals industry value chain will move out of Europe. They named high energy prices, strict ESG requirements, attractive conditions outside of Europe, and geopolitical developments as causes. More than two thirds of respondents (68%) also see an increasing risk of demand destruction in the chemical sector in Europe.

Responses to the question about the effect of EU regulations such as the EU Emissions Trading Scheme and the EU Carbon Border Adjustment Mechanism were mixed. For example, 63% of survey participants fear that regulations will jeopardize the export capabilities of companies in the sector. At the same time, 70% see an opportunity here to accelerate investments and innovations in sustainability and new business models.

“In view of the geopolitical tensions, European chemicals manufacturers are reviewing their investment strategies overall.”

It is high time to set the course for sustainable growth. On the one hand, higher energy costs burden the competitiveness of chemical companies in Europe. On the other, the uncertain regulatory environment makes it difficult to plan for the long term. Chemicals manufacturers are well-advised to continuously assess regulatory and geopolitical developments and integrate them in their strategies. Scenario thinking is becoming enormously important.

Marked Skepticism towards China

Investments are already shifting to the USA, report 58% of respondents, while 71% are considering their first or further steps in this direction. Expectations are clear: 87% anticipate that the USA will maintain its cost advantage in energy and raw materials over Europe until at least 2030.

Meanwhile, the survey respondents are more skeptical towards China. For example, 51% report that they are reassessing their future investments in China. In addition, 71% now want to manage their digital and physical assets in China more independently from the rest of their global business.

“Chemicals manufacturers are well-advised to continuously assess

regulatory and geopolitical developments and integrate them in their strategies.”

In view of the geopolitical tensions, European chemicals manufacturers are reviewing their investment strategies overall. Companies are regionalizing their supplier networks and production capacities and using investment incentives to position themselves more resiliently.

Green Transformation Drivers

Two out of three respondents (66%) view the ESG transformation as a reason to rethink their business model. However, ongoing regulatory developments are creating insecurity about investment decisions, which is causing delays for planning and implementing investments, say 58% of respondents. Also, 56% are afraid that the energy and competitiveness challenges in Europe could slow down the ESG transformation.

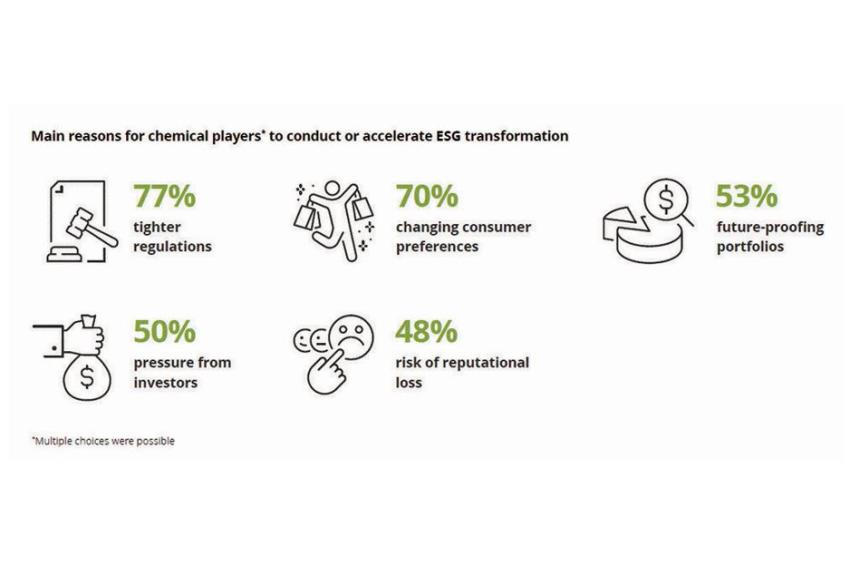

As a central driver of the transformation, respondents mention tighter regulations (77%) and changing consumer preferences (70%). Other causes named are future-proofing portfolios (53%), pressure from investors (50%), and risk of reputational loss (48%).

2023 and 2024 will be key years for the chemicals industry in Europe. Companies will need to make long-term investment decisions. Their focus should now be on Net Zero targets, the circular economy, and the energy transition, as well as turning these into concrete action plans. Their business models urgently need further development. This is the only way in which we will ensure a successful and prospering chemicals industry in Europe in the coming decades.

Stefan Van Thienen, Partner;

Alexander Keller, Director; and Mark Reimer, Director, Deloitte, Munich, Germany