GDUFA: Who Will Benefit?

13.01.2012 -

The pharmaceutical supply chain is increasingly globalized. It is estimated that 80% of the active ingredients used in generic medicines marketed in the U.S. are manufactured in foreign countries with half of this volume originating from China and India.

The U.S. FDA has struggled to conduct inspections of foreign facilities, especially in emerging markets, due to a lack of appropriate resources and funding. Currently, the review time for the average ANDA amounts to 31 months and more than 400 ANDAs are estimated to be otherwise approvable but require an outstanding FDA inspection.

GDUFA Overview

In September 2011, the FDA announced the ratification of a proposed Generic Drug User Fee Act (GDUFA) to collect fees from finished dose and API manufacturers and use them for the review of ANDAs, referenced DMFs and conducting associated facility inspections for fiscal years 2012-2017. The program would provide the FDA with adequate resources to review ANDAs in a timely manner, provide transparency within the complex pharmaceutical supply chain, and improve the safety of generic medicines.

Additionally, the new regulations will require the identification of facilities involved in manufacturing both finished dose and active ingredients and, by 2017, ensure parity of inspections between US and overseas manufacturers, with a goal of biennial inspections of both finished dose and API manufacturers.

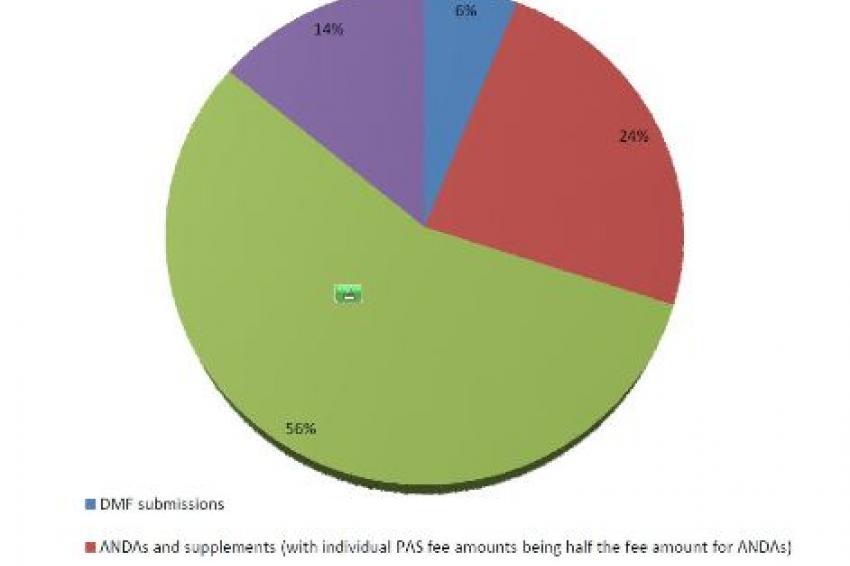

The annual funding from GDUFA user fees is set at $299 million in fiscal year 2013 and will come from application fees (ANDAs, prior approval supplements ((PASs)) and DMFs) and facility fees. Funding for fiscal years 2014-2017 will remain at $299 million plus an annual adjustment. Approximately half of the fees are expected to come from finished dosage form facilities, with the remaining half divided among fees from ANDA filings, API facility fees and DMF first reference fees (figures online). During fiscal year 2013, 17 % (~ $50 million) of the total GDUFA user fees will come from ANDAs remaining in the backlog as of October 1, 2012.

Currently there are more than 2,000 ANDAs waiting in the approval backlog. By the end of 2017, FDA has vowed to review 90% of the backlog ANDAs and reduce the primary review time for ANDAs submitted after Oct. 1, 2012 to 10 months.

The agreement still needs to be reviewed by the Department of Health and Human Services as well as the Office of Management and Budget. FDA indicated in September that it was anticipating providing a generic drug user fee package to Congress in January 2012. At the GPhA Fall Technical Congress in Washington, D.C. last October, Keith Webber, the Acting Director of the Office of Generic Drugs at FDA, expressed hope that the new user fees will be implemented in October 2012.

Impact On The Industry

While the FDA has publicized information about the proposed user fee structure, the actual fee amounts are not yet known. The author had an opportunity to gather speculative feedback regarding possible user fee amounts from several industry experts at CPhI Worldwide last October and learned that fees may fall in the following ranges: $40,000-50,000 for DMFs, $75,000-100,000 for facilities and $100,000-200,00 for ANDAs. Non-payment of annual facility fees from API and/or finished dose manufacturers will result in all products from those facilities being classified as misbranded and banned from sale in the U.S. market.

The creation of a DMF database with "available for reference" status is a possible outcome of GDUFA. For those companies who pay the fee, the FDA will perform an administrative review of the DMF at submission time and will add it to the list of DMFs that are available for reference. The FDA will refuse to review an ANDA application which cites a DMF for which this fee has not been paid. This change may reduce the number of incomplete and/or substandard DMF submissions (so called "marketing DMFs") received by the FDA in the future.

Smaller companies seem to be quite concerned that they will be priced out of the market. Meanwhile, some companies with multiple manufacturing sites are worried that they will get hit hard by annual facility fees. It is possible that some companies may choose to consolidate manufacturing sites to avoid paying multiple fees.

Some manufacturers view the proposed user fees as anticompetitive due to the barrier of entry which it creates while others argue that faster and more predictable review times will speed up product launches thus benefiting the manufacturers. It is also possible that, at least initially, the increased number of global surveillance inspections will lead to additional warning letters and import bans which may prevent certain companies from selling their products into the US market.

Therefore, the creation of additional drug shortages is another possible unintended consequence of GDUFA. Going forward, companies will likely be selective about which active ingredients and finished dose forms they manufacture and may choose to stop production of some low margin products in light of having to pay user fees. Because the budget for GDUFA is fixed and based on a set amount of regulatory filings per year, a decrease in the number of DMF and ANDA submissions would result in higher user fees the following year, further contributing to the drug shortage problem. On the plus side, the quicker review times should make it possible for new players to enter the market if shortages loom.

To date, there is a general lack of certainty regarding the final implementation of GDUFA but it is being viewed as a significant game changer within the industry. So whom will GDUFA benefit? The new legislation will likely favor the generic giants and those smaller players who possess excellent quality systems. The increased frequency with which FDA inspects facilities will lead to improved and more consistent quality generic medicines which ultimately benefit U.S. consumers, although in the short term we should be prepared for additional drug shortages.

Bob Kennedy, Manager of Industry Research, Thomson Reuters

robert.kennedy@thomsonreuters.com

Contact

Thomson Reuters

215 Commercial Str.

Portland, Maine 04101

+1 207 8719700

+1 207 8719800