Realignment of the Pharmaceutical Supply Chain in Japan

11.04.2013 -

Bad Pill - Patent expiries, technological developments, the introduction of innovative products, the increasing incidence of counterfeit drugs and the recent environmental disruptions have forced pharmaceutical companies to realign their supply chains.

Drug Distribution Channels and Stakeholders

Pharmaceutical products, mainly ethical and Over-the-Counter (OTC) drugs, follow the traditional wholesaler-based method of distribution in Japan. Ethical drugs are transferred from wholesalers to the patients by hospitals, clinics or dispensing pharmacies, while OTC products are dispensed by dispensing pharmacies and drug stores. A Direct-to-Pharmacy (DTP) route is also used for the distribution of OTC products.

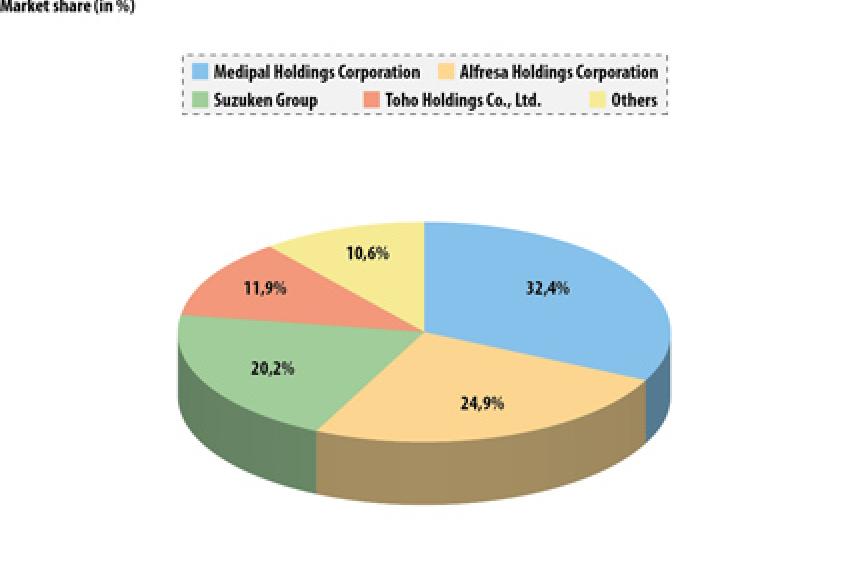

The pharmaceutical distribution (wholesale) industry in Japan is an oligopoly of the top four wholesalers: Medipal Holdings, Alfresa Holdings, Suzuken Group and Toho Holdings, which represent 89% of the market (Fig. 1).

The introduction of price revisions has increased competition among the wholesalers and forced them to lower their costs to remain profitable. Additionally, a trend of strategic consolidations, mainly M&As, has started in the industry, resulting in a 45% decrease in the number of companies in the last decade alone.

The distribution of all medicines, including ethical drugs, OTC products and quasi-drugs (cosmeceuticals), from wholesalers is restricted to within five licensed distribution channels (Tab. 1).

Drivers of Change

In 2008, many batches of an anticoagulant, heparin, were recalled by the Food and Drug Administration (FDA) due to the contamination of the raw material imported from China. The incident highlighted the challenges faced by the pharmaceutical supply chain globally. Contaminated and counterfeit products became a threat for patients and manufacturers. As a result, pharmaceutical companies and Contract Manufacturing Organizations (CMOs) became increasingly vigilant about the quality of raw materials and finished products entering or leaving the shop floor.

Another setback for companies operating in Japan was the Ministry of Health, Labor and Welfare's (MHLW's) reduction of National Health Insurance drug prices by 6.5% in 2010, significantly more than the normal 2% decrease that had been followed since 1994. Because of this price revision, purchasing and selling price negotiations became more challenging, thereby affecting the profit margins of supply chain participants.

The Great East Japan Earthquake of 2011 and the following tsunami and nuclear accidents had a major impact on the already suffering pharmaceutical industry in the country. Many pharmaceutical companies suffered damages and some products experienced supply instability, for example Thyradin, a thyroxine-based thyroid hormone. Manufacturing stopped temporarily and emergency imports were required.

Counter Measures

Efforts are being made along the entire value chain to maintain integrity and safety in the drug manufacture and distribution process. For this, pharmaceutical manufacturers, wholesalers and retailers are leaving no stone unturned. Takeda, for example, has started conducting periodic audits of raw material suppliers, CMOs, packagers, logistics centers and dealers. Questionnaires, facility tours, policy reviews, standard operating procedures, records and interviews are being used to ensure compliance with Takeda's regulations and expectations.

Additionally, the following measures have been taken to make the Japanese pharmaceutical supply chain safe, stable and secure:

- SMS

Manufacturers assign a specific code to drug packages, and once a customer buys that drug, they send a message to a mobile authentication service that identifies it as counterfeit or legitimate. This is particularly useful for checking that no parallel trade exists in the distribution chain. - Barcoding

Barcodes are used extensively to identify specific products by conveying information such as the medication name, dose and route of administration. Depending on the arrangement of the strings, lines and spaces on the barcode, they are of three types, namely linear, two-dimensional matrix, and composite. In 2008, the Japanese government mandated that all medical products must be encoded with a Japan Article Number (JAN), which is a Global Trade Item Number (GTIN), assigned specifically for the Japanese market. A GTIN is 14 digits in length and signals the barcode format, packaging level, company prefix and an item reference number. After the issuance of the MHLW Guidelines for Barcode Marking, the rate of barcode marking on medical devices has been steadily increasing and now exceeds 80% (ISMP-Canada, 2008). - Radiofrequency Identification

Radiofrequency Identification (RFID) is gaining increasing use in the pharmaceutical industry to address issues such as drug traceability, inventory management at wholesalers, and dosing and dispensing errors at hospitals and pharmacies. An RFID label consists of a chip, which records information by means of radio waves. This information can be traced at the different levels in the supply chain for pharmaceutical drugs and serves as the backbone of the electronic pedigree (e-pedigree) system started in countries such as the US and UK. An e-pedigree helps to track the basic data elements of a drug as it moves along the supply chain, such as lot number, potency, expiration, manufacturer and other data elements. However, some believe that this method does not ensure product authenticity (Cronin, 2008). - Business Continuity Planning

Although only marginally affected in comparison with other Japanese industries, production activity in some pharmaceutical manufacturer locations became stagnant due to the restricted power supply and damage to distribution centers as a result of the natural disasters in 2011. In response to the catastrophes and the damage following them, domestic pharmaceutical companies upgraded their disaster counter-measure system. For example, Suzuken, as part of its Business Continuity Plan (BCP), formulated guidelines to ensure the supply of pharmaceuticals in times of major disaster and implemented regular drills. The company's headquarters have been constructed in line with earthquake resistance criteria and have a private generator for use during electrical power failures. A cooperative relationship with hospitals and pharmacies has been developed so that products can be delivered through nationwide branches if supervising branches are not functioning.

Still a Long Way to Go

Caught in the grip of recent environmental disasters and the fear of counterfeit drugs, it is of utmost importance for the pharmaceutical industry in Japan to ensure that the right drug reaches the right patient at the right time. Though efforts are being made at all levels, there is still a long way to go for Japanese companies to stay competitive and attractive. Their counterparts in the West are technologically advanced and proactive in fighting counterfeiting amidst the changing macro-economic and regulatory trends globally.

The Full Story

GBI Research's report, entitled "Pharmaceutical Supply Chain in Japan - Periodic Drug Price Revisions by National Health Insurance Increase Competition and Squeeze Profit Margins" focuses on the current scenario of supply chain management.

It includes segmentation of the pharmaceutical supply industry by its major components, including manufacturers, wholesalers and medical institutions; and the key issues faced by them. It also provides an analysis of technologies adopted by pharmaceutical manufacturers and wholesalers in order to stay competitive in the current scenario with a competitive profiling of the key companies involved. Insights into the legal and regulatory landscape, focusing on laws and regulations followed to obtain marketing, manufacturing and distribution licenses for drugs in Japan, are also discussed in the report.

Contact

GBI Research

Knowsley House

Bolton, BL1 2AH

+44/1204/543528